Republicans in the U.S. House of Representatives have declared “Cryptocurrency Week” from July 14 to 18. Three key bills that could dramatically change the regulation of digital assets in the country will be considered during that week.

Finance Committee Chairman French Hill, Agriculture Committee Chairman Glenn Thompson, and Speaker Mike Johnson announced plans to consider bills on cryptocurrency market structure, stablecoins, and central bank digital currencies.

Source: financialservices.house.gov

“Republicans in the House are taking decisive steps to implement the full range of President Trump’s digital asset and cryptocurrency agenda,” Johnson said.

The speaker added that the House will consider three landmark bills during “Cryptocurrency Week”: the CLARITY Act (a bill establishing clear market structure rules for digital assets), legislation against the surveillance state through central bank digital currencies, and the GENIUS Stablecoin Act passed by the Senate.

Trump is rushing the legislation through Congress

The Republican initiative comes hot on the heels of President Donald Trump’s announcement last month that he wants to pass the GENIUS legislation regulating stablecoins before Congress’s August recess.

These bills would be the first steps in fulfilling Trump’s campaign promises on cryptocurrencies—promises that the crypto industry has actively supported and funded.

GENIUS vs. STABLE

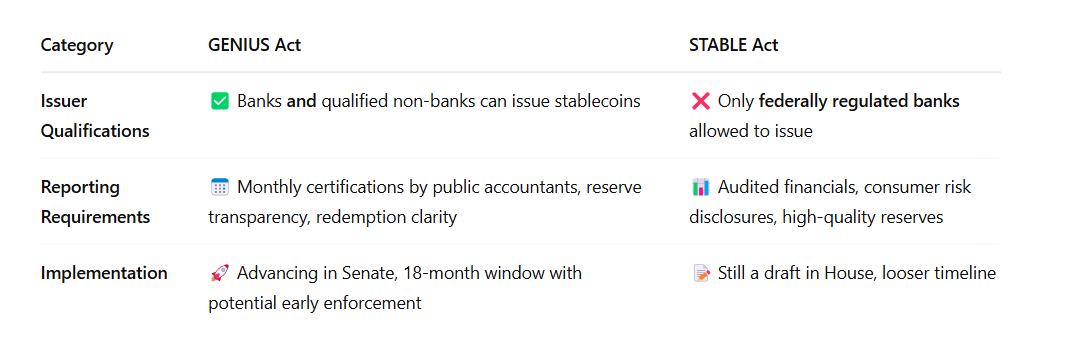

The House appears to favor the GENIUS bill passed by the Senate over its own similar bill, STABLE, which the House Finance Committee passed in May. That document was never brought to a vote.

Source: X/alanotte23

The Senate passed the GENIUS bill with bipartisan support last month. If the House passes the bill without changes, it would go straight to President Trump for his signature.

But lawyers from Pillsbury Law said Wednesday that the House could amend “key provisions, including those related to issuer eligibility, state and federal oversight dynamics, and compliance requirements.”

If amended, the bill would return to the Senate for an amendment vote. Lawyers at Troutman Pepper Locke noted Tuesday that the House and Senate may create a committee to resolve differences between the GENIUS and STABLE bills.

The main difference between the bills concerns oversight: STABLE provides for strict federal oversight of stablecoin issuers, while GENIUS allows for state-level oversight.

CLARITY is on the president’s desk

The CLARITY Cryptocurrency Market Structure Act could be next on Trump’s desk after the House Financial Services and Agriculture committees advanced it on June 10 for consideration by the full House.

The bill, which has yet to pass through the Senate, defines the jurisdiction of the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) over cryptocurrencies.

It requires most types of cryptocurrency exchanges to register with the CFTC and sets rules for disclosure, client asset segregation, and record keeping.

Democrats have largely opposed the GENIUS and CLARITY laws, citing Trump and his family’s growing cryptocurrency empire, which includes a cryptocurrency exchange, stablecoin, and a host of cryptocurrency tokens and projects.

The last bill the House will consider is legislation opposing a surveillance state enabled through central bank digital currencies.

The bill would prohibit the Federal Reserve from testing, developing, creating, or issuing digital currency in any form, and would prevent the central bank from offering financial products directly to individuals.

Republican “Cryptocurrency Week” could be a turning point for U.S. regulation of digital assets. Three bills cover key aspects of the industry, from stablecoins to market structure to central bank bans on digital currencies.

eToro: Best platform for beginners and social trading

- Trade cryptocurrencies, stocks, ETFs, and commodities on one easy-to-use platform

- Follow and copy top-performing traders with eToro’s unique social trading tools

- Earn passive income with staking on popular coins like ETH, ADA, and TRX

- Fully regulated in multiple jurisdictions with strong security protocols

- 0% commission on real stock trading and competitive spreads on crypto

- 30+ million registered users across 100+ countries

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

Source:: Congressional Crypto Week: Is U.S. Regulation About to Change Forever?