Founded in 2011, BTCC is one of the longest-running cryptocurrency exchanges in the industry and a well-established platform for derivatives traders seeking high leverage, deep liquidity, and reliable execution. While many exchanges have introduced mandatory verification requirements, BTCC remains one of the few major platforms where users can deposit, trade, and withdraw without KYC.

With up to 500x leverage, consistently thick order books, and more than a decade of uninterrupted operation without security breaches, BTCC offers a high-performance environment for active traders. Its suite of tools, including futures trading, copy trading, demo trading, and a VIP rewards program, caters to both advanced users and newcomers learning the basics of leveraged markets.

In this review, we’ll explore what BTCC offers in 2026, its security practices, supported assets, fees, and how it compares to other popular derivatives exchanges.

Pros:

- Non-KYC trading and withdrawals available for most account functions

- Up to 500x leverage on major cryptocurrency futures

- Deep liquidity and consistently high derivatives volume

- More than 14 years of operation with no reported security breaches

- Supports tokenized stocks, commodities, and forex in addition to crypto

- Beginner-friendly tools: copy trading, demo accounts, and simple onboarding

Cons:

- Spot market is limited compared to leading multi-asset exchanges

- High leverage increases liquidation risk for inexperienced users

- Tokenized markets may be confusing for first-time traders

- Futures-focused structure may not appeal to long-term investors

BTCC exchange overview

Established in 2011, BTCC is one of the earliest Bitcoin exchanges and has evolved into a global derivatives platform known for its stability and operational transparency. Originally based in China, BTCC later expanded into international markets and now holds regulatory registrations in multiple jurisdictions, including the United States (FinCEN), Canada (FINTRAC), and Europe.

Today, BTCC focuses primarily on futures trading, offering extremely high leverage, a secure trading environment, and a wide range of tools designed for systematic, high-volume, or short-term traders. With its long track record and consistently deep futures liquidity, BTCC remains a notable choice for traders who prioritize execution quality and risk management tools over broad spot-market coverage.

Key features and offerings

BTCC’s feature suite spans both professional-grade tools and beginner-friendly options:

- Futures trading: Trade major crypto pairs with up to 500x leverage

- Spot trading: Limited but functional spot market for major cryptocurrencies

- Copy trading: Mirror top-performing traders with automated replication

- Demo trading: Practice risk-free with 100,000 USDT in virtual funds

- Tokenized markets: Trade stocks, commodities, and forex through tokenized contracts

- VIP program: Tiered fee discounts based on trading volume

With its blend of high-performance derivatives markets and user-friendly tools, BTCC positions itself as a hybrid exchange suitable for both advanced traders and newcomers exploring leveraged markets.

User experience

BTCC’s interface is clean, intuitive, and optimized for both beginners and high-frequency traders. Charting tools are responsive, order placement is seamless, and market data updates in real time.

The platform is available on web and mobile, offering:

- Smooth order execution with minimal slippage

- Easy switching between spot, futures, and copy trading

- Portfolio and PnL tracking dashboards

- Beginner-friendly demos and tutorials

New users can get started quickly, especially since most functionality does not require KYC—an uncommon advantage among major 2026 exchanges.

Regulation and licensing

BTCC operates under multiple regulatory registrations:

- FinCEN (USA) – Registered as an MSB

- FINTRAC (Canada) – MSB registration

- European license (Lithuania) – EU compliance

Its cross-jurisdictional regulatory footprint provides a level of credibility and operational oversight not always found among high-leverage derivatives platforms.

Security practices

BTCC is notable for its clean record: in more than 14 years of operation, the exchange has never experienced a confirmed security breach. This track record is supported by a layered security architecture that includes:

- Cold wallet storage: Majority of user funds stored offline

- Two-factor authentication (2FA): Required for withdrawals and account actions

- KYC-based protections: For users who choose full verification

- Withdrawal whitelisting: Restricts outgoing transfers to approved addresses

- Encrypted data systems: Protect sensitive user information

BTCC’s long-term reliability is a major distinguishing factor compared to newer futures platforms that lack established security reputations.

Supported cryptocurrencies and tokenized assets

BTCC offers access to over 200 cryptocurrencies, including:

- Major assets: BTC, ETH, XRP, ADA, SOL

- Meme coins: DOGE, SHIB, PEPE

- Fan tokens: PSG, CITY, CHZ

Beyond crypto, BTCC is one of the few exchanges offering tokenized exposure to traditional markets, including:

- Gold and oil

- Forex pairs (e.g., EUR/USD)

- Equity markets and index-linked tokens

This multi-market environment allows traders to diversify strategies using a single platform.

Payment methods

- Crypto deposits: BTC, ETH, USDT, and more — free of charge

- Fiat purchases: Visa and Mastercard via third-party providers

Crypto deposits are instant after network confirmation, while fiat purchases depend on card issuer rules and third-party processing times.

Fees and charges

Spot trading fees

BTCC uses a maker–taker model:

- Maker: 0.2%

- Taker: 0.3%

Futures trading fees

- Maker: 0.025%

- Taker: 0.045%

These rates place BTCC among the lower-cost derivatives platforms, especially when combined with VIP tier fee reductions.

Copy trading fees

- Profit-sharing: 10%–15% only on profitable copied trades

- Standard futures fees: Apply normally

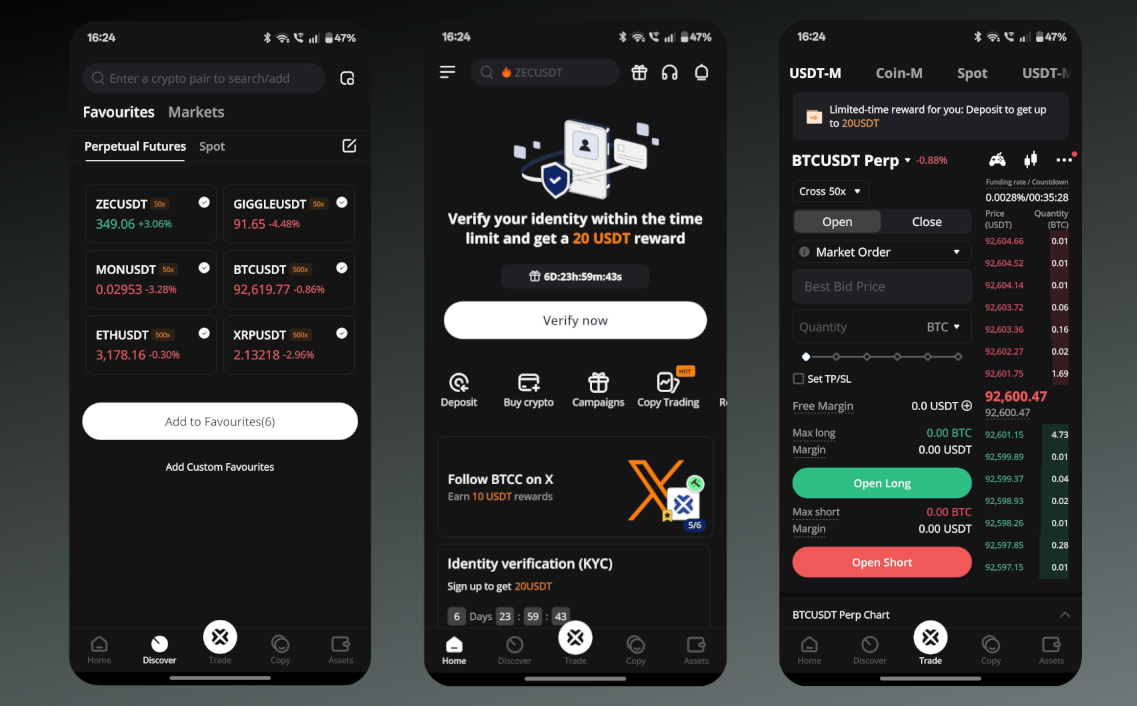

Mobile app functionality

The BTCC mobile app mirrors its desktop experience with:

- Real-time trading data and alerts

- Full support for futures, spot, and copy trading

- Integrated security settings (2FA, notifications)

- Smooth charting and technical tools

For active traders, the mobile platform offers a reliable way to manage positions on the go.

Referral and affiliate program

BTCC runs a dual referral system:

- Affiliate program: High commission rates for content creators and high-volume referrers

- Standard referral program: Up to 35% fee rebates for inviting friends

Both programs include real-time tracking tools and fast reward payouts.

The bottom line

BTCC stands out in 2026 as a high-performance derivatives exchange with a rare combination of deep liquidity, high leverage, non-KYC accessibility, and excellent long-term security. Its focus on futures trading makes it a strong option for active traders, while copy trading and demo trading offer an easy entry point for beginners.

However, traders looking for a broad spot market or low-risk investment products may find BTCC’s futures-heavy structure limiting. And although 500x leverage is attractive for experienced traders, it carries significant liquidation risks for newcomers.

Overall, BTCC remains a powerful choice for users who value liquidity, speed, and advanced tools in a regulated yet flexible trading environment.

Source:: BTCC Exchange Review 2026: High-Leverage Trading With Deep Liquidity & Proven Security