Key highlights:

- Bitcoin ETFs recorded $355 million in inflows after seven straight days of losses.

- Improved global liquidity and easing market pressure helped drive renewed demand.

- Analysts say the rebound reflects short-term positioning rather than a full trend reversal.

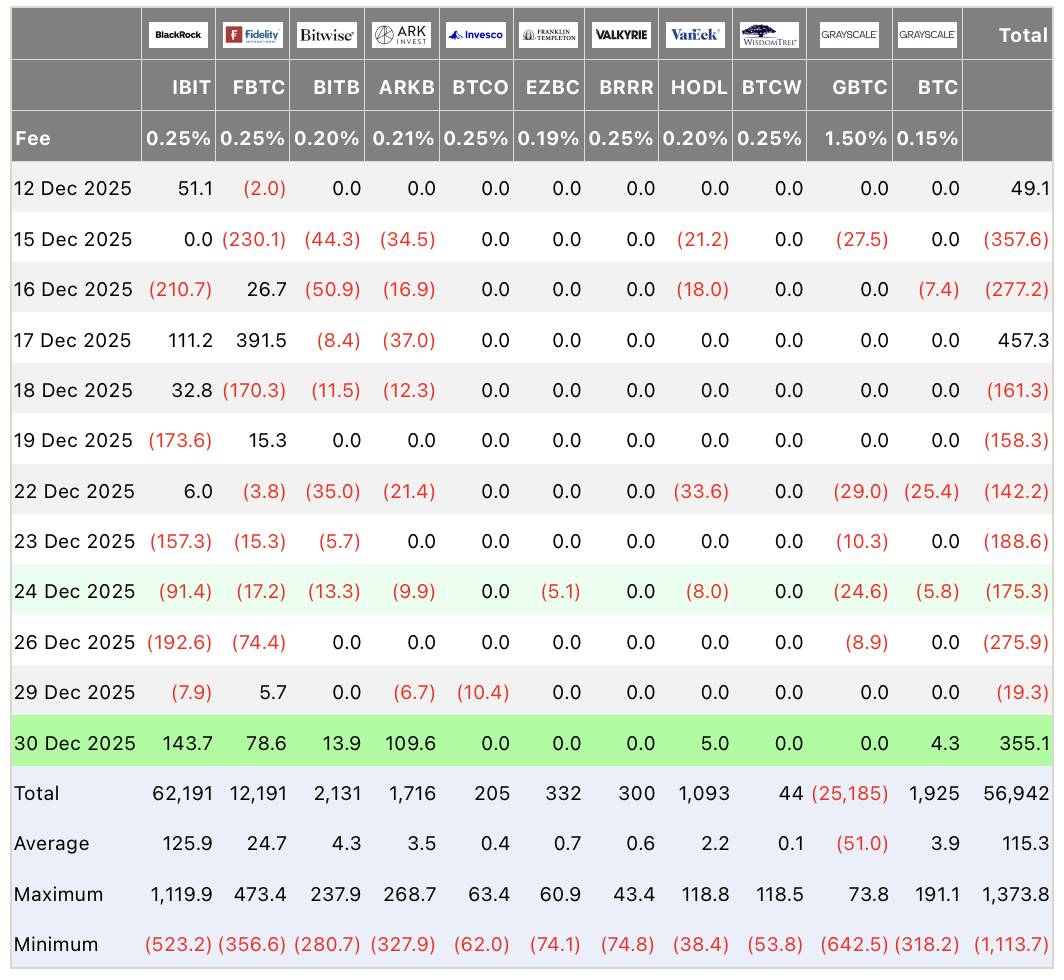

Spot Bitcoin exchange-traded funds (ETFs) ended a seven-day losing streak this week, posting $355 million in net inflows as market conditions improved and liquidity returned to global markets.

The rebound follows a sharp selloff that saw $1.12 billion exit Bitcoin ETFs over the previous week, marking one of the heaviest periods of outflows since their launch.

Source: Farside Investors

According to data from Farside Investors, renewed buying interest emerged as market pressure eased and investors reassessed positioning ahead of the new year.

BlackRock’s iShares Bitcoin Trust (IBIT) led the recovery, attracting $143.75 million in inflows. It was followed by ARK 21Shares Bitcoin ETF (ARKB) with $109.56 million, and Fidelity’s FBTC, which added $78.59 million.

Smaller funds also posted gains. Bitwise’s BITB recorded $13.87 million in inflows, Grayscale’s GBTC added $4.28 million, and VanEck’s HODL gained $4.98 million.

The 8 Best Crypto ETFs to Buy in 2025 (Even for Beginners)

Liquidity improves after December selloff

The reversal comes after a difficult December for crypto-linked funds. Throughout the month, Bitcoin ETFs experienced consistent outflows totaling $744 million, with the worst single day occurring on December 26, when nearly $276 million exited the market.

Analysts attribute the decline to seasonal factors, including reduced year-end liquidity and profit-taking by institutional investors ahead of the holidays.

Liquidity conditions begin to shift

Market observers now point to improving liquidity as the key driver behind the renewed inflows.

Arthur Hayes noted on X that dollar liquidity bottomed in November and has been rising steadily since, a trend that historically supports risk assets such as Bitcoin. Crypto analyst Mister Crypto echoed this view, citing upward momentum in global money supply indicators.

Source: Arthur Hayes

Additional support came from expectations that the U.S. Federal Reserve will inject liquidity through upcoming Treasury bill purchases, including a scheduled $8.165 billion operation.

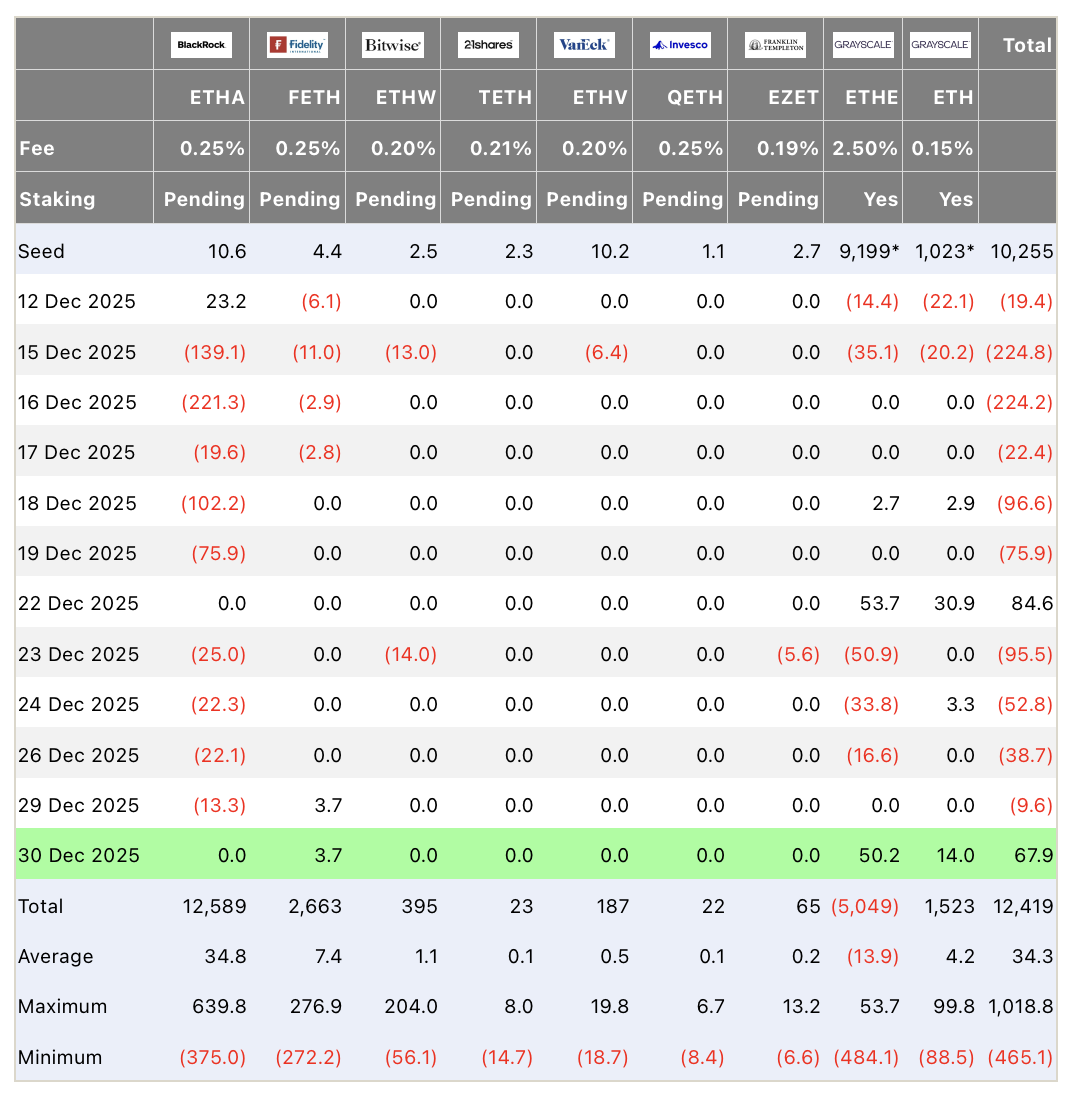

Ethereum ETFs also show signs of recovery

Bitcoin was not alone in the rebound. Spot Ethereum ETFs recorded $67.8 million in inflows, breaking a four-day losing streak that had erased more than $196 million.

Source: Farside Investors

The strongest selling occurred on December 23, when Ethereum funds saw nearly $95.5 million in outflows. The recent reversal suggests improving sentiment across the broader digital asset market.

Analysts caution that the rebound does not necessarily signal the start of a sustained bull market. Instead, the inflows may reflect short-term repositioning as institutions rebalance portfolios at the start of the year.

Historical data shows similar patterns in 2018 and 2022, when post-holiday inflows temporarily lifted prices before longer-term trends became clear.

The simultaneous recovery across both Bitcoin and Ethereum ETFs suggests algorithmic and institutional activity rather than retail-driven optimism. Whether the momentum continues will depend largely on macroeconomic conditions and liquidity trends in the coming weeks.

Source:: Bitcoin ETFs Bounce Back After $1 Billion Selloff as Liquidity Improves