Key highlights:

- BitMine adds $44M in Ethereum while the market remains under pressure

- The company now holds over 3.6M ETH and wants to reach 5% of supply (about $18.5 billion at current rates)

- Bold price predictions fuel BitMine’s aggressive accumulation strategy

BitMine Immersion Technologies (BMNR) expanded its already massive Ethereum reserves by purchasing 14,618 ETH, worth $44.34 million, on Thursday. The transaction was completed through the company’s BitGo wallet address “0xbd0…E75B8” at approximately 5:07 PM local time, according to Lookonchain’s analysis of Arkham Intelligence data.

Tom Lee(@fundstrat)’s #Bitmine just bought another

14,618 $ETH($44.34M) 4 hours ago.https://t.co/P684j5Yil8 pic.twitter.com/LHOpDto1R5— Lookonchain (@lookonchain) November 28, 2025

Although BitMine has not officially confirmed the transaction, the data suggests this is the company’s second major Ethereum acquisition in just days. Earlier this week, BitMine announced that it had purchased $200 million worth of ETH, signaling an aggressive accumulation strategy.

BitMine aims for 5% of all Ethereum

BitMine now holds an extraordinary reserve of 3,629,701 ETH, valued at nearly $10.9 billion. This accounts for roughly 3% of Ethereum’s total circulating supply, placing the company among the largest corporate ETH holders in the world.

Management has repeatedly stated its ambition to increase that share to 5%, a target that would require several more large-scale purchases.

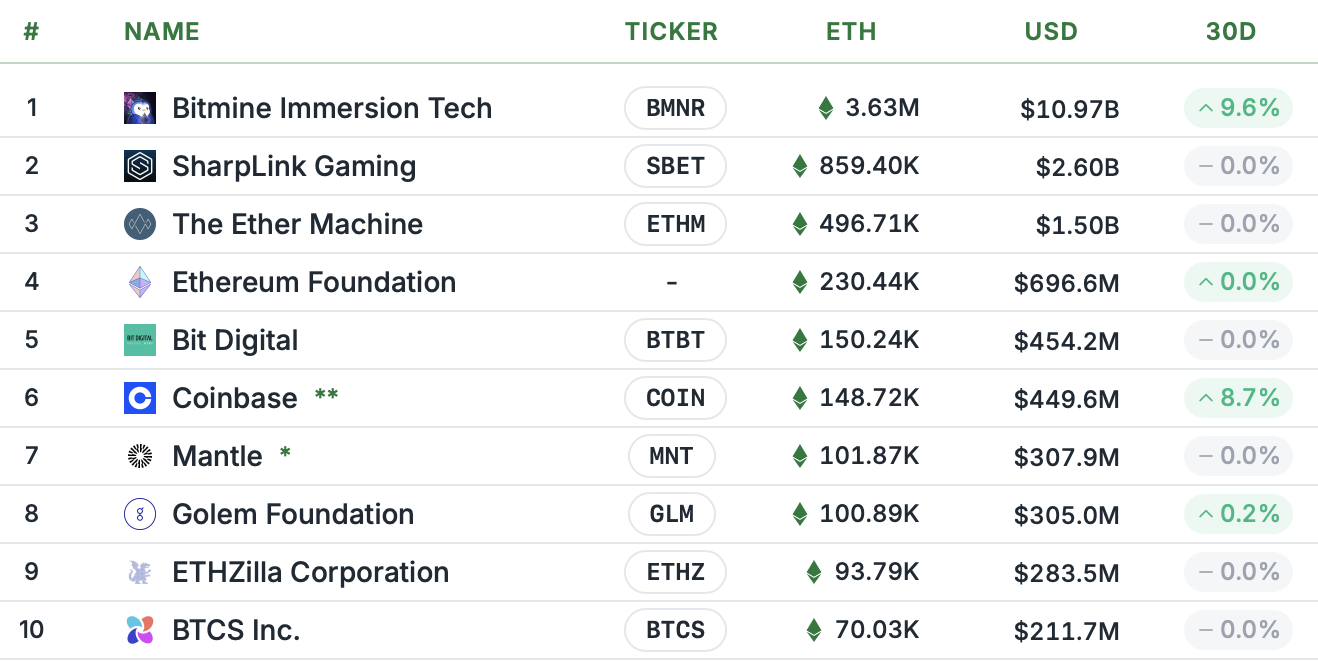

Top 10 Corporate Ethereum Holders. Source: Strategic ETH Reserve

Tom Lee, chairman of BitMine, has been one of Ethereum’s strongest corporate advocates. He describes Ethereum as a “truly neutral network” and believes it will become the preferred blockchain for Wall Street institutions and even U.S. government initiatives.

BitMine has positioned itself as a champion of Ethereum’s long-term role in global financial infrastructure.

Bold predictions push BitMine to keep accumulating

The latest purchase comes even as the broader crypto market declines. Bitcoin, Ethereum, and major altcoins have all faced sustained pressure, yet BitMine appears undeterred (similar to Michael Saylor’s Strategy, another crypto treasury company that recently bought over $800M worth of BTC).

In a recent podcast interview, Lee predicted that Ethereum would bottom near $2,500 before surging to $7,000–$9,000 by January 2026. He also expects the Federal Reserve to ease policy by year-end, providing much-needed relief for risk assets.

Lee believes this environment could help Bitcoin push beyond $100,000, potentially setting a new all-time high.

Despite the current correction, BitMine continues to aggressively increase its Ethereum position, reflecting its conviction in ETH’s long-term value and its future importance within global finance.

Source:: BitMine Adds $44M in Ethereum as It Races Toward $18.5B Supply Target