Key highlights:

- China expands digital yuan settlements across major trade routes

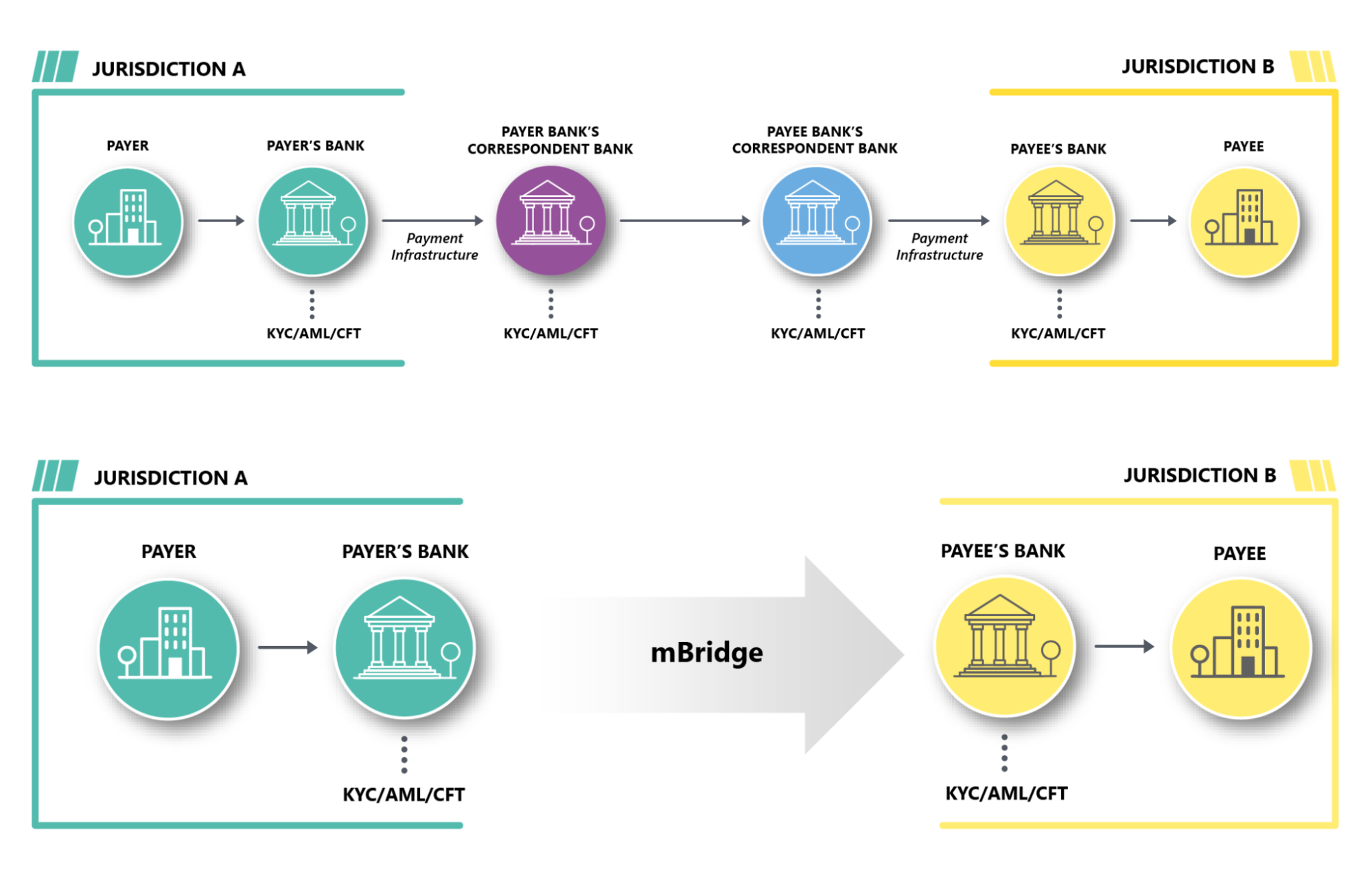

- mBridge cuts cross-border payments to seconds, bypassing SWIFT

- ASEAN and the Middle East deepen yuan adoption in global trade

In March 2025, the People’s Bank of China launched a cross-border settlement system based on the digital yuan, enabling international trade without reliance on SWIFT. The launch, carried out with minimal publicity, now covers trade routes accounting for an estimated 38% of global commerce across 16 ASEAN and Middle Eastern countries.

mBridge delivers faster and cheaper cross-border transfers

The mBridge platform, developed with support from the Bank for International Settlements (BIS), completes cross-border settlements in 7–8 seconds, compared to 3–5 days via SWIFT. Official documentation shows transaction fees reduced by up to 98% versus traditional banking rails.

How the payment system works. Source: HKDCA

The system is fully integrated with the financial infrastructure of all 10 ASEAN states, including Singapore, Indonesia, Thailand, and Vietnam, as well as six Middle Eastern nations, including the UAE and Saudi Arabia.

Pilot transfers demonstrated the platform’s performance:

- Hong Kong → Abu Dhabi: 7 seconds

- China → Indonesia: 8 seconds

Research indicates that 23 central banks are connected and that cross-border payment volume has already exceeded $1.2 trillion.

Digital Yuan adoption accelerates regional trade shift

Trade between China and ASEAN nations settled in yuan reached ¥5.8 trillion in 2024, up 120% from 2021. Thailand executed its first oil settlement in digital yuan, while Malaysia and Singapore began adding yuan to national reserves.

China’s foreign trade rises 3.5% in first seven months of 2025. Source: China Daily

In the Middle East, 65% of regional oil contracts are now priced or settled in yuan. Transactions between Saudi Aramco and Sinopec also use yuan in 65% of settlements, cutting commission costs by up to 75%. Saudi Arabia became a full mBridge participant in 2024.

Broader macro trends support this shift. The dollar’s share of global reserves fell to 58% in 2024 (IMF), while the yuan’s share of international payments rose to 2.44% — a small but rapidly growing base.

Expert concerns and structural limitations

Not all analysts are convinced by China’s projections. Some researchers argue that the “38–40% of global trade” figure may be overstated, and question the number of active participants versus registered ones.

Critics highlight structural risks:

- fragmentation of the global financial architecture

- 12% yuan depreciation in 2025

- limits on currency convertibility

- regulatory barriers across jurisdictions

These factors continue to restrict deeper adoption in Western and emerging markets.

Geopolitical and strategic outlook

The digital yuan rollout strengthens the “Digital Silk Road” under the Belt and Road Initiative, integrating payments across infrastructure projects such as the China–Laos railway.

For sanctioned economies, mBridge offers an alternative channel for global settlements. Russia, for example, now conducts 18% of trade with China through digital yuan channels, bypassing SWIFT.

Despite rapid progress, SWIFT remains dominant, processing the majority of cross-border settlements and generating $120 billion annually in fees. While mBridge is faster and cheaper, SWIFT retains unmatched global compatibility and legacy integration.

China aims not to replace the dollar outright, but to build a yuan-centric economic zone, potentially covering up to 30% of global GDP. The system operates in parallel with CIPS 2.0, which clears ¥137 billion per day for domestic and international partners.

By the end of 2025, ASEAN members plan to settle 90% of intra-regional trade in digital yuan — though experts caution that a full transition could take decades, depending on global stability and currency confidence.

Kraken: Best crypto exchange for security & reliability

- Buy, sell, and trade 400+ cryptocurrencies with industry-leading security

- Spot, Futures & Margin trading – leverage up to 5x for advanced traders

- Earn rewards with staking on top cryptocurrencies

- 24/7 customer support and high liquidity for fast trades

- Regulated in the US with strong compliance and security measures

- 13+ million users worldwide

Source:: China Expands Digital Yuan Settlement Network as 16 Nations Adopt SWIFT Alternative