Key highlights:

- Global search interest in cryptocurrency has fallen to its lowest level of the year, signaling a sharp decline in retail participation.

- Market sentiment remains weak following major crashes, heavy liquidations, and fading speculative activity.

- Historical data suggests periods of low public attention often precede structural changes in the crypto market.

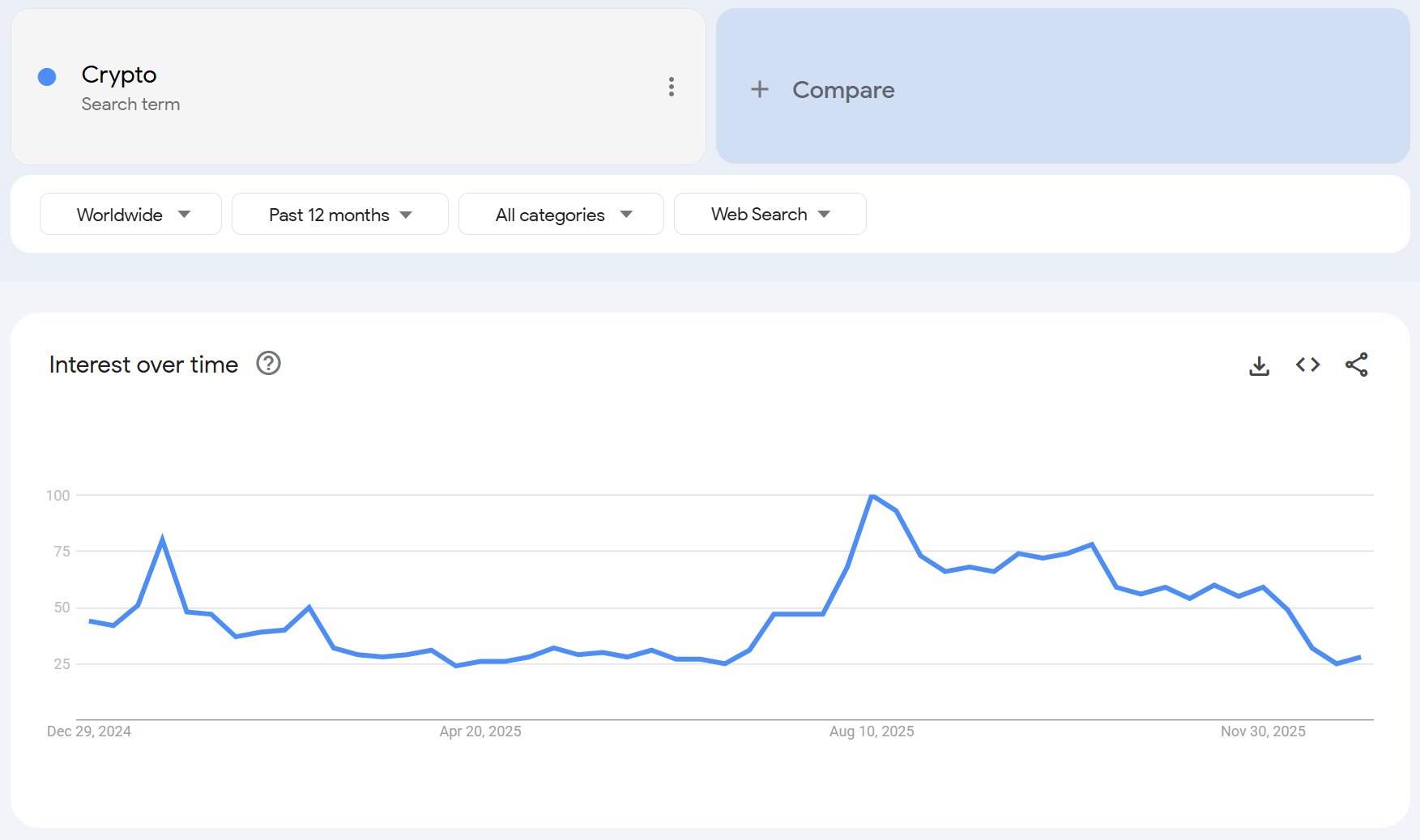

The volume of Google searches containing the word “crypto” has dropped to its lowest level of the year, signaling a clear decline in retail investor interest worldwide.

According to Google Trends, global search interest fell to 25, just two points above the yearly low of 23. On Google’s scale, where 100 represents peak popularity, the current level indicates extremely weak public attention.

Source: Google Trends

The trend is equally visible in the United States, where search interest has also fallen to 26, marking one of the lowest readings of the year. This represents a sharp contrast to January, when crypto-related searches were near their annual highs.

Market crashes and fading retail interest

The decline in interest began after the April market crash, which followed sweeping tariff announcements by U.S. President Donald Trump. Search activity dropped sharply during that period and has failed to recover since.

The impact of the October crash

The situation worsened following the October market collapse, which triggered nearly $20 billion in liquidations. Some altcoins lost as much as 99% of their value in a single day, accelerating capital flight from the sector.

This period appears to have marked a psychological turning point, after which retail participation failed to recover.

Fear index signals persistent market anxiety

The crypto fear and greed index fell to 24 points in December, indicating extreme fear. Since then, sentiment has remained subdued.

Although the index has recently recovered slightly to 28, it still reflects widespread caution rather than renewed optimism. Market sentiment has remained locked between “fear” and “extreme fear” for months.

A structural shift rather than a temporary slump

From a data-driven perspective, the decline in search activity may reflect more than temporary pessimism. Historically, periods of reduced retail attention have often coincided with infrastructure development and regulatory consolidation.

Large institutions and governments continue integrating blockchain technology, even as retail interest fades. Algorithmic analysis of previous cycles suggests that moments of low visibility frequently precede structural advances rather than market collapse.

The current downturn may therefore represent a transition phase, one in which speculative hype gives way to slower, more sustainable development.

Whether this period becomes the foundation for long-term growth or signals a lasting change in crypto’s role remains uncertain. What is clear, however, is that the market is no longer driven by retail excitement alone.

Source:: Crypto Searches Collapse 70% as Retail Exits and the Market Enters a New Phase