Key highlights:

- Europe could see its first digital euro in less than five years

- Privacy and politics stand between plans and progress

- The ECB sees a digital euro as key to financial independence

The European Central Bank (ECB) is intensifying efforts to introduce a digital euro by 2029, according to the ECB. The final decision will depend on the adoption of a legislative framework within the next four years.

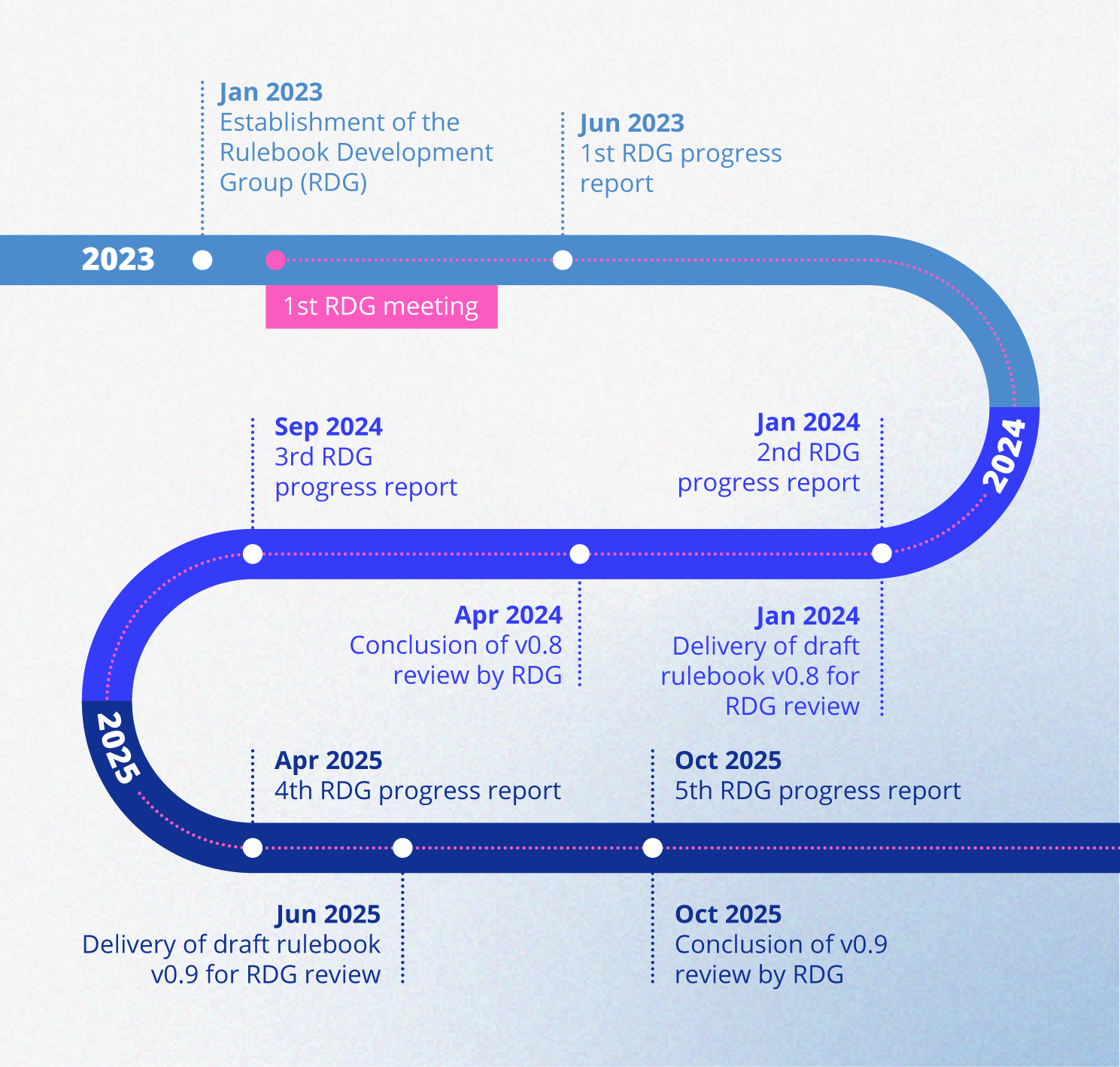

ECB staff working on the digital currency will continue developing the groundwork after completing the current preparatory phase this month. The bank began exploring the concept of a digital euro in 2020 and entered the preparatory stage at the end of 2023.

Progress on the preparation phase of a digital euro. Source: ECB

A meeting in Italy this week will mark the continuation of planning. Bloomberg’s sources say lawmakers hope to reach agreement on a legal framework before 2029, allowing the project to move into its rollout phase.

Skepticism and political obstacles

The initiative has faced skepticism from banks, legislators, and citizens concerned about privacy and data security. Political disagreements and the 2024 elections have slowed parliamentary progress, leaving the bill pending before the European Parliament since 2023.

EU member states remain divided over the feasibility of a central bank digital currency (CBDC). In September, ECB Executive Board member Piero Cipolloni suggested mid-2029 as a potential launch date, expressing confidence that the European Parliament could reach a consensus by May 2026.

The case for a digital euro

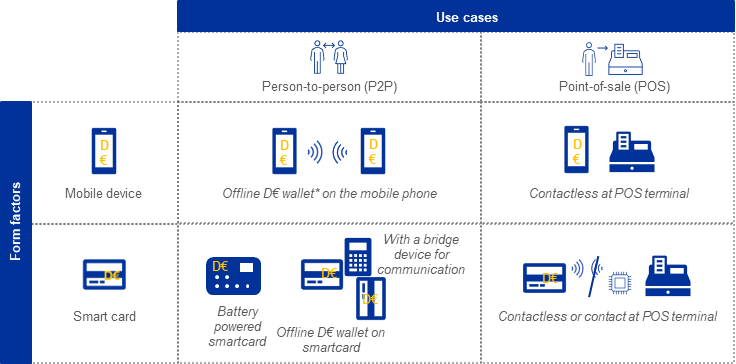

Cipolloni emphasized that a digital euro would allow all Europeans to make secure digital payments anywhere in the EU, without banking fees or reliance on commercial banks. He said such access could be vital in crises such as war or cyberattacks, ensuring financial resilience even if traditional systems fail.

Source: ECB

According to the Atlantic Council, only three central bank digital currencies—those of Nigeria, the Bahamas, and Jamaica are currently in full operation. Another 49 countries are testing CBDCs in pilot programs.

The Human Rights Foundation, which launched its own CBDC tracker in 2023, highlights improved payment efficiency and broader financial inclusion as major benefits. However, critics warn of potential privacy breaches and expanded government control if safeguards are not built into future systems.

Source:: Europe Moves Closer to Launching a Digital Euro by 2029