BNB is trading at $617.77, sitting at a critical technical level after slipping below the key $620 zone. The token is now caught between two competing narratives: a bullish falling wedge breakout targeting $700 and beyond, and a bearish breakdown scenario that could extend losses toward $500.

With high-timeframe support under pressure and derivatives positioning resetting, the next move could be decisive.

BNB tests major support after losing $620

BNB recently slipped below the $620 level, a zone that carried significant technical weight. This area marked the 0.618 Fibonacci retracement of the broader advance, often referred to as the “golden pocket.” It also aligned closely with the 200-week moving average, a macro trend indicator that historically defines long-term market structure.

Price is now hovering just beneath this level, probing whether the move is a temporary liquidity sweep or the beginning of deeper consolidation.

If BNB can reclaim $620 with strong weekly closes and expanding volume, the current breakdown could be classified as a deviation. However, sustained acceptance below this level would weaken the broader bullish structure and shift focus toward lower value areas.

BNB testing the $620 golden pocket and 200-week moving average support zone. Source: TradingView

Falling wedge points to $680–$700 breakout zone

On the lower timeframe, BNB is forming a falling wedge pattern on the four-hour chart. This structure typically appears late in corrective phases and signals fading bearish momentum as lower highs and lower lows compress toward a breakout point.

Momentum indicators support this idea. The Relative Strength Index has rebounded from near-oversold conditions, suggesting downside pressure may be weakening.

A confirmed breakout above wedge resistance would invalidate the lower-high sequence and open the path toward the $680–$700 resistance zone.

That range is especially important.

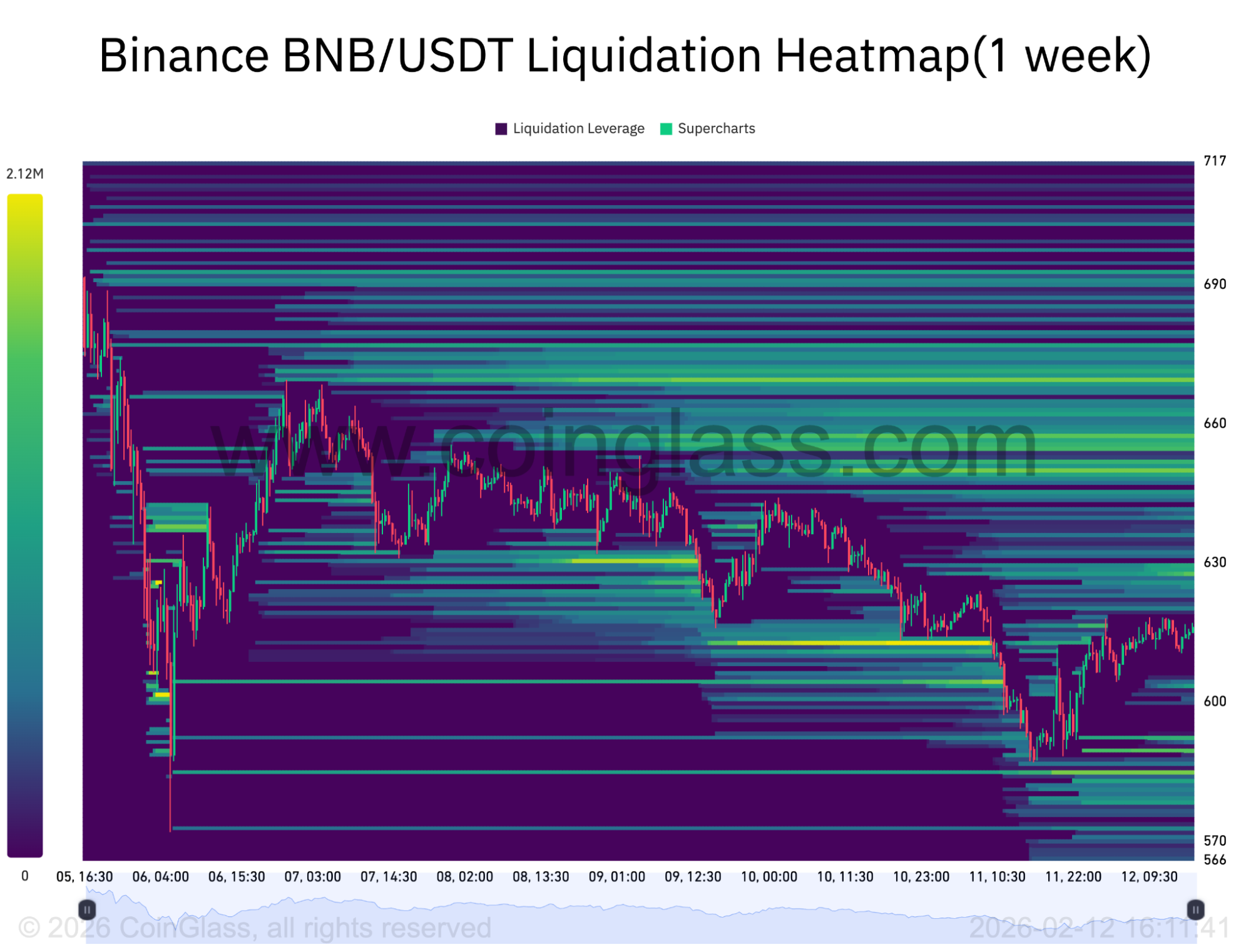

According to Binance’s one-week liquidation heatmap, there is a dense cluster of short positions stacked between $680 and $700. If price pushes into that region, forced liquidations could accelerate upside momentum through a short squeeze.

Binance liquidation data indicates a significant build-up of short positions between $680 and $700, a zone that could amplify volatility if price breaks higher.

BNB liquidation heatmap highlighting short liquidity concentration near $700. Source: CoinGlass

Bearish flag breakdown still looms

Despite the wedge structure, the higher timeframe recently confirmed a bearish flag breakdown on the daily chart.

BNB had formed a tight upward-sloping channel following its prior decline, a classic continuation pattern. The rejection near $620 confirmed seller dominance, and once the psychological $600 level broke, momentum accelerated to the downside.

RSI and MACD both tilted bearish during the move, adding credibility to the breakdown.

If BNB fails to reclaim $620 decisively, the next downside scenario could extend toward the $550–$500 region, particularly if broader crypto market sentiment remains defensive.

This creates a clear technical fork in the road:

Reclaim $620 and squeeze higher, or remain below it and risk extended consolidation.

CoinCodex BNB price prediction

CoinCodex’s BNB price prediction outlines a steady recovery from current levels near $617.77, with upside momentum expected to build into the second quarter of 2026.

In February 2026, BNB is projected to trade between $580.15 and $675.07, with an average price of $630.55, representing a potential 9.40% gain.

March strengthens the bullish case, with a forecast range of $618.11 to $748.77, implying over 21% upside from current levels.

Momentum accelerates in Q2.

In April, BNB is expected to trade between $697.20 and $880.97, with an average near $784.32, marking a potential 42.76% increase. May carries a projected high of $913.50, representing nearly 48% upside from current levels.

By June and July, the model anticipates moderate consolidation, with projected highs of $823.93 and $806.82, respectively. Even so, BNB is forecast to remain comfortably above $700 throughout mid-2026 if bullish structure holds.

Kraken: Best crypto exchange for security & reliability

- Buy, sell, and trade 400+ cryptocurrencies with industry-leading security

- Spot, Futures & Margin trading – leverage up to 5x for advanced traders

- Earn rewards with staking on top cryptocurrencies

- 24/7 customer support and high liquidity for fast trades

- Regulated in the US with strong compliance and security measures

- 13+ million users worldwide

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other advice. Nothing on this page is a recommendation or solicitation. Always seek independent professional advice before making investment decisions. Some links may earn us a commission at no extra cost to you.

Source:: BNB Price Forecast: Falling Wedge Signals $700 Move as Support Gets Tested