Key highlights:

- After a deep pullback, the TAO price has returned to a zone where selling pressure tends to slow and the chart starts asking bigger questions.

- Price is trying to stabilize, though TAO still has work to do before it can clear the resistance levels that matter.

- Analysts see a path higher if current support holds, putting much higher levels back into the conversation.

TAO is hanging out in a spot that usually gets traders talking. Some see it as a classic accumulation zone, the kind that forms after most of the damage is already done. Others see a market that keeps failing to get its footing and assume this is just another pause before the lower prices.

Right now, the TAO price is trading around $189–$195, and it’s doing so right where price has shown interest before. That alone doesn’t guarantee anything, but when a market revisits a level after months of downside, the next move tends to be clearer than the ones before it.

TAO price slows down inside a key accumulation area

Crypto Ronald’s chart tells a pretty simple story. The TAO price has been under pressure for a long time, and now it’s finally settling into a zone where sellers don’t seem as aggressive anymore.

TAO is hanging around $189.43, right in the middle of an area that’s been acting like an accumulation range after months of downside from the $300–$500 region.

$TAO recovery will be epic here

send it back $300++ pic.twitter.com/stwYisgO4q

— Crypto.Ronald (@CryptoGemRnld) February 2, 2026

Earlier on, the chart shows a clear downtrend channel. That eventually gave way to choppy, sideways movement, which usually means a lot of selling has already played out. When the price rolled over again, it didn’t fall apart. Instead, it drifted back into the same lower zone, which is why this area keeps popping up on traders’ radar.

Right now, the TAO price feels squeezed. There’s support underneath, but a descending trendline is still leaning on price from above. A clean break higher could reopen the path toward $250–$300. If this base fails, though, the setup changes fast.

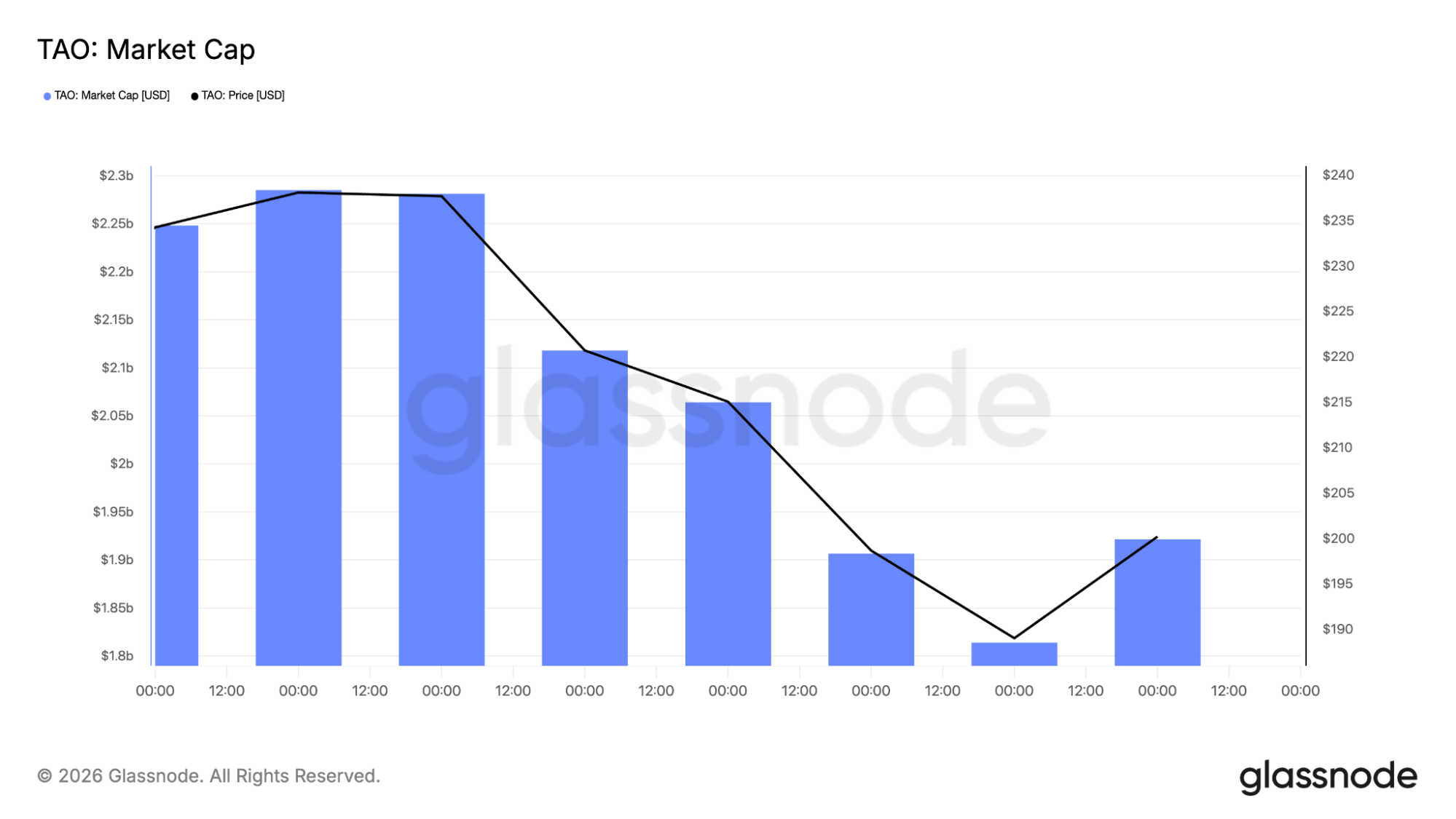

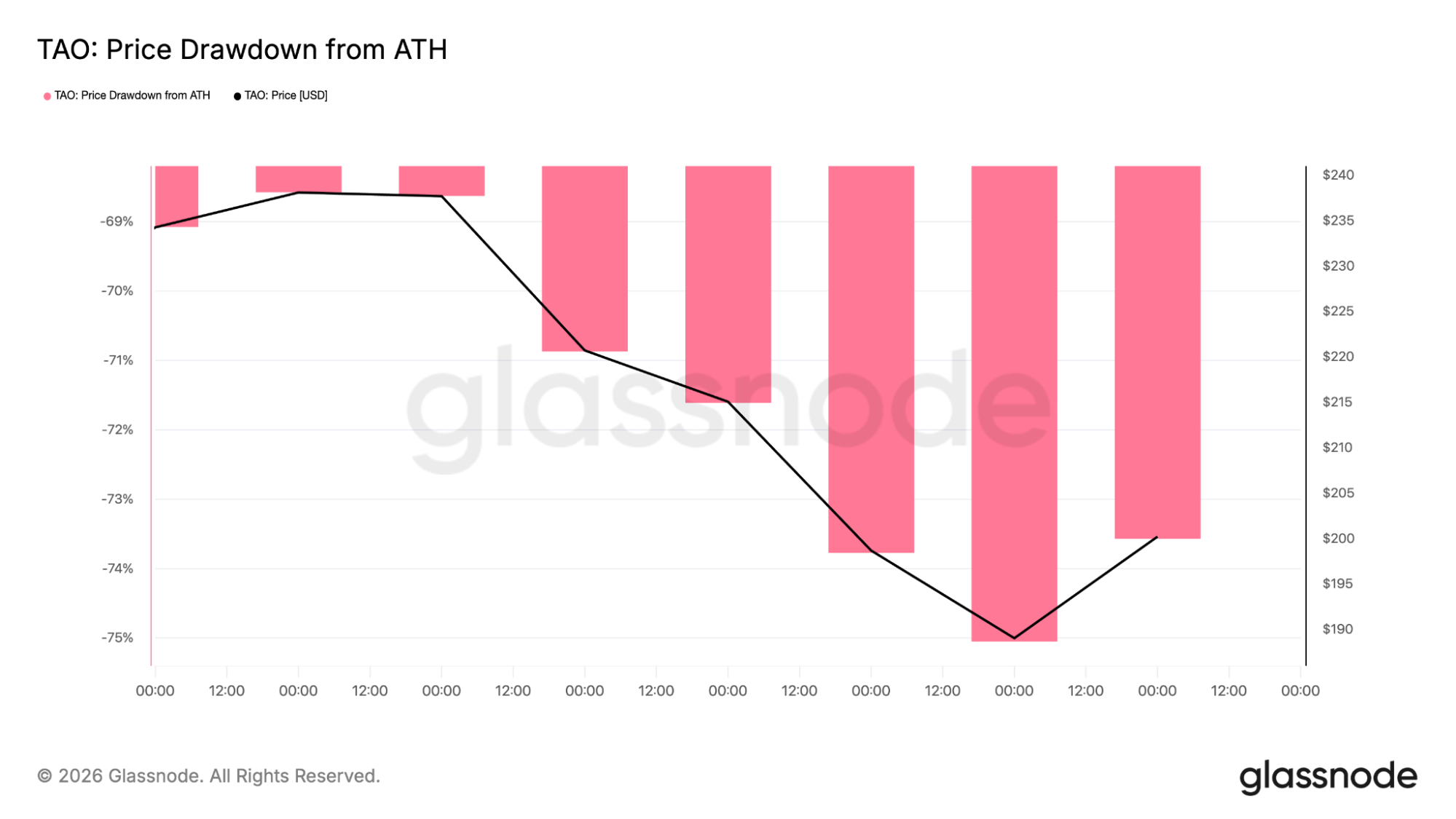

Market cap and drawdown hint that the worst may be behind

Looking at the market cap chart from Glassnode data, you can see how capital slowly drained out of TAO over time. Earlier readings hovered above $2.2B, then slid lower toward roughly $1.8B–$1.9B.

Recently, that decline has started to slow. Price followed the same path, rolling from the low-$230s down into the high-$180s before attempting a small rebound.

The drawdown chart adds another layer. TAO pushed close to a -75% drawdown from its all-time high before bouncing slightly. That doesn’t mean the trend has flipped, but it does indicate that forced selling has eased.

When drawdown stops expanding and begins to flatten, markets often move into a range where accumulation and distribution battle it out. In simple terms, TAO looks like it has already gone through its ugly phase. What happens next depends on whether buyers are willing to step in consistently.

TAO’s short-term structure hints at an early bounce

On the 4-hour chart, the TAO price is hovering near $195.7, sitting just above a well-defined support zone in the high-$170s to low-$180s. Price dipped into that area, bounced, and hasn’t immediately rolled over again. That’s a small but meaningful change in behavior.

4-Hour TAO price chart analysis

Momentum is still weak, though. The RSI sits around 40, which isn’t bullish, but it’s also not collapsing. This is often what early basing looks like. The 100-period moving average is much higher, near $230, reminding us that TAO is still trading below key trend levels. Any upside move will need to deal with resistance quickly.

What stands out is how tight price action has become. After a sharp drop from the high-$200s, TAO has started moving sideways in a narrow range. That kind of compression often comes before a bigger move, in either direction.

TAO’s daily chart explains why $300 feels distant but not crazy

On the daily chart, the TAO price is around $194.7, and the broader trend still looks heavy. The 100-day moving average is up near $290, which is a long way above current price. That gap explains why rallies so far have struggled to stick.

Daily TAO price chart analysis

The daily RSI sits near 32, which shows just how stretched the downside has been. Markets don’t reverse just because RSI is low, but this is often where sharp relief moves begin if selling pressure fades.

The key takeaway here is simple. TAO is sitting just above a major support band. If that level holds, the path higher opens up gradually. If it breaks, the chart loses its structure fast.

Zooming out, the long-term chart labels this zone as accumulation, and that’s not unreasonable. Price spent a long time higher, rolled over, and has now landed back at a horizontal base. This is usually where longer-term players start paying attention.

What comes next for TAO?

The “$300++” call sounds aggressive, but the chart does show what needs to happen. First, TAO needs to keep holding above the current support zone.

Then it needs to reclaim the low-$200s and stay there. After that, the real test comes around $230–$260, where moving averages and prior structure meet.

If TAO can work through that area, a move toward $300 stops sounding unrealistic and starts looking like a mean-reversion rally. If support breaks instead, the narrative flips fast and the market starts hunting for a lower floor.

That’s why this zone matters. The TAO price is sitting at a level where the next move probably won’t be subtle. It’s either the start of a recovery leg, or the calm before another drop.

CoinCodex’s 1-month TAO price prediction places the token’s price near $148.25, pointing to a more bearish near-term view as the market works through its recent volatility.

Kraken: Best crypto exchange for security & reliability

- Buy, sell, and trade 400+ cryptocurrencies with industry-leading security

- Spot, Futures & Margin trading – leverage up to 5x for advanced traders

- Earn rewards with staking on top cryptocurrencies

- 24/7 customer support and high liquidity for fast trades

- Regulated in the US with strong compliance and security measures

- 13+ million users worldwide

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other advice. Nothing on this page is a recommendation or solicitation. Always seek independent professional advice before making investment decisions. Some links may earn us a commission at no extra cost to you.

Source:: Bittensor (TAO) Price Analysis: TAO Enters Recovery Mode as $300 Comes Back Into Focus