Key highlights:

- The Bitcoin price dropped below $75,000, breaking key technical support and triggering renewed bearish forecasts.

- A bearish crossover between the 21-week and 50-week EMAs mirrors patterns seen before the 2022 downturn.

- On-chain data shows Bitcoin trading near realized price levels that historically marked structural bear phases.

Bitcoin has fallen below the $75,000 level, triggering renewed debate among analysts about whether the market is entering a prolonged bearish phase. The breakdown comes amid weakening technical structures and growing caution in on-chain data.

On the daily chart, the loss of support has intensified selling pressure, with traders now closely watching key historical levels for potential stabilization.

Bearish crossover and support targets in focus

Several analysts on social media platform X have identified $74,400 and $49,180 as major support zones in the current cycle. These levels are being cited as potential downside targets if bearish momentum continues.

CryptoBullet Trader highlighted the loss of the 21-week exponential moving average (EMA), a technical development that marked the beginning of previous bear markets.

$BTC has lost the 21-Month EMA 🥶

It’s so over you can’t even imagine pic.twitter.com/UFJnoFZmkv

— CryptoBullet (@CryptoBullet1) February 1, 2026

Historically, sustained trading below this level has coincided with extended corrections.

Rekt Capital pointed to a bearish crossover between the 21-week and 50-week EMAs, where the faster moving average falls below the slower one. The last time this pattern appeared was in April 2022, shortly before a deeper market decline unfolded.

So far, history is repeating, with downside occurring after the Bull Market EMA crossover

Bitcoin has dropped -17% from $90,000 to $78,000 since the crossover took place

History suggests that additional downside continuation over time lays ahead$BTC #Crypto #Bitcoin https://t.co/bts2Qkjf5A pic.twitter.com/SK2imx80xN

— Rekt Capital (@rektcapital) January 31, 2026

The analyst noted on X that historical patterns appear to be repeating, with price declines following a bearish moving average crossover.

On-chain data signals structural pressure

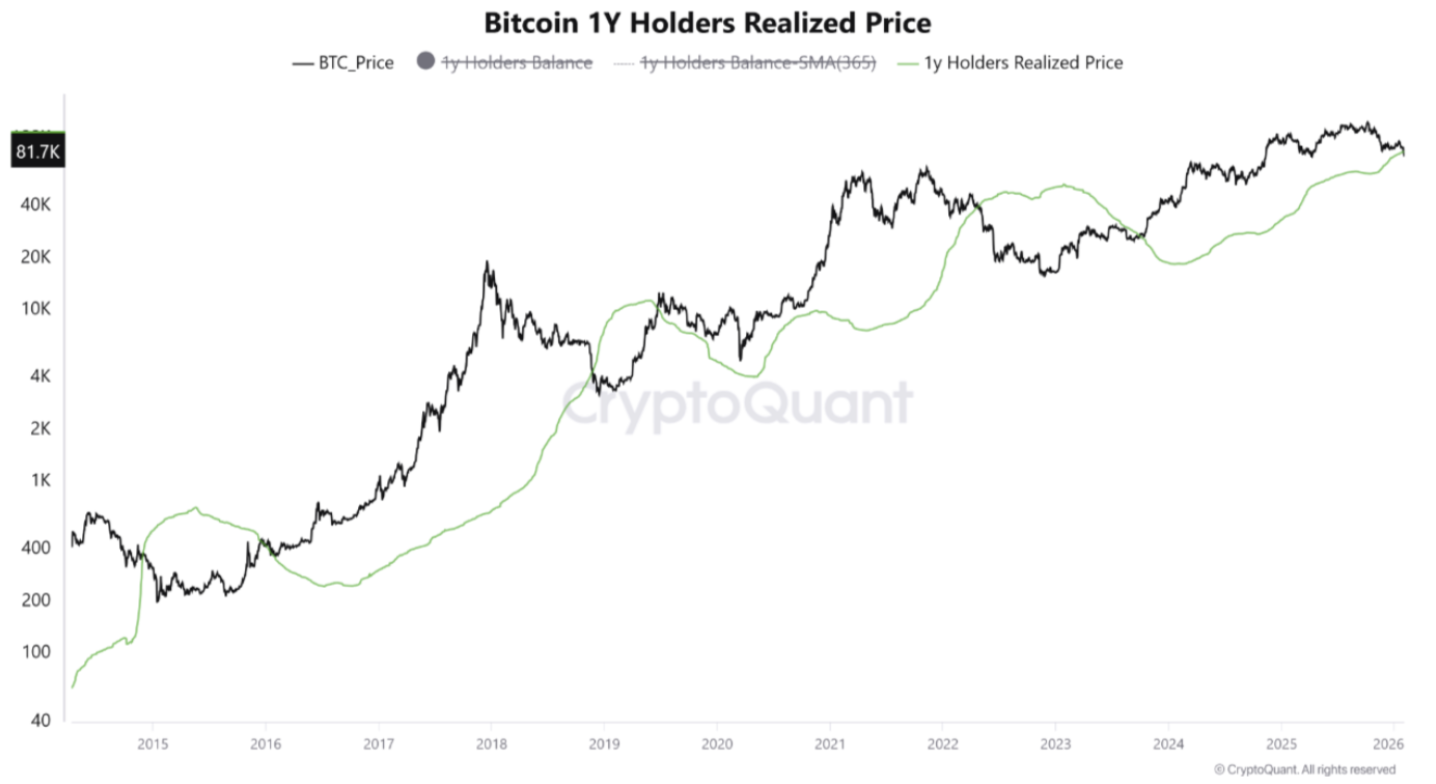

Beyond chart patterns, on-chain metrics are also flashing warning signs. According to analytics platform CryptoQuant, one key indicator is whether Bitcoin’s spot price falls below the realized price of holders who have owned BTC for 12 to 18 months.

Bitcoin’s realized price. Source: CryptoQuant

The realized price represents the aggregate cost basis at which those coins last moved on-chain. Historically, when Bitcoin trades below this level for a sustained period, market behavior has shifted from a standard correction to a more structural bearish phase.

CryptoQuant analysts noted that this realized price currently acts as resistance, limiting upward momentum and reinforcing selling pressure.

ETF era adds a new variable

Unlike previous cycles, the current market operates in the era of spot Bitcoin ETFs. These products have introduced a new channel of institutional supply and demand, potentially altering traditional market dynamics.

In prior bear markets, price action was primarily driven by retail participation, derivatives leverage, and macroeconomic shocks. Now, ETF inflows and outflows could independently influence volatility, creating a feedback loop between traditional financial markets and crypto exchanges.

While technical indicators suggest further downside risk, ETF flows remain a wildcard. A sustained slowdown in institutional demand could amplify pressure, while renewed inflows may help stabilize price action.

Current technical and on-chain signals indicate elevated risk in the near term. However, the longer-term trajectory may depend on macro conditions, liquidity cycles, and the resilience of institutional participation during market stress.

Source:: Bitcoin Price Prediction: Bearish Crossover Signals Risk of $49K Retest