Key highlights:

- The ZEC chart structure mirrors its previous cycle setup, with a liquidity sweep, a reclaim of support, and tightening volatility all signaling early trend strength.

- Momentum indicators and on-chain data finally turn upward, hinting at accumulation beneath the surface after months of selling pressure.

- A mid-range reclaim is the key confirmation, as breaking that zone could open the door to the same rally ZEC posted in its last cycle.

Disclaimer: Always seek independent professional advice before making investment decisions. Some links may earn us a commission at no extra cost to you.

Zcash is showing real strength again, and it’s happening at a moment when almost nobody expected it.

Traders are paying attention not just because privacy coins are getting more interest lately, but because the ZEC chart is starting to look similar to the setup that came right before its last major cycle rally.

The similarities are strong enough that analyst Crypto Zach even said, “History is about to repeat itself with $ZEC,” and honestly, the charts give that idea more weight than usual.

When you line up ZEC’s past cycle bottom with the price action happening now, the resemblance jumps out immediately. The sweep of liquidity, the reclaim of support, the early momentum shifts, even the on-chain behavior, it’s all lining up again.

So naturally, the big question becomes whether the ZEC price is gearing up for a new expansion phase, or whether this is another one of those early teasers that fade before the move actually begins.

ZEC’s current structure looks a lot like its last cycle bottom

Zoom out and it’s pretty hard to miss. Zach’s chart makes it clear, before Zcash kicked off its last big cycle rally, it moved sideways for months, built a rounded base, and slowly squeezed volatility down to almost zero.

It was one of those setups that looked boring until the breakout came, and then the whole trend flipped almost instantly. Right now, Zcash is doing something incredibly similar. The ZEC price dipped below its support around $441.76, swept liquidity, and then bounced sharply back toward $672.79.

That sweep-and-reclaim pattern is the kind of structure that often shows up at early macro reversals. Weak hands exit, stronger buyers accumulate, and the chart quietly shifts before anyone notices.

History about to repeat itself with $ZEC pic.twitter.com/YS5baOPcuZ

— Zach (@CryptoZachLA) November 20, 2025

You can also see the same early higher-lows forming again. It’s not an explosive reversal, but the structure mirrors what happened before ZEC’s last major run, a phase where foundation building was happening beneath the surface long before the breakout showed up.

On-chain data shows Zcash indicators starting to turn up again

Momentum readings are confirming that internal strength is returning. The RSI, which had dipped toward oversold levels, has now curled upward to 65.51, forming a clean bullish divergence, the price made lower lows, but RSI made higher lows.

That divergence is one of the most reliable early reversal signals, especially when paired with ZEC’s rising volume. The MACD histogram is moving upward too, showing that bearish momentum is fading.

The shift isn’t explosive yet, but it’s the same type of gradual turn that marked earlier ZEC cycle bottoms. Volume and market participation are already improving, which is exactly how prior rallies began, quiet accumulation first, breakout volume later.

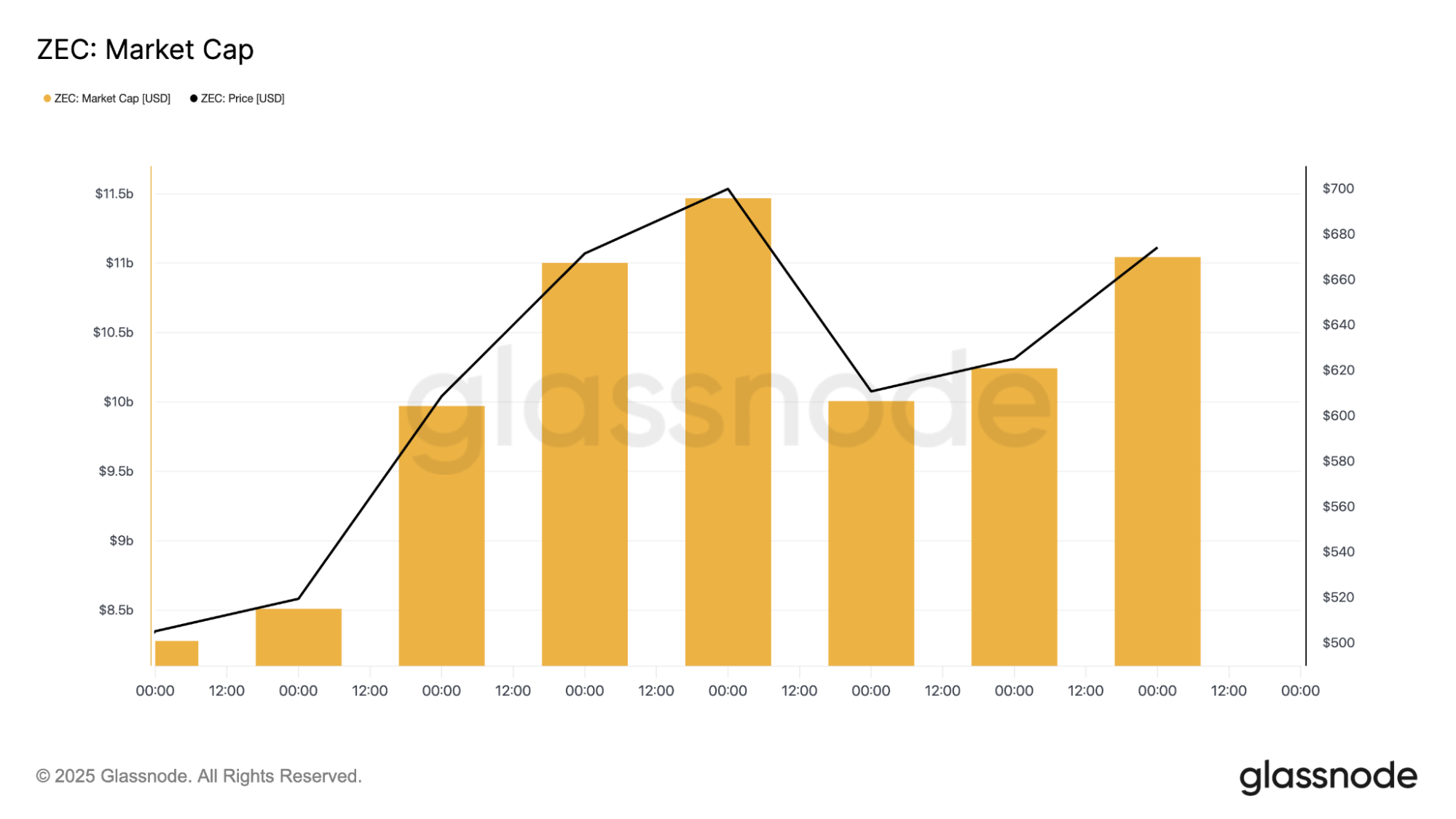

On-chain data from Glassnode supports that view. The market capitalization has grown from around $10.1B to over $11.1B.

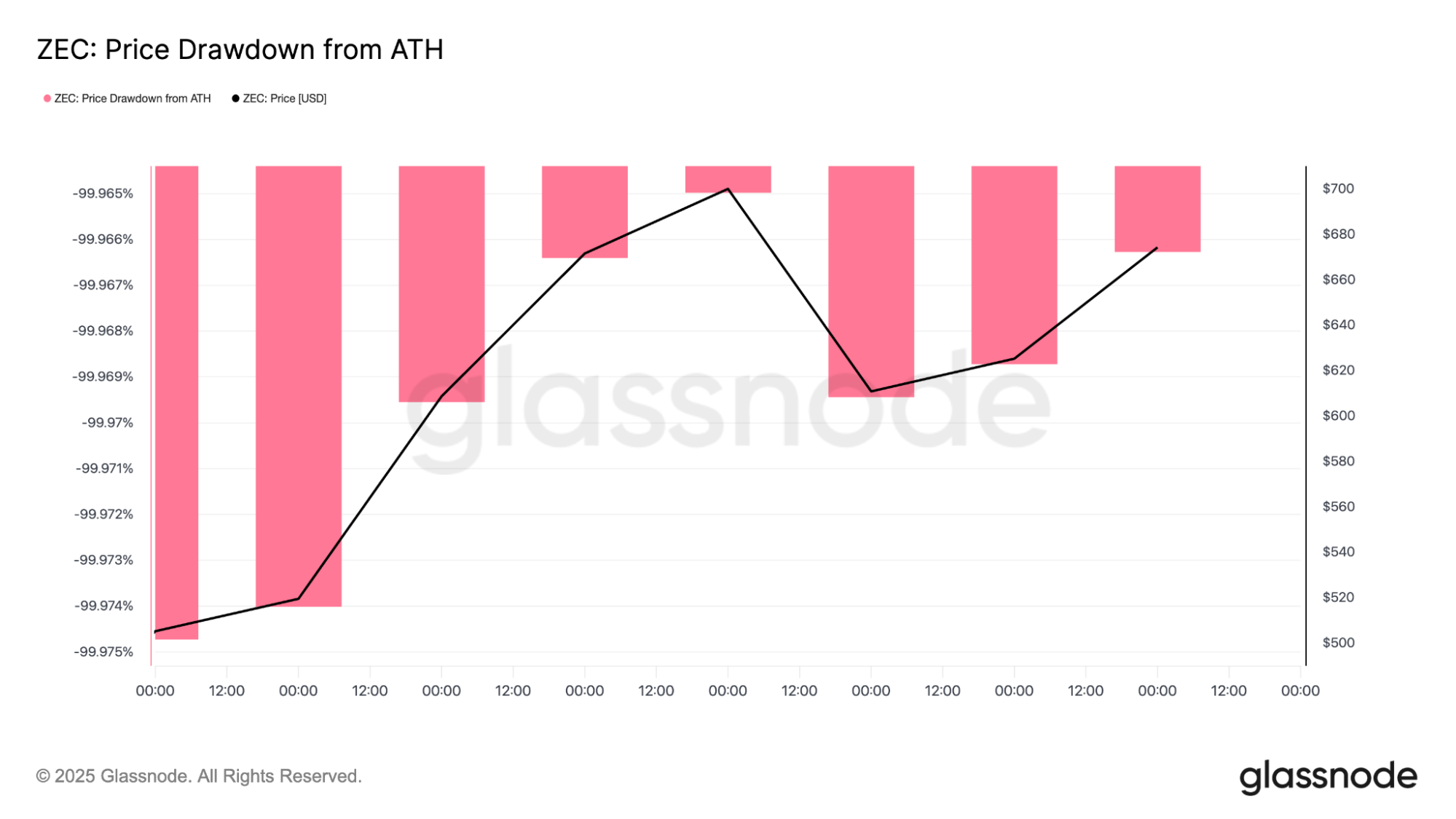

Even the ATH drawdown chart shows ZEC bouncing from extreme drawdown levels that previously lined up with major reversals.

Each signal alone is subtle, but together they paint a picture of a market regaining strength under the surface.

ZEC’s daily chart signals a support bounce and trend shift

The daily chart makes the momentum shift easier to see. The ZEC price tapped long-term demand near $441.76, bounced aggressively, and reclaimed most of the breakdown without giving sellers an easy re-entry.

Instead of rolling over again, the price held its bounce, and started forming one of its first meaningful higher low structures in weeks. That’s usually the point where downtrends begin losing control.

ZEC daily price chart analysis.

Each push lower gets weaker. Each bounce gets slightly stronger. And candles start compressing into a tighter range. That compression is happening now, and it’s a sign that a bigger move is getting ready.

This is exactly how ZEC’s last cycle reversal started. A long squeeze, then a reclaim, then a breakout through mid-range resistance. The pattern isn’t identical yet, but the early steps are matching closely.

Zcash reclaiming mid-range could confirm a reversal

The key level now is the mid-range resistance between $733.12 and $734.94. That band has been a stubborn ceiling in recent months. If the ZEC price breakss above it and turns the area into support, everything changes.

Above that zone, price history gets thin, and ZEC has historically moved very quickly toward the next resistance cluster around $815.64, $917.74, and even the higher Fibonacci bands.

ZEC 4-hour price chart analysis.

It would also place ZEC directly into the same structural path it followed during its previous cycle rally, where momentum exploded almost immediately after the mid-range reclaim.

If ZEC gets rejected at that level, a pullback toward support around $569.36 or even $441.76 is still possible. But as long as the ZEC price holds above that deeper range, the bullish structure stays intact and the Zcash price prediction becomes increasingly bullish.

Privacy sentiment is quietly turning in ZEC’s favor again

Over the past year, people have slowly started talking more about blockchain tracking, stricter KYC rules, and increasingly powerful chain-monitoring tools.

It’s not a full-blown privacy narrative yet, but the topic is gaining momentum again. And whenever that happens, privacy coins, especially Zcash, are usually the first to get noticed.

ZEC still stands out as one of the few major assets with true zero-knowledge privacy built directly into the protocol. There’s no need for mixers or add-ons, privacy is part of how the chain works.

Historically, whenever concerns about transparency start picking up, ZEC is one of the coins that reacts the fastest, both in price and in social sentiment.

We’re seeing the same pattern start to form now. The ZEC price is holding steady at support right as interest in privacy begins to rise again, and Zcash tends to perform well whenever that narrative starts building in the background.

On top of that, Cypherpunk Technologies has launched a Zcash treasury, starting with an initial investment of around $50 million. The company, which is backed by prominent crypto investors and entrepreneurs Cameron and Tyler Winklevoss, plans to acquire 5% of the total ZEC supply (this would equate to 1.05 million ZEC).

From a more long-term perspective, Zcash halvings will continue to reduce the supply of new ZEC entering the market, which could have a positive impact on the price.

Is ZEC setting up for another cycle rally?

Zcash isn’t giving a clear breakout yet, but it’s producing its strongest reversal signals in months. It’s reclaiming support levels with confidence. It’s forming higher lows. It’s building bullish divergence.

On-chain data is improving. The privacy narrative is returning. And the overall structure is tracking closely with the setup that launched its last major cycle move.

The real test will come at mid-range. If the ZEC price breaks above that zone and holds it, the probability of a full cycle repeat increases dramatically.

For now, ZEC looks like it’s in that early phase where accumulation happens quietly, the same phase that preceded its last major rally. The next move above or below these levels will likely determine whether history really does repeat itself.

Kraken: Best crypto exchange for security & reliability

- Buy, sell, and trade 400+ cryptocurrencies with industry-leading security

- Spot, Futures & Margin trading – leverage up to 5x for advanced traders

- Earn rewards with staking on top cryptocurrencies

- 24/7 customer support and high liquidity for fast trades

- Regulated in the US with strong compliance and security measures

- 13+ million users worldwide

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other advice. Nothing on this page is a recommendation or solicitation. Always seek independent professional advice before making investment decisions. Some links may earn us a commission at no extra cost to you.

Source:: Zcash Price Analysis: Can ZEC Repeat Its Last Cycle Rally?