Key highlights:

- Bitcoin buying from whales hits 2025 highs as BTC price falls under pressure

- Major investors quietly accumulate during market fear

- New on-chain data hints at a potential shift in Bitcoin market momentum

Disclaimer: Always seek independent professional advice before making investment decisions. Some links may earn us a commission at no extra cost to you.

Bitcoin whale activity has reached its highest level of 2025, coinciding with the cryptocurrency’s drop below $90,000. The sharp price pullback has attracted major investors who appear to be accumulating Bitcoin at discounted levels.

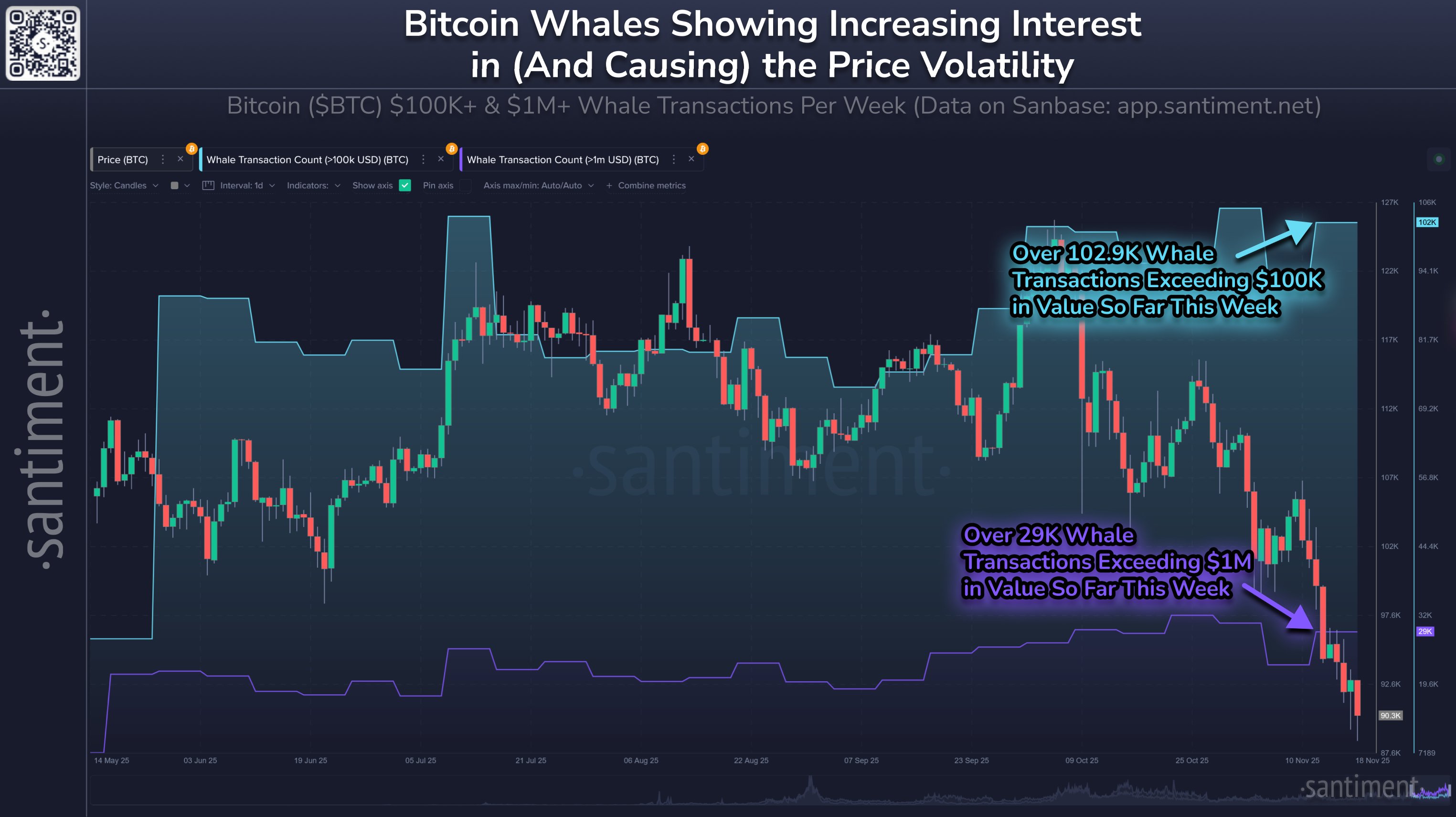

According to Santiment, more than 102,000 whale transactions worth over $100,000 were recorded this week, along with 29,000 transactions exceeding $1 million. Analysts note that this spike in on-chain activity strongly correlates with the overall market decline.

Source: Santiment via X

Whale behavior shifts from selling to accumulation

“This week has a good chance of being the most active whale week of 2025,” Santiment reported, highlighting a shift from earlier selling pressure to renewed accumulation.

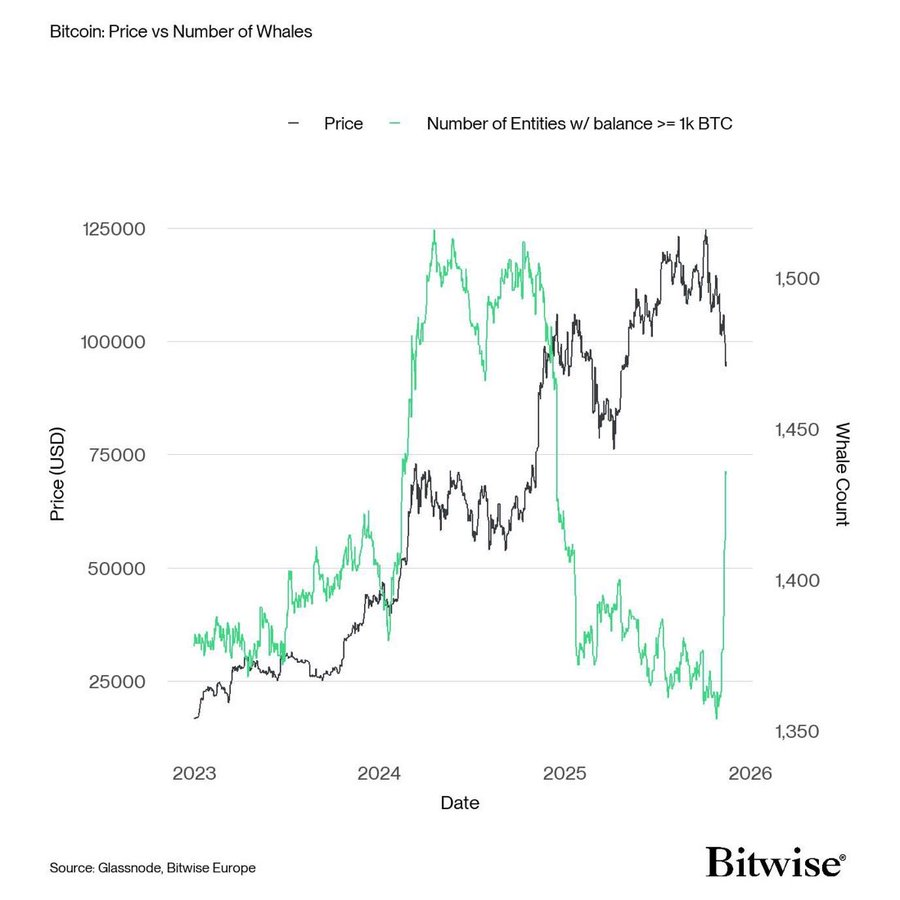

Some market observers initially suggested that large-holder selling triggered the correction. However, Glassnode data shows the opposite: major investors have been steadily increasing their Bitcoin holdings since late October. The most notable rise appeared on November 14, when the number of wallets holding over 1,000 BTC surged.

Pav Hundal, lead analyst at Swyftx, noted that the platform’s buy-to-sell ratio has jumped to 10:1, compared with the usual 3:1. “The market is irrational right now. We’ve seen a major squeeze on short-term holders. This feels like a necessary cleanup and reset,” he said.

Large investors keep buying despite market fear

Bradley Duke, managing director at Bitwise in Europe, echoed similar observations. He noted that while panic spread among retail traders, the number of Bitcoin whales rose sharply.

“Large holders are keeping a level head and buying at discount prices from panic sellers ,” he said.

Dynamics of the number of Bitcoin whales. Source: Bradley Duke via X

This pattern highlights a recurring trend in crypto markets: when prices fall sharply, experienced investors often accumulate rather than retreat, positioning themselves ahead of potential rebounds. For example, Michael Saylor’s Strategy (MSTR) recently announced a $835 million Bitcoin purchase while market sentiment was at very low levels.

Kraken: Best crypto exchange for security & reliability

- Buy, sell, and trade 400+ cryptocurrencies with industry-leading security

- Spot, Futures & Margin trading – leverage up to 5x for advanced traders

- Earn rewards with staking on top cryptocurrencies

- 24/7 customer support and high liquidity for fast trades

- Regulated in the US with strong compliance and security measures

- 13+ million users worldwide

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other advice. Nothing on this page is a recommendation or solicitation. Always seek independent professional advice before making investment decisions. Some links may earn us a commission at no extra cost to you.

Source:: Bitcoin Whales Step In During the Market Drop to Buy at Discount Prices from "Panic Sellers"