Ethereum is showing clear signs of a trend shift as price breaks out of a months-long downtrend while large on-chain staking activity reinforces the bullish case. With ETH reclaiming key technical levels and institutional flows accelerating, analysts are increasingly pointing to higher cycle targets, including a $6,400 level that aligns with long-term structure.

Ethereum breaks falling channel as momentum turns higher

Ethereum recently pushed above a long-standing falling channel that had capped price action since late 2025. The breakout marked a decisive change in structure, with ETH moving out of a pattern defined by lower highs and lower lows.

After clearing the upper boundary of the channel, Ethereum briefly pulled back before stabilizing above former resistance. This move is often interpreted as confirmation rather than rejection. Price is currently holding above the mid-range of the previous structure, suggesting buyers are defending higher levels.

Technicians note that the breakout also coincided with a completed falling wedge formation, a pattern that frequently precedes trend reversals when accompanied by expanding volume.

ETH downtrend channel breakout chart. Source: Crypto King

Bitmine stakes 86,400 ETH as on-chain signals strengthen

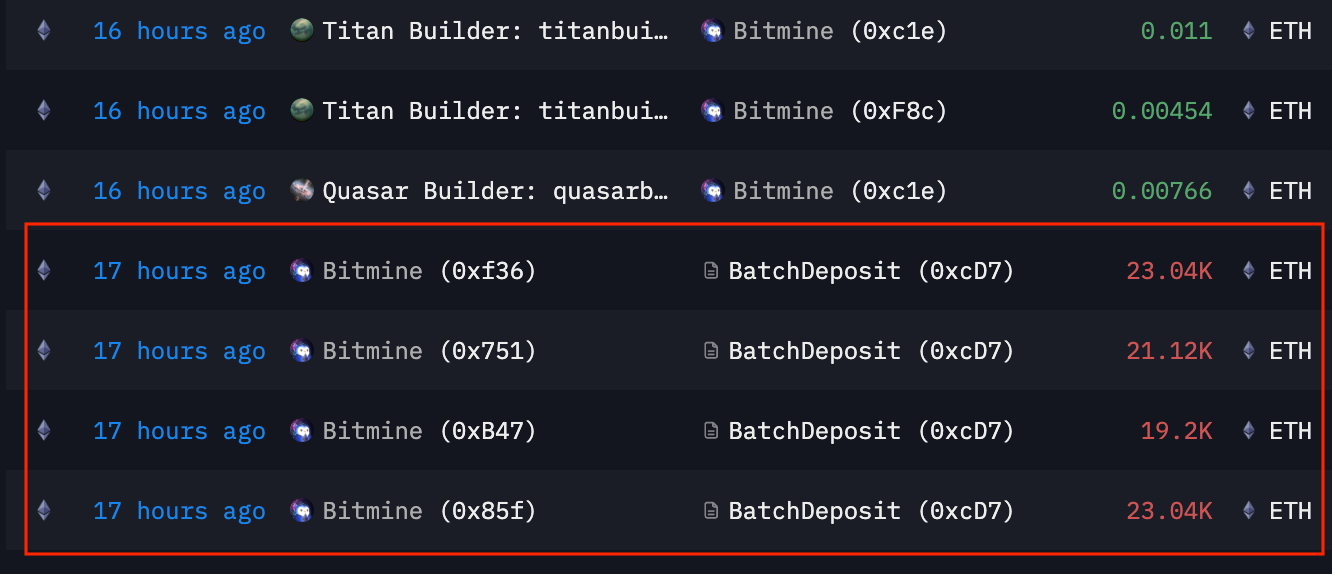

On-chain data added another bullish signal as Bitmine sent 86,400 ETH to Ethereum’s staking deposit contract in a series of large batch transactions. The transfers, totaling roughly $266 million, were flagged by analysts as a meaningful commitment to long-term positioning rather than short-term trading.

According to data shared on X, the deposits were routed through multiple labeled Bitmine addresses into a “BatchDeposit” contract, indicating a coordinated staking action rather than isolated transfers. Reports suggest Bitmine now holds more than 1 million ETH staked, with total holdings estimated at over 4 million ETH, representing a notable share of Ethereum’s circulating supply.

Large-scale staking activity often reduces liquid supply while signaling confidence in the network’s longer-term outlook. This dynamic can support price during trend transitions.

The 86,400 ETH staked by BitMine. Source: Arkham Intelligence

Weekly ETH structure points to higher cycle targets

While the daily breakout highlights near-term momentum, Ethereum’s weekly chart provides broader context for the current move. The long-term structure remains intact, with ETH continuing to respect a rising diagonal support line that has guided price since the 2022 lows.

Technical projections based on Elliott Wave structure and Fibonacci extensions place a conservative cycle target near $6,400, corresponding to the 1.0 extension level. Higher extensions around $9,000 and above are also visible on the chart, though analysts emphasize that even a move toward the lower extension would remain consistent with prior cycle behavior.

Importantly, ETH has reclaimed the 0.618 retracement level from the prior range, a zone that often acts as a pivot between corrective phases and renewed impulse moves.

Ethereum weekly cycle projection chart. Source: Freedom By 40/X

ETH price forecast for the next 6 months

CoinCodex’s ETH price prediction reinforces the technical picture, pointing to a steady expansion in Ethereum’s price range through the first half of 2026. For January 2026, the model projects an average price near $3,430, with upside potential toward the $3,760 area. As the year progresses, February and March forecasts place average prices above $4,000, with projected highs approaching the $5,600 zone as momentum builds.

By April 2026, peak projections extend toward the $5,900 level, while mid-2026 scenarios suggest consolidation may follow without breaking the broader bullish structure. These projections align closely with higher timeframe technical levels, where $4,400 and $6,400 stand out as key reference zones if upward momentum remains intact.

The bottom line

Ethereum’s recent price action reflects more than a short-term bounce. A confirmed downtrend break, sustained support above former resistance, and large-scale ETH staking flows all point to a market transitioning into a higher-probability bullish phase.

While volatility remains part of the process, the broader structure favors continuation rather than retracement as long as ETH holds above its reclaimed trendline. For traders and longer-term participants alike, Ethereum’s ability to build above this breakout zone may determine whether the $6,400 target becomes a realistic milestone in the current cycle.

Kraken: Best crypto exchange for security & reliability

- Buy, sell, and trade 400+ cryptocurrencies with industry-leading security

- Spot, Futures & Margin trading – leverage up to 5x for advanced traders

- Earn rewards with staking on top cryptocurrencies

- 24/7 customer support and high liquidity for fast trades

- Regulated in the US with strong compliance and security measures

- 13+ million users worldwide

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other advice. Nothing on this page is a recommendation or solicitation. Always seek independent professional advice before making investment decisions. Some links may earn us a commission at no extra cost to you.

Source:: Ethereum Price Prediction: $6,400 Target Emerges as ETH Breaks Key Downtrend