Key highlights:

- Bitcoin tumbles below $104K, with traders bracing for a test of $100K

- Analysts eye possible correction toward $92K CME futures gap

- Short-term holders show signs of capitulation amid growing losses

Bitcoin has fallen below $104,000 for the first time in weeks, sparking warnings from traders that the leading cryptocurrency may retest sub-$100,000 levels as new investors face rising unrealized losses.

On November 4, TradingView data showed Bitcoin hitting a low of $103,792 on Binance, marking a 2.7% drop in 24 hours and continuing the downward momentum that began earlier in the week.

Traders warn $100,000 may not hold

Weakness extended into the Asian trading session, as many market participants voiced doubts about Bitcoin’s ability to maintain the key $100,000 support level.

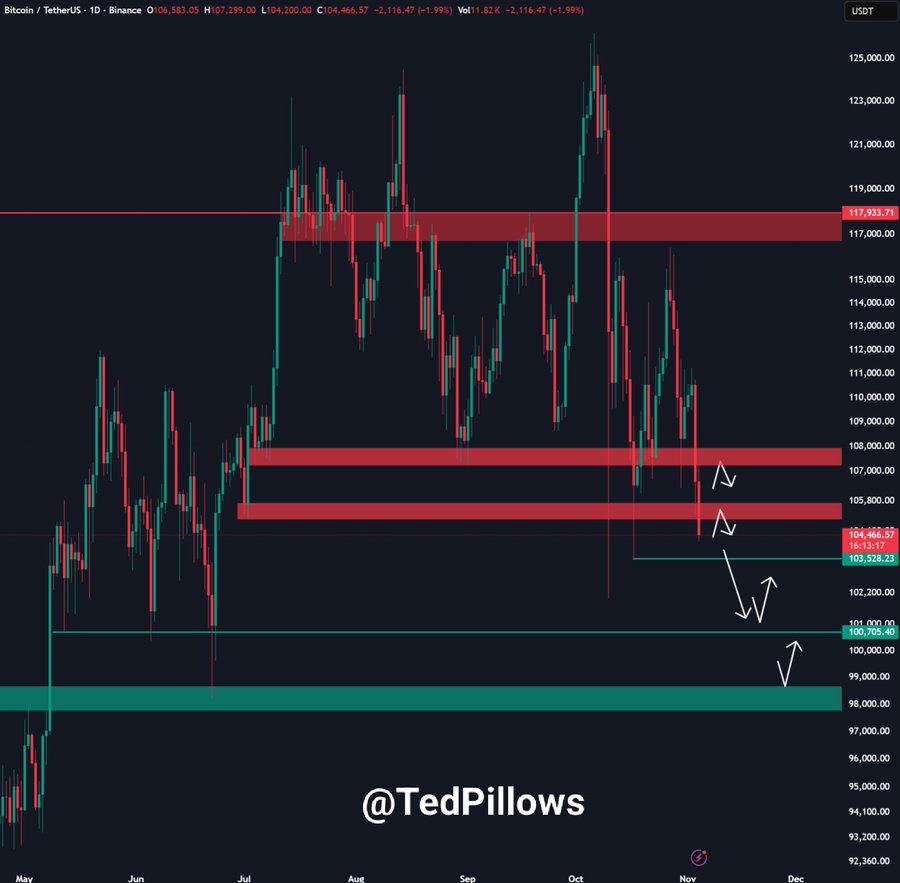

“$BTC is in absolute free fall right now,” reacted crypto investor Ted Pillows on social media. “There’s no strong support until the $100,000 level, which means it’ll most likely get retested.”

BTC/USD 1-Day Chart. Source: X

Pillows pointed to an unfilled CME futures gap around $92,000, just below the 2025 annual open.

Trader Daan Crypto Trades also warned that Bitcoin had lost major support built over recent weeks.

Now nearing the bottom of the range where price made its initial higher low after the bounce post 10/10 liquidation event,” he wrote on X, referencing the sharp market drop earlier in the month.

BTC/USD 4-hour chart. Source: X

Daan added that heavy whale selling, a stronger U.S. dollar, and weaker stock performance are pressuring crypto prices.

“Overall, not a very good recipe right now,” he concluded.

Derivatives trader Ardi noted that Bitcoin could fill the October 10 wick that touched $102,000 on Binance. That level aligns with the 50-week exponential moving average (EMA), which hasn’t been tested for seven months.

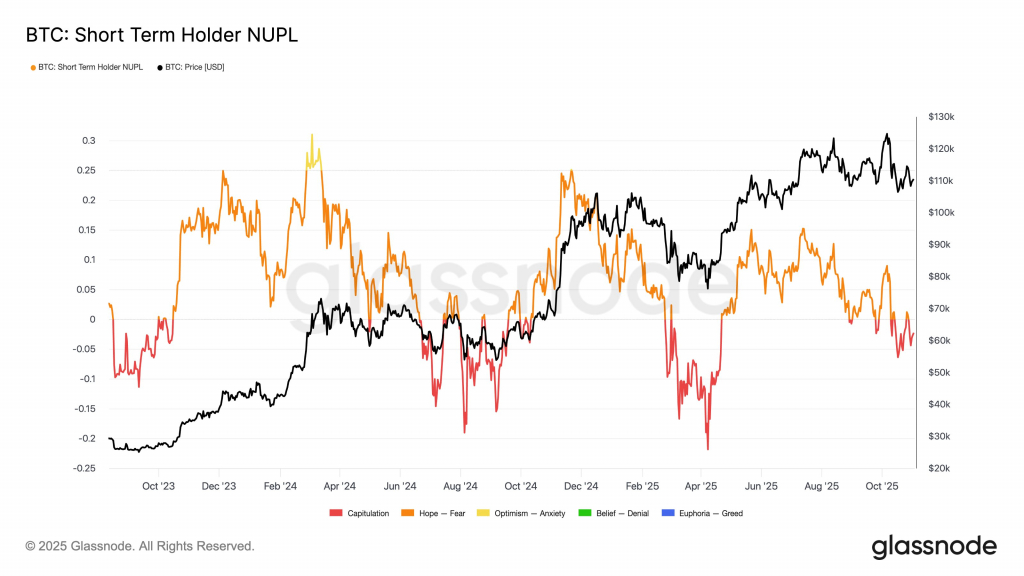

Unrealized Losses Push Short-Term Holders Into Capitulation. Source: X

The ongoing drop has pushed recent buyers into negative territory, triggering signs of stress across the market.

Data from Glassnode shows the Net Unrealized Profit/Loss (NUPL) indicator for short-term holders has fallen back into “capitulation” territory at -0.058 — its lowest since April.

“Historically, these periods of stress and capitulation by short-term holders have often created opportunities for patient investors,” Glassnode analysts noted.

Bitcoin’s current setup reflects a classic test of long-term support levels. A decisive break below $104,000, and especially $100,000, could intensify volatility and uncertainty, particularly for those who entered the market near recent highs.

Kraken: Best crypto exchange for security & reliability

- Buy, sell, and trade 400+ cryptocurrencies with industry-leading security

- Spot, Futures & Margin trading – leverage up to 5x for advanced traders

- Earn rewards with staking on top cryptocurrencies

- 24/7 customer support and high liquidity for fast trades

- Regulated in the US with strong compliance and security measures

- 13+ million users worldwide

Source:: Bitcoin’s Drop Below $104K Has Traders Watching $100K and Even $92K