Bittensor (TAO) has become one of the most talked-about projects in the crypto-AI crossover. And its first major tokenomic event is just around the corner: the first ever TAO halving.

For many crypto veterans, halving events are well known. They’ve historically marked turning points in price cycles, miner behavior, and long-term supply dynamics. And in Bittensor’s case, the halving could signal a new era for the network, its participants, and the economics behind AI-driven consensus.

But how exactly does the TAO halving work? What triggers it? And what does it mean for miners, validators, subnet developers, or anyone watching the TAO chart?

I’ll break it down, step by step.

Key highlights:

- The Bittensor halving is supply-based: The TAO halving occurs when 10.5 million tokens have been mined, not on a fixed date or block number.

- It cuts emissions by 50 percent: Daily token issuance will drop from 7,200 TAO to 3,600 TAO immediately once the halving is triggered.

- The next halving is expected in December 2025: Multiple platforms project the event will happen between December 10 and 13, depending on network activity.

- The impact could be market-moving: Reduced supply and sustained demand may influence TAO’s price, although timing and market reaction remain uncertain.

What is the Bittensor halving?

The TAO halving is a built-in protocol event that reduces the rate at which new TAO tokens are created. It’s inspired by Bitcoin halvings and other deflationary assets. But it’s implemented in a way that fits Bittensor’s architecture and mission.

Instead of relying on time-based triggers or block height, Bittensor’s halving mechanism is based on total supply milestones. Specifically, a halving is triggered when 50% of the total TAO supply has been emitted into circulation.

Here’s what that means in practice:

- Total supply: Bittensor is capped at 21 million TAO. There’s no inflation and no minting beyond that ceiling.

- Halving threshold: The first halving occurs when 10.5 million TAO have been mined.

- Reward adjustment: When the threshold is hit, the block reward (currently set at 1 TAO) is slashed by 50%.

That reward is distributed across Bittensor’s contributors: miners who validate the network, validators who secure consensus, and subnet operators who train models and build applications.

A halving instantly cuts the flow of new TAO entering circulation, which affects all these roles.

So, why does this matter?

Halvings reduce selling pressure from new supply

TAO’s daily issuance, currently around 7,200 tokens per day, won’t stay that way forever. Once the halving hits, the network will start producing just 3,600 TAO daily. That hard shift in supply unlocks two critical dynamics:

- Scarcity increases: There’s suddenly less TAO hitting the market. If demand stays steady or rises, the price has historical precedent to follow upward (though not guaranteed).

- Mining incentives shift: Participants earning TAO must either double down on performance or compete harder for fewer rewards, especially as TAO’s utility expands across the subnet economy.

This design is intentional. Like Bitcoin, Bittensor’s halving serves as a monetary throttle. It:

- Tightens issuance over time

- Rewards early contributors

- Controlling inflation without governance votes or central intervention

All of this is one of the reasons Bittensor (TAO) might be one of the best crypto to buy in November 2025.

How the TAO halving works

The mechanics of the Bittensor halving are pretty simple, but also powerful.

TAO is emitted through a continuous block reward of 1 TAO every 12 seconds, which amounts to approximately 7,200 new TAO tokens created each day. This emission is split equally among three groups that support the network:

- Miners, who process transactions and provide compute power

- Validators, who maintain consensus and verify subnet activity

- Subnet owners, who register and operate machine learning subnets

When the first halving is triggered (after 10.5 million TAO have been mined), that 1 TAO block reward will automatically drop to 0.5 TAO.

In other words, new supply is instantly cut in half without any need for community votes or manual intervention.

Supply-driven vs block-driven halvings

Unlike Bitcoin, which triggers halvings every 210,000 blocks, Bittensor takes a more dynamic approach. Its halving schedule is supply-based, not time-based. That means the halving happens precisely when a certain amount of TAO has entered circulation, regardless of how long that takes.

This structure makes sense for a network designed around machine learning contributions and decentralized resource exchange. It prioritizes fair issuance over fixed timelines. This allows TAO to evolve at the pace of its actual adoption rather than an arbitrary countdown.

What happens after the halving

Once the halving occurs, daily emissions will fall to about 3,600 TAO. All other tokenomics remain the same:

- The 21 million cap stays fixed

- Mining continues as normal, just with smaller rewards

- Subnet rewards and validator payments shrink proportionally

The change is immediate and permanent. There is no rollback or cooldown. It is the first of several halving events that will eventually taper emissions toward zero as TAO reaches full supply.

The result is a tightening of token availability, which historically has affected market behavior in deflationary protocols. But whether the TAO halving leads to a supply shock or a price run depends on more than just math. That brings us to the big question.

When is the next TAO halving?

Now that we’ve covered how the TAO halving works, let’s get to the question everyone is asking: when will it actually happen?

Because Bittensor’s halving is supply driven, not date-driven, there’s no hard-coded timestamp. The halving is programmed to occur when the total mined supply hits 10.5 million TAO, and that number increases with every block.

So the exact TAO halving date depends on current network emissions and how much TAO is recycled back into the system.

That said, several trusted analytics platforms are tracking the Bittensor halving countdown in real time, and most point to a mid-December 2025 estimate.

Current halving projections

Here’s what the data currently shows:

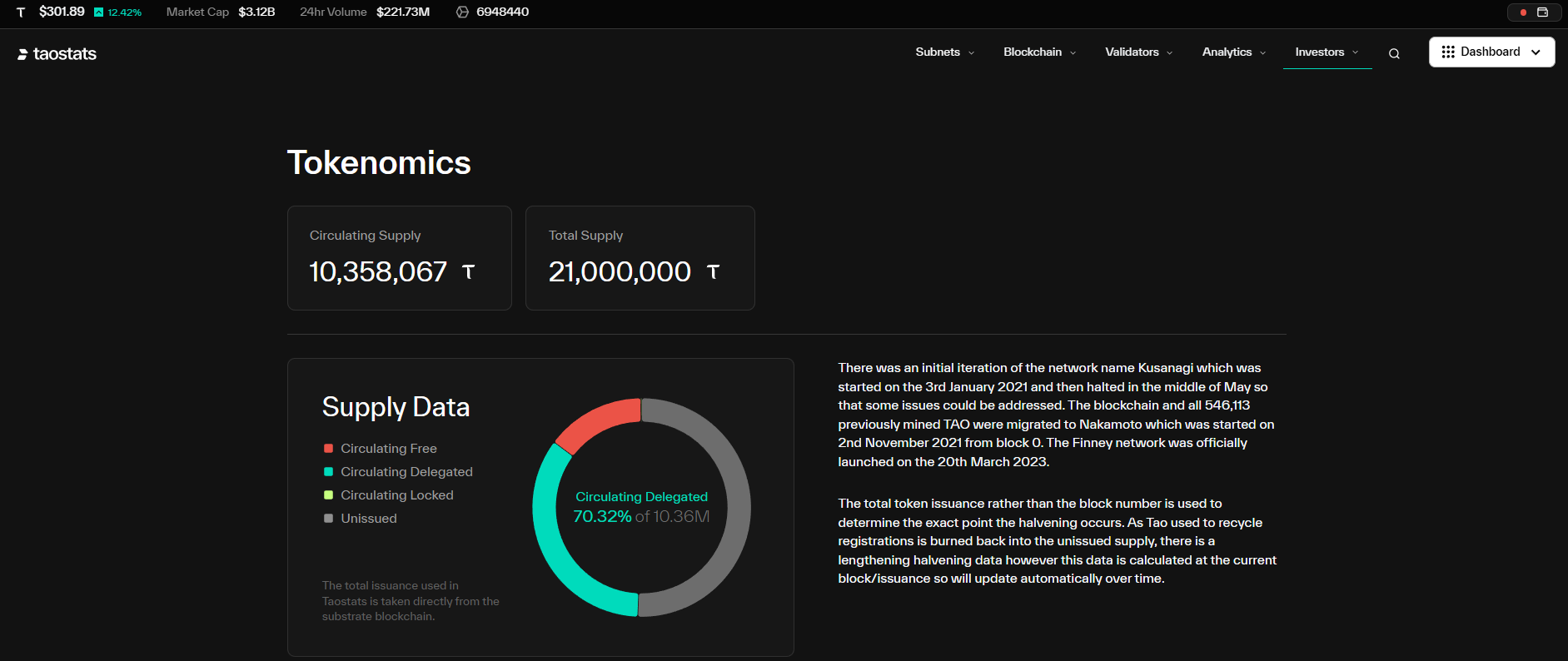

- Taostats (official community explorer): Projects the halving to occur on December 13, 2025, based on current emission rates and on-chain activity.

- CoinMarketCal: Lists the expected halving between December 10 and 12, 2025, depending on how aggressively miners continue operating.

All of these trackers pull live on-chain data to estimate the halving window. Minor shifts in block production speed or TAO recycling could move the date slightly forward or backward, but all indicators suggest December 2025 is a realistic target.

How to track the countdown

If you’re actively staking, building, or investing in TAO, you can monitor the halving timeline on the Taostats tokenomics page. Here, you’ll be able to find he current total supply, daily emission rate, and estimated halving date.

Both tools are updated regularly and reflect real-time emissions. If you’re closely following the Bittensor ecosystem, bookmarking one or both is a good idea.

What happens after the TAO halving

Once the halving is triggered and Bittensor crosses the 10.5 million TAO threshold, the network enters a new phase. The block reward drops from 1 TAO to 0.5 TAO.

The most immediate effect is on the protocol’s inflation rate. Currently, with 7,200 TAO entering circulation daily, the supply expands at a steady clip. After the halving, that number falls to 3,600 TAO per day, effectively slowing down the rate at which new tokens are introduced into the market.

This has several ripple effects across the network:

- Reduced rewards for contributors: Miners, validators, and subnet owners will see their daily earnings drop by 50 percent. This creates more competition for block production and could drive some less efficient participants out of the network.

- Tighter TAO supply on the open market: With fewer new tokens being created, centralized and decentralized exchanges may see lower TAO liquidity, especially if demand increases.

- Greater pressure on protocol efficiency: Participants may need to optimize their setups, upgrade infrastructure, or consolidate operations to remain profitable.

However, the halving does not affect any other mechanics in the protocol. The block time remains the same, the subnet incentive system continues as designed, and the 21 million cap is untouched.

So, the network keeps running, just with fewer rewards in circulation.

Importantly, Bittensor’s design also allows recycled TAO (e.g. transaction fees, burned tokens, slashed balances) to re-enter circulation. But this has minimal impact on emissions and does not delay or reset the halving schedule.

The halving is permanent and automatic. It marks a new stage in TAO’s life cycle, one where scarcity plays a bigger role than pure issuance.

Will the TAO halving affect the price?

This is the section where speculation meets economics. I can’t guarantee anything here. While no one can be sure what will happen after the halving, it’s worth examining how similar events have played out in other crypto ecosystems.

Historically, halvings have had a major psychological and economic impact on token prices. In Bitcoin’s case, every halving has been followed by a significant bull run. Not immediately, but within months of the supply cut, a year at most. That’s because supply shocks tend to create upward pressure when demand holds steady or increases.

With TAO, the setup is comparable:

- Fixed supply with decreasing emissions

- Growing demand from miners, validators, and subnet operators

- Expanding ecosystem of apps and models running on the protocol

If those trends continue post-halving, and network adoption accelerates, the TAO halving could trigger a new rally. Less daily sell pressure from miners and reduced token dilution are structurally bullish signals.

That said, markets are never purely rational. Macroeconomic conditions, exchange listings, AI sector hype cycles, and investor sentiment will all play a role. It’s possible the halving is already priced in by traders anticipating the event. It’s also possible the impact is delayed, as it often is with protocol-level shifts.

What is clear is this: TAO’s first halving is a milestone. It reduces inflation, raises scarcity, and introduces new dynamics into an already fast-evolving ecosystem.

It might result in a stronger market price, or a temporary plateau. But regardless, the fundamentals of the network become more sound.

The bottom line

The upcoming TAO halving is a defining moment in Bittensor’s evolution. From miners and validators to developers and investors, every participant will feel the impact of this transition.

Of course, as with any halving, the event introduces uncertainty and opportunity. It could boost price momentum, increase demand for TAO, and drive long-term growth across the protocol. Or it could mark a quieter structural shift that sets the stage for deeper adoption over time.

Either way, the countdown has begun. And in a network where AI and crypto incentives meet, that countdown may be more significant than anyone realizes: there’s a reason why Bittensor is near the very top of our best AI crypto list.

Source:: Bittensor Halving Dates: When Is the Next TAO Halving?