Key highlights:

- After Gary Gensler’s resignation, the SEC dismissed multiple high-profile crypto cases and reversed years of enforcement policy.

- Republican leadership reshaped the agency, leaving no Democratic commissioners and raising concerns about political influence.

- Congress may soon overtake the SEC’s role as lawmakers push a comprehensive crypto framework into law.

The US Securities and Exchange Commission has dramatically altered its approach to cryptocurrency regulation following the departure of former Chair Gary Gensler.

In the span of roughly a year, the agency abandoned dozens of enforcement actions, reversed long-standing policy positions, and reshaped its leadership, marking one of the most abrupt regulatory pivots in recent financial history.

The changes have been widely welcomed by the crypto industry, but they have also raised concerns about regulatory consistency, political influence, and the long-term stability of oversight in digital asset markets.

From enforcement to retrenchment at the SEC

Gary Gensler resigned as SEC chair in January 2025 amid the inauguration of President Donald Trump. During his campaign, Trump had promised crypto industry leaders that he would remove Gensler “on day one,” criticizing the agency’s aggressive enforcement posture.

Under Gensler, the SEC pursued a strategy centered on lawsuits and investigations, arguing that most digital assets qualified as securities. That approach triggered strong backlash from the crypto sector, prompting companies such as Ripple Labs to support political action committees and back pro-crypto candidates during the 2024 election cycle.

Shortly after Gensler’s departure, Trump appointed SEC Commissioner Mark Uyeda as acting chair. The shift in leadership was followed by a rapid rollback of enforcement efforts and a restructuring of the commission that left only Republican members in senior roles.

Major crypto cases dropped

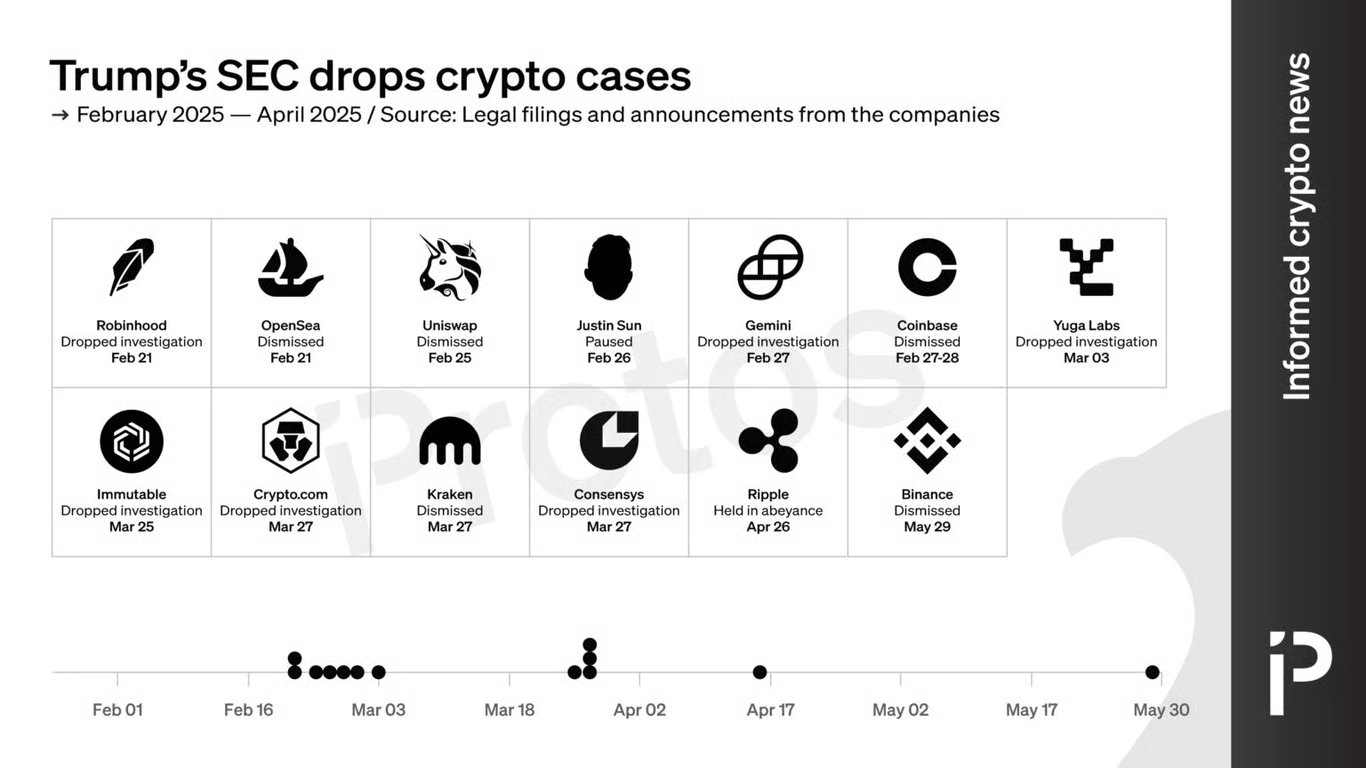

In February 2025, the SEC announced it was dropping its civil lawsuit against Coinbase, originally filed in 2023. The decision signaled a broader change in direction.

Investigations into Robinhood Crypto and Uniswap Labs were soon closed, and in March, Ripple CEO Brad Garlinghouse revealed that the SEC would withdraw its appeal in the long-running lawsuit filed against the company in 2020.

Source: Protos

Additional cases were dismissed in the following months. The trend continued after the Senate confirmed Paul Atkins – Trump’s nominee known for his market-friendly views, as SEC chair in April 2025.

The mass dismissals prompted questions from lawmakers, particularly Democrats, about whether political considerations and industry ties played a role in the agency’s retreat.

Politics, congress, and the future of crypto oversight

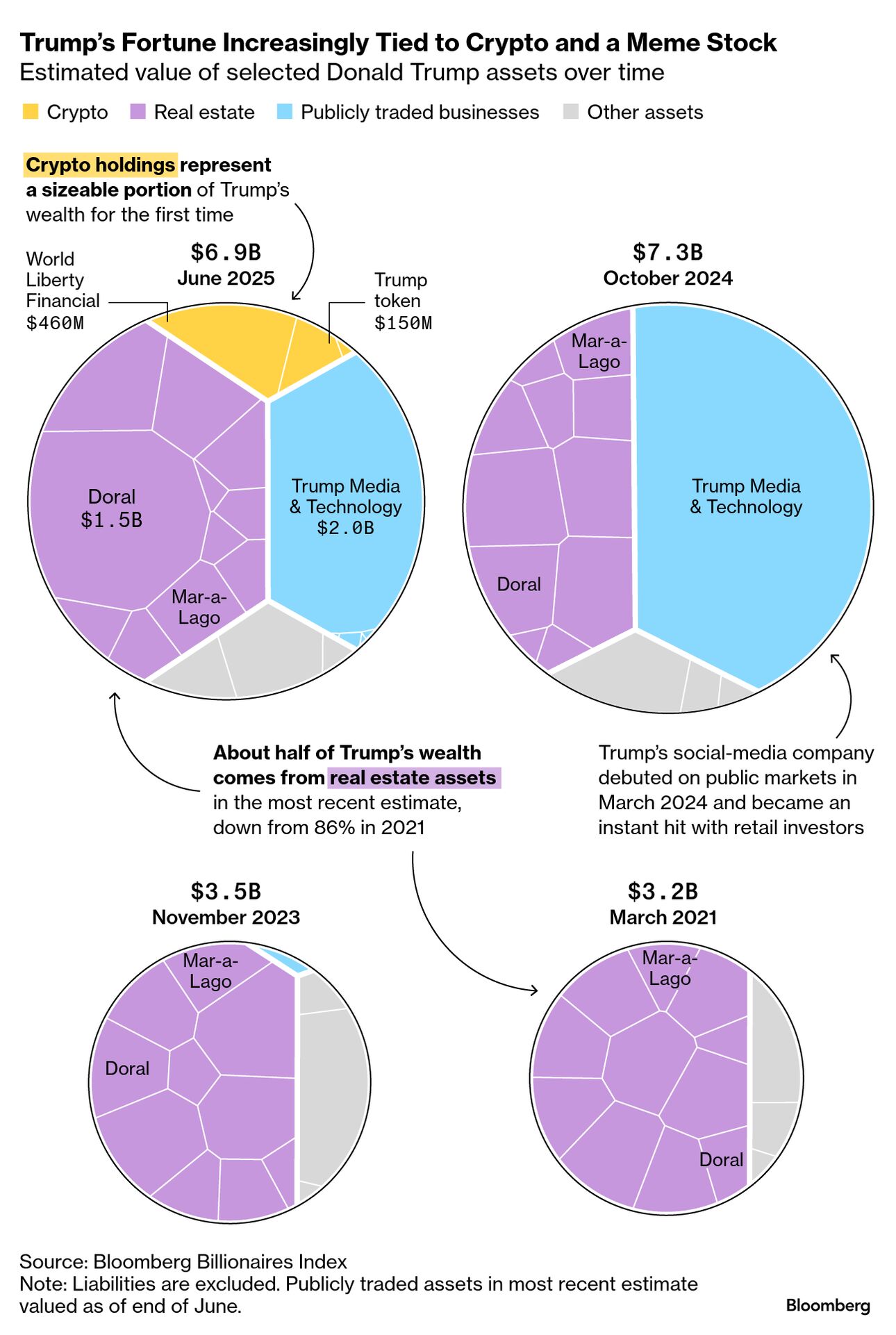

The regulatory shift has unfolded alongside growing political involvement in the crypto sector. President Trump and his family have been publicly associated with several crypto ventures, including World Liberty Financial, which launched a stablecoin while Congress debated new digital asset legislation.

Trump has also promoted his own memecoin, Official Trump, while his sons helped launch American Bitcoin, a crypto mining company.

Some analysts estimate that Trump-related crypto ventures may have generated more than $1 billion in revenue by mid-2025, though precise figures remain difficult to verify.

At the same time, the SEC has attempted to redefine its role through a series of crypto roundtables held throughout 2025. These discussions covered digital asset custody, decentralized finance, tokenization, and financial privacy. However, their relevance may be short-lived.

Congress is moving forward with the Digital Asset Market Clarity (CLARITY) Act, a sweeping bill designed to establish a clear regulatory framework for cryptocurrencies and divide oversight responsibilities among federal agencies. The House passed the bill in July, but Senate consideration has been delayed amid committee negotiations and shifting industry support.

Meanwhile, the SEC’s internal balance has changed fundamentally. Following the departures of Gensler and former Commissioner Jaime Lizarraga in January 2025, Caroline Crenshaw remained the only Democratic commissioner. She left the agency in January 2026, more than a year after her term expired, leaving the SEC without bipartisan representation.

After leaving office, Gensler returned to academia at the MIT Sloan School of Management. He continues to comment publicly on digital assets, frequently describing Bitcoin as a speculative instrument.

Whether the SEC’s new posture will bring lasting regulatory clarity, or simply reflect another politically driven swing, remains an open question. What is clear is that the era of aggressive crypto enforcement at the SEC has, at least for now, come to an end.