Microsoft is under renewed pressure after a sharp post-earnings selloff, with investors increasingly focused on rising AI-related costs and signs that cloud growth may be entering a more mature phase. Despite another quarterly earnings beat, the stock’s reaction highlights growing sensitivity to capital intensity and risk at elevated valuation levels.

At the time of writing, Microsoft shares trade around $425.05, down sharply from recent highs and well below the company’s all-time peak of $553.79.

Earnings beat fails to calm market concerns

Microsoft reported strong second-quarter results, exceeding Wall Street expectations on both revenue and earnings. Quarterly revenue reached $81.27 billion, while earnings per share came in at $5.16, comfortably ahead of consensus estimates.

Microsoft Q2 earnings. Source: Microsoft

Cloud performance remained a highlight, with Microsoft Cloud revenue surpassing $50 billion for the first time, reaching $51.5 billion. Azure and the broader Intelligent Cloud segment also beat expectations, reinforcing Microsoft’s position as a dominant infrastructure and enterprise software provider.

However, the market response was swift and negative. MSFT shares fell more than 11% following the report, as investors shifted focus from near-term execution to longer-term cost pressures tied to artificial intelligence investments.

AI spending becomes a double-edged sword

Microsoft’s aggressive push into AI continues to reshape its financial profile. Capital expenditures surged to $37.5 billion in the quarter, up sharply from $22.6 billion a year earlier, driven largely by data center expansion and AI infrastructure.

While CEO Satya Nadella emphasized that Microsoft is still in the early stages of AI adoption, investors appear increasingly cautious about how quickly those investments will translate into sustainable profit growth. The company also acknowledged ongoing AI capacity constraints, suggesting demand currently exceeds supply and placing a temporary ceiling on revenue realization.

Adding to concerns, Remaining Performance Obligations (RPO) climbed to $625 billion, with roughly 45% tied to OpenAI-related commitments. While this underscores long-term demand visibility, it also reinforces how deeply Microsoft’s future growth is linked to continued AI spending.

Market rotation adds pressure to MSFT shares

The broader market backdrop has also become less forgiving. Investors are increasingly rotating away from mega-cap technology names that rely on heavy capital deployment, especially as peers like Google have outperformed over the past year.

Despite Microsoft’s scale and balance sheet strength, its shares have lagged key competitors and are now down over the past 12 months. This shift reflects a market environment where execution alone is no longer enough to justify premium multiples.

Technical picture: Breakdown from the recent range

From a technical perspective, Microsoft’s selloff marks a decisive break from its recent consolidation range. The stock failed to hold above the $460–$470 zone and quickly retraced toward the low $420s.

Momentum indicators reflect growing downside risk, with prior support now acting as resistance. Unless buyers reclaim higher levels, rallies may continue to face selling pressure.

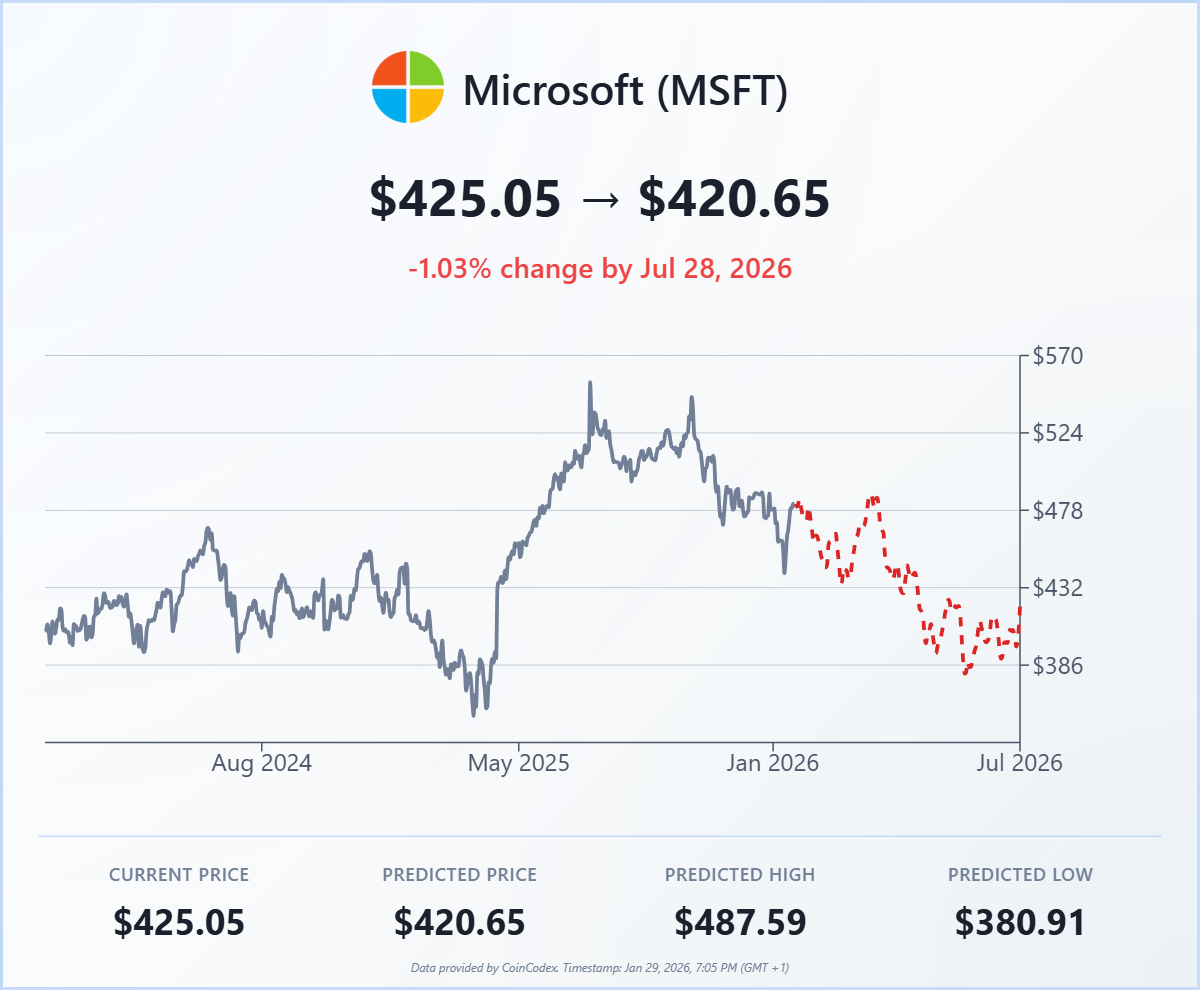

Coincodex’s 6-month MSFT price prediction

Coincodex’s MSFT price prediction suggest a more cautious outlook for the company over the coming months. Average price expectations trend lower into mid-2026, with downside scenarios extending toward the $380–$400 range before stabilization.

While short-term rebounds remain possible, the forecast reflects elevated uncertainty around capital efficiency, AI monetization timelines, and margin compression.

As with all quantitative models, these projections rely on historical patterns and trend continuation. They should be viewed as scenario guidance rather than precise price targets, particularly given Microsoft’s sensitivity to broader tech-sector sentiment.

Plus500: Best CFD trading platform for global investors

- Trade 2,800+ CFDs – stocks, forex, indices, commodities, crypto & more

- 0% commission and competitive spreads with no hidden fees

- Leverage up to 1:30 for retail clients and higher for professionals (professional accounts do not have ICF rights)

- Advanced risk management tools

- Regulated in multiple jurisdictions, ensuring security & compliance

- 26+ million users worldwide

CFDs are complex instruments with a high risk of losing money due to leverage. 82% of retail investors lose money trading CFDs with this provider. Ensure you understand the risks before trading. Past performance is not indicative of future results. Professional accounts do not have ICF rights.