If you’ve been on X, YouTube, TikTok or Telegram lately, you’ve probably seen it: VDR crypto, “Vanguard Digital Reserve,” and a lot of confident price talk. The posts tend to sound the same. A tiny token, a “reserve” story, and a countdown to the next big pump.

The name is doing a lot of work here. “Vanguard” makes people think of the real Vanguard Group, the household-name asset manager behind index funds and retirement accounts. That instant trust is powerful, and it can short-circuit common sense.

Here’s the core issue: VDR (Vanguard Digital Reserve) does not appear to be connected to the real Vanguard investment company based on publicly available information as of February 2026.

I’ll break down the red flags, how to verify claims yourself, and safer ways to get crypto exposure if you still want it. Crypto is risky, and this is not financial advice.

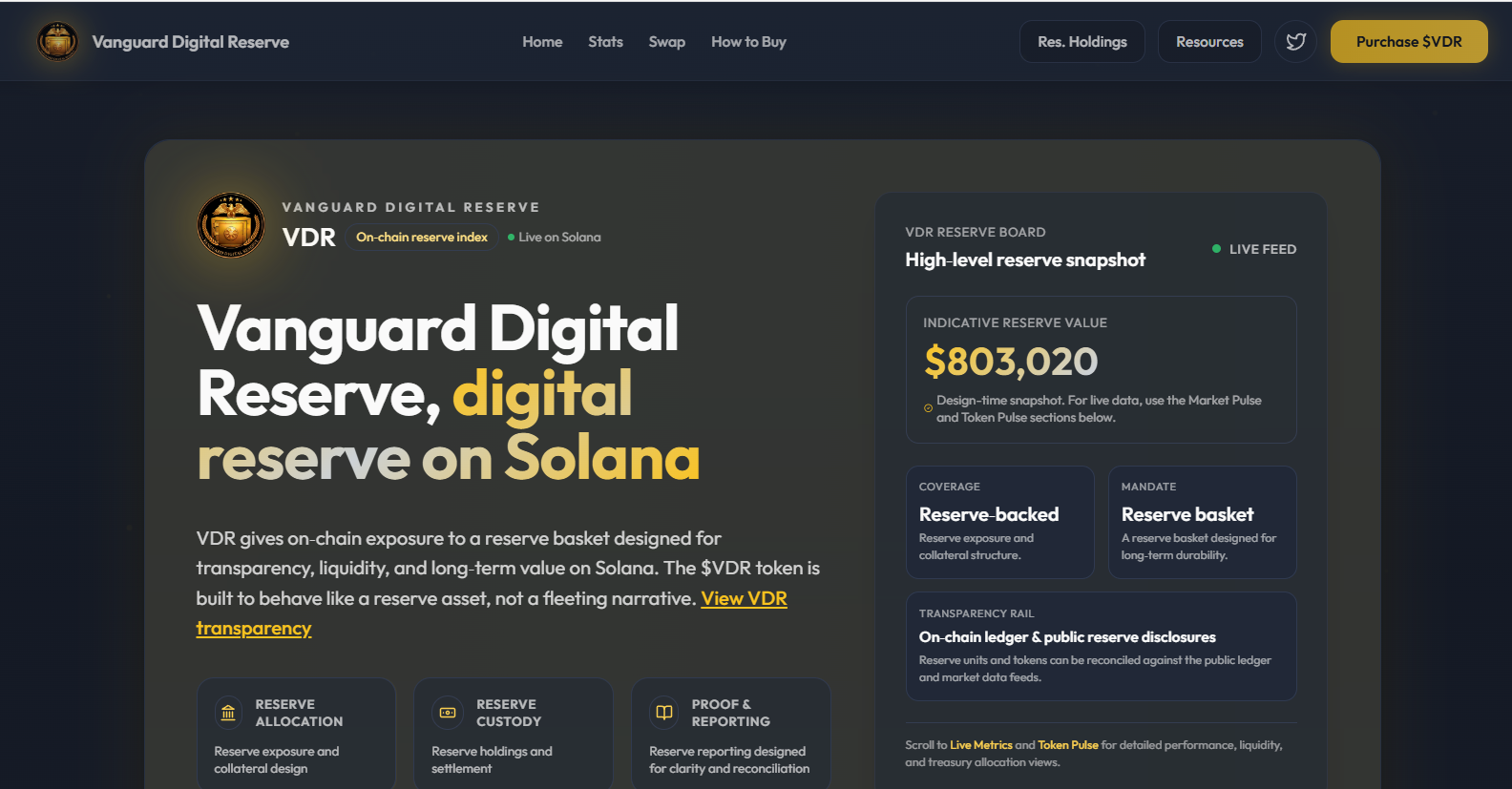

What VDR Crypto claims to be, and what can be verified

VDR (Vanguard Digital Reserve coin) is marketed as a “digital reserve token” on Solana, with messaging about transparency, liquidity, and long-term value. It’s tradable through Solana DEXes, including Jupiter, and it’s tracked like many small tokens with basic market stats and a public contract address.

So far, so normal. Lots of tokens pitch big ideas.

Where things get shaky is the gap between the story and what you can actually verify. Based on available public data, VDR has been trading around $0.018 to $0.019, with about 1 billion tokens in supply and an estimated market cap around $19 million.

Reported daily volume has been in the hundreds of thousands (around $300,000 – $700,000). It has also been reported around #1702 by market cap, which puts it deep in “small coin” territory.

That matters because tiny projects can move fast for reasons that have nothing to do with progress. With a lower market cap and thinner liquidity, it doesn’t take much money to push price up or down. A few wallets buying in a short window can create a chart that looks like a rocket. Then the rocket runs out of fuel.

Another thing you’ll notice is that mainstream coverage is basically missing.

Now, that doesn’t prove a scam on its own. It does mean most of what people “know” about VDR is coming from promotional content, not independent reporting, not a long track record, and not audited documentation.

The Vanguard name confusion, and why it is a serious trust problem

A legit project makes it easy to answer one question: “Who are you, exactly?”

With VDR, the branding creates a strong association with Vanguard. But public information does not show an endorsement, partnership, or launch by Vanguard Group, the major investment firm.

In fact, the real Vanguard has been known for being cautious around crypto, and it has allowed customers to access third-party crypto ETFs through its brokerage, not a “Vanguard coin.”

This kind of look-alike naming is a trust problem. People buy faster when they feel safe, and a familiar brand name can do that even when it shouldn’t. If a project benefits from brand confusion, that’s not a small marketing quirk. It’s a reason to slow down.

The biggest red flags around the Vanguard Digital Reserve coin

Not every small token is a scam. Not every anonymous team is evil. But when several warning signs stack up, the odds shift hard against regular buyers.

With VDR, the red flags don’t come from one obscure detail. They come from the overall pattern:

- Hype-heavy promotion

- Unclear accountability

- Weak proof behind big-sounding claims

- No presence on social media

One more detail that shouldn’t be ignored – VDR has shown up in places like KuCoin Alpha, and KuCoin Alpha itself warns that these tokens can carry higher risk, including extreme volatility and even the loss of all funds. That warning is not there for decoration.

If you’re buying because you think “Vanguard” equals safety, stop. That’s exactly how people get trapped in viral coins.

Hype-first marketing (quick-rich promises, price targets, viral videos)

The promo style around VDR in early February 2026 looks familiar if you’ve watched meme coin cycles.

You’ll see confident targets like a quick push to $0.10, then bigger numbers like $0.20 tossed out like they’re just a matter of time. Some promoters compare VDR to other fast pumps (one comparison that’s circulated is to a token called USOR crypto that allegedly ran hard).

There’s also language that flirts with the idea that this could be a pump-and-dump, while still telling viewers they can “get in early.”

Here’s the problem: serious projects usually spend more time on product, security, and adoption than on price prophecies. Price can go up for lots of reasons, including coordinated buying, thin liquidity, and social pressure. None of those mean the project is building anything real.

When the marketing is mostly price targets, the “plan” often looks like this:

- Create attention

- Push for buys

- Sell into the spike

- Leave late buyers holding the bag.

That’s not a conspiracy theory. It’s a common pattern.

No clear team, no accountability, and little proof of real backing

A “digital reserve” pitch implies backing. If a token claims to function like a reserve (or hints at a reserve basket), the obvious question is, “Backed by what, and where’s the proof?”

Public sources don’t show clear, independent evidence of:

- A doxxed, verifiable founding team (names, track record, LinkedIn history)

- Independent security audits

- Transparent custody details or on-chain proof that reserve assets exist

- Clear documentation that matches the size of the claims

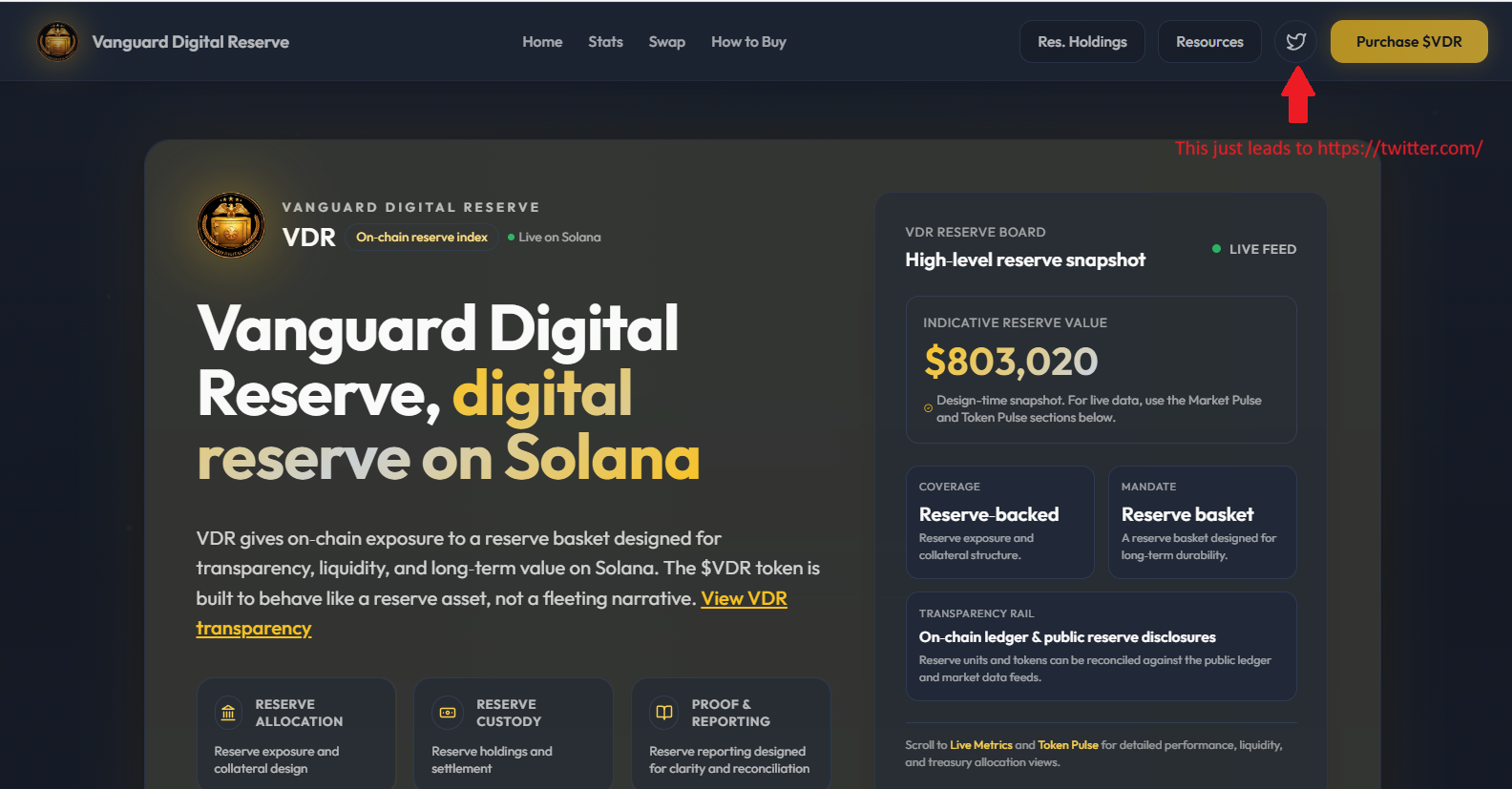

Even basic signals are shaky. VDR has been labeled unverified in at least one top crypto wallet context (Phantom), and the official site commonly cited, vdr-us.com (we recommend you avoid going to this website), has not been widely associated with a public team page in the available information.

Even if you go to their website, you can’t find any verifiable information on anyone behind this project. Even the link to their X profile on the website only leads to X’s home page!

This doesn’t prove malicious intent by itself. It does mean there’s no clear accountability if something goes wrong. It’s extremely risky.

How to do a simple safety check before you buy any small crypto token

If you’ve ever bought something expensive online, you probably looked for reviews, checked the return policy, and made sure the site wasn’t fake. Small crypto tokens deserve at least that level of caution, and more.

You don’t need to be a developer. You need a process. Here’s a simple one you can do in under an hour:

- Confirm the official identity: Find the project’s main site and social accounts, then cross-check that they all point to each other (and have consistent history).

- Verify the contract address: Match it across multiple sources, then confirm it in your wallet before swapping.

- Read the docs like a skeptic: Look for clear explanations, not slogans. If it claims a reserve, demand proof.

- Check where it trades: DEX-only can be fine, but it also makes it easier for fake tokens to circulate.

- Assume volatility: With small caps, price can spike and crash fast. Only risk what you can afford to lose.

This won’t make you 100% guaranteed to avoid crypto scams. But it will keep you from stepping on the most common land mines.

If you still want exposure, consider safer options than a hype token

Not everyone wants to sit out. That’s fair. If you still want crypto exposure without betting on a tiny, hype-driven token, you’ve got options that don’t depend on viral posts.

You can keep it simple:

- Stick with well-known assets that have deep liquidity and broad coverage (many people start with BTC or ETH).

- Use regulated platforms where possible, and be strict about security basics.

- Consider widely traded crypto ETFs available through brokerages, instead of a small DEX token you found through a promo thread.

- Wait. A real project will still be there after it proves itself with audits, clear docs, and real usage.

Even if VDR turns out not to be outright malicious (unlikely, but possible), buying early based on branding and price targets is still the high-risk path.

The bottom line – VDR crypto is extremely sketchy

VDR crypto (the “Vanguard Digital Reserve Project”) has a cluster of warning signs that should slow anyone down:

- Confusing branding that looks like it borrows (steals) trust from Vanguard

- Hype-driven price predictions

- Small and easily moved market profile

- No independent coverage

- No clear public team

- No public proof of any real “reserve” backing

The simplest takeaway is also the most useful: don’t buy a token because the name looks familiar. Verify the project, verify the contract address, and treat viral posts like advertisements, not research.

If you want crypto exposure, pick routes that don’t depend on hype staying hot for one more day.

FAQ

What is the Vanguard Digital Reserve coin?

The Vanguard Digital Reserve coin (VDR) is a small-cap Solana token promoted as a “digital reserve” asset emphasizing liquidity and long-term value narratives. Publicly available data confirms trading activity, but limited independent validation exists regarding governance, backing, or institutional relationships.

Is VDR crypto legit?

Public information does not show verified links between VDR (Vanguard Digital Reserve) and the established Vanguard investment firm. There is 0 transparency around the team and documentation. That doesn’t confirm fraud, but it makes VDR extremely risky, and increases the likelihood of a scam.

How to buy VDR crypto

You can buy VDR coin through Solana decentralized exchanges such as Jupiter. You need to connect your wallet to the exchanges, and make the swap. However, we recommend that you do not purchase this coin, as it’s almost certainly a rug pull scam.

Source:: Don't Buy VDR Crypto: The Vanguard Digital Reserve Project Is Full of Red Flags