When Bitcoin miners are switching en masse to focus on artificial intelligence, and the network hashrate is falling to a four-month low, this combination signals a fundamental restructuring of the digital economy.

What initially appears to be a mining-specific issue is, in reality, part of a broader shift: mining infrastructure is becoming universal computing centers, where decisions on power allocation depend not on the economics of cryptocurrencies, but on the demand for AI computing.

This structural transition provides the backdrop for a much wider conflict unfolding across energy markets, hardware supply chains, and financial markets.

Energy war over computing resources

The battle for electricity has turned into a real one‑resource war between mining and AI. Alphabet paid $4.75 billion for an energy company, while Meta signed deals for 6.6 GW of nuclear power, and the Trump administration is pushing for emergency auctions of capacity exclusively for data centers.

These moves highlight how access to energy, rather than algorithms, is becoming the decisive competitive advantage.

Copper, the physical foundation of any digital infrastructure, increased by 40% in a year, transforming from an industrial metal into a strategic asset of the AI era. As power generation expands, transmission capacity and raw materials are becoming the next bottlenecks, directly linking commodity markets to the future of computation.

Hardware shortages and cascading effects

The pressure on infrastructure is already rippling through the hardware market. A lack of high‑speed memory creates cascading effects across the entire tech ecosystem. OpenAI entered into agreements to purchase 900,000 DRAM wafers per month, around 40% of global production.

As a result, prices for conventional memory have risen by 50-60%, while SSD drives have doubled to tripled in price.

These shortages are spilling into consumer markets. Sales of game consoles have plummeted: Xbox Series X sales fell by 70%, while PlayStation 5 declined by 40%. Consumer electronics are increasingly becoming collateral damage in the race for AI supremacy, reinforcing the idea that AI demand is now reshaping industries far beyond software.

The AI economic model under strain

Against this backdrop of surging costs, the AI economic model itself is starting to show cracks. The AI economic model is bursting at the seams. OpenAI demonstrates the paradox of the modern AI industry: the company earned $20 billion in 2025, but spends $15 million daily on Sora alone. Of its 800 million users, only 5% pay, which is a critically low monetization rate.

Industry analysts have announced the completion of the “honeymoon” with AI, warning that 2026 could mark a period of disappointment, system failures, and growing distrust in the industry. This reassessment is happening just as AI infrastructure investments reach historic highs, increasing the risk of overcapacity and financial stress.

Automation ambitions and distributed computing

At the same time, companies continue to push aggressive automation narratives. An xAI engineer has revealed details of the Macrohard project, an ambitious plan to create a fully AI‑driven company with human emulators that operate 1.5 to 8 times faster than humans. Scaling is planned through idle Tesla vehicles, effectively turning millions of cars into a distributed computing network.

These experiments highlight how the boundary between consumer products, transportation, and computing infrastructure is rapidly dissolving, further intensifying competition for energy and hardware.

Bitcoin market: pressure and consolidation

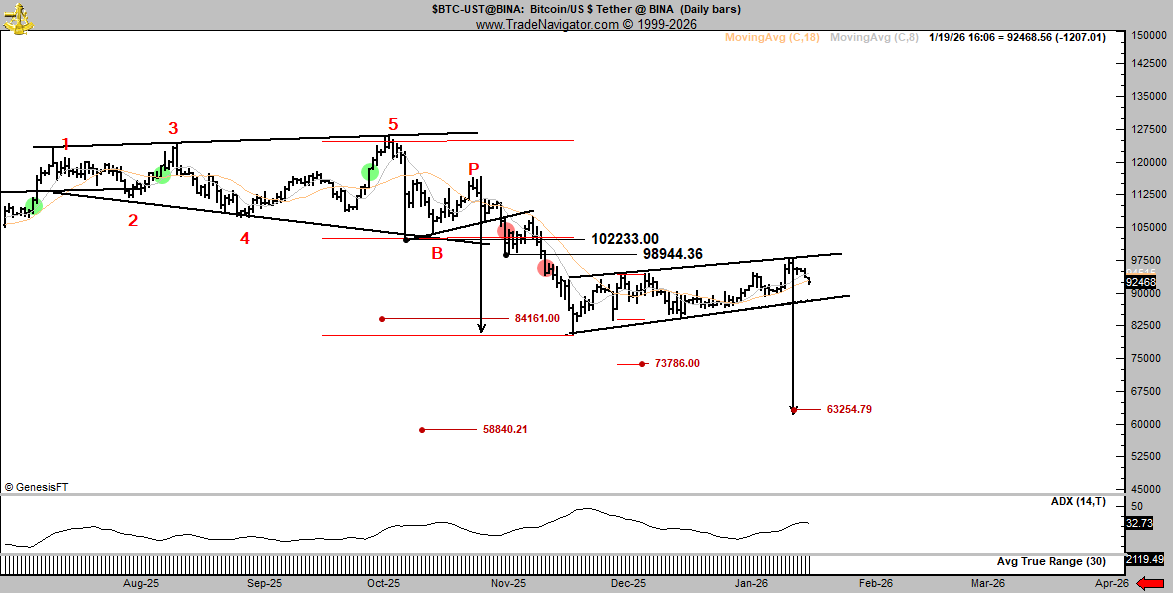

While AI reshapes infrastructure, Bitcoin remains caught in the crosscurrents. Bitcoin is stuck in a sideways trend. The asset is showing a classic range‑bound movement, falling below $88,000 after a false breakout of the $94,000-$96,000 zone.

Analysts are warning of a possible test of the $83,000-$85,000 levels.

A particularly alarming signal was the “death cross” of the 21‑week and 50‑week moving averages – a pattern that has historically preceded the formation of long‑term bottoms. This technical weakness reflects broader uncertainty driven by macro, regulatory, and technological shifts.

Veteran trader Peter Brandt predicts a decline below $60,000, while Bitcoin is also in a bearish trend against gold, having fallen 50.66% year‑over‑year. For a true bull market to resume, the cryptocurrency would need to reach $191,000, requiring a 116% increase from current levels.

BTC/USD 1‑day chart. Source: Peter Brandt via X

Institutional behavior, however, tells a more nuanced story. Institutional investors continue to accumulate assets: wallets with balances from 100 to 1,000 bitcoins accumulated 577,000 coins per year. Strategy has surpassed the mark of 700,000 bitcoins, controlling 3.37% of the total supply. In contrast, Bitcoin ETFs lost $1.72 billion over five trading days, signaling that retail investors are retreating amid “extreme fear.”

Political risk and shutdown fears

Macroeconomic and political uncertainty is adding another layer of risk. Predictive betting platforms provide an 80% probability of a US government shutdown following the January 31 funding deadline.

The crisis was sparked by killings involving federal agents in Minnesota, after Democrats refused to support a funding bill that included funding for the Department of Homeland Security.

The latest shutdown lasted a record 43 days and triggered sharp volatility across markets. During that period, Bitcoin fell sharply, with massive liquidations totaling $19 billion. One of the main negative factors was the SEC shutdown, which prevented the approval of new cryptocurrency ETFs.

Analysts at QCP Capital note that with gold at $5,000 per ounce and silver at $100, sentiment toward Bitcoin is “reminiscent of the bear market during the FTX crash.”

Regulatory shifts and geopolitical realignment

Regulatory dynamics are also evolving rapidly. In the year after Gary Gensler’s resignation, the SEC radically changed cryptocurrency regulation in the US. It closed dozens of cases against crypto companies, including Coinbase and Ripple. For the first time, the SEC and CFTC announced joint efforts on the harmonization of crypto surveillance.

Beyond the US, alternative crypto ecosystems are gaining momentum. The ruble‑denominated stablecoin A7A5 exceeded $100 billion in transactions per year, outpacing the growth of USDT and USDC despite international sanctions. Kazakhstan has supplied cryptocurrencies under the control of the central bank, giving the National Bank the right to compile a list of “permitted” cryptocurrencies.

Over the past week, markets have also reacted to renewed discussions around central bank digital currencies, increased scrutiny of cross‑border stablecoin flows, and additional guidance from regulators on AI use in financial services, further tightening the link between crypto, AI, and state policy.

Conclusion

The convergence of cryptocurrency and AI technologies is creating a new paradigm for the digital economy. Mining farms are transforming into universal computing centers, energy resources are becoming the main constraint on technological growth, and political instability in the United States is creating additional risks.

Bitcoin remains stuck in a wide range, testing the patience of both institutional and retail investors amid growing geopolitical challenges

Source:: Week in Crypto: AI Drains Bitcoin Mining, Energy Wars Escalate