Buying Bitcoin safely isn’t actually hard, but it does require a plan.

The thing about crypto is that, once it’s sent, it’s usually gone for good. There’s no “chargeback,” no “undo,” and no friendly bank rep who can reverse a bad transfer.

That’s why safety needs to come first, even before you worry about price. The good news is that most disasters are avoidable with a few boring, repeatable habits.

In this guide, I’ll explain how to buy Bitcoin safely in 2026 for beginners. You’ll learn how to:

- Choose a trusted place to buy Bitcoin

- Lock down your account before you deposit money

- Place your first buy without getting hit by hidden fees

- Store BTC safely after you purchase

I’ll also cover the scams that keep catching smart people on a tired day.

Let’s get into it!

Pick a trustworthy place to buy Bitcoin

For most beginners, the safest on-ramp is a large, well-known, regulated exchange. It’s not “perfect,” but it usually beats wiring money to an unknown site with a logo and a promise.

In 2026, some of the best crypto exchanges include Coinbase, Kraken, Gemini, and Binance. They are safe because they follow identity checks (KYC), operate under US rules, and have long security track records.

Kraken: Best crypto exchange for security & reliability

- Buy, sell, and trade 400+ cryptocurrencies with industry-leading security

- Spot, Futures & Margin trading – leverage up to 5x for advanced traders

- Earn rewards with staking on top cryptocurrencies

- 24/7 customer support and high liquidity for fast trades

- Regulated in the US with strong compliance and security measures

- 13+ million users worldwide

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other advice. Nothing on this page is a recommendation or solicitation. Always seek independent professional advice before making investment decisions. Some links may earn us a commission at no extra cost to you.

Recent reporting and security reviews often point out that these major platforms haven’t had headline-grabbing exchange hacks in the same way many smaller, offshore platforms have.

Unknown platforms are risky for a few reasons:

- They can disappear overnight

- Withdrawals can be “temporarily paused” forever

- Support can be a black hole when something goes wrong

- Fake apps and cloned websites target their users because it’s easy

A safe exchange choice also makes your life easier at tax time and reduces the odds you’ll accidentally break platform rules.

I should note that if you’re in the US, use Binance.US if you choose Binance at all. Don’t try to access the global platform through workarounds, it can lead to account restrictions.

What makes an exchange safer in 2026?

Look for clear signals that the platform is built for boring adults, not for gamblers.

Green flags to prioritize:

- Security history: A long track record matters. Big exchanges tend to publish security controls like cold storage practices (keeping most funds offline) and account protections like 2FA.

- Clear fees: If you can’t quickly understand how they make money, you’re the product. The best exchanges show fees before you confirm.

- Compliance and KYC: It’s annoying, but it’s a safety feature. Identity checks reduce fraud and can help with account recovery.

- Easy withdrawals to your own wallet: You should be able to move BTC out without confusing hoops.

- Real customer support: When things break, support is the difference between a stressful hour and a stressful month.

- Sane deposit and withdrawal limits: Limits can be frustrating, but they also reduce damage if your account gets compromised.

Quick checklist you can copy:

- Bookmark the official website URL, then only use that bookmark to log in

- Install the app only from the official app store, check the publisher name

- Read the exchange’s withdrawal rules before you deposit money

- Turn on address whitelisting if the exchange offers it (only approved withdrawal addresses work)

Common buying methods, ranked by safety

How you fund your purchase matters as much as where you buy. Some methods are safer, cheaper, and easier to trace if there’s a dispute.

Here’s a plain-language ranking for beginners:

| Funding method | Safety for beginners | Speed | Typical cost | What to watch for |

|---|---|---|---|---|

| ACH or bank transfer | High | Slower | Usually low | Settlement time, withdrawal holds |

| Debit card | High | Fast | Often higher | Extra fees and “spread” on instant buys |

| Credit card | Medium | Fast | Highest | Cash-advance fees, debt risk, blocks |

| P2P with strangers | Low | Varies | Varies | Scams, fake proofs, payment disputes |

For a first purchase, ACH/bank transfer is usually the safest and cheapest. Debit is fine when you value speed and accept higher fees. Credit cards are rarely worth it.

P2P can be private, but it’s not beginner-friendly because you’re dealing with people, not systems. Even when there’s escrow, social engineering is a real threat.

Lock down your account before you buy a single dollar of BTC

Most losses don’t happen because “Bitcoin got hacked.” They happen because someone got into a user’s email or exchange login, then drained the account. Phishing, SIM swaps, password reuse, and fake support chats cause more pain than the asset itself.

Before you add money, take 15 minutes to set up defenses that keep working in the background.

A good mental model: your exchange account is like a checking account that can send irreversible wires. You wouldn’t leave that account protected by one reused password, right?

Your must-do security setup: strong password, 2FA, and safer logins

Start with the basics, but do them properly.

Use a password manager and create a long, unique password for your exchange. Reused passwords are still one of the easiest ways people get wiped out. A manager also keeps you from typing passwords into sketchy look-alike sites because it won’t autofill on the wrong domain.

Turn on two-factor authentication (2FA). If the exchange supports it, avoid SMS codes. Text messages can be hijacked through SIM swaps or carrier tricks.

Better options are:

- Authenticators, such as Authy or Google Authenticator

- Hardware security key (like a YubiKey)

Add these extra layers if available:

- Login alerts (email or push notifications)

- Withdrawal confirmations

- Address whitelisting (approved withdrawal addresses only)

One underrated move: use a dedicated email for crypto, separate from your main inbox. It reduces the damage if your everyday email ends up in a data breach, and it makes phishing easier to spot.

Buy on a safe connection and keep your devices clean

Many scams don’t “break” security, they just wait for you to slip. Public Wi-Fi is a classic place to slip.

Keep it simple:

- Avoid public Wi-Fi when logging in or buying.

- Use home internet or your phone’s hotspot.

- If you travel often, a reputable VPN can help on untrusted networks.

Keep your device boring:

- Install updates for your phone and computer.

- Don’t install random browser extensions “for crypto,” many are spyware in a nice jacket.

- Be careful with search ads. Fake exchange ads can lead to cloned sites.

Here’s a rule that blocks a lot of thef.: If you didn’t type the URL yourself or use your bookmark, don’t log in. No exceptions when money is involved.

If you get a text saying “your account is locked,” don’t tap the link. Open the official app or your bookmarked site and check there.

How to buy Bitcoin safely, step-by-step guide

Most major US exchanges follow the same flow. Create an account, verify your identity, fund your account, buy BTC, then decide where to store it.

The danger is rushing, or clicking the first big “Buy Now” button without reading the fine print.

Slow is smooth. Smooth is safe.

Use this exchange-agnostic checklist, it matches how Coinbase, Kraken, Gemini, and Binance typically work:

- Create your account using your dedicated crypto email

- Complete identity verification (KYC). Use real info, take clear photos, don’t do it on public Wi-Fi

- Turn on security settings before funding: 2FA, login alerts, withdrawal confirmations

- Go to the Buy option. Most exchanges make it very clear with a “Buy Crypto” or “Purchase Crypto” or “Buy/Sell Crypto” button.

For example, if using the Coinbase app, click the “Buy & Sell” button

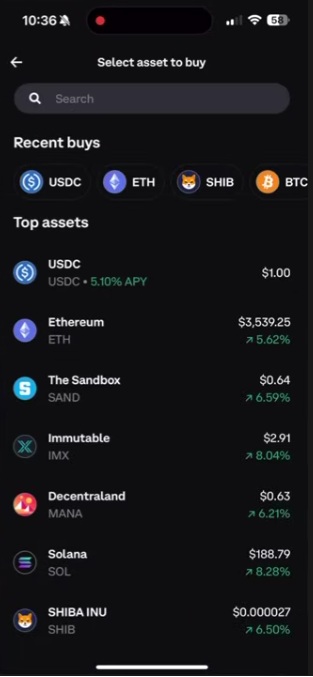

Then, simply select the crypto (e.g. Bitcoin) you want to buy.

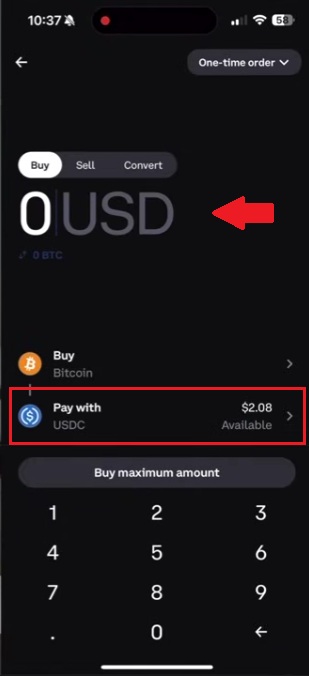

Choose the amount and method of payment.

Review the total before confirming. You should see the price, the fee, and the final amount of Bitcoin you’ll receive. Confirm, then save a record for yourself. A screenshot of the confirmation page is fine for tracking, but never screenshot or store seed phrases digitally.

How to avoid the fee traps that hit beginners

Fees aren’t always labeled “fees.” Sometimes they show up as a spread, which is the gap between the price you see and the price you actually get.

Here are some common beginner traps:

- Card purchases cost more: Debit card buys often include extra processing fees and a wider spread. You pay for speed.

- Instant buy screens can be pricey: The simplest buy button is convenient, but it can carry higher costs than the “advanced” or “pro” interface.

- Advanced screens are cheaper but easier to mess up: Limit orders and order books can save money, but one wrong setting can place a buy you didn’t mean to place.

- One rule that keeps things safe: If you don’t understand the order type, don’t use it yet. Start with a small market buy, then learn limit orders later when you’re not stressed.

Also watch for withdrawal fees and minimums. You want the option to move your BTC to your own wallet without jumping through hoops.

After you buy, protect your Bitcoin

Buying BTC is the easy part. The “after” is where people get hurt, usually through storage mistakes or scams that show up the moment you post “Just bought Bitcoin” online.

Two ideas can both be true:

- Keeping a small amount on a reputable exchange can be fine for convenience.

- Long-term holdings are safer in a wallet you control.

Where should you store Bitcoin: exchange, hot wallet, or hardware wallet?

Think of storage like where you keep cash.

- Exchange wallet: Like keeping money at a payment app. Convenient, but you don’t control the keys.

- Hot wallet (software wallet on phone or computer): You control the keys, but it’s connected to the internet.

- Hardware wallet (cold wallet): A small device that keeps your keys offline, which blocks almost all types of theft.

If you’re holding a larger amount (your personal definition of “a serious number”), a hardware wallet is often the safest option. Some of the best crypto hardware wallets in 2026 include Ledger Nano X, Trezor, and Cypherrock.

Golden rules for self-custody:

- Buy hardware wallets from authorized retailers.

- Do a small test send first, then send the rest once you confirm it arrived.

- Back up your seed phrase (the 12 to 24 recovery words) offline, on paper or a metal seed phrase backup. No photos, no cloud docs, no email drafts.

Your seed phrase is the master key. If someone gets it, they don’t need your phone, your face, or your password. They just take your Bitcoin.

Scams to watch for in 2026 (and the simple rules that stop most of them)

Scams keep getting more polished. AI deepfakes make fake “giveaways” look real. Pig butchering scams can feel like a real friendship until the money part starts. Then there are classics like phishing and fake support.

Watch for these patterns:

- Deepfake giveaway scams: A “famous person” promises free BTC if you send a little first. This is a scam 100% of the time.

- Pig butchering: A friendly stranger builds trust, then pushes a fake investment platform with fake profits and blocked withdrawals.

- Phishing and fake support: Emails, texts, and ads that lead to cloned login pages, or “support agents” who ask for codes.

- Address poisoning: A scammer sends a tiny amount from an address that looks like yours, hoping you copy it from history later.

- Fake airdrops: “Free tokens” or links that trick you into approving something that drains your wallet.

Red flags you can treat as automatic “no”:

- Anyone asking for your seed phrase

- “Guaranteed returns”

- Pressure to act now and quickly, especially with secrecy

If this happens, do this:

- Stop and don’t send anything else.

- Verify the URL using your bookmark (not a message link).

- Contact support only through the official app or official site.

- If you think your account is compromised, move funds to your own wallet (or at least remove bank links and lock withdrawals) after you regain control.

Slow decision-making is a superpower in crypto. Whenever you feel rushed to do something or make a decision quickly, step away.

The bottom line

Buying Bitcoin safely in 2026 comes down to a simple path you can repeat:

- Use a reputable exchange (Coinbase, Kraken, Gemini, or Binance are good examples)

- Secure your account with a strong password manager and non-SMS 2FA

- Fund with bank transfer or debit card when you can

- After you buy, move long-term BTC to a wallet you control, ideally a hardware wallet, and protect your seed phrase like it’s the only key to your safe (because it is)

Ignore anyone offering free crypto, urgent “support,” or guaranteed profits. Safety is mostly habits, not heroics.

Bitcoin can swing hard, so only invest what you can afford to lose. Before your next buy, write your own one-page safety checklist and follow it every time, even on busy days.

FAQ

How to buy crypto safely?

Use a trusted exchange, set up security before depositing (2FA, unique password, login alerts), avoid public Wi-Fi, verify URLs manually, check fees before confirming the order, and consider self-custody with a hardware wallet for larger amounts. Slow, checklist-based execution is the key.

How to buy Bitcoin for beginners?

The steps are:

- Pick a reputable exchange.

- Create an account and complete KYC.

- Add security (password manager, authenticator app, withdrawal confirmations).

- Fund with bank transfer or debit card.

- Buy a small test amount first.

- Decide where to store it (exchange wallet vs. hardware wallet).

Source:: How to Buy Bitcoin Safely? The Safest Ways to Invest in Crypto