Key highlights:

- China warns crypto speculation is rising again despite its nationwide ban.

- Stablecoins targeted as regulators claim they fuel fraud and illegal transfers.

- Beijing boosts surveillance while Hong Kong moves toward regulated issuers.

The People’s Bank of China (PBOC) has reaffirmed its nationwide ban on cryptocurrencies after detecting a renewed wave of speculative trading in digital assets. Following a joint meeting with 12 other agencies, the central bank warned that “speculation in virtual currencies has resumed”, creating fresh challenges for financial-risk prevention.

“Virtual currencies do not have the same legal status as fiat currencies, are not legal tender, and cannot be used as currency in the market,” the PBOC declared on November 29. Regulators reiterated that all activities related to virtual currencies remain illegal financial activity under Chinese law.

Stablecoins emerge as a major concern for Beijing

Stablecoins were singled out as the most pressing threat. The PBOC stated that these tokens fail to meet customer-identification and AML (anti-money laundering) requirements, making them vulnerable to misuse in money laundering, fundraising fraud, and illegal cross-border transfers.

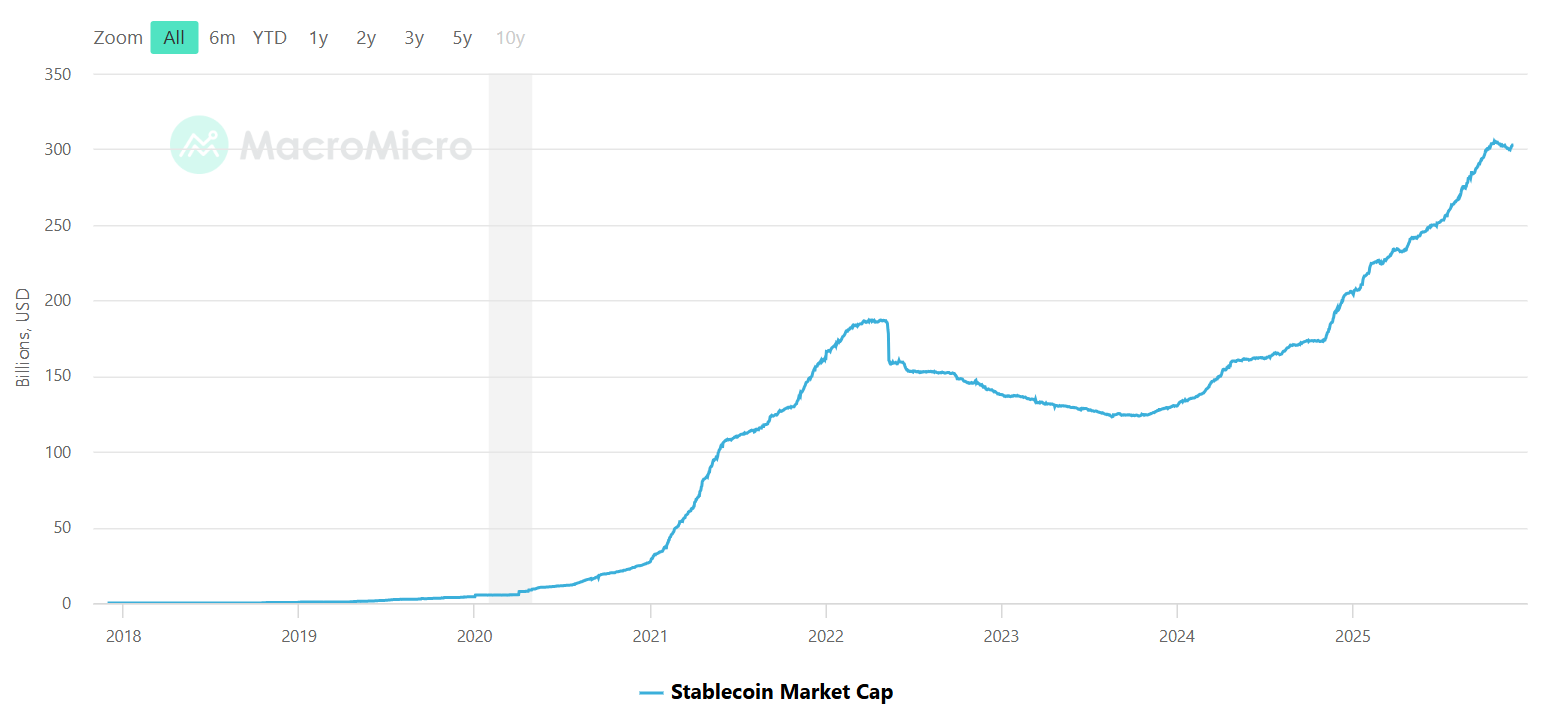

Stablecoin market cap surpasses $300 billion, with 95% pegged to the US dollar, even as China renews its nationwide crypto ban. Source: MacroMicro

Authorities pledged to “vigorously combat illegal financial activities” tied to crypto in order to protect the “economic and financial order.” China originally banned cryptocurrency trading and mining in 2021, citing concerns around capital flight and systemic risk.

Beijing steps up coordination as crypto activity persists

Despite the harsh regulatory landscape, activity has not disappeared. The 13 government bodies participating in the meeting agreed to strengthen data sharing and expand their monitoring tools to identify individuals using crypto.

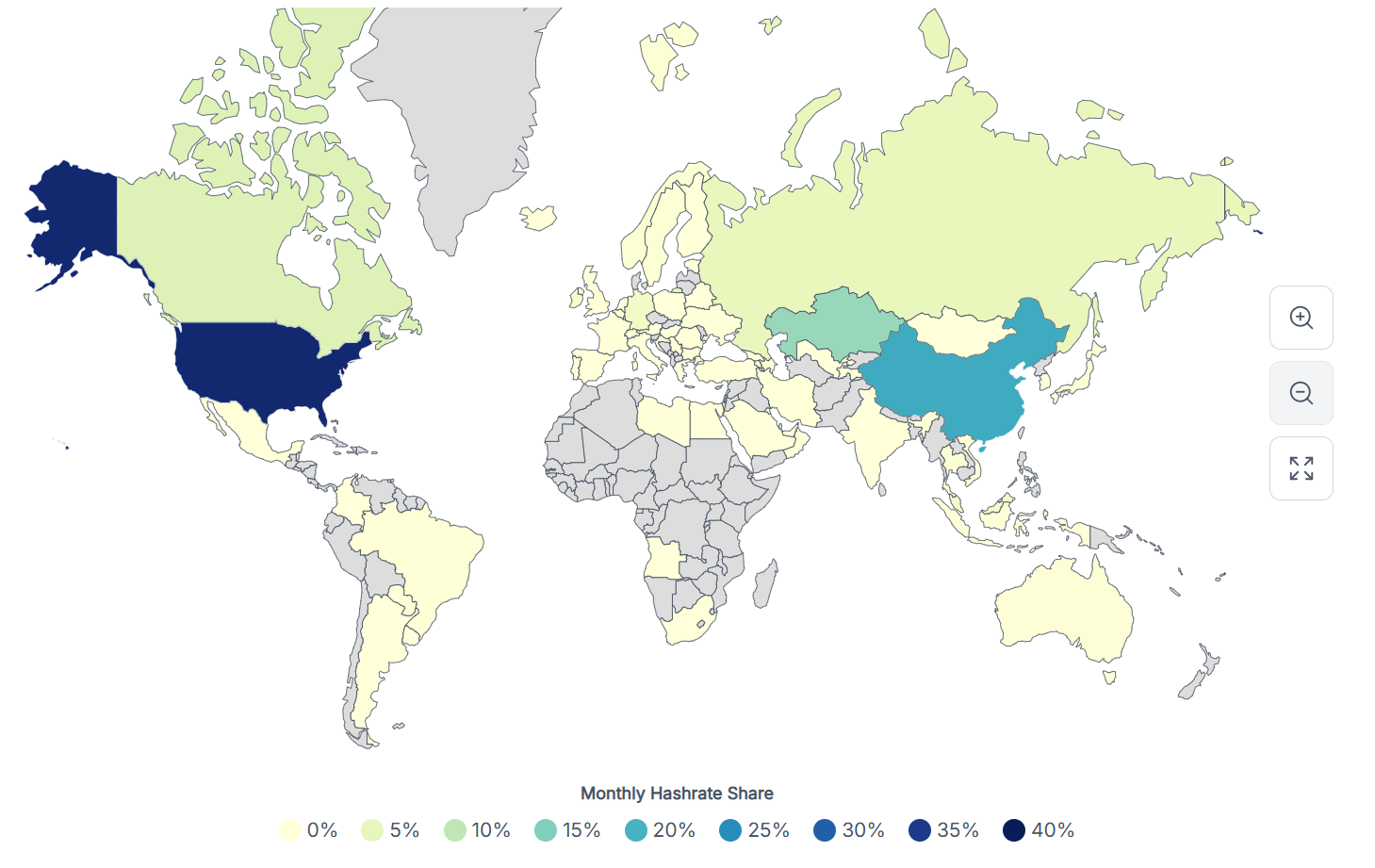

According to Reuters data, China held the third-largest share of global Bitcoin mining, at 14% as of late October. This underscores that crypto operations continue to exist in the country, even under strict prohibition.

Bitcoin mining by country in 2025. Source: World Population Review

In August, Chinese regulators reportedly instructed brokers to cancel educational events and halt the promotion of stablecoin research, arguing these activities could facilitate fraud or unregulated fundraising.

Hong Kong follows a different path

In sharp contrast, Hong Kong has been moving in the opposite direction. In July, the region opened its licensing framework for stablecoin issuers. However, several tech firms have paused their launch plans after mainland regulators intervened and halted their proposals.

The latest PBOC statement makes clear that Beijing intends to continue tightening, warning that attempts to bypass the ban will be met with expanded enforcement and inter-agency coordination.

Source:: China Confirms Crypto Ban Again as Stablecoins Quietly Surge