Key highlights:

- Long-term Bitcoin holders have stopped selling for the first time in six months, easing market pressure.

- Ethereum whales have increased their holdings, signaling growing confidence among large investors.

- Analysts say these shifts could mark an early change in market direction despite cautious sentiment.

Long-term Bitcoin holders have halted their selling activity for the first time in six months, while major Ethereum investors are actively increasing their positions. Despite lingering bearish sentiment across the crypto market, these developments suggest that a shift in investor behavior may be underway.

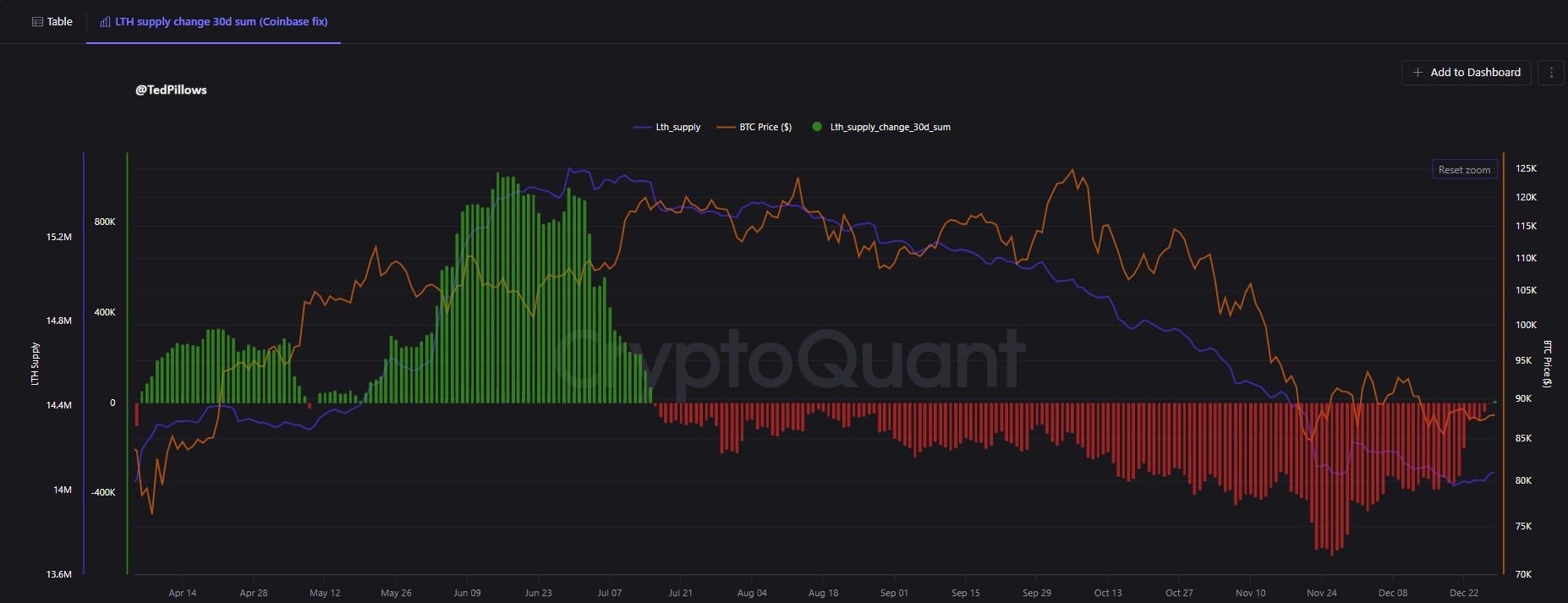

Market data shows that wallets holding Bitcoin for more than 155 days, commonly referred to as long-term holders, have significantly reduced selling pressure. This marks a notable change after months of steady distribution.

Crypto analyst Ted Pillows noted that long-term holders have stopped selling for the first time since July, adding that similar conditions in the past have often preceded short-term recoveries.

Source: Ted Pillows via X

Large holders, often referred to as whales, play a critical role in shaping market trends. When selling activity from this group slows, it can signal improving confidence and reduced downward pressure on prices.

Ethereum whales step in as accumulation accelerates

While Bitcoin selling has eased, Ethereum whales have moved in the opposite direction. According to data cited by analysts at the investment newsletter Milk Road, large holders added roughly 120,000 ETH in recent days.

Growing share of supply

Addresses holding more than 1,000 ETH now control nearly 70% of the total supply, a share that has steadily increased since late 2024. Analysts note that this level of accumulation often reflects long-term positioning rather than short-term speculation.

Since Dec 26, large Ethereum holders have added 120,000 ETH ($350M).

Addresses holding 1,000+ ETH now control roughly 70% of supply, a share that has been rising since late 2024.

If this behavior continues, the market may not fully be pricing in where the smart money expects… https://t.co/JBjtv1EbTD pic.twitter.com/iENEybMPSu

— Milk Road (@MilkRoad) December 29, 2025

The report suggested that if the trend continues, current market pricing may not yet reflect the direction experienced investors expect Ethereum to take.

The rise in Ethereum accumulation comes as interest in the asset strengthens alongside expectations for future network developments and improving on-chain activity. It’s also important to highlight that ETH staking inflows have surpassed withdrawals for the first time since June.

Shifting market dynamics and investor behavior

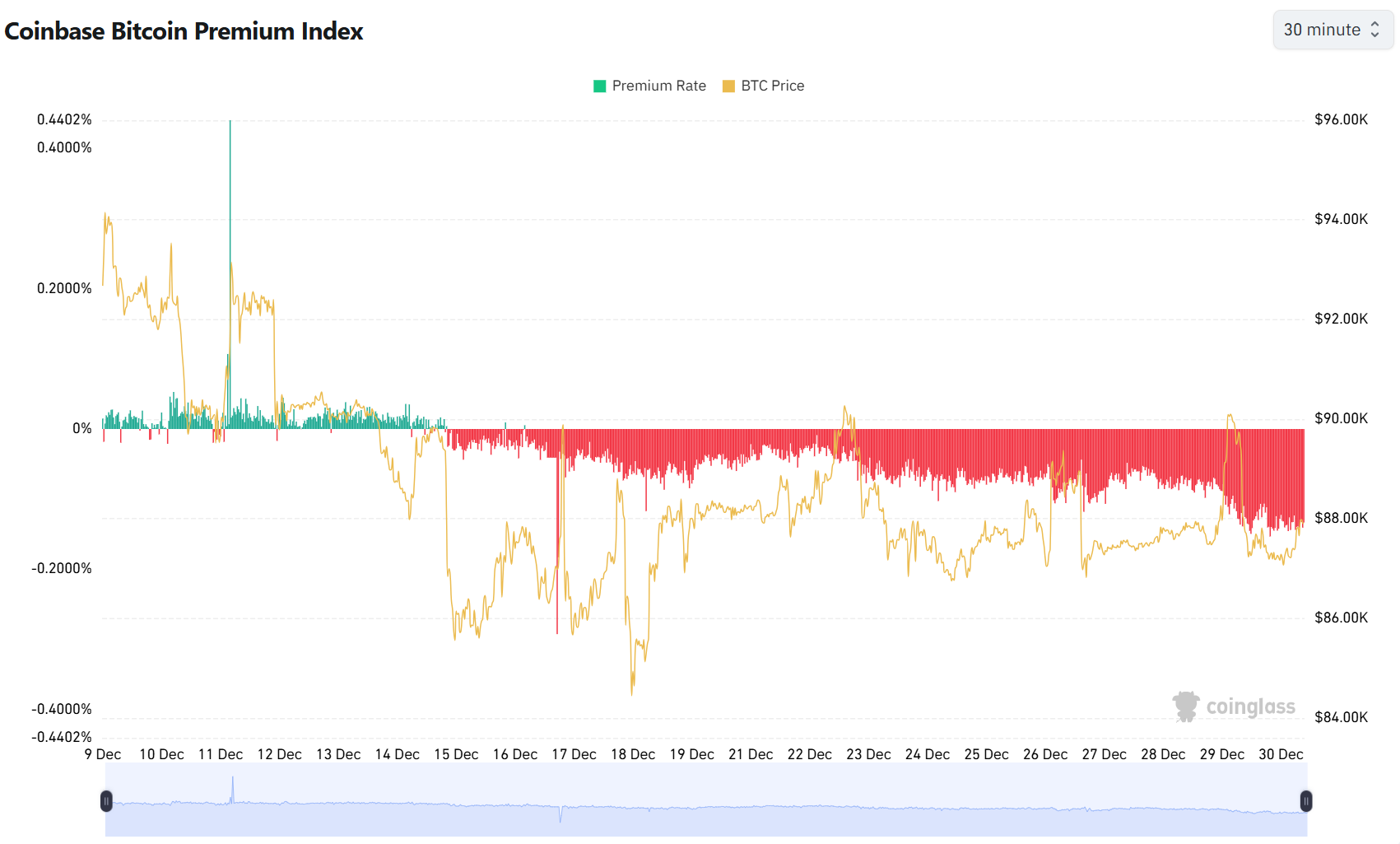

Some of the remaining selling pressure appears to be coming from U.S.-based traders. The Coinbase Bitcoin Premium Index, which measures the price difference between U.S. and global markets, remains in negative territory, which is a sign of cautious sentiment among American investors.

Source: Coinglass

At the same time, analysts say capital is beginning to rotate back into crypto from traditional markets. Former BitForex CEO Garrett Jin recently noted that flows are moving away from commodities such as silver and platinum and gradually returning to digital assets.

The combination of reduced Bitcoin selling, rising Ethereum accumulation, and shifting capital flows suggests the market may be entering a transitional phase. While uncertainty remains, the behavior of large holders often provides early signals of broader market direction.

Kraken: Best crypto exchange for security & reliability

- Buy, sell, and trade 400+ cryptocurrencies with industry-leading security

- Spot, Futures & Margin trading – leverage up to 5x for advanced traders

- Earn rewards with staking on top cryptocurrencies

- 24/7 customer support and high liquidity for fast trades

- Regulated in the US with strong compliance and security measures

- 13+ million users worldwide

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other advice. Nothing on this page is a recommendation or solicitation. Always seek independent professional advice before making investment decisions. Some links may earn us a commission at no extra cost to you.

Source:: Double Market Signal: The End of Bitcoin Selling and Growing Interest in Ethereum