Key highlights:

- Circle plans to move its institutional-focused Arc blockchain from testnet to full production in 2026.

- The company will expand USDC and related tokens to more blockchain networks to improve enterprise interoperability.

- Circle aims to let corporations adopt stablecoin payments without building their own infrastructure.

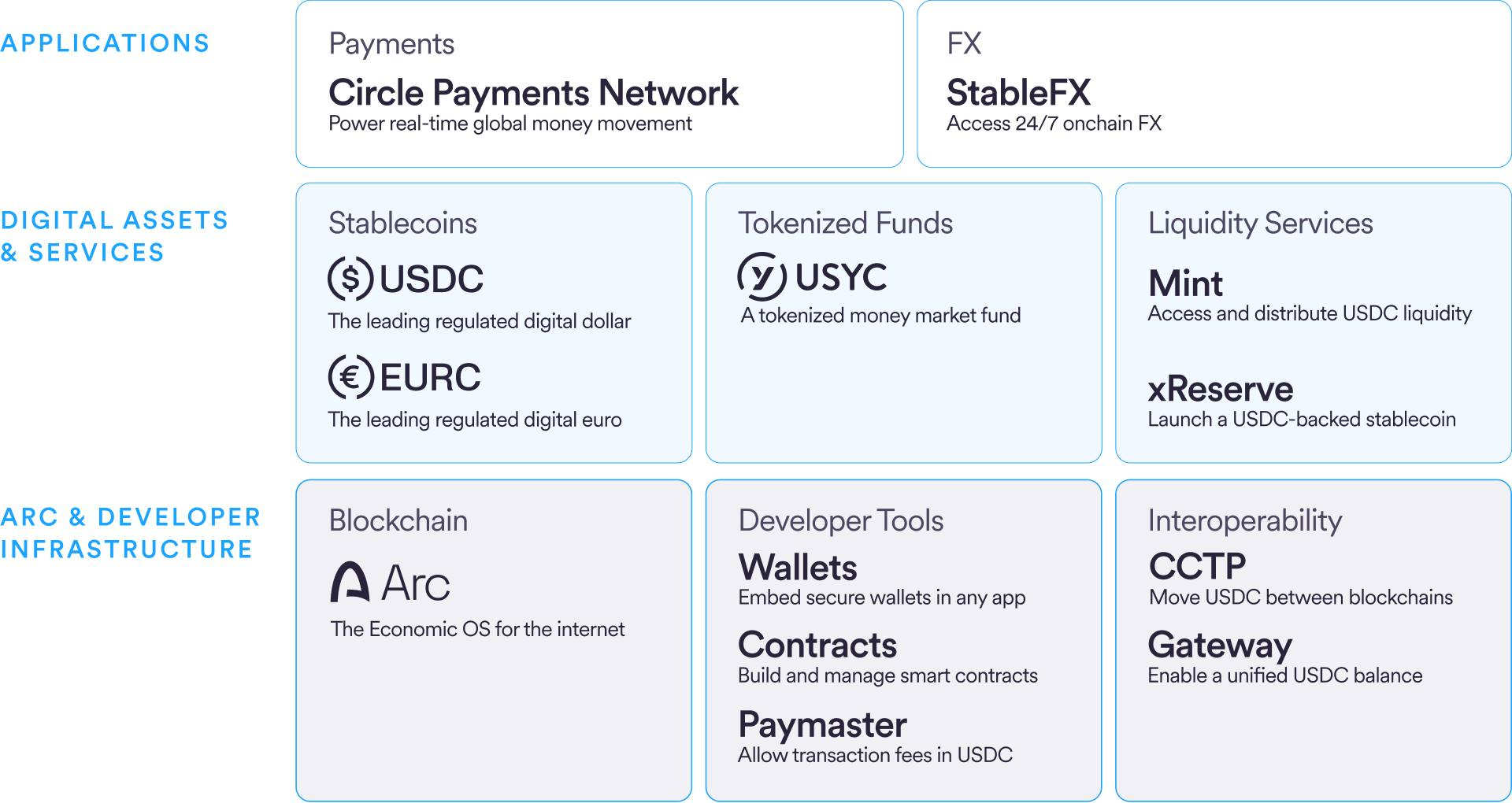

Circle (CRCL), the issuer of USDC, is preparing a broad infrastructure expansion in 2026 aimed at accelerating stablecoin adoption among enterprises and institutional investors. The company plans to focus on building more durable, scalable systems while deepening integration across blockchain networks.

Circle Chief Product and Technology Officer Nikhil Chandhok said in a company blog post that a central objective is moving Arc, the company’s Layer 1 blockchain, from testnet into production. Arc is designed specifically for institutional and large-scale financial use cases.

We’re building toward an internet financial system through Arc, USDC, Circle Payments Network, and our interoperability services that connect them.

The goal is simple: make money movement and value exchange efficient, programmable, and accessible worldwide. Read our product…— Nikhil Chandhok (@chandhok) January 29, 2026

Alongside Arc’s rollout, Circle intends to expand the utility and reach of its tokens, including USDC, EURC, USYC, and stablecoins issued by partners. The company also plans to extend support to additional blockchain networks, strengthening interoperability and improving enterprise access.

Institutional adoption becomes the core strategy

Stablecoins have become one of the most prominent themes in crypto throughout 2025. In the United States, lawmakers have advanced regulatory frameworks for dollar-pegged digital assets, prompting banks and major corporations to explore issuing their own stablecoins.

Circle’s 2026 roadmap. Source: Circle

Circle’s 2026 roadmap reflects that shift. The company plans to scale its payment network and related applications so that enterprises can integrate stablecoin payments without developing and maintaining backend infrastructure themselves.

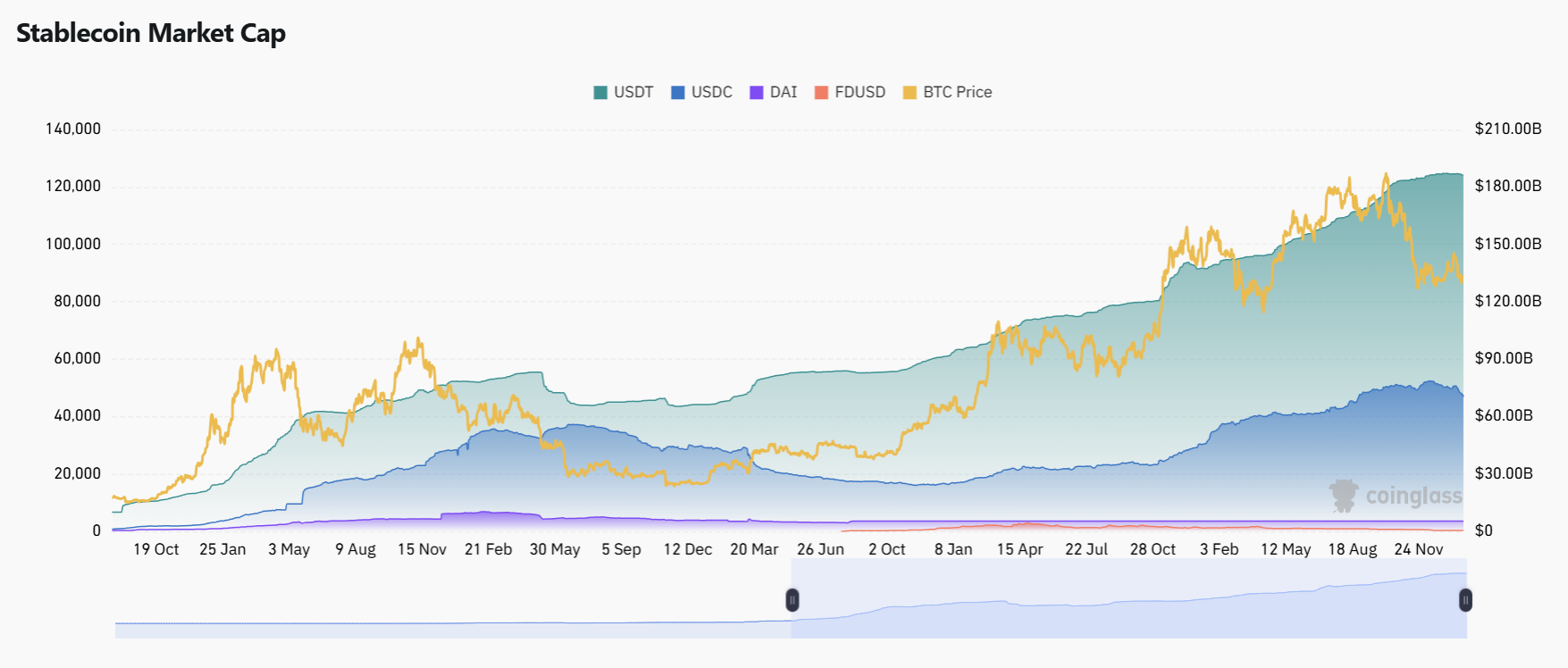

USDC remains the second-largest U.S. dollar-pegged stablecoin, with a market capitalization exceeding $70 billion. Tether’s USDT continues to dominate the sector at roughly $186 billion, out of a total stablecoin market capitalization of about $306 billion, according to data from CoinCodex.

The broader stablecoin market surpassed $300 billion in total capitalization for the first time last October, driven largely by USDT, USDC, and yield-generating models such as Ethena Labs’ USDe.

Market capitalizations of the biggest stablecoins. Source: Coinglass

Competition and regulatory pressure intensify

Circle’s infrastructure push comes amid fierce competition for institutional market share. While Tether maintains a significant lead in overall supply, Circle has increasingly positioned itself as the compliance-focused alternative for regulated financial institutions.

Launching Arc into production will require not only technical maturity but also the development of a robust ecosystem of partners, developers, and liquidity providers. Historically, building such ecosystems around new Layer 1 networks can take several years.

At the same time, institutional adoption depends heavily on regulatory clarity in major jurisdictions. As Circle deepens its role in enterprise finance, regulators may increase scrutiny of systemic risks associated with large-scale stablecoin operations.

Circle’s 2026 strategy suggests that the next phase of stablecoin growth will be driven less by retail speculation and more by enterprise integration, cross-border payments, and programmable finance infrastructure.

Source:: Circle Prepares for Arc L1 Launch: USDC Enterprise Era Begins