Meta surged sharply this week, pushing its share price toward the $720 area after a strong earnings report reignited optimism around the company’s artificial intelligence strategy. With Wall Street banks lifting price targets and investors embracing Meta’s long-term AI roadmap, the stock is once again testing key resistance levels.

At the time of writing, Meta trades near $719, up more than 17% over the past seven days, as markets reassess the balance between rising capital expenditures and sustained profitability.

JPMorgan turns more bullish on Meta shares

JPMorgan recently raised its price target on Meta to $825, up from $800, while maintaining an Overweight rating. The bank cited stronger-than-expected revenue growth, with Meta’s first-quarter outlook pointing toward growth in the 30% range, a level that could comfortably offset projected 2026 expenses and capital spending.

According to JPMorgan, Meta has established clearer bottom-line guardrails, with operating income growth expected in 2026 and Reality Labs losses likely peaking this year. The firm also highlighted that Meta is managing expectations around frontier AI models, focusing instead on steady progress toward advanced large language models throughout 2026.

Several other major banks echoed this optimism. BofA Securities raised its target to $885, while Citizens reiterated a $900 target, emphasizing Meta’s AI-driven engagement gains across platforms like Instagram Reels.

Earnings strength reinforces core business confidence

Meta’s latest earnings report delivered across the board. The company posted $59.9 billion in quarterly revenue, representing roughly 24% year-over-year growth, while earnings per share reached approximately $8.88. Net income climbed to around $22.8 billion, easing concerns that aggressive investment would erode profitability.

Advertising remains Meta’s primary profit engine. Ad impressions rose 18%, while Instagram Reels watch time jumped 30%, reinforcing confidence in Meta’s ability to monetize its massive user base. The company now reports more than 3.5 billion daily active users across its family of apps, underscoring its scale advantage.

This combination of revenue growth, engagement, and cash flow has helped investors look past near-term margin pressure tied to infrastructure expansion.

AI spending takes center stage in 2026 outlook

A key driver behind Meta’s recent rally is its ambitious AI investment plan. Management outlined expected 2026 capital expenditures between $115 billion and $135 billion, largely dedicated to data centers, custom AI chips, and model training.

Total expenses are projected to reach $162 billion to $169 billion, reflecting the company’s push to position itself not just as a social media platform, but as a long-term AI infrastructure provider. While this level of spending has sparked debate, markets appear willing to accept near-term cost pressure in exchange for future dominance in AI-driven products and services.

Technical outlook: Can Meta break above resistance?

Meta stock attempts breakout as momentum indicators turn bullish. Source: TradingView

From a technical perspective, Meta’s share price recently broke out of a descending price channel and is now challenging resistance near $740. A decisive move above this level could open the door toward $780 in the near term.

Momentum indicators remain constructive. The Relative Strength Index has moved higher without entering extreme overbought territory, while the MACD recently crossed into bullish alignment, suggesting buyers remain in control.

However, failure to clear resistance could trigger a pullback toward the $670 support zone, an area that aligns with previous consolidation levels.

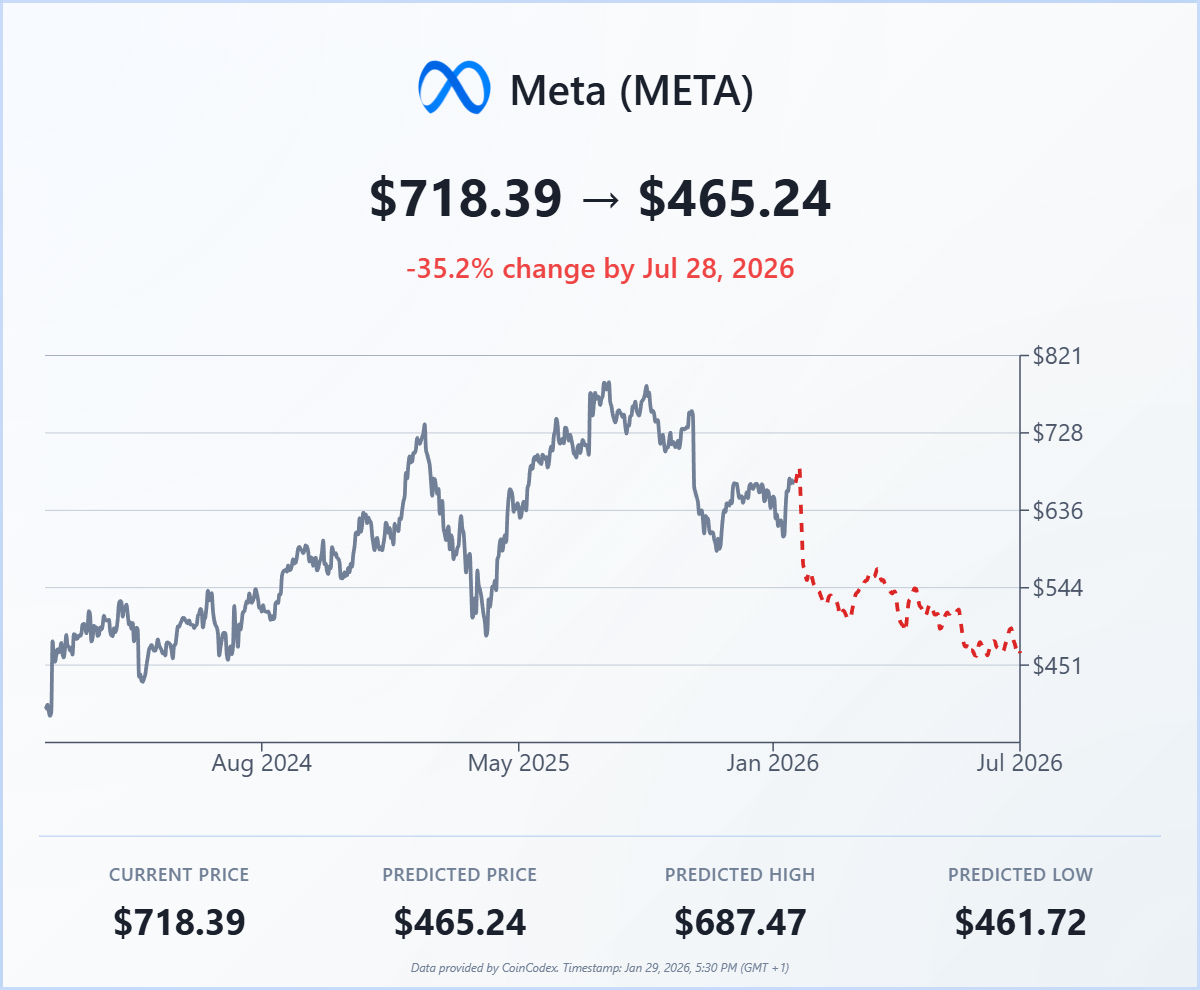

Coincodex’s 6-month Meta stock forecast

While banks remain optimistic, longer-term model-based forecasts paint a more cautious picture. CoinCodex’s Meta price prediction suggests that Meta could trend lower into mid-2026, with average price estimates drifting toward the $460–$520 range. This divergence highlights the tension between strong near-term fundamentals and uncertainty around long-term returns on massive AI investment.

For now, Meta sits at the center of investor attention. Strong earnings, aggressive AI expansion, and bullish Wall Street targets support the upside narrative, while valuation risks and spending scale remain the key variables to watch.

Plus500: Best CFD trading platform for global investors

- Trade 2,800+ CFDs – stocks, forex, indices, commodities, crypto & more

- 0% commission and competitive spreads with no hidden fees

- Leverage up to 1:30 for retail clients and higher for professionals (professional accounts do not have ICF rights)

- Advanced risk management tools

- Regulated in multiple jurisdictions, ensuring security & compliance

- 26+ million users worldwide

CFDs are complex instruments with a high risk of losing money due to leverage. 82% of retail investors lose money trading CFDs with this provider. Ensure you understand the risks before trading. Past performance is not indicative of future results. Professional accounts do not have ICF rights.

Source:: Meta Stock Prediction: JPMorgan Raises Target to $825 as AI Spending Drives New Momentum