Key highlights:

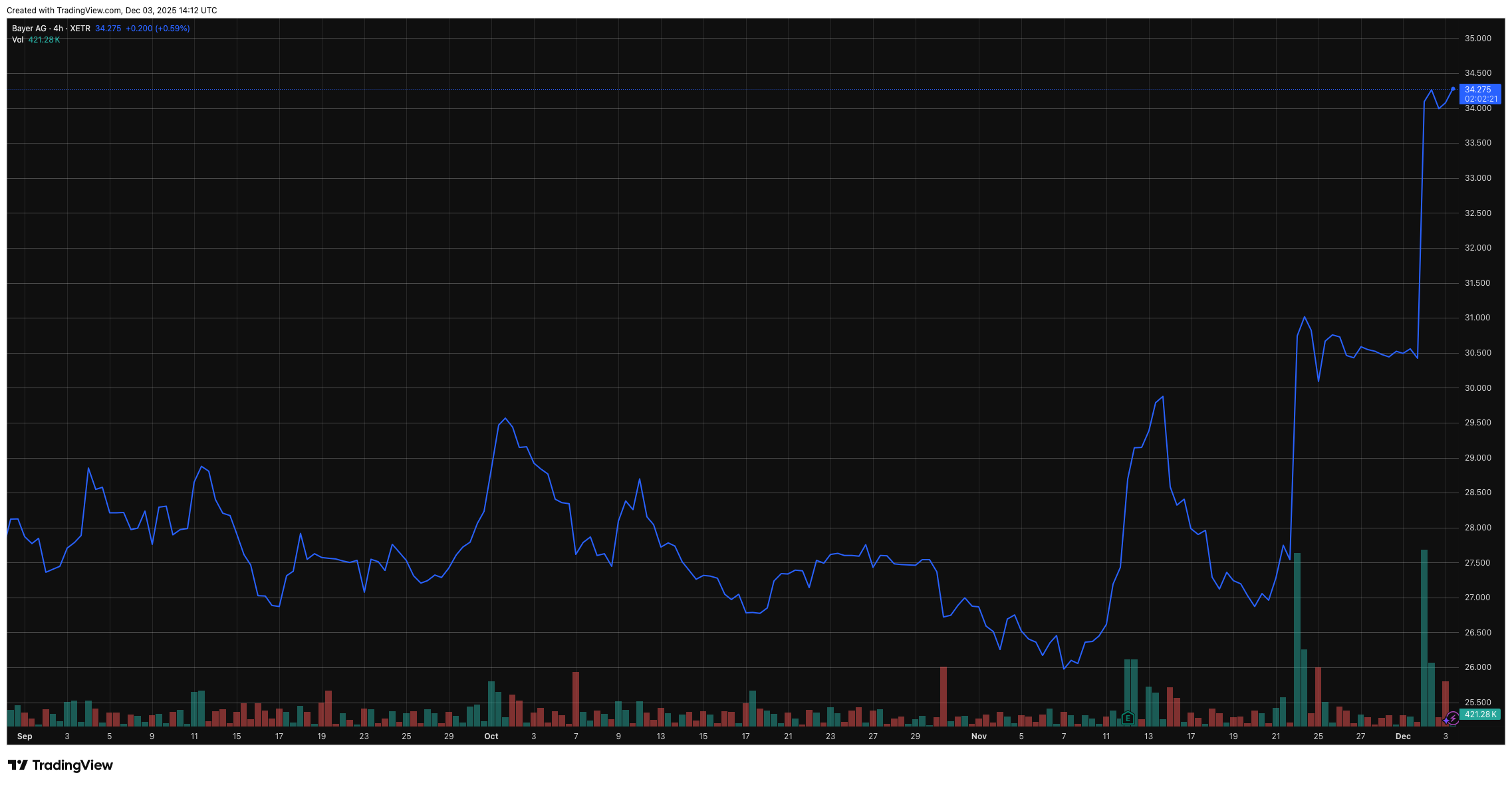

- Bayer shares rallied 12% after the U.S. Solicitor General urged the Supreme Court to limit Roundup-related litigation.

- European markets finished mixed, with the Stoxx 600 index gaining a marginal 0.07% to close at 575.65.

- UK banks saw gains as the Bank of England reduced capital buffer requirements for the first time in a decade.

CFDs are complex instruments with a high risk of losing money due to leverage. 82% of retail investors lose money trading CFDs with this provider. Ensure you understand the risks before trading. Past performance is not indicative of future results.

European equity markets struggled to find a clear direction on Tuesday following a broad sell-off earlier in the week. While the wider region remained relatively flat, German biotech giant Bayer stole the spotlight with a massive double-digit surge, buoyed by favorable legal developments in the United States.

The pan-European Stoxx 600 ended the session just above the flatline, adding 0.38 points (+0.07%) to close at 575.65. Regional bourses were mixed, with Germany’s DAX climbing 0.51% and Italy’s FTSE MIB adding 0.22%, while France’s CAC 40 dipped 0.28%.

Bayer gains on legal optimism

Shares of Bayer closed 12% higher on Tuesday, marking one of the company’s best trading days in recent history. The surge came after U.S. Solicitor General D. John Sauer urged the Supreme Court to limit lawsuits regarding the company’s Roundup weedkiller.

Bayer 🇩🇪 $BAYN $BAYRY is up 80% YTD at $35B. It’s still $65B less than before the $63B Monsanto acquisition in 2018.

Insane M&A, legal and strategic failure!

— Philip Hemme (@PhilipHemme) December 2, 2025

Since acquiring Monsanto for over $60 billion in 2018, Bayer has faced thousands of lawsuits alleging that Roundup causes cancer. Sauer supported Bayer’s argument that federal pesticide laws should preempt state-level claims.

🚨 BREAKING: $BAYRY SURGES +13% ON TRUMP NEWS.

The turnaround is officially live.

The Trump Admin just backed Bayer in the Supreme Court to BLOCK Roundup lawsuits.

Why this matters:

• Biggest daily gain since 2008.

• The “Bankruptcy Thesis” is dead.

• JPM upgrades outlook.… pic.twitter.com/AtaNJHBIqu— Tom 🅰️LPHA Trades | +440% since ’21 (~45%/yr) 📈 (@TomAlphaTrades) December 2, 2025

Bayer CEO Bill Anderson welcomed the development, stating:

“The support of the U.S. Government is an important step and good news for U.S. farmers, who need regulatory clarity.”

He added that the misapplication of federal law jeopardizes innovation and investment in the broader U.S. economy.

Utilities and banks lead European gains

Outside of the biotech sector, utilities provided a safe haven for investors. The sector index added 0.3%, viewed as a stable bet during market turbulence. Renewable energy firm Orsted rose 3%, while electric utility EDP finished 1.7% higher.

The banking sector also outperformed, particularly in the UK. The FTSE 350 Banks index climbed 1.2% after the Bank of England (BoE) announced it would trim capital buffer requirements for banks operating in the UK, the first such reduction in ten years.

The BoE’s stress tests confirmed that major lenders are resilient enough to withstand severe economic shocks. Following the news, Lloyds Banking Group rose roughly 2%, and Metro Bank added 2.6%. Meanwhile, Spanish lender Banco Santander rose 1.5% after selling a 3.5% stake in its Polish subsidiary for approximately $473 million.

Inflation data and central bank outlook

Macroeconomic data continues to drive sentiment as investors look toward upcoming central bank meetings. A flash print for the euro zone showed inflation inching higher to 2.2% in November, slightly exceeding economist expectations.

Conversely, UK data showed signs of cooling. In-store prices fell 0.6% year-on-year in early November, with food inflation dropping to 3%.

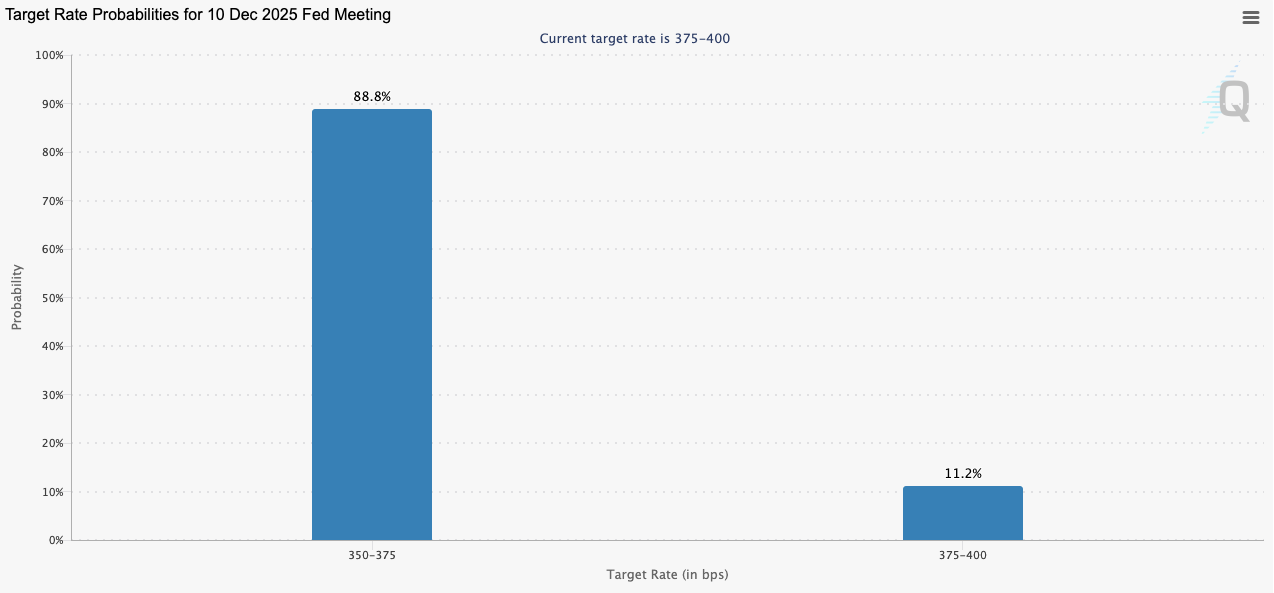

Market participants are now heavily focused on the U.S. Federal Reserve’s upcoming meeting on Dec. 9-10. According to the CME FedWatch Tool, traders are pricing in an 88.8% probability of a quarter-point rate cut.

Megan Greene of the Bank of England’s Monetary Policy Committee noted that the BoE is closely monitoring the Fed for spillover effects, highlighting that global economic interconnectivity remains a key driver for local yields.

Plus500: Best CFD trading platform for global investors

- Trade 2,800+ CFDs – stocks, forex, indices, commodities, crypto & more

- 0% commission and competitive spreads with no hidden fees

- Leverage up to 1:30 for retail clients and higher for professionals (professional accounts do not have ICF rights)

- Advanced risk management tools

- Regulated in multiple jurisdictions, ensuring security & compliance

- 26+ million users worldwide

CFDs are complex instruments with a high risk of losing money due to leverage. 82% of retail investors lose money trading CFDs with this provider. Ensure you understand the risks before trading. Past performance is not indicative of future results. Professional accounts do not have ICF rights.

Source:: Bayer Stock Jumps 12% as Trump Admin Backs Limitation on Roundup Lawsuits