The S&P 500 has pushed to fresh all-time highs as investors weigh resilient economic growth against a shifting Federal Reserve outlook. With monetary policy nearing a pause and earnings momentum holding up, major banks argue that the index still has room to run despite elevated valuations.

At current levels, the rally is increasingly driven by fundamentals rather than liquidity alone. Earnings growth, easing financial conditions, and sustained investment in artificial intelligence are emerging as the dominant forces shaping the market’s 2026 trajectory.

Fed holds rates as markets look beyond January

The Federal Reserve is widely expected to keep the federal funds rate unchanged at 3.75% at the January 28 FOMC meeting. Futures markets price a near-certainty of a pause, reflecting confidence that policymakers are comfortable with current conditions after three rate cuts in 2025.

While inflation remains sticky near 3.0%, economic growth has surprised to the upside. Fourth-quarter GDP is tracking near a 5.4% annualized pace, even as job growth cools modestly. This combination leaves the Fed walking a narrow line between restraining inflation and avoiding unnecessary tightening.

Political pressure is also building ahead of 2026, with increasing scrutiny around Fed independence and leadership changes expected later in the year. These dynamics have begun to show up in currency markets, where the U.S. dollar has weakened notably.

$DXY hitting it’s weakest levels since Feb 2022, which was beginning of the “recovery” after massive Covid stimilus.

Could very well be the start of a major decline towards .90 level.

More dollars = weaker dollars = higher metals, commodity & some asset prices pic.twitter.com/0iWXcfaX1x

— Eddie (@eddietradezz) January 26, 2026

Dollar weakness and policy uncertainty support risk assets

The U.S. Dollar Index has slipped toward the 97.00 area, its weakest levels since early 2022. Lower yield expectations and growing political uncertainty around monetary policy have reduced the dollar’s appeal, indirectly supporting equities and other risk assets.

Historically, periods of dollar softness combined with stable growth have been favorable for U.S. stocks. With real rates easing and liquidity conditions improving at the P 500 to deliver a 12% total return in 2026, following gains of 25% in 2024 and 18% in 2025. The bank projects 12% EPS growth this year, arguing that earnings rather than multiple expansion will drive further upside.

The firm highlights several structural tailwinds:

- Accelerating U.S. GDP growth supported by easing financial conditions

- Continued profit strength among large-cap technology firms

- Early productivity gains from artificial intelligence adoption

Goldman notes that while valuations are elevated, they do not necessarily signal an imminent peak. The index currently trades near 22x forward earnings, matching 2021 highs but still below the extremes seen during the dot-com bubble.

Earnings growth remains the primary driver of S&P 500 returns as valuation expansion slows. Source: Goldman Sachs

Concentration and AI spending remain key variables

Market concentration is now at record levels, with a small group of mega-cap technology stocks accounting for more than 50% of the S&P 500’s 2025 gains. While this concentration has amplified returns, it also increases downside risk if earnings disappoint.

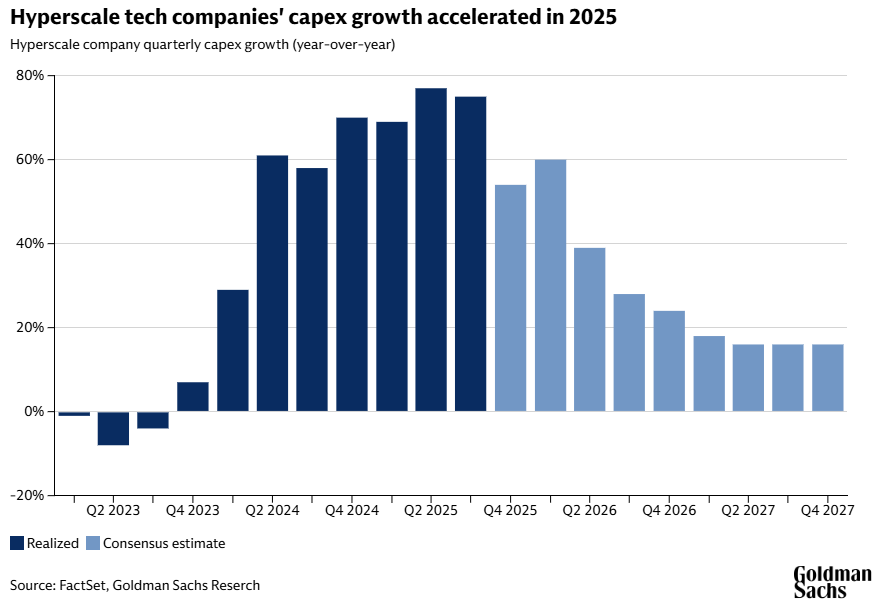

Goldman Sachs expects AI-related capital expenditure to continue rising in 2026, even as growth rates slow from last year’s surge. Hyperscale tech firms spent nearly $400 billion on capex in 2025, up almost 70% year-over-year, and investment remains central to long-term earnings expectations.

The bank cautions that future gains within the AI trade may come from rotation rather than broad multiple expansion, favoring companies that successfully translate AI adoption into productivity and cash flow.

Hyperscale technology capex surged in 2025, reinforcing AI’s central role in equity market leadership. Source: Goldman Sachs

Risks to the bullish outlook

Despite the constructive base case, risks remain. A re-acceleration in inflation or a hawkish pivot from the Fed could pressure valuations. Likewise, slower-than-expected earnings growth would expose the market’s reliance on optimistic forecasts.

Goldman identifies the primary downside risks as:

- Unexpected economic slowdown

- Renewed inflation forcing tighter policy

- Disappointing returns on AI investment

For now, none of these appear imminent. Broad equity flows remain measured, speculative activity is well below prior bubble peaks, and corporate leverage, while rising, is still historically moderate.

With the S&P 500 at record highs, the path forward is likely to be less about broad market beta and more about earnings execution. Stable growth, easing policy, and AI-driven productivity gains provide a solid foundation, but elevated valuations raise the stakes for results.

As long as earnings continue to justify prices, major banks see room for further upside. The rally may slow, but the underlying trend remains intact heading deeper into 2026.

Plus500: Best CFD trading platform for global investors

- Trade 2,800+ CFDs – stocks, forex, indices, commodities, crypto & more

- 0% commission and competitive spreads with no hidden fees

- Leverage up to 1:30 for retail clients and higher for professionals (professional accounts do not have ICF rights)

- Advanced risk management tools

- Regulated in multiple jurisdictions, ensuring security & compliance

- 26+ million users worldwide

CFDs are complex instruments with a high risk of losing money due to leverage. 82% of retail investors lose money trading CFDs with this provider. Ensure you understand the risks before trading. Past performance is not indicative of future results. Professional accounts do not have ICF rights.

Source:: S&P 500 Forecast: Major Bank Sees 12% Upside as Index Hits New All-Time High