Key highlights:

- The ENA price is squeezing into a key support area, and the chart is starting to feel tense.

- On-chain activity is holding steady, but fresh capital hasn’t really stepped in yet.

- The next move could be decisive, especially in a market where altcoins are already under pressure.

Ethena isn’t collapsing, but it’s definitely not inspiring confidence either. The ENA price is down 1.37% over the past 24 hours, trading around $0.111 and underperforming the broader market bounce. That tells you something important right away: this isn’t strength.

Volume is also flashing a warning. ENA’s 24-hour trading volume jumped 52% to $100.2 million. When you see rising volume during price weakness, that often means sellers are active. It looks more like distribution than accumulation.

In the near term, the ENA price has one job: stay above $0.10. If that level holds, consolidation is possible. If it breaks, the next logical zone sits between $0.085 and $0.09. Sentiment doesn’t help either. As long as the Fear & Greed Index stays in “Extreme Fear,” risk appetite remains thin.

The 4-hour ENA chart: Why $0.108 matters

Ali Martinez called out $0.108 as the key level, and when you look at the 4-hour chart, it makes sense. The ENA price keeps reacting around that area. It’s clean horizontal support. It acted as resistance before flipping, and now price keeps revisiting it. That tells you traders are watching it closely.

$0.108 is the level for Ethena $ENA.

Hold it, and $0.129 comes into focus. pic.twitter.com/HuNPrWA0B5

— Ali Charts (@alicharts) February 20, 2026

Right now, ENA is hovering just above that line. If $0.108 continues to hold, a push toward $0.124 and then $0.129 comes into play. That $0.129 zone lines up with previous highs and visible supply.

But if $0.108 gives way with strong volume, the chart weakens fast. $0.10 becomes the next stop, and below that, the mid-$0.08s come into focus.

On-chain activity is holding up but lacks momentum

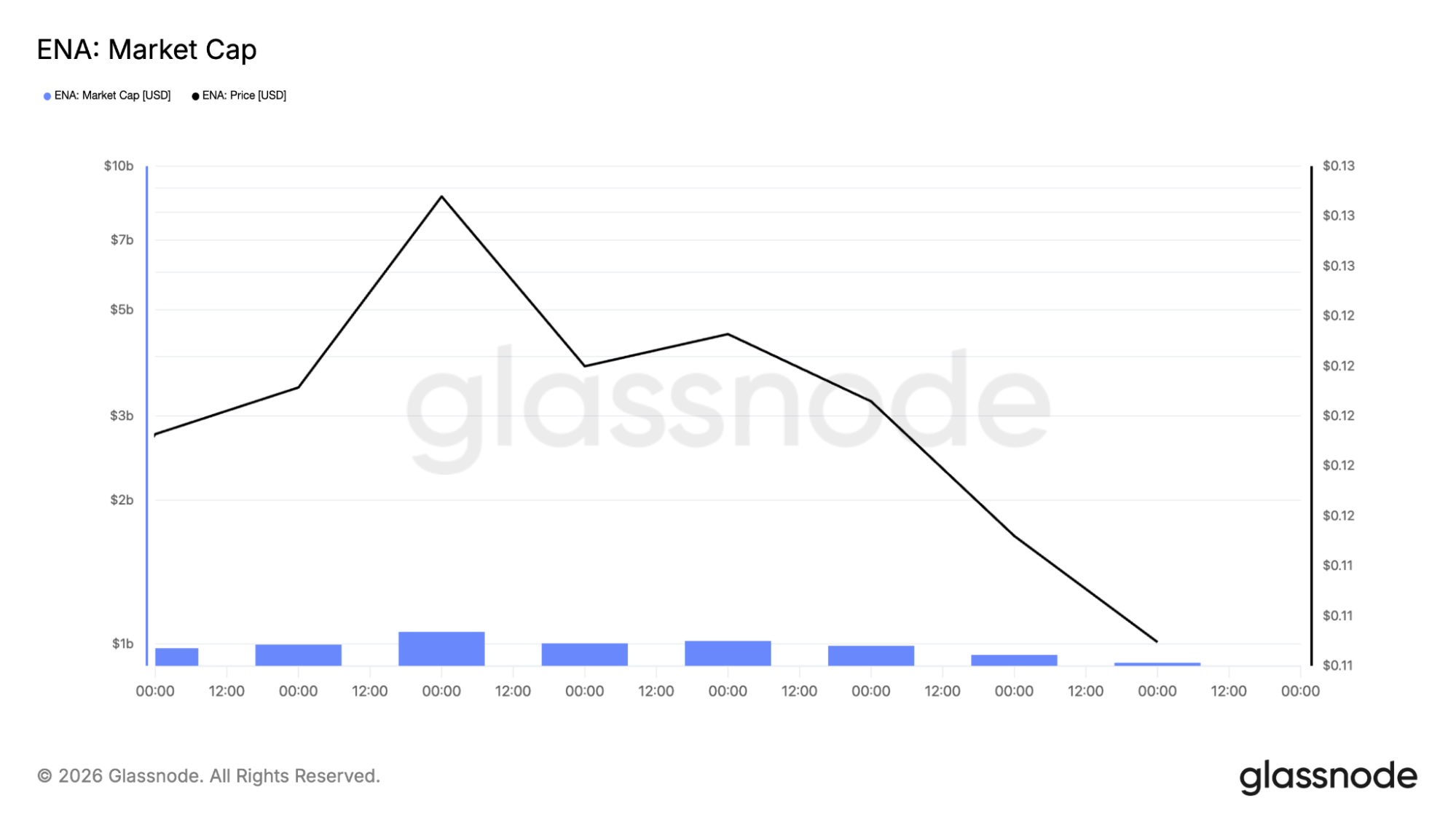

Glassnode data shows ENA’s market cap topping out earlier and then rolling over in line with the drop in the ENA price. When both price and market cap fall together, it usually means money is actually flowing out, not just bouncing around. That confirms the recent weakness isn’t just noise, capital has stepped aside.

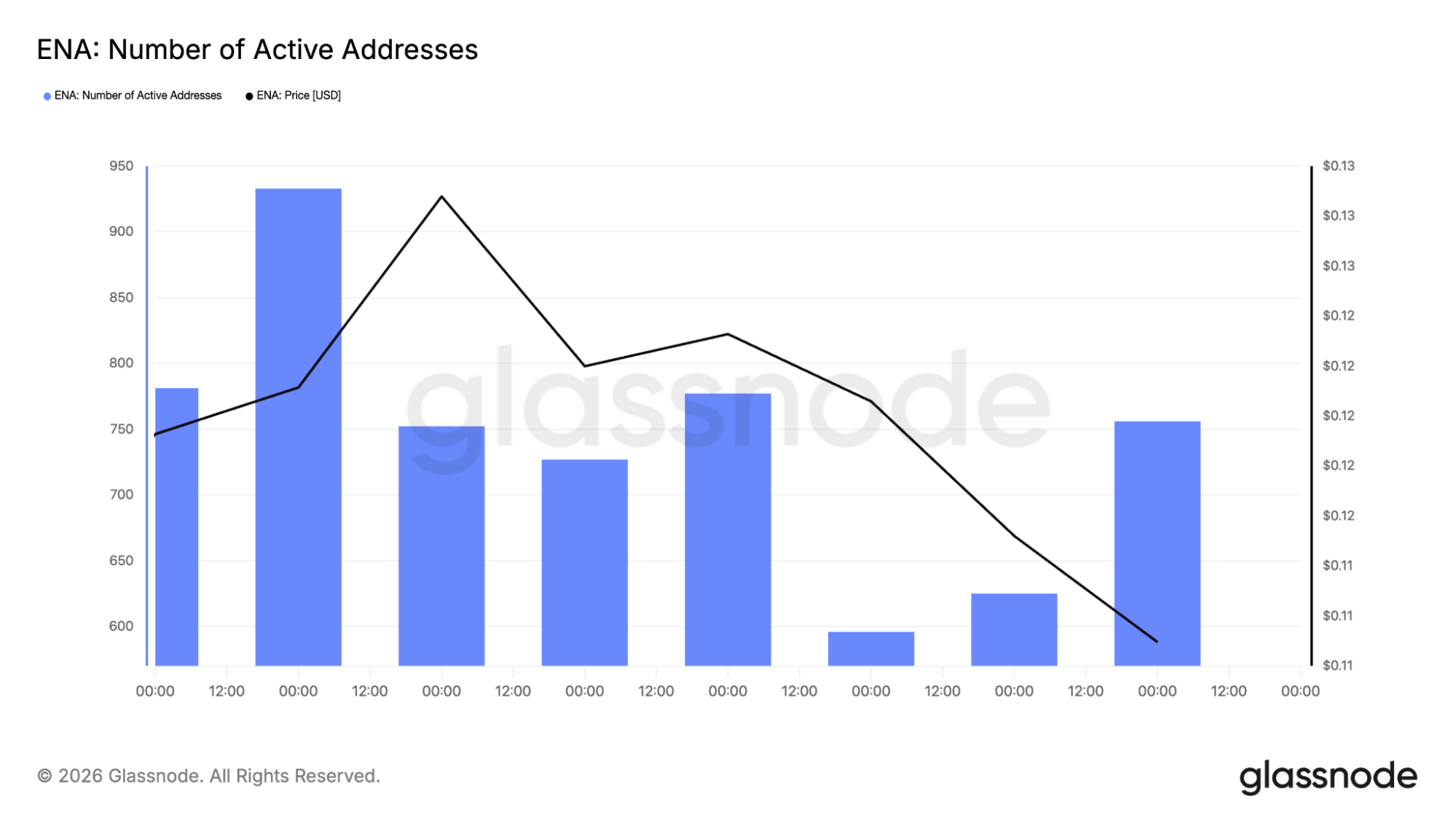

Active addresses tell a slightly different story. Even though the ENA price pulled back, daily participation didn’t fall off a cliff. There was a dip during the heavier selling, but activity stabilized fairly quickly. That means users are still interacting with the network. Interest hasn’t disappeared.

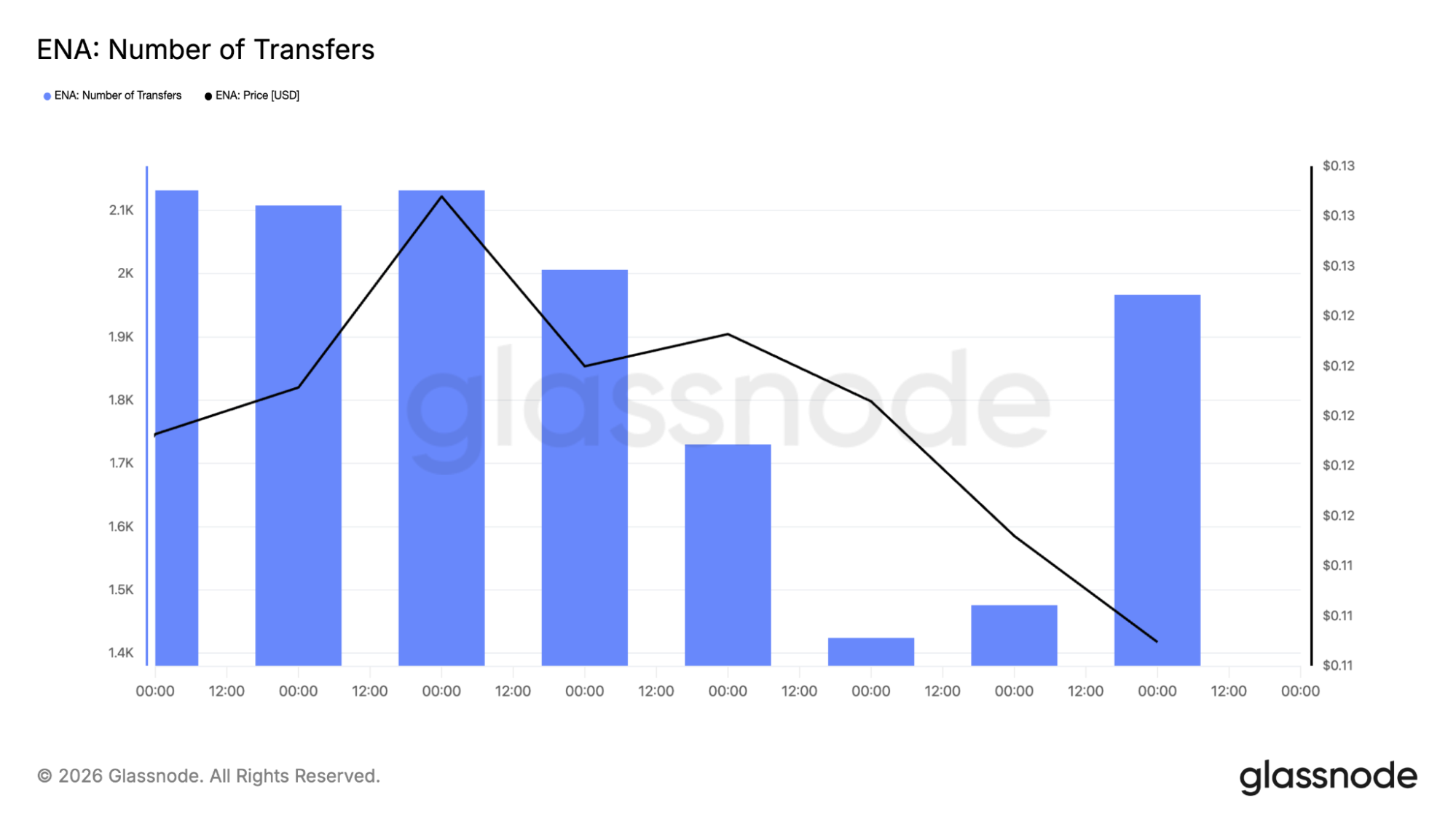

Transfer activity adds another layer. You can see clear spikes during volatile periods, which usually means traders are moving tokens around, shifting funds to exchanges or reshuffling positions. But there’s no steady increase that would point to aggressive accumulation. It feels more like repositioning than fresh buying.

The bigger picture for ENA: Trend still down, momentum still soft

Zoom out, and the picture changes. The ENA price is still in a broader downtrend on the daily timeframe. A descending trendline has capped rallies for months. The 100-day moving average is overhead. Every relief bounce has stalled below prior resistance

Daily ENA price chart analysis

There are multiple break-of-structure points on the way down. That’s not random. That’s sellers staying in control. The real support cluster sits between $0.08 and $0.10. That’s the demand zone bulls need to protect if they want any medium-term recovery story to make sense.

On the 4-hour chart, RSI is sitting in the high 30s to low 40s. That tells you the ENA price is leaning bearish but not deeply oversold. There’s room for a bounce, but there’s no strong momentum shift yet.

4-hour ENA price chart analysis

On the daily chart, RSI is near the low 30s. That’s close to oversold territory, but oversold doesn’t automatically mean reversal. In weak markets, the price can stay heavy longer than expected. Right now, this feels more like a pause than a turning point.

ENA is sitting at a make-or-break support zone

The bullish case is simple. If the ENA price keeps holding $0.108 and starts forming higher lows on lower timeframes, momentum could slowly stabilize. A move back above $0.118 would be the first small signal. After that, $0.124 and then $0.129 come into focus.

A clean break above $0.129 would shift short-term structure and likely force some short covering. That’s where a sharper bounce could develop, especially if broader altcoin sentiment improves. But buyers need to show up first. So far, they’ve been cautious.

The bearish path is more straightforward. If the ENA price loses $0.108 with conviction, $0.10 is the next obvious test. If that level fails, the broader support band between $0.085 and $0.09 becomes the target.

CoinCodex’s 1-month ENA price prediction puts the token at around $0.08351. That would place the Ethena back near its lower demand zone, pointing to continued short-term pressure and a possible retest of support before any meaningful recovery attempt begins.

What comes next for Ethena

The ENA price is sitting right at a decision point. It’s not breaking down aggressively, but it’s also not recovering with strength. Volume shows sellers are active. The daily structure remains heavy. Yet $0.108 is still holding.

If that line stays intact, $0.129 becomes realistic. If it cracks, the chart opens up quickly on the downside. Right now, ENA isn’t exciting. It’s tense. And the next real move likely comes from whichever side wins the battle around $0.108.

Kraken: Best crypto exchange for security & reliability

- Buy, sell, and trade 400+ cryptocurrencies with industry-leading security

- Spot, Futures & Margin trading – leverage up to 5x for advanced traders

- Earn rewards with staking on top cryptocurrencies

- 24/7 customer support and high liquidity for fast trades

- Regulated in the US with strong compliance and security measures

- 13+ million users worldwide

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other advice. Nothing on this page is a recommendation or solicitation. Always seek independent professional advice before making investment decisions. Some links may earn us a commission at no extra cost to you.

Source:: Ethena Price Prediction: ENA Is Coiling – A Violent Move Could Be Next