Key highlights:

- The JUP price is finally getting a bit of a bounce off the $0.16 area, but the bigger downtrend still hasn’t gone away.

- That $0.18–$0.19 zone is still the main hurdle. Until Jupiter can push through it, this move is still just a rebound attempt.

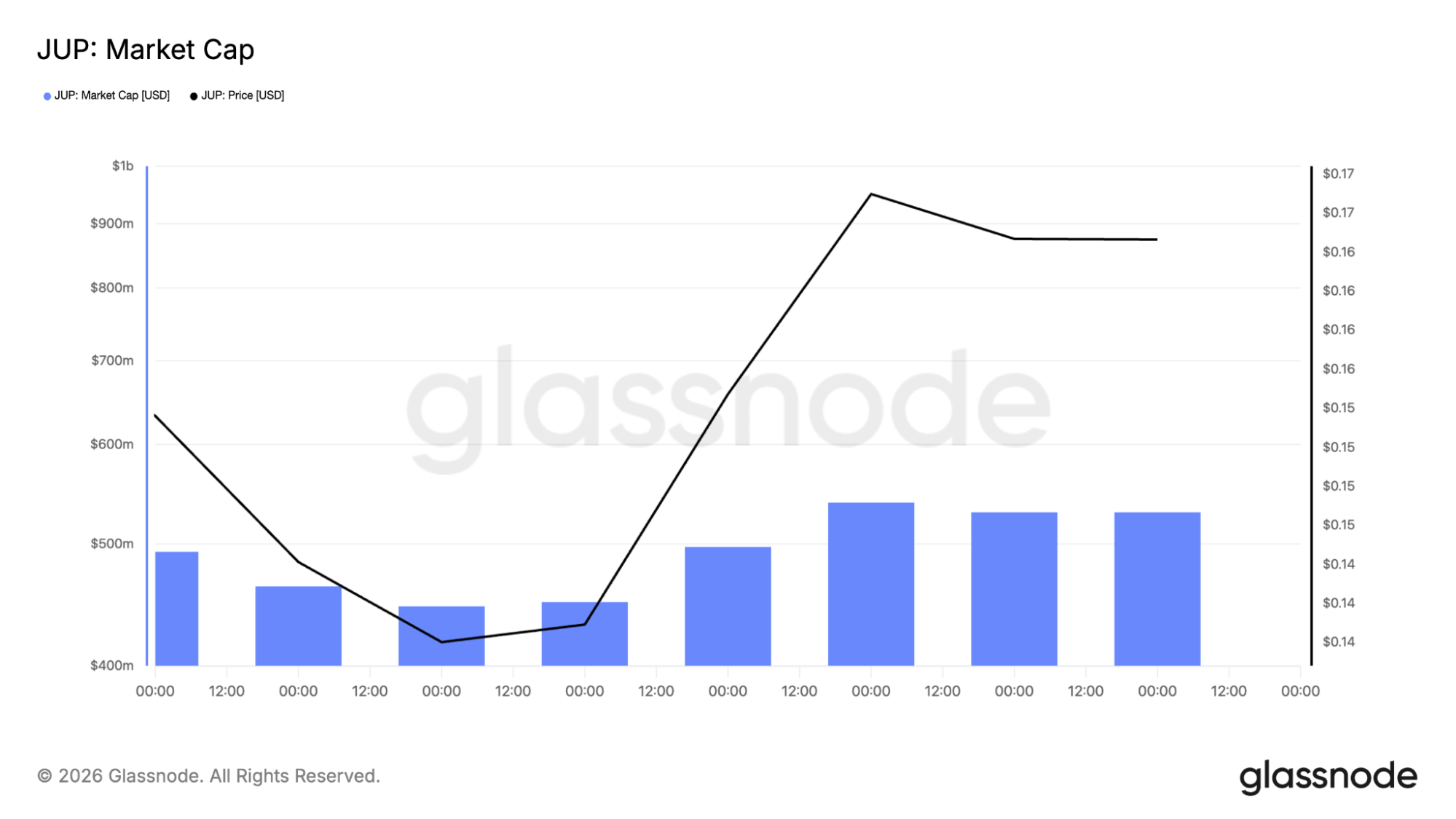

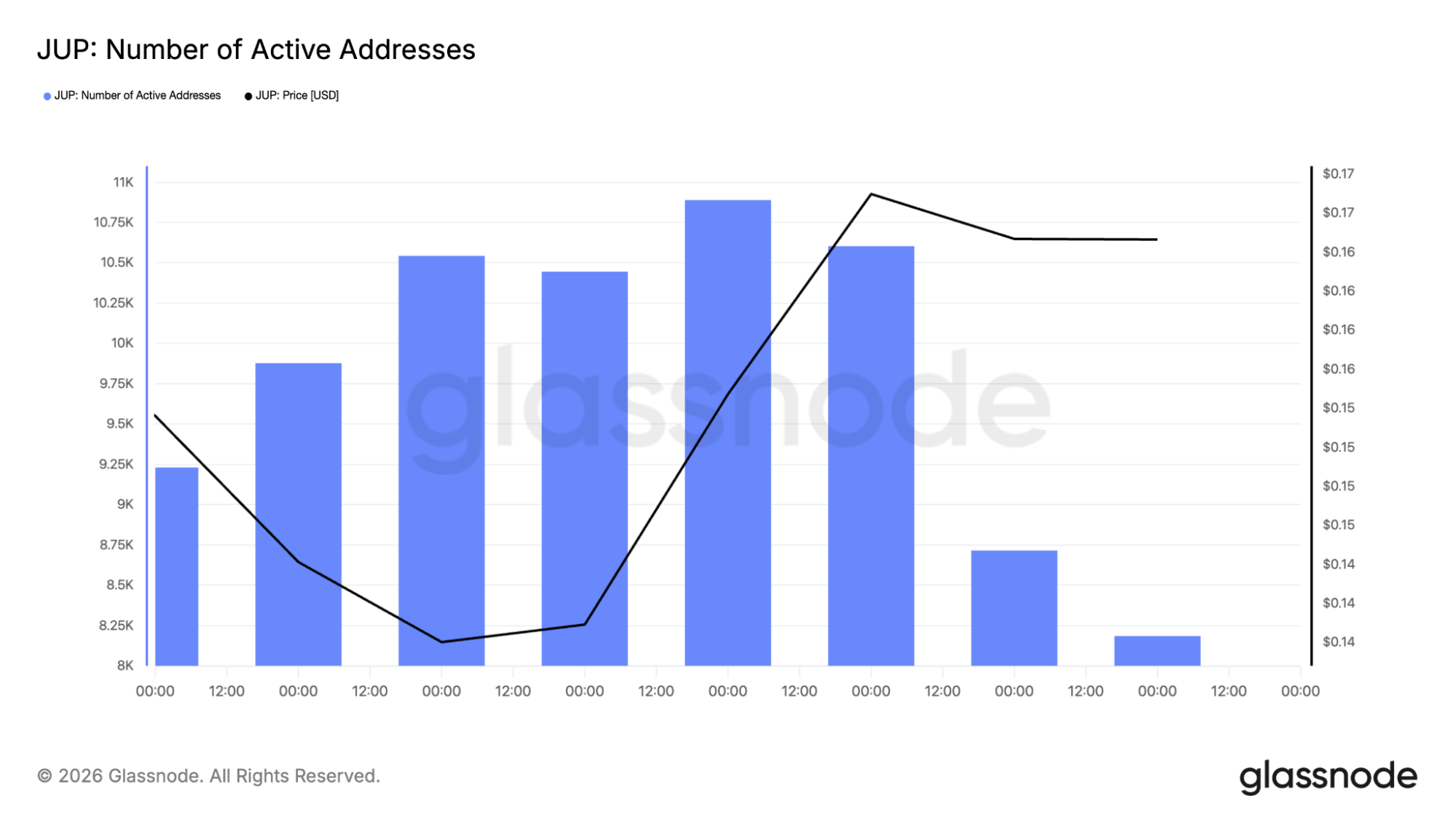

- On-chain numbers are waking up too, with market cap rising and more wallets showing up on the network.

Jupiter is finally showing some signs of life. The JUP price has risen by about 4% over the past day, trading around $0.167, and it is performing better than most in the market at present.

What’s interesting is that this move doesn’t seem tied to one big headline or major announcement. It feels more like a small rotation back into certain altcoins that are sitting at key levels. And Jupiter is definitely sitting at one of those levels.

The trend still isn’t bullish – but the selling has slowed down

Zoom out for a second, and the bigger picture is still pretty clear. The JUP price has been in a downtrend for weeks. Lower highs, shaky bounces, and a lot of hesitation from buyers. The trendline is still pressing down, and Jupiter hasn’t broken free yet.

That’s basically what analyst Sjuul pointed out too. Even with this bounce, the token is still technically trending lower, and bulls haven’t proven anything yet. But here’s the shift: the heavy selling doesn’t feel as aggressive anymore.

$JUP is without a doubt still downtrending; in fact, as you can see, it is just forming fresh lower lows.

If bulls want to have any chance of recovery, they need to start at least a kind of power of three setup.

Basically, you want the last move to end up like a manipulation… pic.twitter.com/kMLZYmw4F8

— Sjuul | AltCryptoGems (@AltCryptoGems) February 16, 2026

The $0.16 area has started acting like a real floor. Every time price dips into that zone, buyers show up quickly. So instead of collapsing further, the JUP price is starting to stabilize. It’s not a breakout yet, but it’s not falling apart either.

One of the more interesting ideas from Sjuul is the possibility of a “Power of Three” setup. That’s basically a pattern where price moves through three phases. First, you get boring consolidation where nobody cares. Then you get a sharp dip that shakes people out. And finally, you get the real expansion move higher.

When you look at Jupiter’s chart, it kind of fits. The JUP price spent weeks chopping sideways in a wide range. Then it dipped hard into the $0.14–$0.15 zone, which could’ve been that manipulation phase.

Now it’s bouncing back toward $0.167, and traders are watching closely to see if this is the start of something bigger, or just another temporary relief bounce.

On-chain data shows Jupiter isn’t being ignored anymore

One of the more interesting things about this JUP move is that it isn’t happening in complete silence on-chain.

Glassnode’s market cap chart shows Jupiter starting to climb again after dipping earlier this month, with the JUP price moving up alongside it. That’s a meaningful detail, because the market cap doesn’t rise unless fresh money is coming back in. It makes this look less like a random bounce and more like a real attempt at recovery.

The active address data backs that up too. As JUP returns to the $0.16 range, wallet activity increases, peaking above 10,000 users. It is the type of activity that is usually associated with traders, as activity increases after a quiet period.

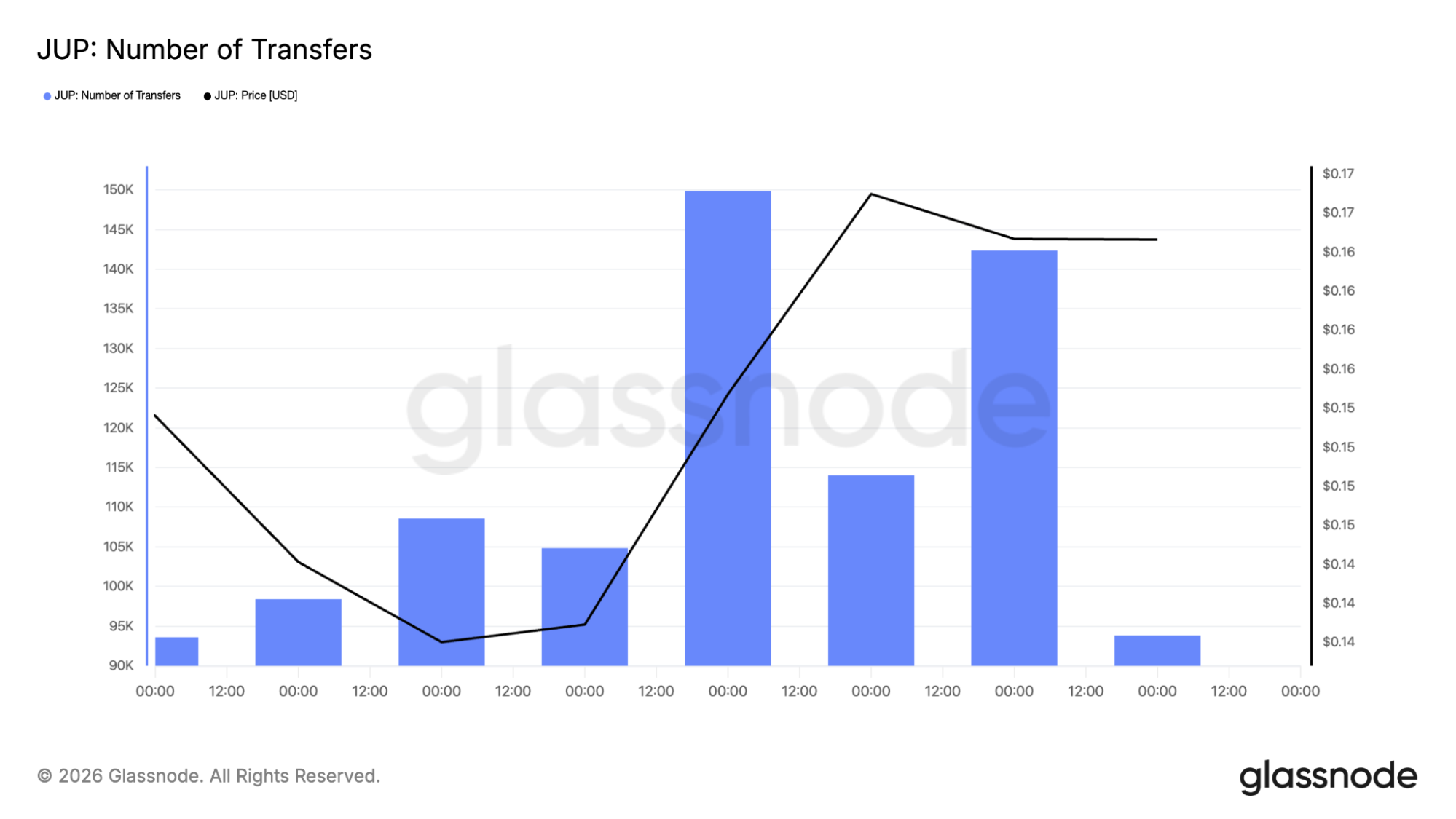

The number of transfers also spiked during the move, which is another good sign. More transfers typically mean more activity across the network, not just price movement on an exchange chart.

None of this guarantees that Jupiter is about to break out, but it does show that it’s no longer being ignored. The JUP price still has key resistance levels ahead, but on-chain interest is starting to wake back up.

Jupiter still has a major hurdle overhead at $0.18

Even though Jupiter has managed to bounce a bit, it’s still not out of the woods yet. On the 4-hour chart, the JUP price has climbed back into the $0.16–$0.17 range, which is a nice step up from the recent lows. But the real challenge is still sitting right above.

4-hour JUP price chart analysis

That $0.18–$0.19 zone has basically been a brick wall. Every time price pushes into that area, the rally stalls out pretty quickly. And it’s not just a random resistance level either. It also lines up with the main downtrend line that’s been controlling price action since January, which makes it an even tougher level to break through.

If the JUP price can finally clear $0.18 and actually hold above it, then things start getting a lot more interesting. That’s when $0.20 becomes the next obvious target. But until that breakout happens, this still looks like a recovery bounce inside a bigger downtrend.

On the daily chart though, RSI is still sitting in a pretty neutral zone, which tells the bigger trend hasn’t fully flipped yet. But that’s not necessarily a bad thing. It actually means this move isn’t overheated or running on pure hype.

Daily JUP price chart analysis

The JUP price still looks like it’s early in the recovery process, not deep into a full breakout rally. Right now, it’s a simple setup: momentum is improving, but Jupiter still needs to prove it can reclaim $0.18 before the market starts treating this as a real trend change.

So where does the JUP price go from here?

It really comes down to two levels. As long as JUP trades above $0.16, there is a firm floor for the bullish momentum to push from, making a retest of $0.18 a definite possibility. A strong run from there would likely take JUP to $0.20 in short order.

If the $0.16 mark does give way, the chart looks unstable, and a retest of $0.15 looks like the likely outcome. CoinCodex’s 1-month JUP price prediction also points to more weakness, with the token projected to drift toward $0.1251 in the near term.

For now, Jupiter is sitting in that classic decision zone. The downtrend isn’t gone yet, but the floor is forming. And the next move out of this range is going to tell the real story.

Kraken: Best crypto exchange for security & reliability

- Buy, sell, and trade 400+ cryptocurrencies with industry-leading security

- Spot, Futures & Margin trading – leverage up to 5x for advanced traders

- Earn rewards with staking on top cryptocurrencies

- 24/7 customer support and high liquidity for fast trades

- Regulated in the US with strong compliance and security measures

- 13+ million users worldwide

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other advice. Nothing on this page is a recommendation or solicitation. Always seek independent professional advice before making investment decisions. Some links may earn us a commission at no extra cost to you.

Source:: Jupiter Price Prediction: The JUP Bounce Is Real, But the Downtrend Isn’t Done Yet