Key highlights:

- Dogecoin has settled into a long consolidation range that looks a lot like the setups that came before its biggest rallies.

- The DOGE price is still holding key support, even as momentum stays quiet, which is often how larger moves start to build.

- On-chain data indicates activity is stabilizing, not disappearing, hinting that DOGE may be quietly building pressure.

Dogecoin is back in one of those phases that most people tend to ignore. The DOGE price isn’t pumping, it isn’t crashing, and it’s not really giving traders much to get excited about. It’s just moving sideways, doing its thing, quietly frustrating anyone looking for quick action.

But if you’ve watched Dogecoin long enough, you know this kind of calm has shown up more than once before. DOGE has spent months looking boring and stuck, only to flip the script when market conditions changed.

Dogecoin’s bigger cycles all start the same way

When you zoom out and look at Dogecoin’s full price history, one thing becomes pretty clear. The big moves didn’t come out of nowhere. They came after long stretches where price barely went anywhere and most people lost interest.

In the first major cycle, Dogecoin spent a long time grinding sideways before eventually delivering a massive upside move. The second cycle followed a similar script, but on a much larger scale. In both cases, the quiet periods came first, and the explosive rallies came later.

Could this cycle be the one that takes $DOGE above 1$ ? 🚀

Looking at previous cycles, we can see that #Dogecoin has followed a pretty similar pattern to the upside.🎯

A long consolidation, followed by a parabolic run to fresh new highs, when market conditions allow it 📈🔥… pic.twitter.com/G4n92ZNor4

— Bitcoinsensus (@Bitcoinsensus) January 28, 2026

What’s interesting is how closely the current structure resembles those earlier setups. DOGE already had its big run, followed by a deep pullback. Since then, the DOGE price has settled into another wide consolidation range, very similar to what happened before previous cycle expansions.

That doesn’t mean history has to repeat itself exactly. But it does mean the current phase fits a pattern Dogecoin has followed more than once.

On-chain activity suggests DOGE isn’t being left behind

Price alone never tells the full story, especially for a meme-driven asset like Dogecoin. On-chain data from Glassnode helps fill in the gaps, and right now, it doesn’t paint a picture of abandonment.

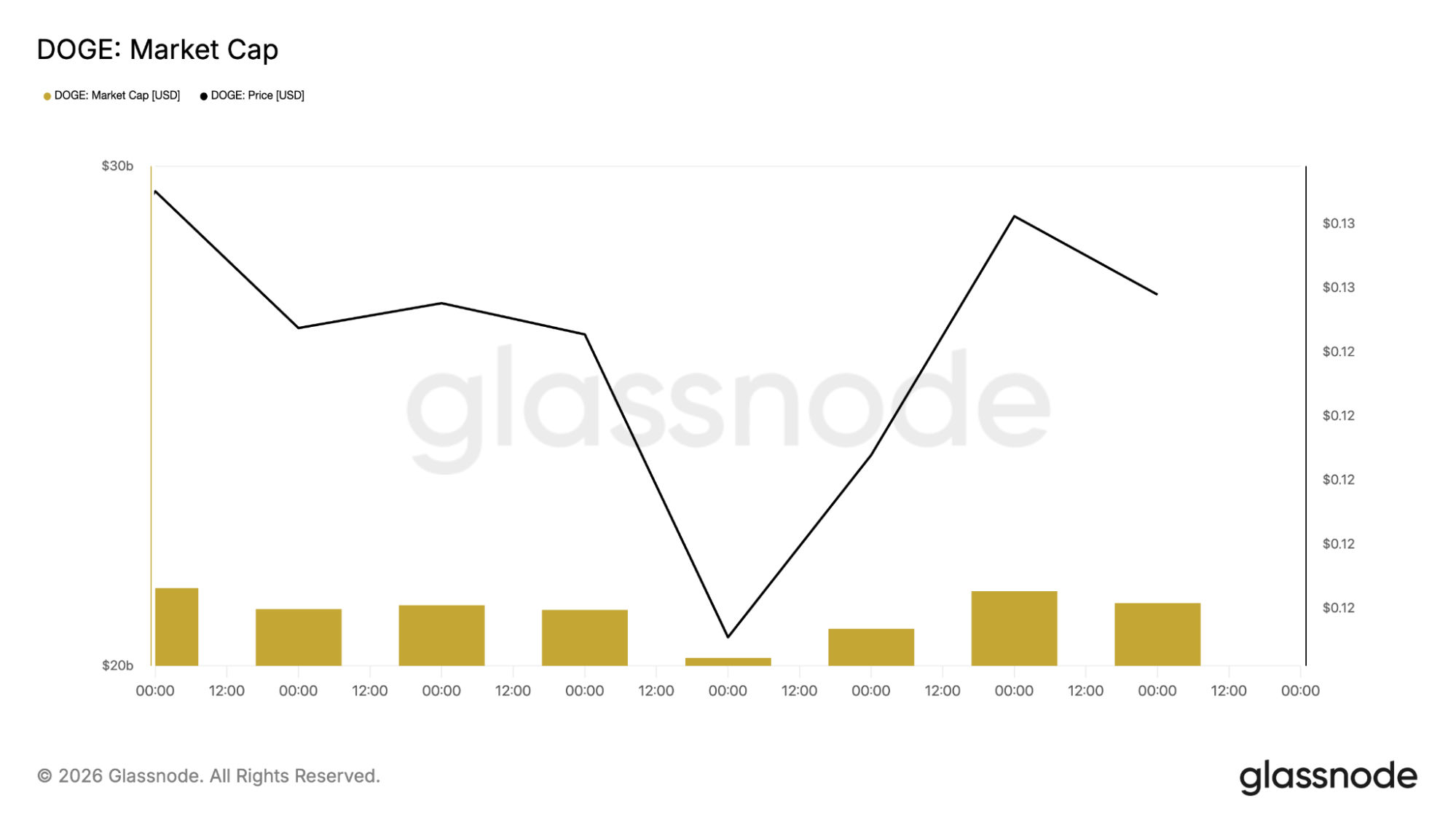

Dogecoin’s market cap dipped during the recent pullback but stabilized fairly quickly. Capital didn’t rush out permanently. It paused, adjusted, and held.

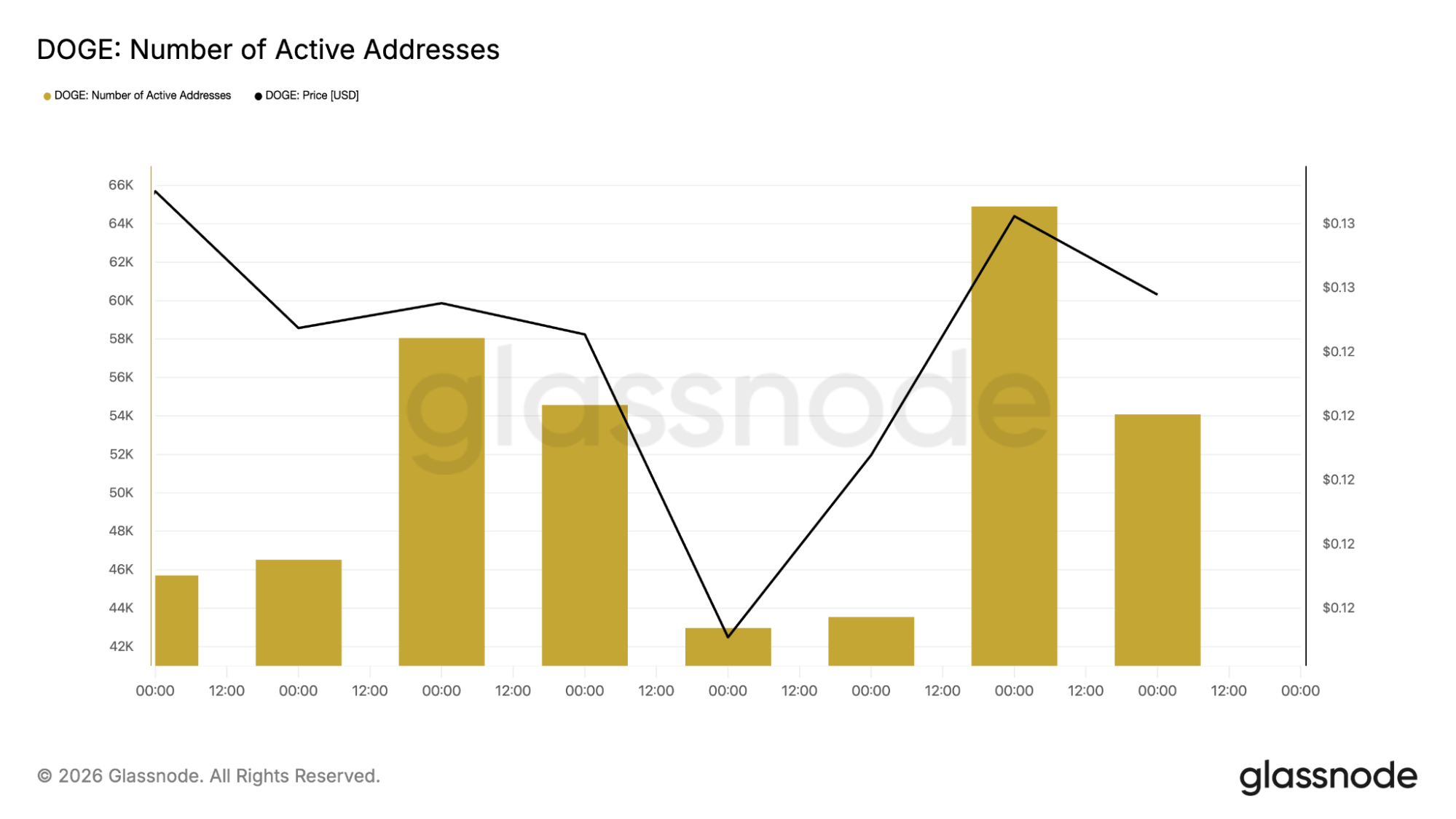

Active address data tells a similar story. Network activity fell during the correction, but it started to recover as the DOGE price found support. That usually signals that users and traders are still engaged, even when price isn’t trending higher.

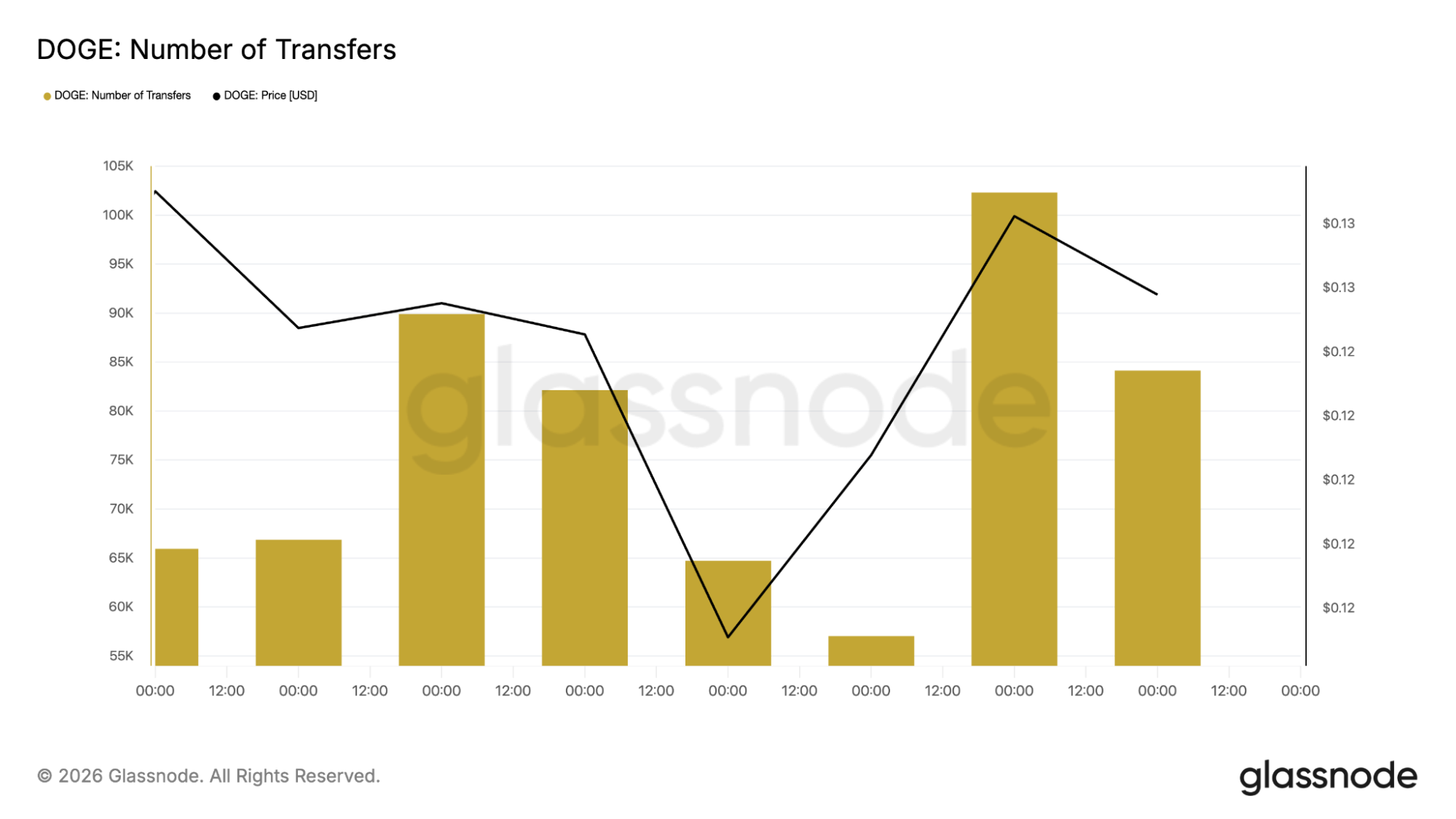

Transaction counts follow the same pattern. Transfers dipped, then picked back up once price stabilized. In past cycles, DOGE rallies were often preceded by this kind of quiet recovery in network usage. Taken together, the data indicates Dogecoin is resting, not fading away.

The DOGE daily chart shows pressure, not collapse

Looking at the daily chart, the DOGE price is still under some pressure, but it’s far from broken. Price is hovering around the $0.12–$0.13 area, sitting just above a support zone that has held up several times already.

Each dip into that region has found buyers. The bounces haven’t been dramatic, but the important thing is that sellers haven’t been able to push DOGE decisively lower. That tells you there’s still demand underneath the market.

Daily DOGE price chart analysis

On the upside, resistance remains clear. The DOGE price keeps running into trouble around the $0.15–$0.16 area, where rallies have stalled repeatedly. This has kept the price trapped in a tightening range, with neither side really taking control.

According to CoinCodex’s 1-month DOGE price prediction, Dogecoin could move toward $0.1409, which reflects a more constructive near-term outlook as the market continues to stabilize.

Momentum reflects that balance. Daily RSI is sitting in a neutral zone, not oversold and not showing strong bullish pressure either. In past cycles, Dogecoin often spent long stretches with RSI behaving exactly like this before volatility returned.

DOGE 4-hour chart points to stabilization, not fear

Dropping down to the 4-hour chart adds a bit more context. Recently, the DOGE price bounced again from the $0.115–$0.12 support zone, which has now been tested multiple times. Buyers keep showing up there, even if they’re not pushing the price aggressively higher.

After the bounce, DOGE tried to climb but ran into resistance near $0.14. That rejection wasn’t surprising. What matters more is how the price reacted afterward. Instead of dumping hard, DOGE drifted lower slowly, with smaller candles and lighter selling pressure.

4-Hour DOGE price chart analysis

That kind of behavior usually points to indecision rather than panic. RSI on the 4-hour timeframe has stabilized near the mid-40s, which often happens when a market is resetting rather than breaking down.

This is the kind of price action that tends to frustrate traders. Nothing dramatic happens, but structure quietly builds underneath.

Is this the cycle where the DOGE price pushes toward $1 again?

Talk of the DOGE price reaching $1 still sounds extreme to a lot of traders, especially after such a long consolidation. But when you view Dogecoin through the lens of its past cycles, those kinds of targets don’t feel completely random.

Each previous cycle featured long periods of boredom, followed by upside moves that surprised almost everyone once conditions lined up. If the current structure resolves in a similar way, the upside potential could change quickly.

That doesn’t mean a breakout is guaranteed. Market conditions, liquidity, and overall sentiment still matter. But the setup itself looks familiar enough that Dogecoin continues to stay on the radar.

Right now, the DOGE price doesn’t look ready to explode. It looks compressed. And historically, compression has been the phase that mattered most for Dogecoin. If that pressure finally releases, DOGE probably won’t move quietly.

Kraken: Best crypto exchange for security & reliability

- Buy, sell, and trade 400+ cryptocurrencies with industry-leading security

- Spot, Futures & Margin trading – leverage up to 5x for advanced traders

- Earn rewards with staking on top cryptocurrencies

- 24/7 customer support and high liquidity for fast trades

- Regulated in the US with strong compliance and security measures

- 13+ million users worldwide

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other advice. Nothing on this page is a recommendation or solicitation. Always seek independent professional advice before making investment decisions. Some links may earn us a commission at no extra cost to you.

Source:: Dogecoin Price Analysis: Could This Be the Cycle That Takes DOGE Above $1?