Gold continues to trade near record levels after decisively breaking above the $5,000 per ounce mark, reinforcing a bullish narrative that has been building for months. At the time of writing, gold is trading around $5,087, holding above a level that many analysts previously viewed as a long-term ceiling rather than a near-term milestone.

The move above $5,000 reflects more than short-term momentum. Institutional forecasts, central-bank demand, and geopolitical uncertainty have combined to reshape expectations for gold’s role in global portfolios, with several major banks now projecting higher prices over the coming quarters.

Gold breaks $5,000 as bullish momentum holds

Gold (XAU/USD) breaks above the $5,000 level and consolidates near record highs, confirming a strong bullish trend. Source: TradingView

Gold’s surge through $5,000 marked a historic moment for the precious metals market. After clearing the psychological barrier, prices pushed toward the $5,100 area before entering a period of consolidation, suggesting buyers remain in control even as momentum cools slightly.

Analysts note that gold’s rally has been supported by sustained central-bank purchases, rising geopolitical tensions, and persistent uncertainty around fiscal and monetary policy. Unlike prior spikes that faded quickly, this advance has been accompanied by steady inflows and relatively contained volatility, pointing to structural demand rather than speculative excess.

Morgan Stanley targets $5,700 as banks turn more bullish

Morgan Stanley has reinforced the constructive outlook for gold, forecasting prices could reach $5,700 per ounce in the second half of the year. The bank points to a combination of geopolitical risk, ongoing central-bank accumulation, and renewed investor demand as key drivers behind its projection.

According to Morgan Stanley, central banks continue to buy gold even at elevated price levels, reducing downside risk and creating a higher price floor. The bank also expects ETF inflows to strengthen as financial conditions ease and real yields soften, particularly if expectations for Federal Reserve rate cuts in 2026 gain traction.

Other institutions echo this view. Société Générale has outlined a bullish scenario targeting $6,000 per ounce, while several Wall Street firms argue that gold’s role is shifting from a cyclical hedge to a longer-term strategic allocation amid currency debasement concerns and global fragmentation.

Technical outlook keeps focus on $5,100 and higher levels

Gold consolidates above $5,000 with $5,100 acting as near-term resistance, while higher Fibonacci extension levels come into focus. Source: TradingView

From a technical perspective, gold remains firmly in an uptrend. Prices have repeatedly held above the $5,000 support zone, with buyers stepping in on pullbacks toward the $5,030 to $5,060 area. Short-term resistance sits near $5,100, a level traders are watching closely for either a breakout continuation or a brief corrective pause.

Indicators suggest momentum has moderated from overbought conditions, but the broader structure remains intact. A sustained move above $5,100 would expose higher extension targets, while a rejection at that level could trigger a controlled pullback without necessarily threatening the underlying bullish trend.

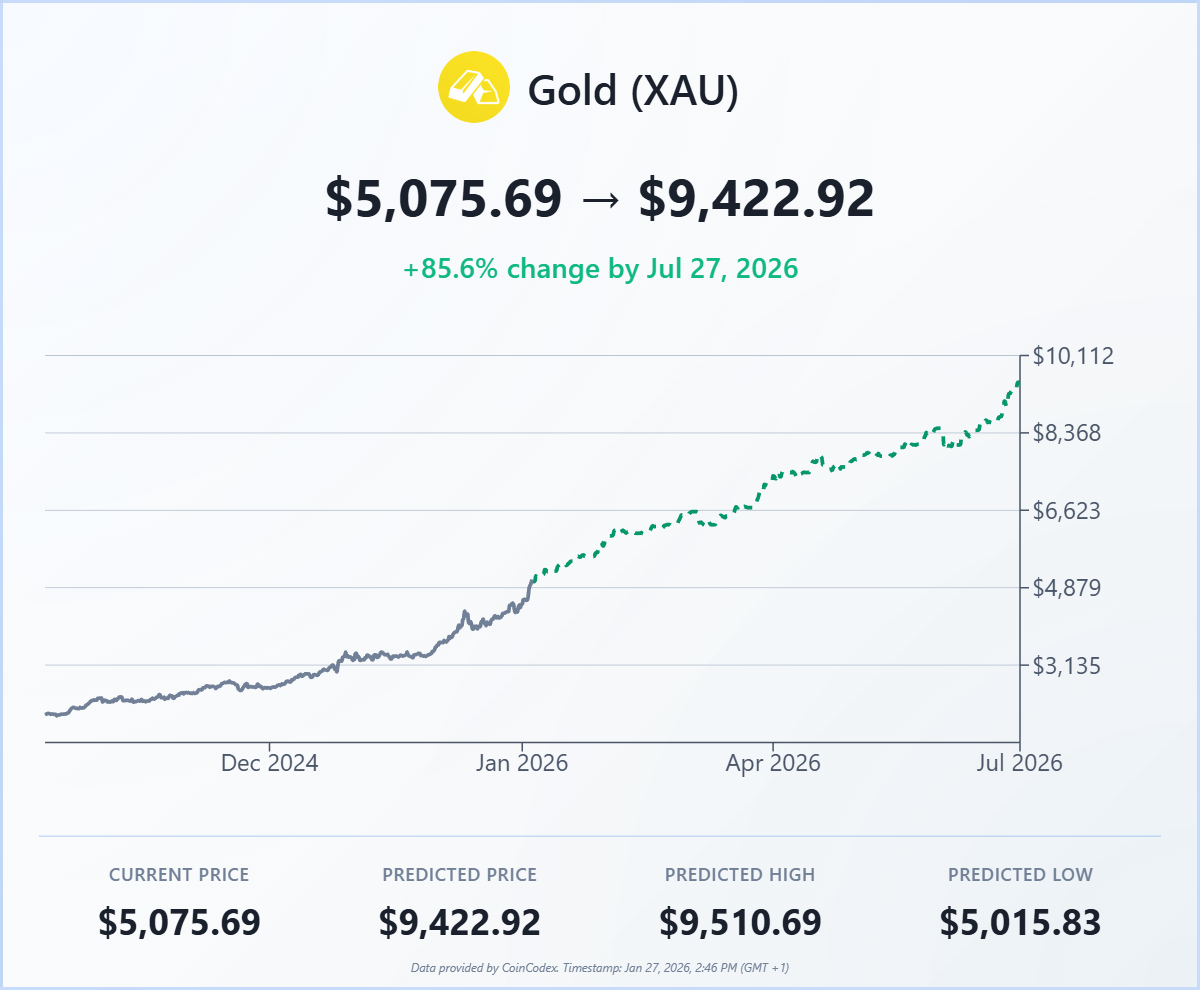

CoinCodex gold forecast outlines aggressive scenario

CoinCodex’s gold price prediction outlines a notably aggressive upside scenario if current trends persist. According to the projection, gold could average around $5,700 in February 2026, with models pointing toward prices above $6,400 by March and potentially approaching $8,800 to $9,500 by mid-2026.

While these figures highlight the strength of the prevailing trend, such projections rely heavily on continued macro stress, strong safe-haven demand, and uninterrupted momentum. As with all quantitative forecasts, CoinCodex’s outlook should be viewed as a scenario framework rather than a certainty, especially given gold’s tendency to consolidate sharply after extended rallies.

Plus500: Best CFD trading platform for global investors

- Trade 2,800+ CFDs – stocks, forex, indices, commodities, crypto & more

- 0% commission and competitive spreads with no hidden fees

- Leverage up to 1:30 for retail clients and higher for professionals (professional accounts do not have ICF rights)

- Advanced risk management tools

- Regulated in multiple jurisdictions, ensuring security & compliance

- 26+ million users worldwide

CFDs are complex instruments with a high risk of losing money due to leverage. 82% of retail investors lose money trading CFDs with this provider. Ensure you understand the risks before trading. Past performance is not indicative of future results. Professional accounts do not have ICF rights.

Source:: Gold Forecast: Major Banks See Path Higher as Gold Holds Above $5,000