Key highlights:

- Bitcoin’s hash rate dropped 4% in December, marking its steepest decline since April 2024.

- VanEck analysts say prolonged hash rate declines have historically preceded stronger Bitcoin returns.

- Rising energy costs and competition from AI data centers are pressuring miners worldwide.

Bitcoin miners are beginning to capitulate, and some analysts believe the development could be constructive for the market. Bitcoin’s hash rate fell by 4% in the month ending December 15, marking the steepest decline since April 2024. While falling network activity often raises concern, analysts at VanEck argue the pattern may signal a potential turning point.

According to VanEck analysts Matt Sigel and Patrick Bush, extended declines in hash rate have historically coincided with stronger Bitcoin price performance over subsequent months. Their analysis suggests that miner capitulation often occurs near periods of market stress rather than prolonged downturns.

Hash rate declines have historically favored returns

VanEck’s research shows that since 2014, Bitcoin’s 90-day returns have been positive in 65% of cases when the network’s hash rate declined over the prior 30 days. By contrast, positive returns followed only 54% of the time when hash rate increased.

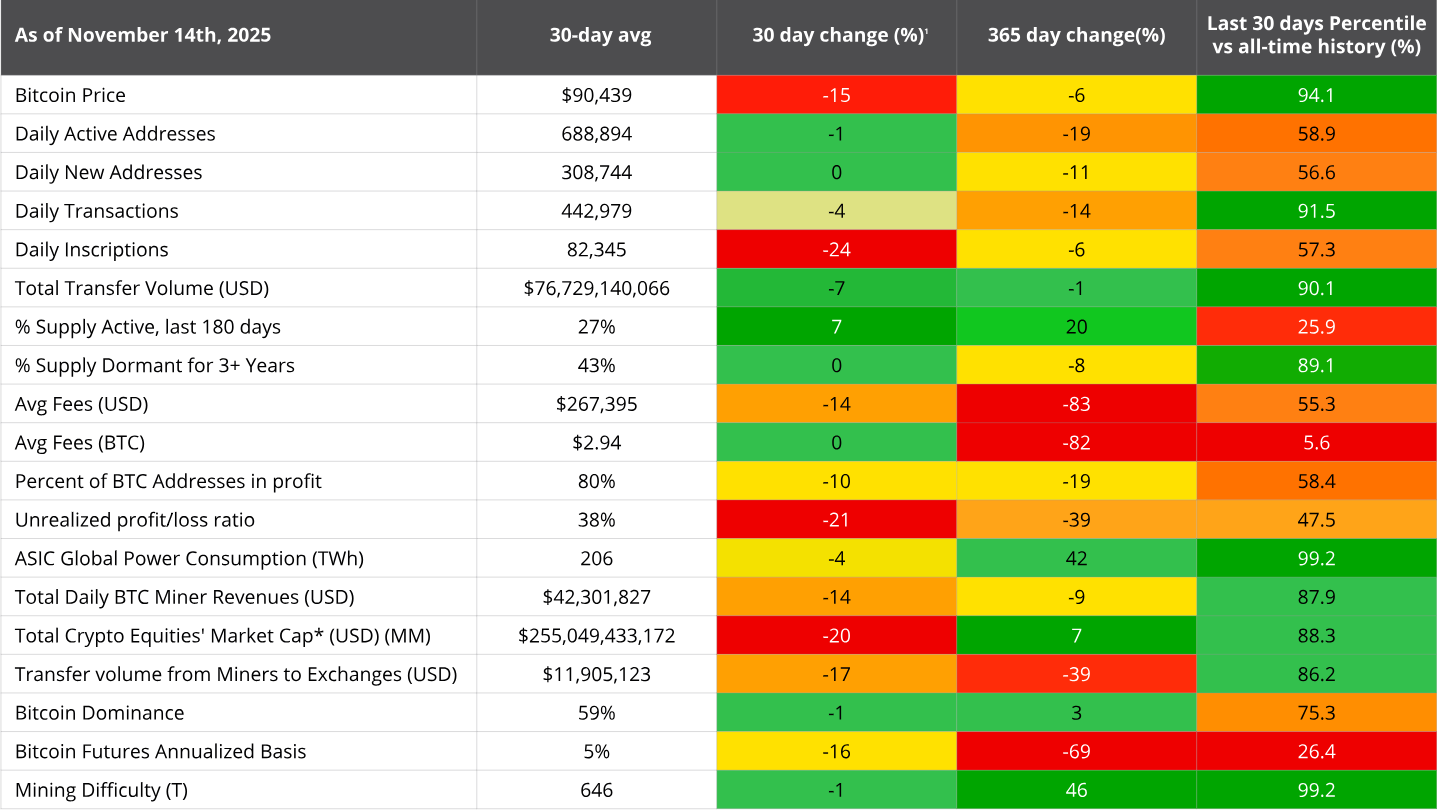

Bitcoin ChainCheck Monthly Dashboard and Highlights. Source: VanEck

Longer-term data strengthens the trend. When hash rate declined over a 90-day period, Bitcoin delivered positive 180-day returns in 77% of cases, with an average gain of 72%. This compares with a 61% success rate during periods of rising hash rate.

Analysts attribute this pattern to miner behavior. When miners shut down equipment en masse, it often reflects financial stress driven by lower prices or higher operating costs. Historically, such conditions have tended to coincide with market lows rather than extended sell-offs.

Miners face rising costs and structural pressure

Bitcoin is currently trading about 30% below its all-time high reached on October 6, compressing margins for mining operators. Falling prices combined with rising energy costs have pushed many miners close to breakeven.

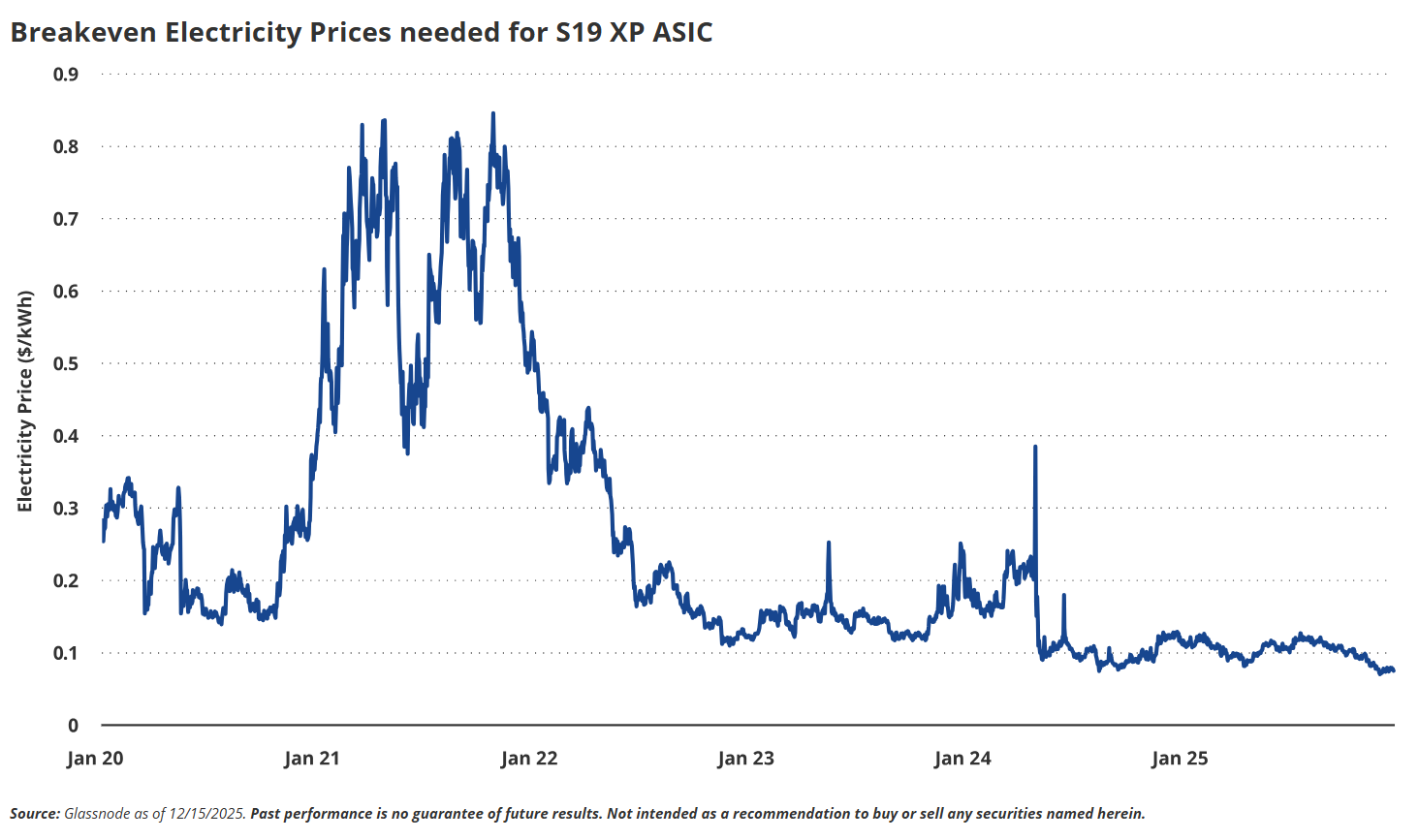

For example, the breakeven electricity cost for the 2022-model Bitmain S19 XP mining rig has fallen by nearly 36%, from roughly $0.12 per kilowatt-hour in December 2024 to about $0.077 per kilowatt-hour by mid-December. Under these conditions, less efficient operations struggle to remain profitable.

VanEck analysts link the recent 4% hash rate decline to the disconnection of approximately 1.3 gigawatts of mining capacity in China. Much of this energy, they say, is likely being redirected toward artificial intelligence data centers, a shift that could eventually remove as much as 10% of Bitcoin’s total hash rate.

Governments take diverging views on mining

Despite mounting pressure, Bitcoin mining is not universally in retreat. Analysts estimate that around 13 countries continue to actively support mining activity, viewing it as a strategic use of energy resources.

These include Russia, France, Bhutan, Iran, El Salvador, the United Arab Emirates, Oman, Ethiopia, Argentina, Kenya, and Japan. In these regions, governments increasingly see mining as a way to monetize excess energy rather than as a regulatory risk.

Analysis

The latest hash rate decline highlights a broader shift in global energy allocation. Competition from AI infrastructure is reshaping electricity markets, creating structural challenges for miners that extend beyond Bitcoin’s price cycles. Unlike the politically driven mining bans seen in 2021, today’s capacity reductions reflect economic pressure and energy reprioritization.

At the same time, the continued support of mining by multiple governments suggests the emergence of a more geographically diversified network. Whether rising competition for energy will permanently limit hash rate growth remains uncertain, but miner capitulation has historically marked periods of transition rather than long-term weakness for Bitcoin.

Source:: Bitcoin Miner Capitulation May Signal Market Bottom: VanEck