Key highlights:

- Bitcoin recovers sharply, but analysts say tension is building beneath the surface

- Fed leadership changes could reshape markets sooner than expected

- Major volatility triggers arrive in weeks as crypto waits for clarity

Trading firm QCP Capital has released a new report assessing market conditions following the turbulence of December 1st. Bitcoin is now trading above $93,000 after a sharp 5% rebound from its $86,000 low, yet the calm recovery masks growing unease as investors wait for new catalysts.

Fed leadership shifts could become the market’s next big driver

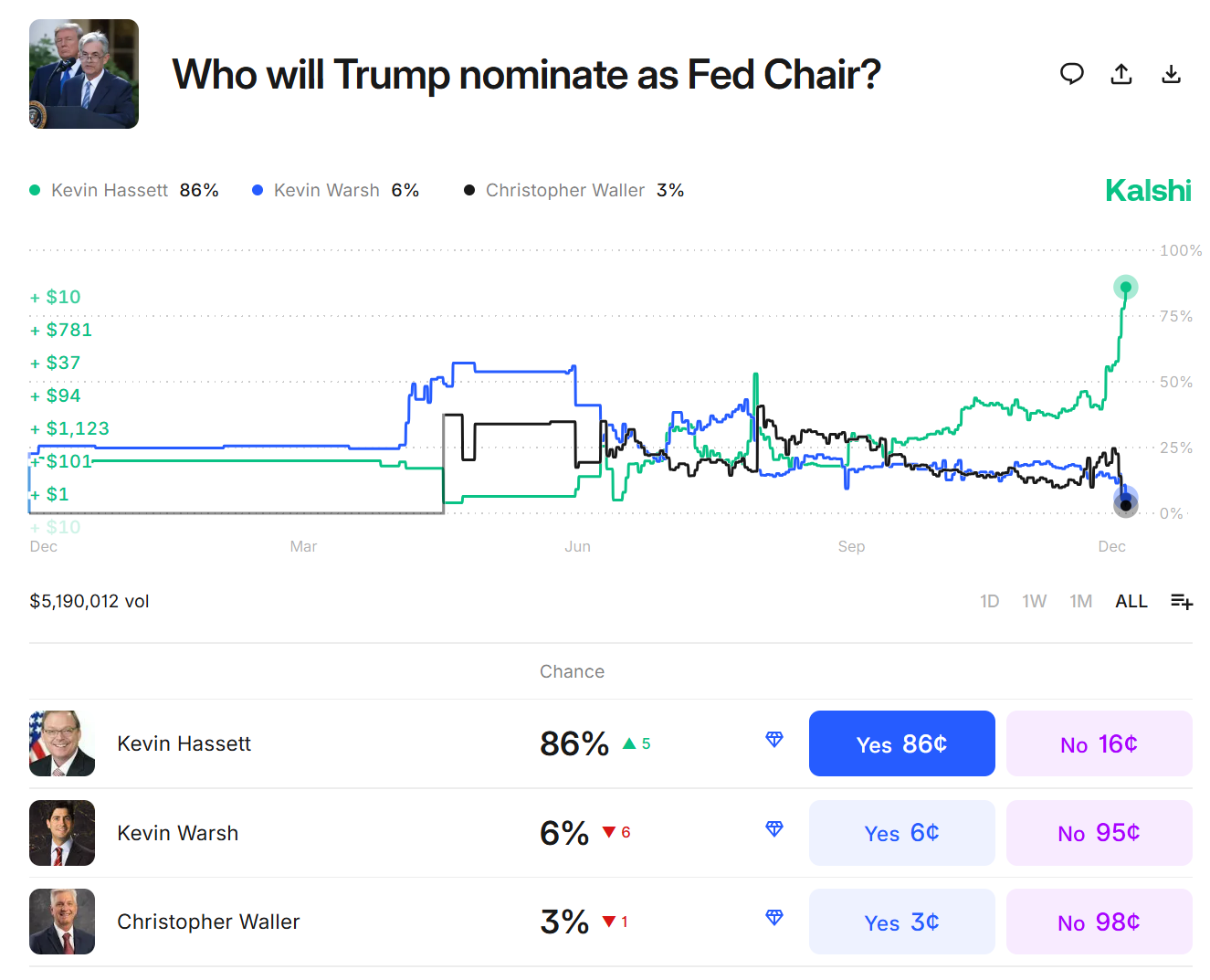

The Federal Reserve, and the uncertainty surrounding who will lead it next term, may soon dominate market sentiment. Bettors on the Kalshi prediction market currently assign an 85% probability to Kevin Hassett becoming the next Fed Chairman, with Trump expected to confirm his decision early next year.

Source: Kalshi

This change comes at a crucial time for monetary policy. Mirani is set to leave his position in January 2026, Bostic in February, and Powell in May. As these shifts unfold, the FOMC may become more accommodative than today’s markets expect.

The upcoming December 10 meeting will take place without fresh CPI or employment data, complicating policymakers’ ability to accurately assess economic conditions. Despite this, futures markets are pricing in a 90% chance of a “safeguard” 25-basis-point rate cut.

Rather than focusing solely on inflation data, discussions are shifting toward leadership, policy direction, and institutional priorities.

Cryptocurrency markets find temporary relief but remain on alert

One of the weekend’s major concerns has eased, at least for now. Strategy attracted roughly $1.4 billion through a share placement, extending its financial buffer to around 21 months and restoring its market-to-net-asset (mNAV) ratio to about 1.14. Management confirmed that Bitcoin would only be sold if mNAV fell below 1.0.

Although this stabilizes sentiment in the short term and potentially opens the door for Bitcoin to reach $100,000, structural pressures remain. The next major event is the MSCI index inclusion criteria review on January 15, which could bring significant volatility to Strategy-linked flows.

A market waiting for its next catalyst

For now, crypto markets remain stable, but it is a stability filled with anticipation. With muted macroeconomic drivers and rising uncertainty around the Fed’s direction, digital assets are effectively in a holding pattern until policymakers deliver the next decisive signal.

The market resembles a compressed spring: quiet on the surface, yet ready to release energy the moment the right trigger appears. All attention now turns to upcoming regulatory and political decisions that could shape the path ahead.

Kraken: Best crypto exchange for security & reliability

- Buy, sell, and trade 400+ cryptocurrencies with industry-leading security

- Spot, Futures & Margin trading – leverage up to 5x for advanced traders

- Earn rewards with staking on top cryptocurrencies

- 24/7 customer support and high liquidity for fast trades

- Regulated in the US with strong compliance and security measures

- 13+ million users worldwide

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other advice. Nothing on this page is a recommendation or solicitation. Always seek independent professional advice before making investment decisions. Some links may earn us a commission at no extra cost to you.

Source:: Bitcoin Rebounds but Market Tension Builds Ahead of Critical Fed Decisions: QCP Capital