Key highlights:

- Analysts say Bitcoin may be showing its first real signs of a market bottom

- Selling pressure is weakening as traders brace for potential Fed cuts

- A second sell-off wave could confirm a turning point in the market

Disclaimer: Always seek independent professional advice before making investment decisions. Some links may earn us a commission at no extra cost to you.

Bitcoin has recovered to $88,000 after dipping toward $80,000 on November 21, and analysts say the rebound may mark the first real signs of a market bottom. The bounce comes as selling pressure eases and expectations for Federal Reserve interest rate cuts grow stronger.

Tech stocks and crypto have been under pressure for the past two weeks “because of the market flip flopping on expectations for a rate cut,” said Capriole Fund founder Charles Edwards on X.

“As the market reverts, expect it will carry Bitcoin somewhat higher,” he added.

Weakening selling pressure and rising Fed odds boost trader confidence

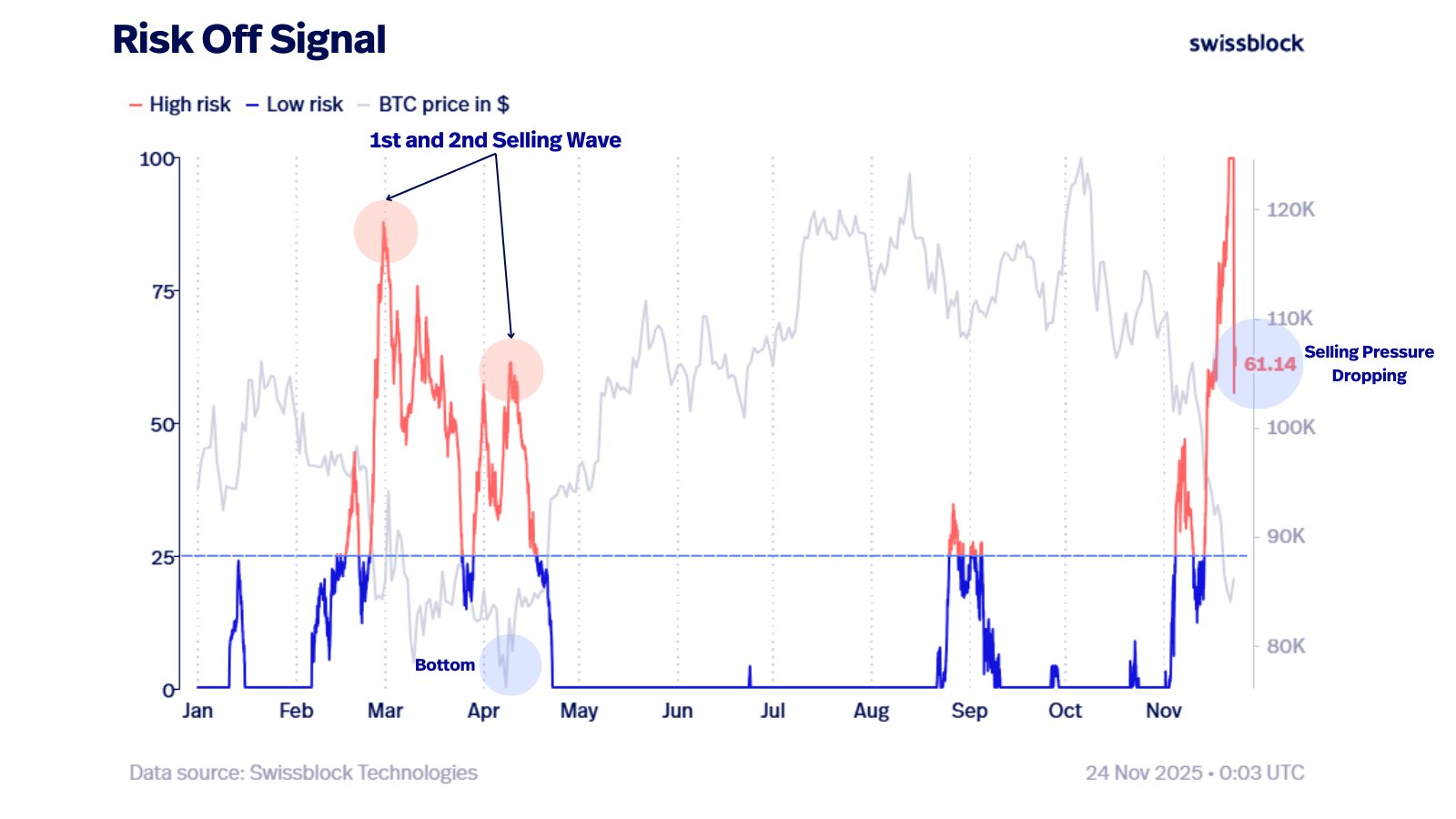

Analysts at asset manager Swissblock believe Bitcoin may finally be forming a bottom.

“The Risk-Off Signal is dropping sharply, which tells us two things: selling pressure has eased, and the worst of the capitulation is likely behind us, for now,” the firm stated.

They noted that this week is crucial to confirm whether the selling continues to fade.

Source: Swissblock via X

Swissblock explained that markets often see a second wave of selling (usually weaker than the first), and if Bitcoin holds above its previous lows, it becomes one of the strongest signals that the bottom has formed. Meanwhile, some traders expect the bottom to come between the $70,000 and $75,000 price levels, implying that Bitcoin’s correction is not yet over.

Even if a bottom is indeed close, it might take a while for Bitcoin to make major gains. Recently, veteran trader Peter Brandt said it could take until 2029 for Bitcoin to reach $200,000.

Fed cut expectations surge back to 70%

Last week, the odds of a Federal Reserve rate cut in December fell to 30%, but they have since jumped back to 70%, according to Edwards.

The CME FedWatch Tool, which tracks interest rate probabilities, shows a 69.3% chance of a 0.25% cut at the December 10 meeting.

“This is up from ~30% on Wednesday (October’s jobs report canceled by BLS), with the entire move occurring over just 2 days,” remarked a Global Markets Investor researcher who shared updated Polymarket forecasts on X.

Source: GlobalMktObserv via X

Liquidity expectations build ahead of the next Fed meeting

A market analyst at Sykodelic suggested the Fed may soon announce a reserve management program, effectively increasing liquidity.

This time is different.

In 2019 the FED overdid QT and broke the system.

This was the 2019 repo crisis.

Right now, reserves are getting pretty low, but not within danger territory just yet.

In addition, we have already had the harshest drop in Bitcoins history(record breaking… https://t.co/KHEgho2dwE

— Sykodelic 🔪 (@Sykodelic_) November 22, 2025

The analyst warned that the central bank will eventually need to inject liquidity into the system, “otherwise it will go bankrupt.”

Source:: Bitcoin Rebounds Toward $88K As Analysts Spot Early Bottoming Signals