Key highlights:

- Elon Musk forecasts double-digit US economic growth within 12 to 18 months, reigniting optimism across Bitcoin markets.

- Bitcoin investors are reassessing how rapid growth, interest rate cuts, and AI adoption could reshape crypto demand.

- Analysts warn that strong economic expansion may attract capital away from Bitcoin toward traditional assets.

Elon Musk has predicted that the United States could experience double-digit economic growth within the next 12 to 18 months, a forecast that has drawn renewed attention from Bitcoin investors searching for signs of the next cryptocurrency rally.

Double-digit growth is coming within 12 to 18 months.

If applied intelligence is proxy for economic growth, which it should be, triple-digit is possible in ~5 years.

— Elon Musk (@elonmusk) December 24, 2025

The Tesla founder shared his outlook on social media, stating that double-digit growth will happen within 12 to 18 months. He added that if artificial intelligence serves as a reliable proxy for economic expansion, “triple-digit is possible in ~5 years.”

The comments quickly circulated within the crypto community, where macroeconomic trends are closely watched for clues about Bitcoin’s next major move.

Why Musk’s growth forecast matters to Bitcoin

Bitcoin supporters have long tracked economic growth forecasts, central bank policy, and liquidity conditions to gauge future price direction. This year, particular focus has been placed on the Federal Reserve, as interest rate cuts have raised expectations that easier financial conditions could benefit risk assets.

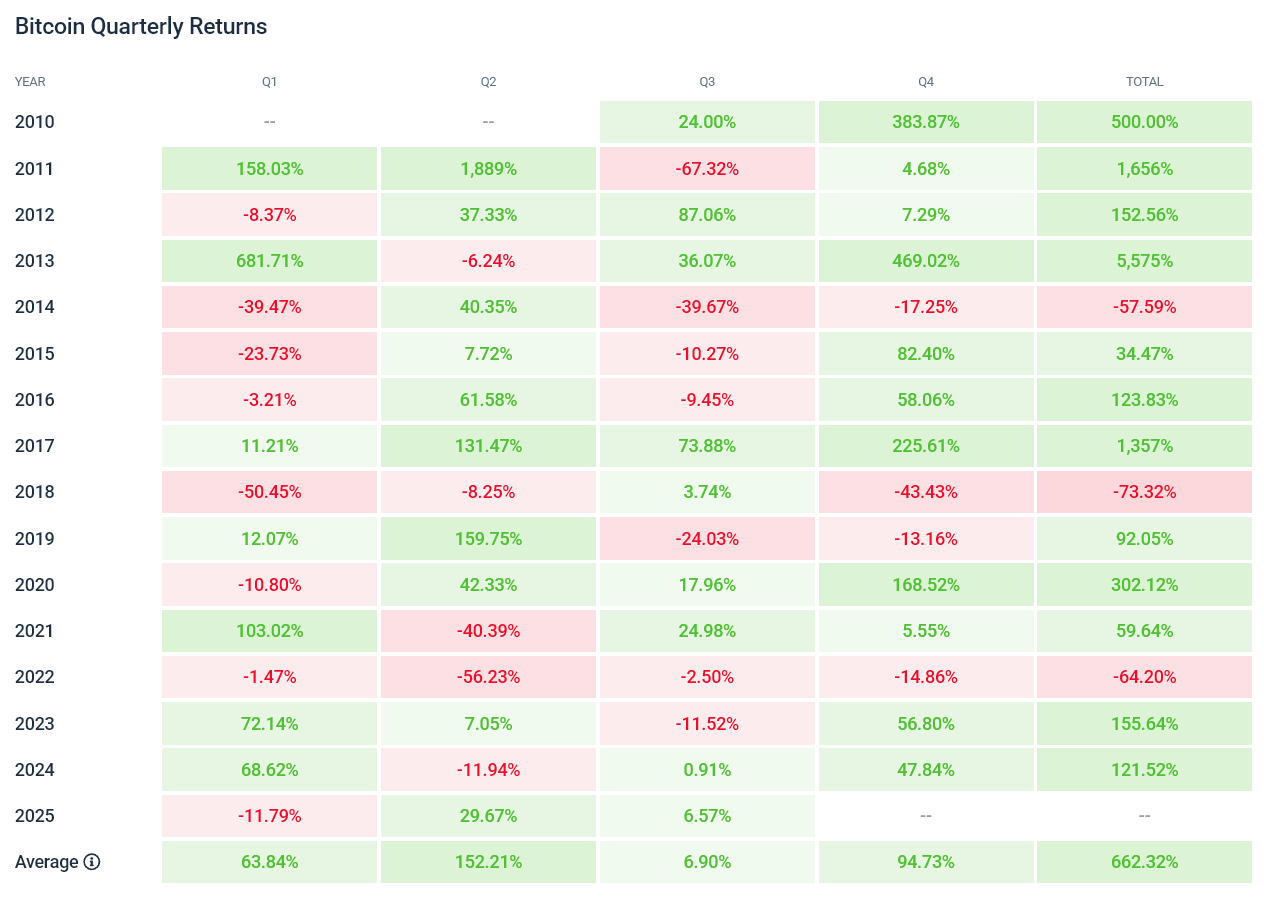

Bitcoin quarterly returns (%).

Musk’s comments added fuel to those expectations. Bitcoin entrepreneur Anthony Pompliano echoed the optimism, noting that the world’s wealthiest individual sees a path toward unusually strong GDP growth, especially if artificial intelligence reaches its full economic potential.

Wow.

The world’s richest man is predicting double-digit GDP growth within 18 months.

Says over 100% GDP growth is possible if AI fulfills its true potential. https://t.co/ig6BmTlBks

— Anthony Pompliano 🌪 (@APompliano) December 24, 2025

However, skepticism remains. Some market observers argue that Musk’s public predictions have not always proven accurate.

Could strong growth work against Bitcoin?

While rapid economic expansion may seem positive for speculative assets, historical data suggests a more complex relationship. Periods of strong growth have often coincided with tighter regulation and inflationary pressures, prompting central banks to intervene more aggressively.

Veteran trader Peter Brandt and Fidelity researcher Jurrien Timmer have also cautioned that Bitcoin may revisit the $60,000 range in 2026, reflecting a more measured long-term outlook.

Artificial intelligence itself adds another layer of uncertainty. While Musk views AI as a powerful engine for growth, some analysts believe it could compete with Bitcoin for investor attention as capital flows toward AI-focused companies and infrastructure.

As optimism builds and caution persists, Bitcoin investors are left weighing a critical question: will rapid economic growth amplify crypto demand, or will it shift enthusiasm elsewhere just as the market regains momentum?

Source:: Musk Predicts Double Digit US Economic Growth as Bitcoin Supporters Anticipate a Rally