AI infrastructure is the new gold rush. Platforms that enable developers to build AI-native applications are emerging as some of the most sought-after assets in tech. Among them, Replit has captured outsized attention.

From hobbyist coders to global enterprises, millions of users are now building apps and automations in their browsers using Replit’s cloud-based tools. With a $3 billion valuation, booming usage, and bleeding-edge AI features, investors are lining up to ask:

“Can I buy Replit stock? And if not, how can I get in before it goes public?”

In this guide, I’ll walk you through everything you need to know about Replit stock:

- How to invest

- Where to find shares on secondary markets

- What to expect from a potential IPO

Let’s get started!

Key highlights:

- Replit is not publicly traded. There’s no stock ticker or IPO yet, and shares are only available privately.

- Private shares are accessible via secondary markets like Forge or Nasdaq Private Market, but only to accredited investors.

- The current stock price ranges from ~$93 to ~$130 per share in private transactions, with no guarantee of future liquidity.

- Retail investors can gain exposure indirectly through vehicles like the ARK Venture Fund or by investing in AI ecosystem players.

What is Replit and why are investors watching?

Replit is a browser-based software development environment. But that simple description doesn’t do it justice.

Over the past year, it has become an AI-powered coding platform that allows users to build, deploy, and host applications. It all happens in one place, with minimal setup or infrastructure.

Its latest releases go far beyond autocomplete. Replit’s Agent 3 is a fully autonomous coding assistant that can plan and build software features from scratch, fix bugs, and even deploy code to production. The result? You describe the idea, and Replit does most of the building.

Replit’s growth in numbers

Investors are responding to eye-popping growth metrics. Here’s a quick snapshot:

- Annual recurring revenue (ARR): Grew from $2.8M to $150M in just 12 months.

- User base: Over 40 million developers worldwide.

- Enterprise traction: Used by teams at Coinbase, Duolingo, and Zillow.

- Latest valuation: $3 billion, as of its $250M funding round in September 2025.

That level of traction makes Replit a part of the critical infrastructure layer for the future of software, especially as AI becomes central to application development.

With its focus on automation, software agents, and AI-native app development, Replit is often mentioned in the same breath as leading AI stocks, even though it’s not yet available on public markets.

Replit stock: Can you buy it?

Here’s the straight answer: Replit stock is not publicly traded. There’s no stock ticker. You can’t find it on Nasdaq, the NYSE, or any retail trading platform. As of November 2025, Replit remains a private company, and no IPO has been announced.

Quick answers to investor FAQs:

| Question | Answer |

|---|---|

| Can you buy Replit stock? | Not publicly, only privately if eligible. |

| What is the Replit stock ticker? | None. Replit doesn’t have a ticker. |

| Is there a Replit stock price? | Yes, in private markets (details soon). |

| Has Replit IPO’d yet? | No. There’s no public listing. |

So why is this important? Because the demand to invest is real. Retail and accredited investors are increasingly looking for early access to high-growth private companies. And Replit fits the mold perfectly.

But unless you’re in a very specific investor category, you’re locked out of traditional share purchases. Fortunately, there are other ways to get exposure. I’ll break them down in the next section.

How to buy Replit stock as a private investor

Even though Replit isn’t publicly traded, there are still ways to gain access to its stock. But you can do it only if you meet specific investor qualifications.

Replit shares are occasionally available on private secondary markets like:

- Nasdaq Private Market

- Forge Global

- EquityZen

- Hiive

- UpMarket

These platforms specialize in matching accredited investors with early employees or institutional holders looking to liquidate some of their equity. You’re not buying shares from Replit itself, you’re buying from someone who already owns them.

Step-by-step: Buying Replit shares privately

Here’s how the process usually works:

- Verify your accreditation. In the U.S., that means a net worth over $1 million (excluding your home), or an income of $200,000+ for the past two years. Most platforms require verification before showing you available deals.

- Create an account on a secondary platform. Each one has its own onboarding process, legal disclosures, and investment minimums (often $10K–$25K).

- Find a Replit share listing. Listings come from employees or early backers. These are often limited and may not be continuously available.

- Negotiate price and quantity. Unlike public markets, pricing isn’t standardized. You’ll likely see a share quote and can choose to bid or accept.

- Complete the transaction. Once matched, you’ll need to sign legal documents, go through Replit’s right-of-first-refusal (ROFR) process, and wait for the deal to close.

Key considerations

- Not everyone qualifies: You must be accredited or institutional.

- Limited availability: Shares only appear when insiders choose to sell.

- Transaction times vary: Transfers can take weeks due to legal approvals and company policies.

If you don’t meet these criteria (or prefer a lower-risk approach), don’t worry. In the next section, I’ll cover what private investors are currently paying for Replit shares, and later, how non-accredited investors can still get exposure.

What is the Replit stock price?

Because Replit isn’t publicly listed, there’s no official stock price like you’d find for Apple or Google. However, private market platforms provide estimates based on recent secondary trades and funding rounds.

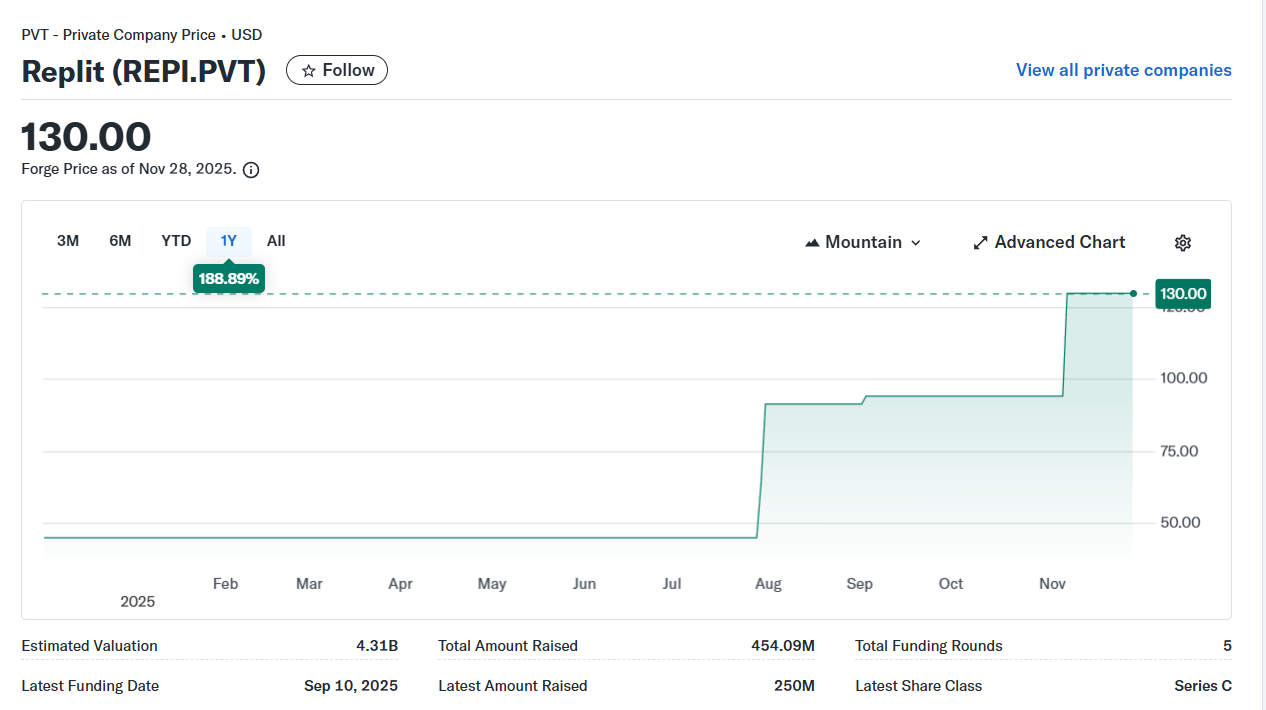

As of late 2025, these are the key benchmarks:

| Source | Estimated Price per Share | Notes |

|---|---|---|

| Nasdaq Private Market (Tape D) | ~$92.98 | Based on recent private trades in Q3–Q4 2025 |

| Forge Global (Premier Offering) | ~$130.00 | Based on “Forge Price” as of November 27, 2025 |

| Series C Preferred Round | $91.51 | Official price from Replit’s September 2025 funding round |

Why the price varies

Private shares aren’t traded on open markets, so pricing is determined by supply, demand, and negotiation. Sellers often apply premiums to reflect the company’s growth, limited liquidity, and potential IPO value.

Also, keep in mind:

- Share types may differ (common vs. preferred)

- Prices can fluctuate sharply with new funding or secondary activity

- No guarantee of future appreciation. Private shares are high risk

In other words, Replit stock price isn’t fixed, and it may not reflect public market values until an IPO or acquisition occurs.

Can you invest in Replit without buying stock?

If you’re not an accredited investor, there are still ways to get exposure to Replit’s growth. While you can’t buy Replit stock directly on public exchanges, some investment vehicles hold shares in Replit privately, which can give you indirect access.

Option 1: Venture capital-backed funds

The most notable example is the ARK Venture Fund (ARKVX), which provides retail investors exposure to private tech companies. This includes Replit.

As of August 2025, Replit made up about 3.7% of the fund’s holdings, according to ARK’s own disclosures.

What makes this powerful is that:

- ARKVX is publicly available to retail investors in the U.S.

- It includes exposure to other high-growth private firms alongside Replit.

- It can be purchased via platforms like Schwab, Fidelity, or Robinhood (check local availability).

I want to make it clear: Indirect exposure means you’re buying into a basket of companies. You won’t control how much is allocated to Replit specifically, and you won’t benefit from individual shareholder rights or information access.

Option 2: Invest in Replit’s strategic backers

Several well-known firms have invested in Replit during its growth rounds. These include:

- Andreessen Horowitz

- Y Combinator

- Khosla Ventures

- Coatue Management

- NVIDIA

- Google Ventures

While these firms themselves aren’t public, some of their portfolio companies or partner funds may offer limited exposure. It’s not a direct play, but it can be part of a broader AI-aligned investment strategy.

Option 3: Bet on the ecosystem

Replit is deeply tied to the growth of AI developer tools. If you want to play the broader theme, consider publicly traded companies building infrastructure or competing tools:

- Microsoft (MSFT): GitHub Copilot serves 150M developers and competes directly with Replit AI.

- Alphabet (GOOGL): Investing heavily in AI dev platforms and infrastructure.

- Amazon (AMZN): Offers CodeWhisperer and cloud tools aimed at dev teams.

These companies offer alternative exposure to the AI coding revolution Replit is helping lead.

Replit IPO: what we know (and don’t)

This is the big one for investors hoping to see a public listing: When will Replit IPO happen?

As of November 2025, Replit has not filed for an IPO, and no formal plans have been announced. That means there is:

- No S-1 filing with the SEC

- No target date or price range

- No underwriter news or listing venue disclosed

Why Replit might delay going public

Despite its massive growth, Replit may choose to stay private longer for several reasons:

- Plenty of capital: With $250 million raised in its most recent round, it doesn’t need to rush into the public markets for funding.

- Strategic control: Remaining private allows the team to focus on product development without quarterly earnings pressure.

- Market timing: Tech IPOs have seen mixed outcomes in 2025, with many firms waiting for more favorable conditions.

What investors should watch

Keep an eye on:

- Hiring for public-readiness roles (CFOs, compliance leads)

- Increased media coverage or PR visibility

- S-1 rumors or filings with the SEC (search EDGAR)

Until then, any speculation about a Replit IPO is just speculation. If you’re buying private shares today, understand that your exit could be years away, and depends entirely on what the company decides to do next.

Risks of investing in pre-IPO stocks

Investing in a high-growth private company like Replit can be exciting. But it’s not without risk.

Unlike public market trades, where liquidity, pricing, and disclosures are regulated and standardized, private equity carries unique challenges that investors must understand before committing capital.

Key risks to keep in mind

- Illiquidity: Once you purchase Replit stock through a secondary platform, you likely won’t be able to resell it easily. There’s no public market for the shares, and liquidity depends entirely on private interest, or a future IPO.

- Transfer restrictions: Most private companies, including Replit, enforce transfer rules. For example, they may require board approval, enforce right-of-first-refusal (ROFR) policies, or restrict share sales entirely before certain events (like a public listing).

- No voting or info rights: If you purchase shares through a secondary marketplace, you’re typically not getting a board seat or detailed company financials. You’re a passive investor, and your control is minimal.

- No guaranteed exit: There’s no timeline for when (or if) Replit will go public or get acquired. Your investment could remain locked up for years.

- Valuation volatility: Just because Replit was valued at $3 billion in its last round doesn’t mean that valuation will hold. Down rounds happen, and private share prices can be affected by shifts in market sentiment or business performance.

Real talk: it’s not for everyone

If you’re not comfortable with holding illiquid assets for 3–7 years, or if you need access to your capital in the short term, investing in private companies like Replit may not align with your goals.

That said, if you’re looking for early-stage exposure to companies driving the AI revolution, and you meet the criteria, it can be a compelling play.

Final thoughts: should you invest in Replit?

Replit sits at the intersection of three explosive trends:

- AI

- Developer tooling

- Cloud-native app creation

Its product-led growth, high-profile users, and massive funding round in 2025 have made it one of the most-watched private tech companies on the market.

But it’s not publicly traded, and that changes the game. Here’s a quick recap to help guide your decision:

Replit stock: the big picture

| Factor | Current Status |

|---|---|

| Publicly traded? | No; private company |

| Stock ticker? | None available |

| Replit stock price? | Available in secondary markets (e.g. $92–$130) |

| Who can invest directly? | Accredited or institutional investors only |

| Indirect access for retail? | Yes, through ARK Venture Fund (ARKVX) |

| Replit IPO timeline? | No public plans announced as of Nov 2025 |

Who should consider investing?

- Accredited investors who understand the risk/reward profile of pre-IPO shares

- Tech-forward investors looking for AI-native exposure

- Retail investors willing to play the long game via indirect fund access

And finally, Replit is still in hypergrowth mode. Whether or not you invest now, keeping it on your radar is smart. Because when (or if) it hits the public markets, it could be one of the most talked-about IPOs in the developer and AI space.

Source:: How to Invest in Replit Stock? Get Exposure to the AI-Powered App Platform