Key highlights:

- Bitcoin could briefly test $80,000 as part of a Wyckoff Spring pattern during January 28-30.

- Key catalysts include FOMC meetings, options expiries worth $2.3 billion, and corporate earnings reports.

- A Spring pattern at $80,000 may signal a final accumulation phase before a potential move toward $120,000.

Trader MartyParty’s analysis points to a potential short-term drop in Bitcoin below $80,000, forming a Spring pattern according to the Wyckoff accumulation scheme. This move could occur amid an unprecedented convergence of volatility factors between January 28 and 30, 2026.

Five key events driving Bitcoin volatility

Several market events coincide during this period:

- FOMC meeting – The Federal Open Market Committee meeting on January 27-28 will be closely watched. Chairman Jerome Powell is under investigation by the Justice Department, raising uncertainty around policy guidance.

- Digital asset regulation vote – On January 29, the Senate Agriculture Committee will vote on a bill defining the regulatory powers of the CFTC and SEC.

- Options expiry – Bitcoin and Ethereum options worth $2.3 billion expire on January 30. A concentration of Bitcoin calls around $100,000 could provoke gamma-driven volatility.

- Corporate reporting – Extremist Meta, Microsoft, Tesla, and Apple are all expected to release earnings, adding pressure to the market.

- Government shutdown risk – Temporary resolution for U.S. government funding expires January 30, increasing uncertainty.

Spring signal and Wyckoff accumulation

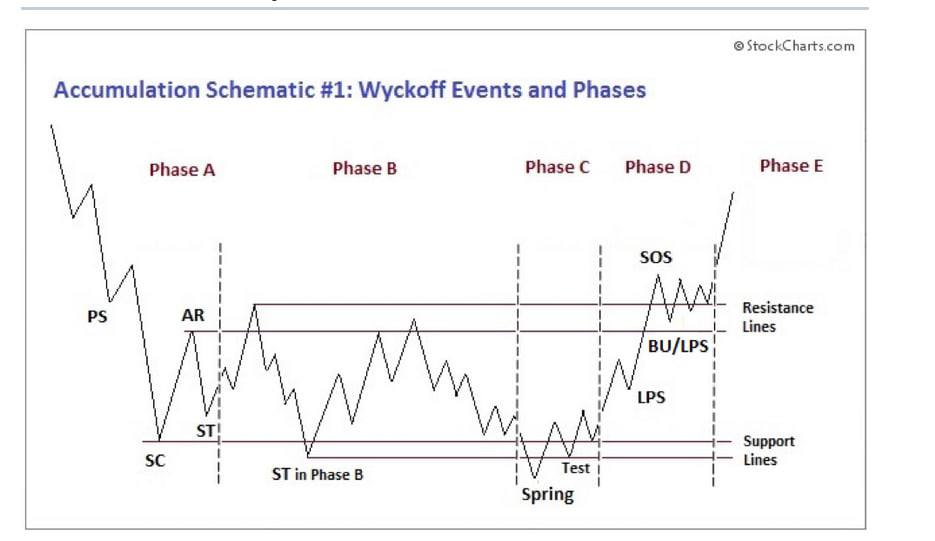

According to the Wyckoff method, a Spring signal represents a short-term false breakout below support before a significant price increase.

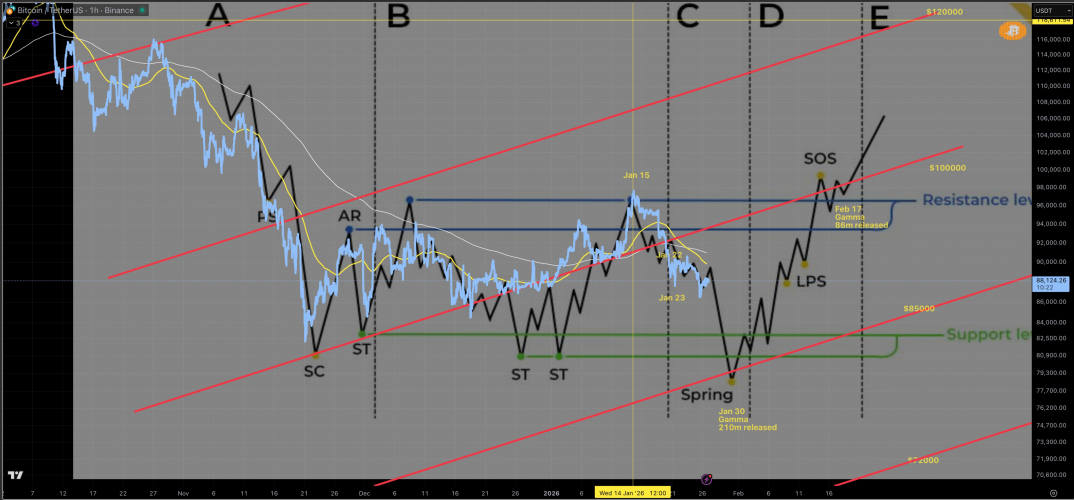

MartyParty notes that the $80,000 area could serve as the final test in Bitcoin’s accumulation phase, aligning with the lower boundary of a long-term ascending channel.

Wyckoff accumulation phases. Source: MartyParty via X

Bitcoin’s 1-hour chart shows a wide trading range between support at $82,000-$85,000 and resistance at $96,000-$98,000.

Bitcoin’s 1-hour chart and the Wyckoff accumulation phase. Source: MartyParty via X

A Spring formation near $80,000 may precede a move toward the upper boundary of the channel at $120,000. Confirmation would come with a breakout above $100,000 on high volume.

Historical crypto market behavior indicates that when extreme events align, traders preemptively price in risks, sometimes creating a “sold on the news” effect.

Institutional support for Bitcoin in 2026, including inflows into Bitcoin ETFs and corporate balance sheets, could smooth out technical volatility, potentially turning the anticipated Spring into a simple consolidation rather than a sharp drop. Focusing too closely on specific dates and levels can also become a self-fulfilling prophecy, as the market reacts to perceived observation.

Source:: Bitcoin Could Dip Below $80K Before a Massive Rally, Analyst Warns