Key highlights:

-

Bitcoin rebounds as volatility signals return to the market

-

Altcoins near key reversal zone after the longest bear cycle

-

Fed, earnings, and geopolitics set up a decisive week for crypto

Bitcoin returned to growth after a week-long rebound from key support levels, climbing above $116,000 and gaining more than 12% from its October 17 low.

Technical signals remain divided. Analyst Daan Crypto Trades notes that Bitcoin has traded within a narrow 8% range for four months, with sentiment repeatedly flipping. September closed in the green despite bearish expectations, while October, widely expected to be bullish, closed negative. The analyst expects volatility to expand into 2025.

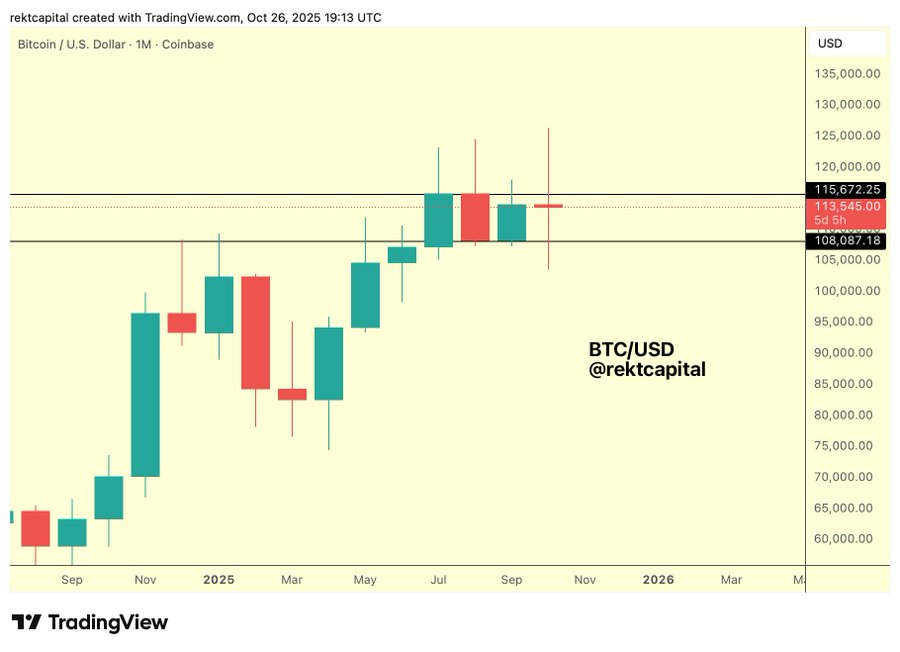

BTC/USD 1-Month Chart. Source: X

Meanwhile, analyst Rekt Capital views the current move as a strong rebound from the lower boundary of Bitcoin’s long-term range. BTC remains in a broad monthly consolidation, but the market has a chance to retest and confirm September highs as new support this month.

Source: X

However, trader Roman warns of a potential head-and-shoulders pattern forming on the weekly chart. A confirmed breakdown below $109,000 would validate the structure. Roman argues that higher timeframes are losing momentum, reducing the probability of a continued rally in the short term.

Source: X

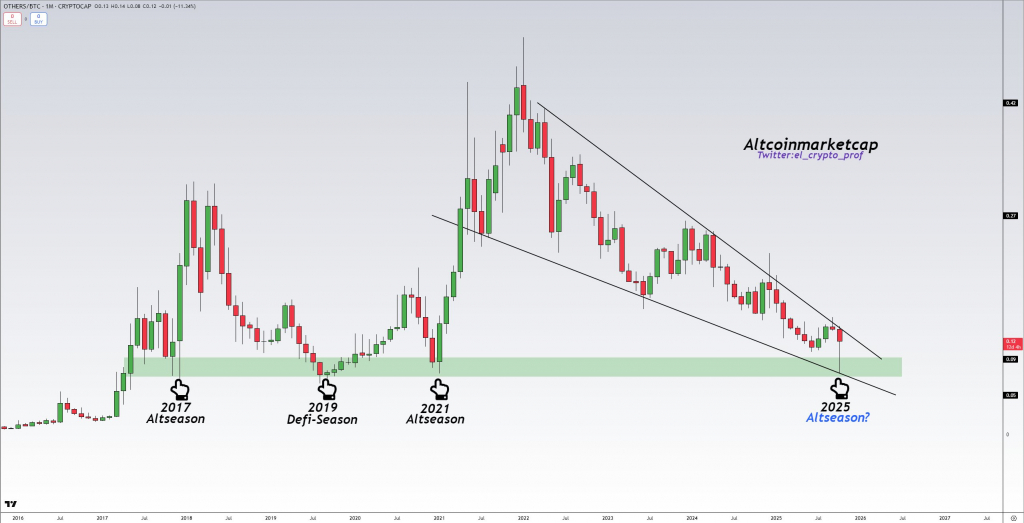

Altcoin market positions for its first breakout in years

Cryptotrader Michaël van de Poppe calls the current environment the longest altcoin bear market in history — nearly four years straight. He compares the structure to late 2019 and early 2020, citing MACD signals that resemble pre-breakout conditions.

Source: X

Van de Poppe highlights two key signals:

MACD has shown persistent red bars since Q4 2021, now on the verge of flipping green. A monthly bullish divergence has been forming for more than two years

The analyst believes this may be the final cycle with outsized altcoin returns before the market matures and profit potential declines over time.

Trader Moustache shares the bullish view, arguing that investors are not too late, and that the coming months could exceed expectations, especially in BTC-paired altcoins.

Source: X

Macro triggers could define the trend this week

Analyst BitBull calls this the most important week of Q4. The Federal Reserve is expected to announce a 25 bps rate cut on Wednesday (7:00 PM CET), followed by a press conference from Fed Chair Jerome Powell. In parallel, Microsoft, Alphabet, Meta, Apple, and Amazon will report earnings — collectively influencing ~20% of the S&P 500.

Adding to the complexity, a Trump–Xi Jinping meeting is scheduled for Thursday, with potential implications for trade relations and global liquidity.

Bitcoin has already reacted to the upcoming events, pushing above $116,000 on expectations of volatility. After four months of sideways compression, a major move in either direction now appears increasingly likely.

Source:: Bitcoin Surged to $116,000 amid Fed Decision Expectations — Are Altcoins Poised for a Breakout?