Key highlights:

- Massive ETF inflows clash with a weakening price trend investors didn’t expect

- Top analysts argue over whether October’s peak was the real top or just a pause

- Macro uncertainty from the Fed intensifies doubts about the famous four-year pattern

Disclaimer: Always seek independent professional advice before making investment decisions. Some links may earn us a commission at no extra cost to you.

The debate over the validity of Bitcoin’s four-year cycle has split cryptocurrency analysts into two determined camps, and neither side is backing down.

We’re in mid-November, historically one of Bitcoin’s strongest months. Yet this year tells a different story: the cryptocurrency is trading lower than it was on January 1.

At the time of writing, the Bitcoin price stands at $91,211, shedding 15% in just ten days. It’s far from the scenario predicted by high-profile optimists Tom Lee and Arthur Hayes, who both expected a surge toward $250,000 by year-end.

When ETFs rewrite the old rules

According to traditional cycle theory, the October peak of $125,100 should represent the cycle’s top roughly 18 months after the April 2024 halving, perfectly aligned with past patterns. That’s usually followed by a steep correction and a multi-year decline until the next Bitcoin halving.

Michaël van de Poppe, founder of MN Trading Capital, believes the story isn’t over yet. He argues Bitcoin could still reach new highs in 2026:

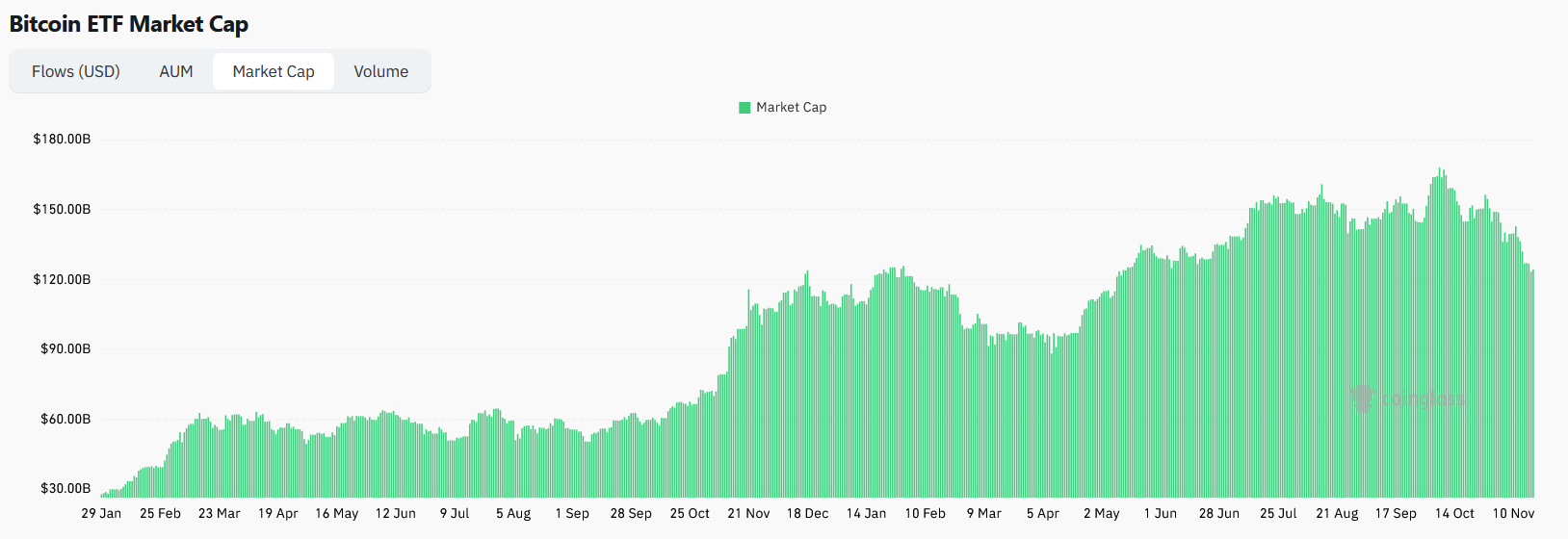

“In the past 18 months in the Bitcoin ETF, which is a significant constant demand through institutions, which changes the supply/demand framework.”

Still, he warns that calling the cycle “dead” is short-sighted.

Bitcoin ETF Market Cap. Source: Coinglass

He acknowledges that this cycle behaves differently but says the October high could still prove to be the top:

“We’re on the crossroads of market changes, maturing of an asset like Bitcoin and therefore, different market dynamics.”

Bitwise CIO Matt Hougan shares the long-term optimism. He believes weak market performance heading into late 2025 could set the stage for a powerful move in 2026.

Macro shockwaves challenge the optimists

BitMEX founder Arthur Hayes, once vocal about a $250,000 price target, has grown noticeably quiet. In his latest Substack post, he argues Bitcoin won’t break to new heights until global markets fall sharply enough to push central banks back into aggressive monetary easing.

Swyftx lead analyst Pav Hundal is carefully watching economic data, warning it’s too early to declare a top:

“Any decline in inflation or weakness in labor markets pushes us back toward lower rates.”

Recent statements from Federal Reserve Chair Jerome Powell added more uncertainty, sending the probability of a December rate cut down to 40%, according to CME’s FedWatch tool. Hundal says markets are now “floating blindly” while waiting for clearer signals.

“The issue isn’t just Bitcoin. The warning light is flashing for all risk assets.”

Defenders of the traditional cycle hold their ground

Some analysts insist the four-year cycle remains intact and the recent downturn actually confirms its strength.

Rekt Capital warned back in July that the rally left “very little room for upward movement.” He now argues that it will take time to determine whether the cycle is longer or simply late.

BTC/USD 1-Month Chart. Source: Linton Worm via X

Gemini’s Head of Asia Pacific, Saad Ahmed, also believes cycles are here to stay:

“People get really excited and overextend themselves, and then you kind of see a crash, and then it kind of corrects to an equilibrium.”

Analyst Colin Talks Crypto adds that the “Bitcoin holiday period is over,” suggesting a bear market or significant correction is imminent unless the price rebounds quickly.

Source: ColinTalks Crypto via X

With ETF-driven demand meeting historical cycle expectations and a volatile macro backdrop, Bitcoin’s future path has rarely been more hotly contested. The next few months could determine whether the four-year cycle remains a reliable guide, or becomes a relic of Bitcoin’s early years.

Kraken: Best crypto exchange for security & reliability

- Buy, sell, and trade 400+ cryptocurrencies with industry-leading security

- Spot, Futures & Margin trading – leverage up to 5x for advanced traders

- Earn rewards with staking on top cryptocurrencies

- 24/7 customer support and high liquidity for fast trades

- Regulated in the US with strong compliance and security measures

- 13+ million users worldwide

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other advice. Nothing on this page is a recommendation or solicitation. Always seek independent professional advice before making investment decisions. Some links may earn us a commission at no extra cost to you.

Source:: Bitcoin’s Four-Year Cycle Theory Faces Its Biggest Test Yet