Key highlights:

- Blockchain tokenization is allowing stocks, currencies, and assets to function like money in daily finance.

- Crypto platforms are enabling instant transfers and settlement that traditional finance cannot match.

- As tokenized assets grow, regulators and central banks may face new limits on monetary control.

The concept of money is undergoing a fundamental shift. Assets that once served purely as investments, from Tesla shares to tokenized commodities, are increasingly being treated as stores of value and mediums of exchange.

Mark Greenberg, head of consumer trading at Kraken, said in an interview with CNBC that the definition of money has expanded far beyond traditional fiat currencies.

Greenberg said the traditional definition of money has expanded beyond fiat and local currencies, noting that advances in blockchain tokenization now make it possible for almost any asset to function as money.

Investors can now hold value in Tesla shares, Bitcoin, or stablecoins pegged to major currencies. In Canada and other markets, it is increasingly common for individuals to store funds in U.S. dollars, euros, or euro-pegged stablecoins rather than their local currency.

Crypto platforms push beyond traditional finance

Kraken’s momentum illustrates how quickly this shift is taking shape. Its tokenized xStocks product, which is not available in the United States, has already attracted more than 80,000 wallets.

Another stacked week 🧱🧱

→ xStocks just crossed $10B+ in volume

→ Kraken Launch goes merit-based

→ Follow @KrakenInsto for institutional updates

→ Partnered with Crypto Insights Group

→ #Bitcoin supply is nearing 95% of its 21M cap.#KrakenIn60 @Pete_Rizzo_ pic.twitter.com/9isePof48p— Kraken (@krakenfx) November 14, 2025

Since launching in the second quarter of this year, trading volume has reached roughly $14 billion, a notable figure for a new financial product.

Kraken is not alone. Coinbase and Gemini have also expanded into tokenized assets, while actively promoting prediction markets as a way to bring new users into their ecosystems.

Greenberg points to speed and flexibility as tokenization’s main advantage over traditional finance. Moving assets between brokers in Canada can take weeks, or even months. By contrast, transferring crypto assets between platforms such as Coinbase and Kraken typically takes seconds.

Blockchain-based settlement also eliminates long-standing inefficiencies in securities markets, where core infrastructure has changed little in decades.

The growing battle for tokenized assets

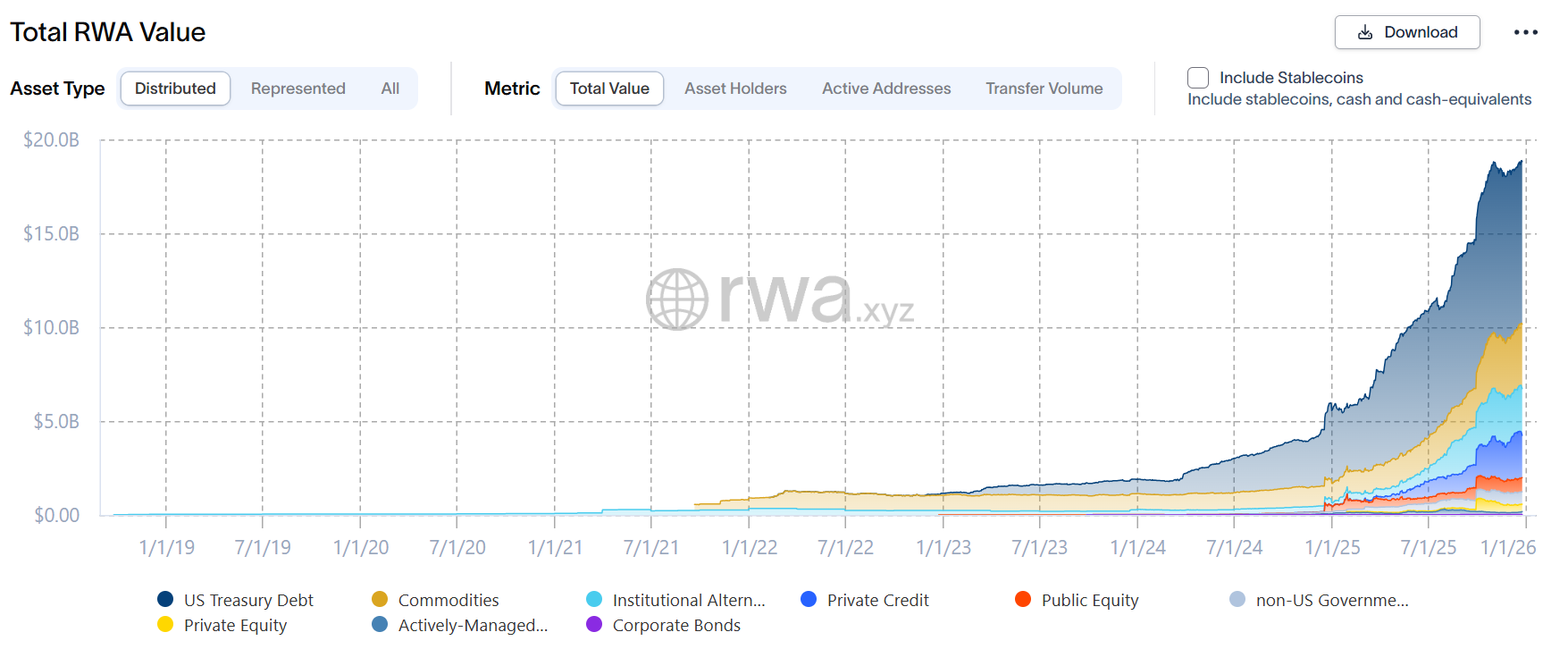

According to data from RWA.xyz, the total value of tokenized real-world assets on blockchains has reached nearly $415 billion. Boston Consulting Group projects that figure could grow to $16 trillion by 2030, while McKinsey & Company offers a more conservative estimate of $2 trillion.

Total RWA value. Source: RWA.xyz

Even the lower forecast points to a major structural shift in finance.

Robinhood has also entered the race, focusing on tokenization of private shares in companies such as OpenAI and SpaceX. Data from Dune Analytics shows Robinhood has tokenized 1,993 assets worth a combined $13.7 million.

Coinbase, meanwhile, is developing a real-world asset tokenization platform for institutional clients as part of its broader ambition to build an “app for everything” in finance.

As competition intensifies, each platform is trying to define its role in what is becoming a new tokenized asset economy.

Blockchain technology is no longer just changing how assets trade, but is also reshaping what people consider money. Instant transfers, programmable ownership, and global accessibility are challenging long-standing assumptions about value and currency. How quickly traditional finance adapts may determine whether this transformation remains niche or becomes the new financial norm.

Source:: Tokenization Is Changing The Way We Think About Money Says Kraken Executive