You’re pumping gas, grabbing a drink, and there it is by the door, a Bitcoin ATM (sometimes called a crypto kiosk). It seems so simple. Feed in cash, scan a code, and boom, you own Bitcoin.

For someone new to crypto, that sounds perfect. There’s no bank link, no long sign-up, no waiting. Just cash to crypto in minutes.

The problem is what happens after you tap “Buy.” Many Bitcoin ATMs in the US can hit you with total costs in the 15% to 30% range once everything is added up. Meanwhile, top crypto exchanges often land under 1.5% when you use an ACH bank transfer and a normal trade (not an “instant buy”).

So yes, Bitcoin ATMs can be convenient. They can also be one of the most expensive, risky ways to buy crypto, especially for beginners who don’t know what to watch for.

The real cost of a Bitcoin ATM is way higher than most people expect

Bitcoin ATM pricing rarely works like a normal ATM fee, where you pay $3 and move on. Instead, the final cost can come from several places at once, and not all of them look like “fees” on the screen.

A lot of people only notice the obvious charge, like “12% fee.” Then they assume that’s the whole hit. Unfortunately, it often isn’t.

Here’s the simplest way to think about it: when you buy Bitcoin at an ATM, you’re paying way more than a service fee. You’re also often buying Bitcoin at a worse price than the real market price. That “bad price” is something that you’re paying for, even if it never shows up as a line item.

One short table makes the difference clear. This is a simplified example, but it matches what many users experience.

| What you pay | What you get | |

|---|---|---|

| Bitcoin ATM (typical all-in) | $100 | About $72 to $85 of BTC |

| Major exchange (ACH + trade) | $100 | About $98.50 to $99.90 of BTC |

If your goal is “get as much Bitcoin as possible for my money,” a Bitcoin ATM usually fails that test.

Bitcoin ATM fees, markups, and network costs can stack into a 15% to 30% hit

Most Bitcoin ATM fees combine multiple cost layers:

- Percentage fee: Often around 10% to 25%, depending on the operator and location. Some operators publish ranges, and they can vary by machine.

- Flat fee: Commonly $1 to $5 on top.

- Exchange-rate markup (spread): Often an extra 5% to 15% baked into the price you’re shown.

- Network fee: Sometimes you’ll see a miner or network charge, or it gets folded into the rate.

Put those together and the math gets ugly fast.

Say you insert $100 in cash:

- 15% operator fee = $15 gone

- $3 flat fee = $3 gone

- 10% spread from a marked-up Bitcoin price = about $10 gone (because you bought at an inflated price)

Now your $100 may turn into roughly $72 of Bitcoin. Some machines land a little better, some worse. Either way, it’s a serious haircut for a basic purchase.

Also, the Bitcoin price on the ATM screen might not match what you see on a major exchange at that moment. That’s not a “crypto is volatile” problem. It’s often a pricing model problem.

Quick gut check: If the ATM’s Bitcoin price looks noticeably higher than the market price you see on your phone, you’re paying a hidden markup.

This is why two people can use two different Bitcoin ATMs with the same $100 and walk away with very different amounts of BTC.

Limits and minimums make it even worse if you just want to test with a small amount

Many first-time buyers want to “try crypto” with a small bill, like $20. That’s reasonable. Bitcoin ATMs often punish that approach.

Common realities include:

- Minimum buys, often around $10 to $20 per transaction.

- Daily limits that can range widely (often from $500 up to $25,000), depending on the operator and how much identity verification you complete.

- Tiered verification, where higher limits trigger more checks.

Small buys feel worse because flat fees and spreads take a bigger bite. Losing a flat $5 on a $20 test purchase hurts more than losing $5 on $500, even if the percentage math is similar.

Another detail trips people up: many machines are buy-only. If you later want to sell, you may need a different service anyway. If you find a bidirectional machine (buy and sell), selling can come with its own fees, often around 4% to 8% in some setups.

So you can end up paying a premium to get in, then paying again to get out.

Bitcoin ATM scams are exploding, and the payments are hard to undo

High crypto ATM fees are painful, but scams are worse. Bitcoin ATMs have become a favorite tool for fraud because they mix three things scammers love:

- Urgency

- Confusion

- Irreversible payments

If someone convinces you to deposit cash into a machine and send crypto to a wallet they control, your money can disappear in minutes. There’s no “cancel” button after the transfer confirms.

Reports and investigations keep showing how badly older adults get hit. For example, FBI IC3 data for 2024 showed people lost $5.8 billion to crypto scams overall in a year. Trend reports point to continued growth, with scams boosted by AI tools and more organized operations.

The reason scammers push Bitcoin ATMs is simple: they’re easy to explain on the phone, and they move value fast.

Why scammers love Bitcoin ATMs, and why victims rarely get their money back

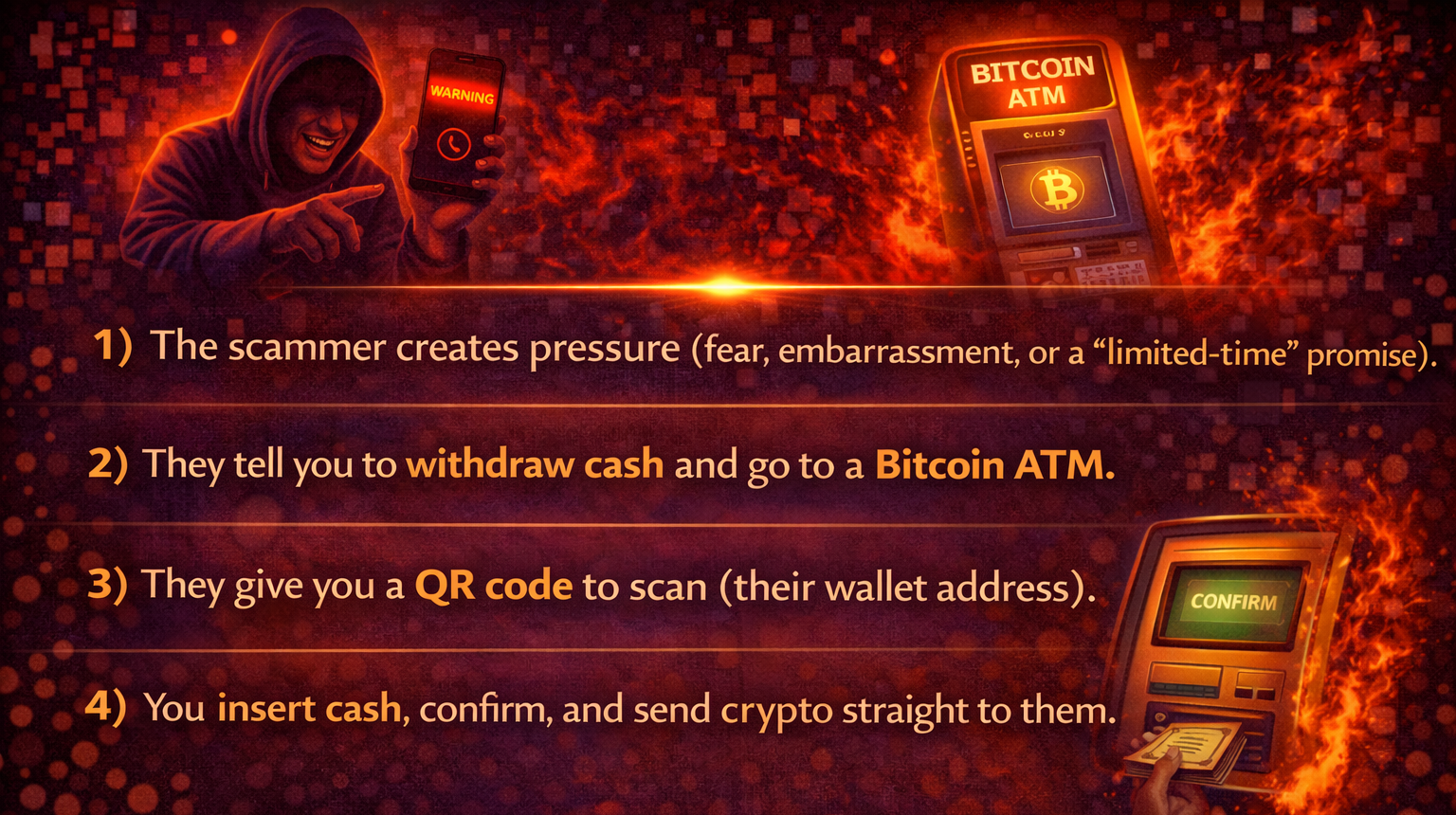

The scam flow is usually the same, even when the story changes:

Once the crypto is sent, it’s usually permanent. Unlike many card payments, there’s often no clean dispute process. Banks can sometimes help with certain fraud cases, but a cash-to-crypto transfer is hard to unwind.

After that, scammers can move funds quickly. They may send it through multiple crypto wallets, sometimes using services outside the US. That speed is part of the trap. By the time you realize what happened, the money is already gone.

Recovery does happen sometimes, but it’s rare. Most victims never see their funds again, especially if they delay reporting.

The most common crypto ATM scam scripts to watch for

Scammers recycle a few stories because they work. These are the big ones:

- Fake police or IRS-style threats: “You owe money,” or “There’s a warrant,” so you must pay now.

- Fake tech support pop-ups: A scary screen says your computer is infected, then a “support agent” directs you to an ATM.

- Fake investment promises: A friendly stranger “teaches” you crypto, then steers you to a kiosk to fund a bogus platform.

- Fake family emergency calls: “I’m in trouble,” so you need to send money fast and keep it quiet.

A short red-flag checklist can help you avoid crypto scams:

- Pressure: You’re told to act now or face punishment.

- Secrecy: You’re told not to tell family or the store clerk.

- Urgent deadline: Minutes, not days.

- Coaching: You’re told what to say if staff asks questions.

- Specific ATM: They pick the location and stay on the phone until you pay.

If anyone asks you to use a Bitcoin ATM to fix a problem, treat that as a giant warning sign. Real agencies and real companies don’t collect payments that way.

You don’t get the privacy or safety people assume

Bitcoin ATMs look familiar, so people treat them like bank ATMs. That’s a mistake.

A bank ATM connects to a system built for error handling. It also comes with strong consumer rules. Crypto kiosks don’t work the same way.

On top of that, many people still believe the old myth that Bitcoin ATMs are anonymous. In the US, that’s usually not true anymore.

Many Bitcoin ATMs now require ID or phone verification, so it is not truly anonymous

KYC means “Know Your Customer.” These are identity checks required by financial rules. Operators often increase checks as the dollar amount increases.

In practice, a Bitcoin ATM may ask for:

- Your phone number (often for smaller buys)

- A government ID scan (driver’s license or passport)

- A selfie or extra verification steps for higher limits

Rules vary by operator and location. Some states add tighter limits. For example, California caps users at $1,000 per day under state rules, and California’s DFAL framework is set to start in July 2026.

So the tradeoff can feel rough: you share personal data, and you still pay very high fees.

Easy-to-make errors, plus uneven support when something goes wrong

Bitcoin ATM transactions also create more “oops” moments than people expect.

Common mistakes include scanning:

- The wrong QR code, especially if someone is “helping” you

- A QR code for the wrong network or wallet type

- A wallet you don’t control (for example, a scammer’s)

- The wrong coin, because some machines offer more than Bitcoin

Confusion about the exchange rate adds another problem. You might think you’re buying at one price, but the final rate can be worse after you confirm.

Support exists, but it can be uneven. Some operators respond quickly, others don’t. Refunds are not guaranteed, especially once crypto has been sent.

Regulators also pay more attention now. FinCEN issued a notice in August 2025 warning about fraud and laundering risks tied to crypto kiosks, and states keep pushing tougher compliance. That doesn’t magically protect you at the machine, but it does show the problem has gotten big enough to trigger enforcement.

Better ways to buy crypto

Bitcoin ATMs aren’t always pointless. If you have no bank access, need to use cash, and understand the fees, they can work. Still, for most people, they’re a pricey shortcut.

If your goal is to buy crypto without giving up a big chunk of your money, you have better options.

Low-fee alternatives to consider, based on what you need (speed, cash, or simplicity)

A few paths usually cost less than a Bitcoin ATM:

- Reputable exchanges with ACH bank transfer: Many users can pay under 1.5% in crypto exchange fees, especially with standard trades (often much lower on some platforms). Debit card buys tend to cost more, often in the 2% to 5% range.

- Regulated apps with clear pricing: Some mainstream apps show fees up front and feel simpler than a trading screen. Costs vary, so compare the all-in price you’re quoted.

- Cash options at retail counters where available: Some services let you fund crypto purchases with cash at participating stores. Fees can still be high, but some advertise lower all-in costs than typical ATMs.

No matter which route you choose, compare the total cost, not just the headline fee. The spread matters.

If you still use a crypto ATM, a quick safety checklist to reduce damage

If you’re set on using a Bitcoin ATM, keep it boring and careful:

- Confirm the operator name on the machine and the support number shown.

- Read the full fee and the exchange rate before you insert cash.

- Start with the smallest amount allowed, even if it feels silly.

- Never buy because someone told you to, even if they sound official.

- Double-check the wallet address (or QR code) is yours.

- Keep the receipt and any on-screen confirmation details.

- Don’t share codes, screenshots, or your phone screen with “support.”

- If you suspect a scam, stop and report it (FBI IC3, your state attorney general, and local police).

That won’t make fees cheap, but it can prevent a disaster. In crypto, boring = good.

The bottom line

Bitcoin ATMs look simple, but the downsides are significant.

- The total cost can land in the 15% to 30% range once fees and markups hit

- Bitcoin ATM scams are common because the payments are hard to reverse

- You often get less privacy and fewer protections than people assume, even when you hand over personal info

The clean takeaway is this: compare the all-in price before you buy, choose safer on-ramps when you can, and treat any request to pay via a Bitcoin ATM as a major red flag.

If convenience is the only reason, you’re probably paying too much for it.

Next, if you want to pay virtually 0 fees for your crypto, learn about the best no-fee crypto exchanges.

FAQ

How does a Bitcoin ATM work?

A Bitcoin ATM (a.k.a. crypto ATM or crypto kiosk) lets you exchange cash for cryptocurrency.

In most cases, the process looks like this:

- Select the coin (often Bitcoin).

- Scan your wallet QR code.

- Insert cash.

- Confirm the exchange rate and fees.

- The machine sends crypto to your wallet address.

Some machines are buy-only. Others allow selling, but that usually involves additional steps and separate fees.

How much does a Bitcoin ATM charge per $100?

It varies by operator, but many users end up with $72 to $85 worth of Bitcoin for every $100 inserted, once everything is included.

Typical cost layers can include:

- 10% to 25% operator fee

- $1 to $5 flat fee

- 5% to 15% exchange-rate markup

- Possible network fee

When combined, the total hit often lands in the 15% to 30% range, depending on location and machine.

Do Bitcoin ATMs require ID?

In the US, many Bitcoin ATMs now require some form of identity verification.

For small purchases, you may only need a phone number (with SMS verification)

For larger amounts, machines often require a government-issued ID and a selfie or additional verification. Exact rules depend on the operator and state, but fully anonymous transactions are increasingly rare.

Is a Bitcoin ATM safe?

The machine itself is not automatically unsafe, but the risk comes from:

- Extremely high fees

- Irreversible transactions

- Frequent use in scams

If you control your wallet and understand the fees, the transaction can work technically as intended. The danger appears when someone pressures you to use the ATM, provides a wallet address for you to scan, or stays on the phone guiding you.

Source:: Why Using a Bitcoin ATM Is One of the Worst Ways of Buying Crypto