Key highlights:

- Bitcoin and Ethereum ETFs attract hundreds of millions in new inflows

- Fed Chair Jerome Powell signals possible rate cuts amid weak data

- Investors rush back into crypto after recent sell-off recovery

American Bitcoin and Ethereum ETFs have rebounded sharply after Federal Reserve Chair Jerome Powell signaled that the U.S. central bank may soon consider interest rate cuts.

Investors quickly recovered from the recent sell-off, and capital began flowing back into crypto assets.

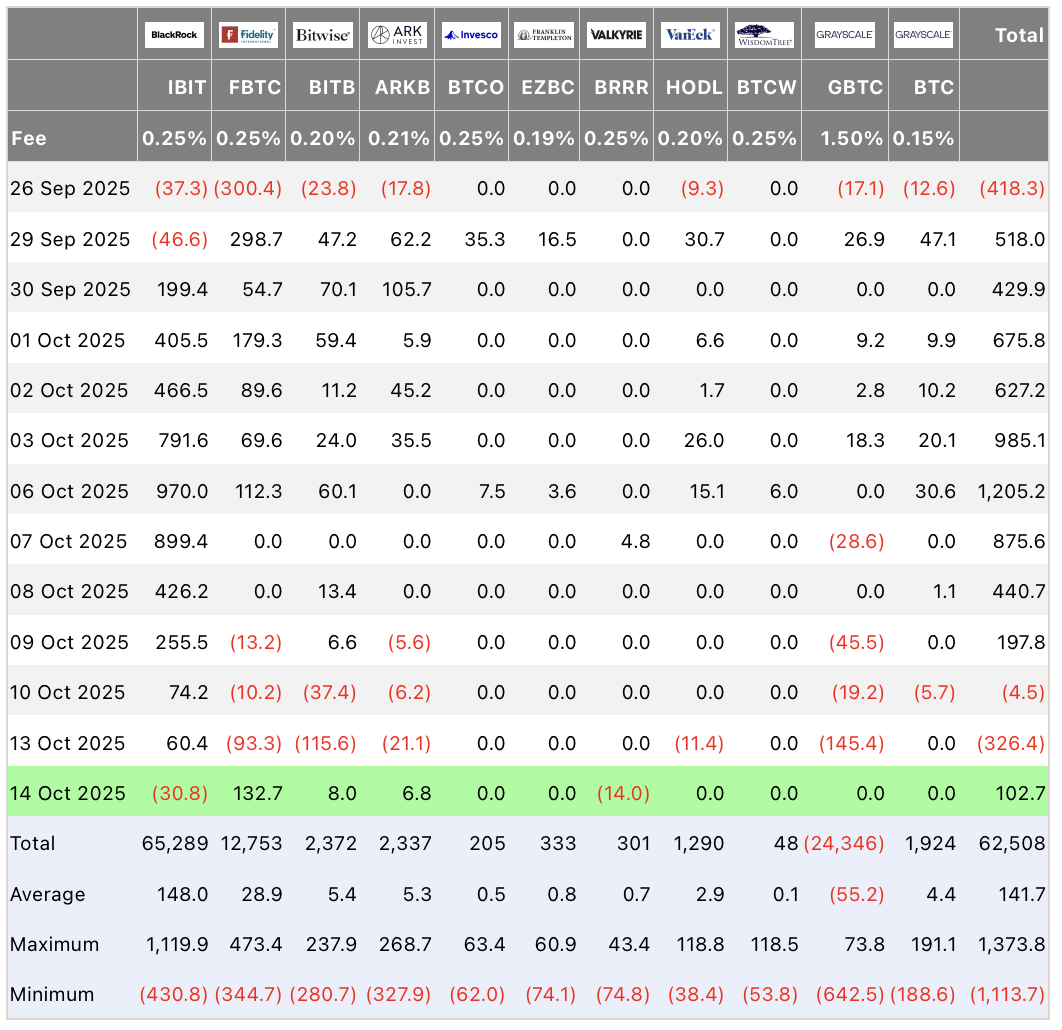

On October 14, spot Bitcoin ETFs recorded $102.58 million in inflows, a dramatic reversal from the $326 million outflow just a day earlier, according to SoSoValue. The Fidelity Wise Origin Bitcoin Fund (FBTC) led with $132.67 million in inflows, while BlackRock’s iShares Bitcoin Trust (IBIT) saw a smaller $30.79 million outflow.

Capital flows into U.S. Bitcoin ETFs. Source: Farside Investors

The total net assets of all spot Bitcoin ETFs rose to $153.55 billion, now representing 6.82% of Bitcoin’s market capitalization. Since their launch, cumulative net inflows have reached $62.55 billion.

Ethereum ETFs lead the comeback

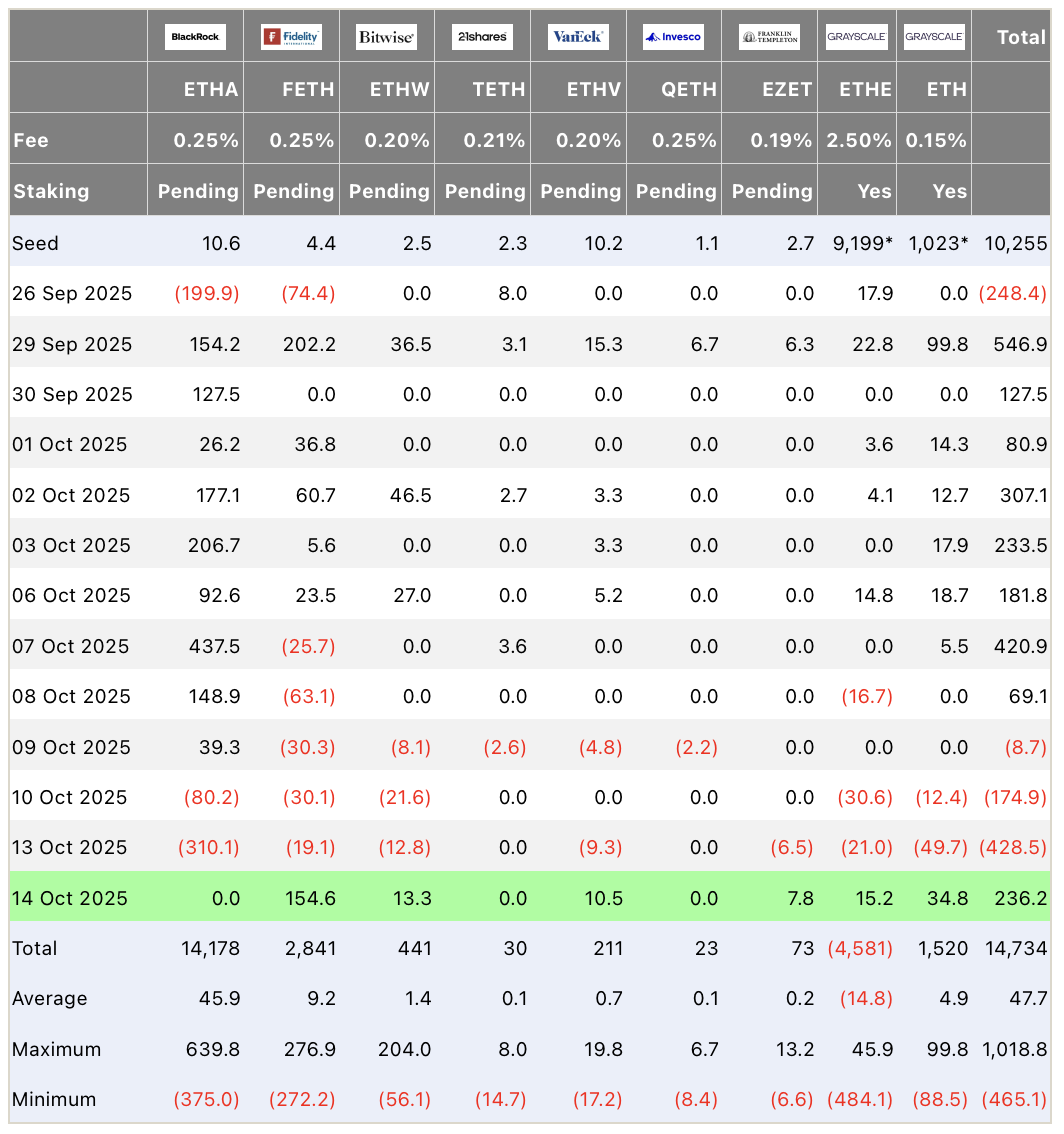

Ethereum funds staged an even stronger recovery, attracting $236.22 million in net inflows following Monday’s $428 million outflow. The Fidelity Ethereum Fund (FETH) dominated with $154.62 million, followed by the Grayscale Ethereum Fund and Bitwise Ethereum ETF, which brought in $34.78 million and $13.27 million, respectively.

Capital flows into U.S. Ethereum ETFs. Source: Farside Investors

This market turnaround came after Powell’s remarks at the National Association for Business Economics Conference, where he suggested the Federal Reserve is nearing the end of its balance sheet reduction program and could prepare for potential rate cuts amid a weakening labor market.

Powell noted that the Fed may soon pause its quantitative tightening, adding that reserves are now “slightly above the level indicating sufficient liquidity.”

Kraken: Best crypto exchange for security & reliability

- Buy, sell, and trade 400+ cryptocurrencies with industry-leading security

- Spot, Futures & Margin trading – leverage up to 5x for advanced traders

- Earn rewards with staking on top cryptocurrencies

- 24/7 customer support and high liquidity for fast trades

- Regulated in the US with strong compliance and security measures

- 13+ million users worldwide

Source:: Bitcoin and Ethereum ETFs Soar After Fed Hints at Rate Cuts