Key highlights:

- The International Monetary Fund confirmed that negotiations to sell El Salvador’s state-owned Chivo wallet are well advanced.

- Despite IMF conditions, President Nayib Bukele insists El Salvador will continue buying Bitcoin as part of its long-term strategy.

- The dispute highlights growing tension between international lenders and countries experimenting with cryptocurrency-based policies.

Negotiations between the International Monetary Fund and El Salvador have entered a decisive phase as both sides navigate the future of El Salvador’s Bitcoin policy and its state-owned digital wallet, Chivo.

The IMF confirmed that talks to sell Chivo are “well advanced,” signaling potential progress on a key condition tied to a major financing agreement. However, public statements from President Nayib Bukele suggest that El Salvador’s Bitcoin acquisition strategy remains firmly in place.

IMF negotiations and the Chivo wallet sale

The head of the IMF’s mission to El Salvador stated that discussions with the country’s authorities regarding the sale of the national Bitcoin wallet are ongoing.

Chivo has been a central part of El Salvador’s effort to integrate Bitcoin into its financial system since the cryptocurrency was granted legal tender status in 2021.

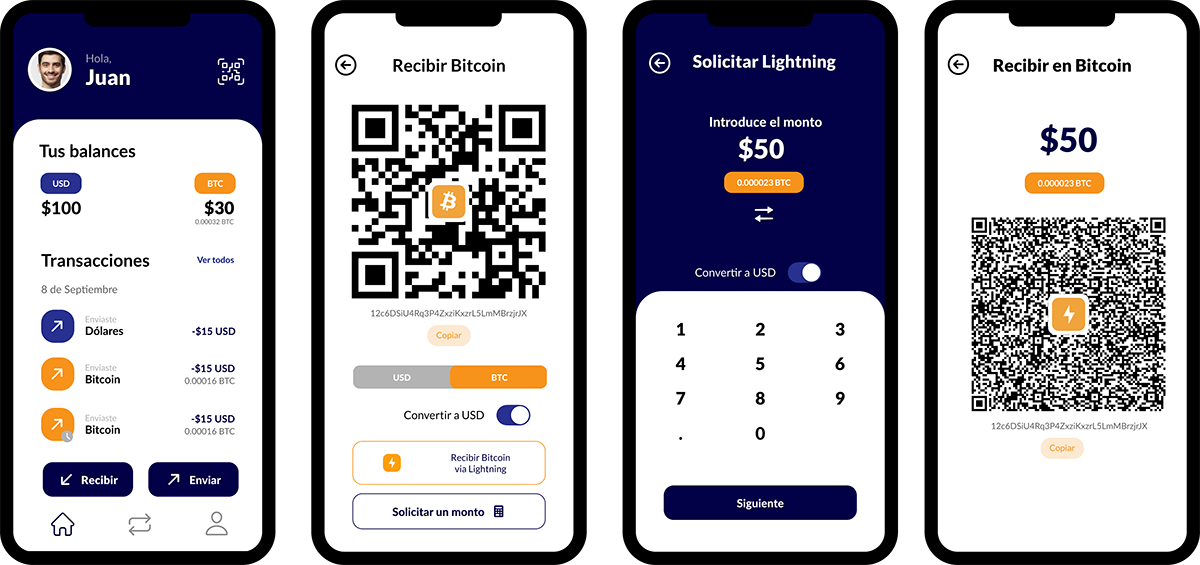

The Chivo Bitcoin wallet. Source: Chivo

Under a May agreement, the IMF committed $120 million as part of a broader $1.4 billion loan package. In return, El Salvador agreed to limit public sector involvement in Bitcoin-related activities, make Bitcoin use voluntary for the private sector, and exit direct participation in the Chivo wallet.

An IMF spokesperson declined to provide details on the potential sale but confirmed that negotiations remain active.

Bitcoin purchases and a growing compliance question

Although the IMF reported in July that El Salvador had not purchased Bitcoin since December 2024, official announcements from the country’s Bitcoin Office continue to suggest otherwise.

In November 2024, El Salvador disclosed the purchase of 1,090 Bitcoins, valued at approximately $100 million at the time.

Hooah! pic.twitter.com/KxMVbUrcGE

— Nayib Bukele (@nayibbukele) November 18, 2025

President Bukele has repeatedly stated that the government will continue acquiring at least one Bitcoin per day, regardless of external pressure. According to the Bitcoin Office, El Salvador currently holds 7,509 BTC, worth roughly $659 million at the time of publication.

This apparent disconnect between IMF reporting and domestic announcements has fueled uncertainty over whether El Salvador is complying with the spirit, or merely the letter, of its IMF agreement.

Why El Salvador’s Bitcoin model matters

El Salvador’s case is unprecedented. It is the first country to formally integrate Bitcoin into its national financial framework while maintaining a dollarized economy and negotiating IMF-backed financing.

The proposed sale of Chivo introduces a notable distinction: state-owned cryptocurrency infrastructure may be privatized, while Bitcoin reserves remain on the government’s balance sheet. This separation could offer a blueprint for other developing economies seeking exposure to digital assets without directly confronting international creditors.

Whether this model proves sustainable remains uncertain, but its outcome will likely influence how future governments approach cryptocurrency under global financial oversight.

Source:: El Salvador and the IMF Advance Talks to Privatize the Chivo Bitcoin Wallet