Bitcoin is holding above $106,000 after the announcement of a truce in the Middle East, while fresh hopes of an earlier Fed interest rate cut add to investor optimism.

A New Level for Buying on Dips

A temporary ceasefire in the Middle East triggered a rally in risk assets and cryptocurrencies, while oil prices continued to decline. For Bitcoin traders, signs of a bull market recovery were evident.

“Strong rally from the range lows after a big liquidity grab and deviation,” summarized trader Daan Crypto Trades in his latest analysis on X, the social network. “Now back near the middle of the range from the past 6 weeks or so.”

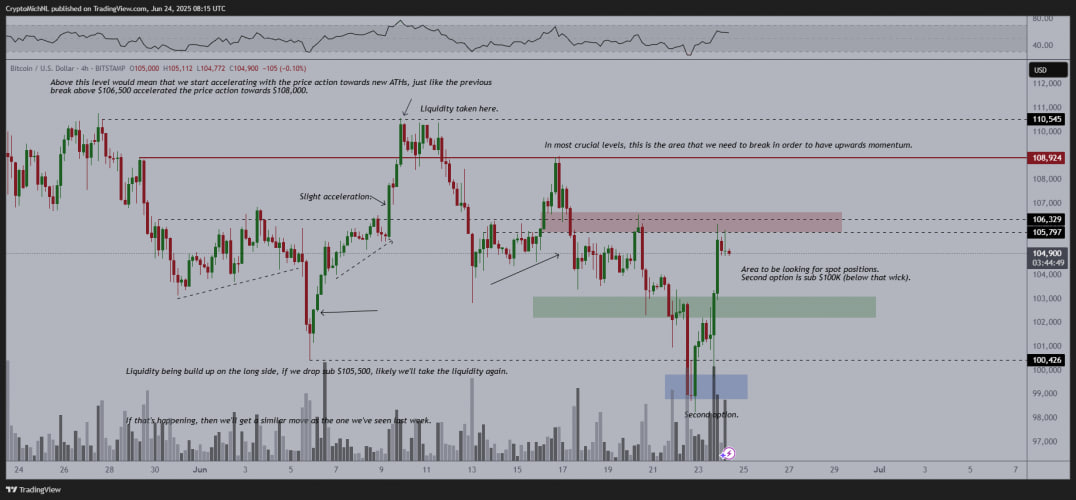

BTC/USD 4-hour chart. Source: X/Daan Crypto Trades

Trader, analyst, and entrepreneur Michaël van de Poppe described the Bitcoin price movement as a “trend switch.”

“It’s uptrending now, after we’ve had a massive liquidation crash taking place to sub $100K. It broke through $103K and hit the next resistance,” he reported to subscribers on X.

BTC/USD 4-hour chart. Source: X/Michaël van de Poppe

“Time to be buying the dip, so if we get to $103K, that’s the area you’d want to accumulate,” van de Poppe added.

Institutional Investors Remain Confident

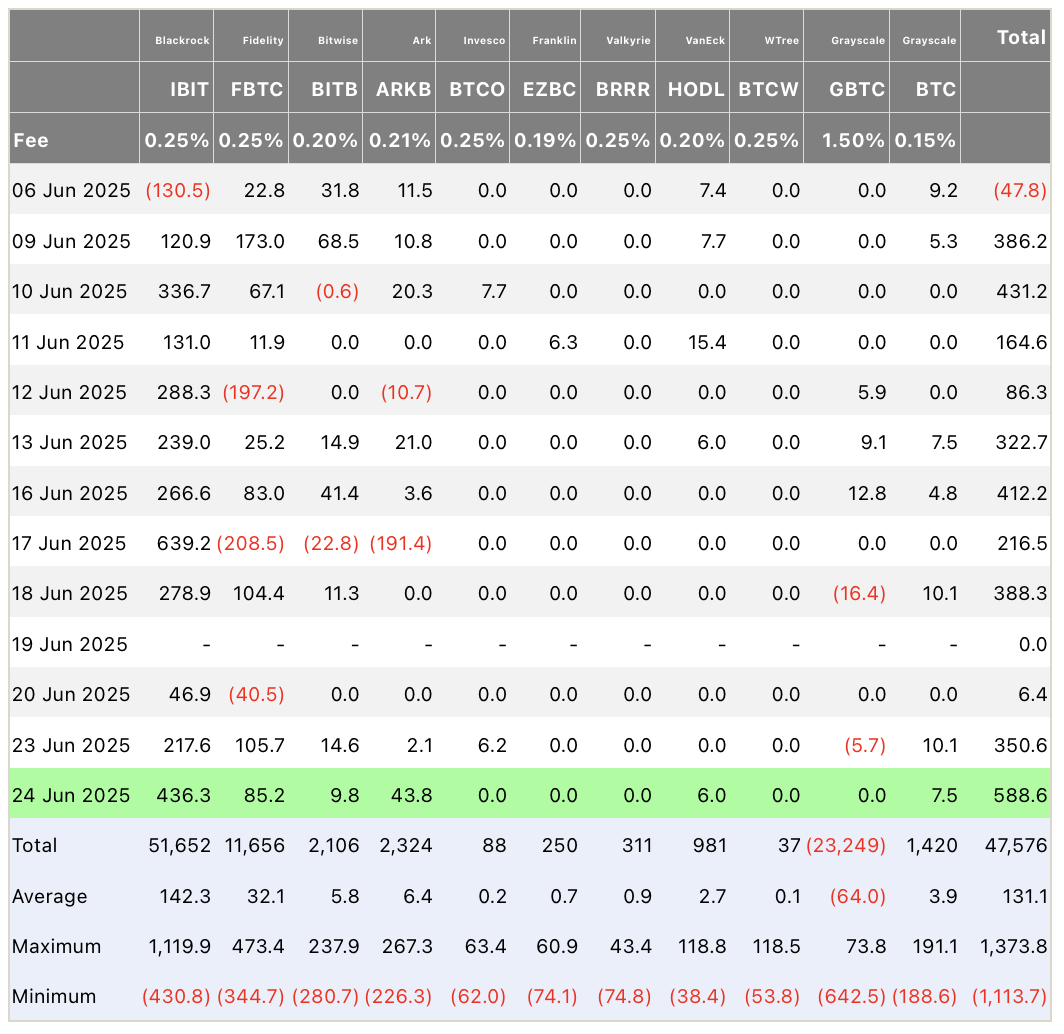

Institutional trends remained unchanged even amid military strikes between the US and Iran. Spot Bitcoin ETFs continued to show net inflows.

Movement of funds in US Bitcoin ETFs (Source: Farside Investors)

“While inflows were modest, no significant outflows were recorded either, which is a notable sign of investor confidence,” analyst platform Glassnode commented on ETF activity.

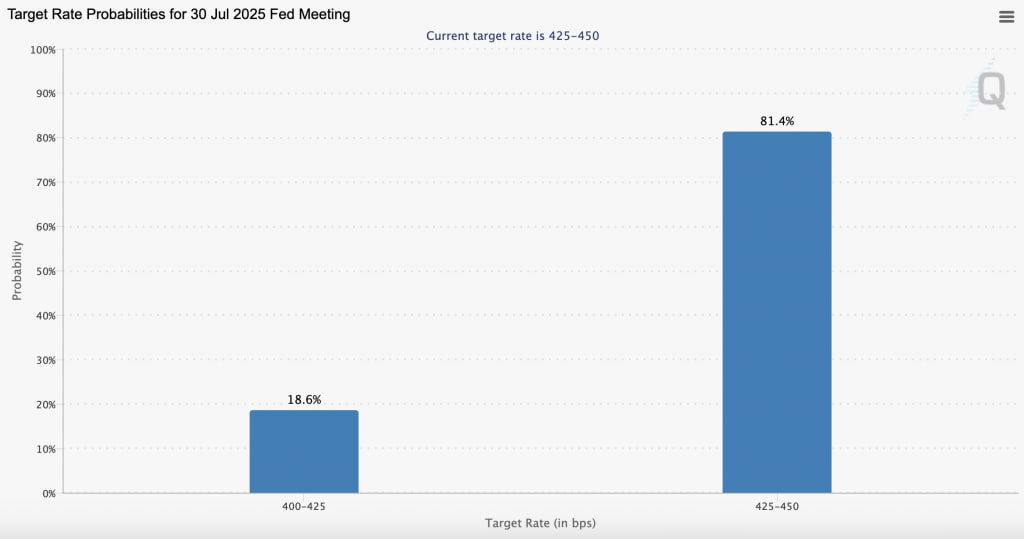

The Fed May Cut Rates in July

In an additional bullish signal, the U.S. Federal Reserve announced that it is ready to cut interest rates earlier than markets expected.

During a speech in Prague on June 23, Vice Chair for Supervision Michelle Bowman suggested that she would support a rate cut at the Federal Open Market Committee’s July meeting.

Bowman also suggested that the economic impact of U.S. trade tariffs may be less severe than feared. She also stated:

“If upcoming data show that inflation continues to evolve favorably, with growth remaining constrained by commodity prices, and if we see signs that lower consumer spending is affecting the weakening labor market, such developments should be factored into our policy discussions.”

If inflation growth remains subdued, I would support a policy decision to cut rates as early as our next meeting to bring them closer to neutral and encourage a healthy labor market.

The latest data from the Chicago Mercantile Exchange FedWatch Tool shows that markets expect the first of two rate cuts in 2025 at the September Federal Open Market Committee (FOMC) meeting.

The likelihood of a Fed rate change in July (Source: FedWatch)

Fed Chairman Jerome Powell, under pressure from President Trump to cut rates, is scheduled to speak before lawmakers in Washington on June 24–25.

eToro: Best platform for beginners and social trading

- Trade cryptocurrencies, stocks, ETFs, and commodities on one easy-to-use platform

- Follow and copy top-performing traders with eToro’s unique social trading tools

- Earn passive income with staking on popular coins like ETH, ADA, and TRX

- Fully regulated in multiple jurisdictions with strong security protocols

- 0% commission on real stock trading and competitive spreads on crypto

- 30+ million registered users across 100+ countries

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

Source:: Bitcoin Holds Strong—Could Fed and Middle East News Trigger a New All-Time High?