Trump pardons CZ: the biggest crypto shock of October

US President Donald Trump pardoned former Binance CEO Changpeng “CZ” Zhao, in what became the most explosive crypto story of October. Zhao, who had served a four-month sentence for violating anti–money laundering laws, walked free after a massive lobbying campaign that reportedly cost Binance $740,000.

Deeply grateful for today’s pardon and to President Trump for upholding America’s commitment to fairness, innovation, and justice.

🙏🙏🙏🙏Will do everything we can to help make America the Capital of Crypto and advance web3 worldwide.

(Still in flight, more posts to come.)…

— CZ 🔶 BNB (@cz_binance) October 23, 2025

Trump defended the decision, claiming Zhao had been “persecuted by the Biden administration” and insisting his actions “aren’t even a crime.”

The move instantly set off speculation that former FTX CEO Sam Bankman-Fried could be next. Polymarket odds jumped from 5.6% to 12%, but analysts caution against comparing the two cases: Zhao violated compliance rules, while Bankman-Fried was convicted of misusing billions in client assets.

Bitcoin caught between whale profit-taking and institutional demand

BTC traded in the $102,000–$113,000 range, stuck in a tug-of-war between profit-taking whales and hesitant institutions.

Bitfinex analysts say long-term holders locked in $1.7 billion in profits per day, the third-highest peak of the cycle. Glassnode’s James Check argued that this selling pressure — not manipulation or futures is what’s suppressing the rally. Galaxy Digital’s Mike Novogratz echoed the trend, joking that early Bitcoin OGs are finally cashing out for yachts and sports-team ownership stakes.

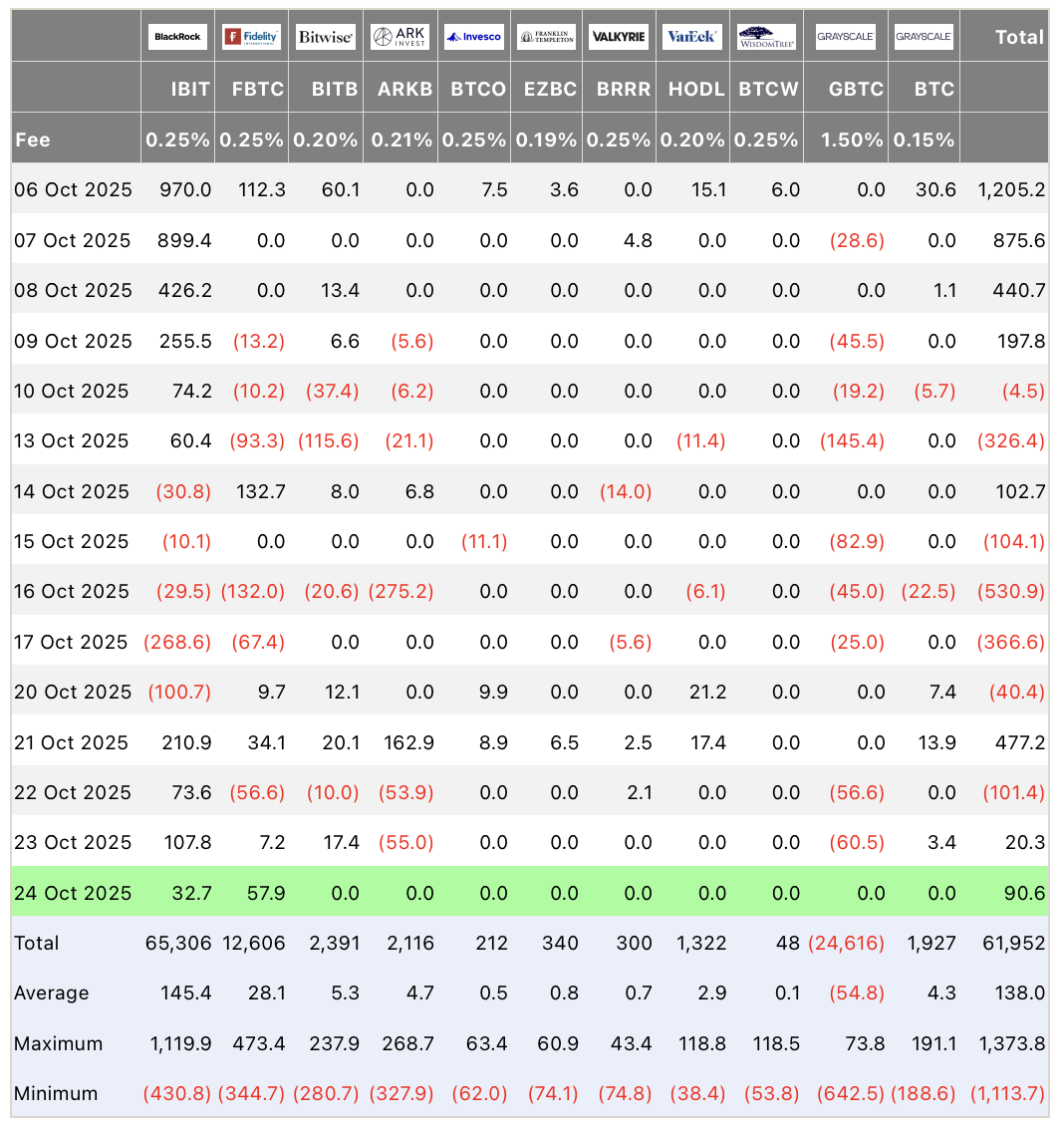

Meanwhile, institutions are sending mixed signals. Spot Bitcoin ETFs saw a $477M inflow on October 21 after a wave of outflows.

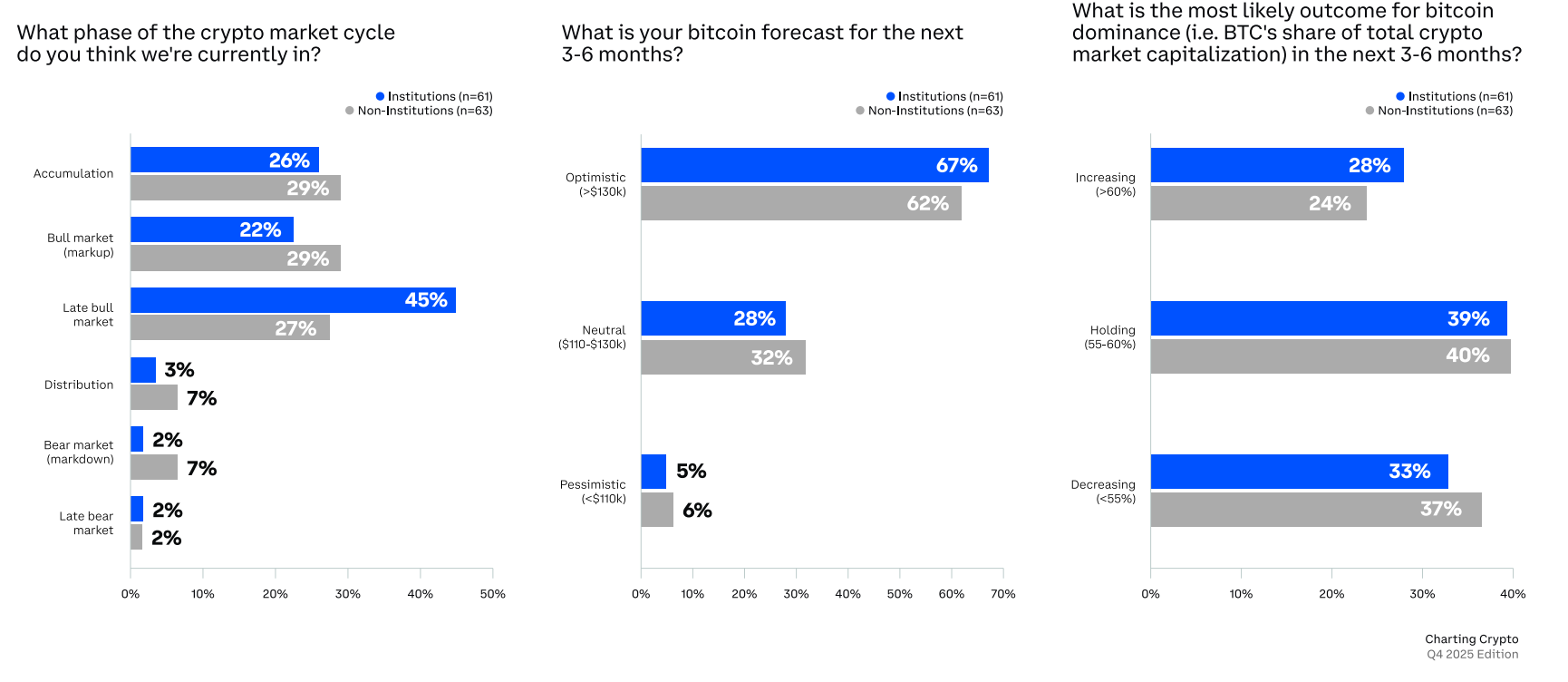

But Bitfinex analysts warn that weak accumulation leaves the $107k–$108k zone exposed, especially after $1.23B exited ETFs between October 13–17. Yet paradoxically, 67% of institutional investors are bullish for the next 3–6 months, according to Coinbase. They believe in upside — but are waiting for better entries before buying aggressively.

Investor Survey. Source: Coinbase

Geopolitical storm: sanctions, tariffs, and a new era of trade war

Macro headwinds tightened as global tensions escalated. Trump imposed sanctions on Rosneft and Lukoil, freezing U.S.-based assets and threatening secondary sanctions on banks dealing with them. Brent crude spiked 3.9% to $65, while India signaled that Russian oil imports could soon fall to near-zero.

Source: TE

The EU joined in, sanctioning Russian crypto platforms and the ruble-pegged stablecoin A7A5 for the first time.

At the same time, the U.S.–China trade war deepened. The Financial Times noted that China holds the upper hand due to its dominance in rare-earth minerals and chemical components used in ~700 U.S. pharmaceuticals. U.S. Treasury Secretary Scott Bessent warned that the world could be forced to decouple unless Beijing backs down on critical-resource threats. Bitcoin dipped below $108,000 ahead of the late-October Trump–Xi meeting.

Analyst Willy Woo added a sobering angle: the next crypto bear market could be triggered by a real recession — something Bitcoin has never faced. If a downturn hits, the open question is whether BTC behaves like tech stocks…or like gold.

Stablecoins go macro: from crypto niche to global infrastructure

Stablecoins are no longer a side-car to Bitcoin — they’re becoming core global infrastructure. USDT users now exceed 500 million, or roughly one out of every 16 people on Earth. Tether CEO Paolo Ardoino called it “the biggest financial inclusion achievement in history.”

Tether USDT reached officially 500 million users!

Likely the biggest financial inclusion achievement in history. https://t.co/jbmnMDwidi— Paolo Ardoino 🤖 (@paoloardoino) October 21, 2025

Meanwhile, Andreessen Horowitz projects stablecoin volume to hit $46 trillion in 2025, up 87% YoY. Stablecoins also now hold over $150B in U.S. Treasuries, making them the 17th-largest holder of U.S. debt.

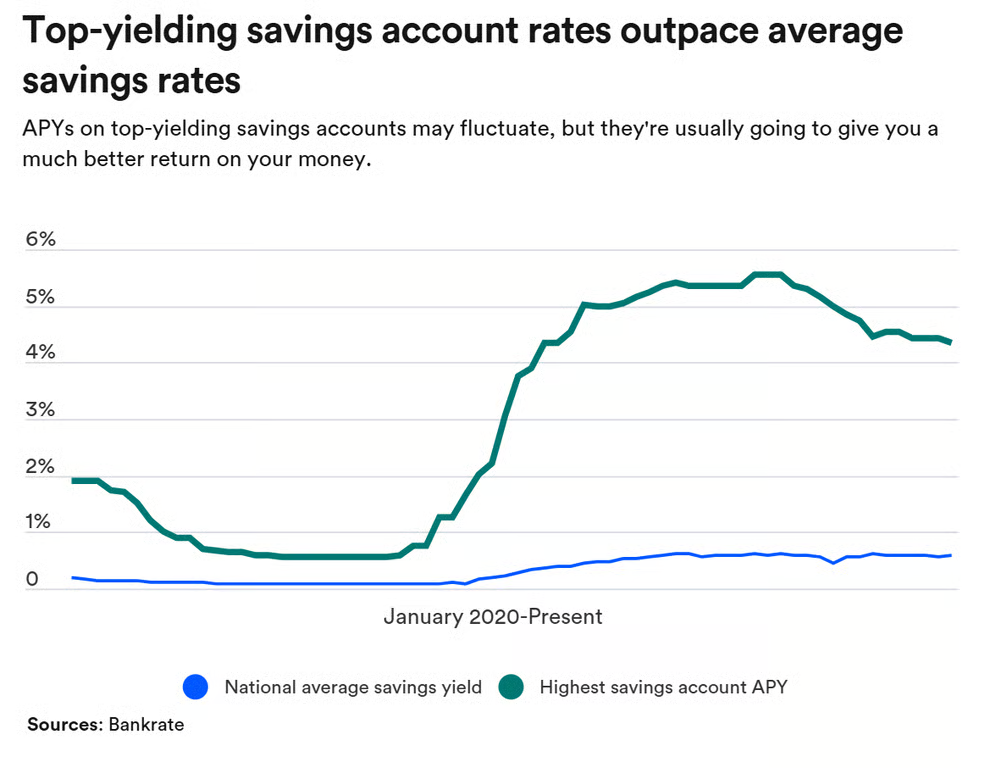

Kraken CEO Dave Ripley clapped back at the American Bankers Association after criticism that stablecoin yields undermine banks. With some platforms offering up to 5% APY vs just 0.6% in U.S. savings accounts — Ripley argued crypto is democratizing access to financial products once reserved for the wealthy.

Source: CoinCodex/Bankrate

And in a twist of irony, JPMorgan, whose CEO once mocked Bitcoin, will allow institutional clients to use BTC and ETH as loan collateral by year-end.

AI agents + Blockchain: the autonomous economy takes shape

AI is colliding with crypto faster than expected. OpenAI unveiled its Atlas browser, which features an AI agent capable of navigating the web, executing tasks, and making purchases autonomously. Kevin O’Leary predicts a world where “AI orders the coffee, blockchain pays for it.”

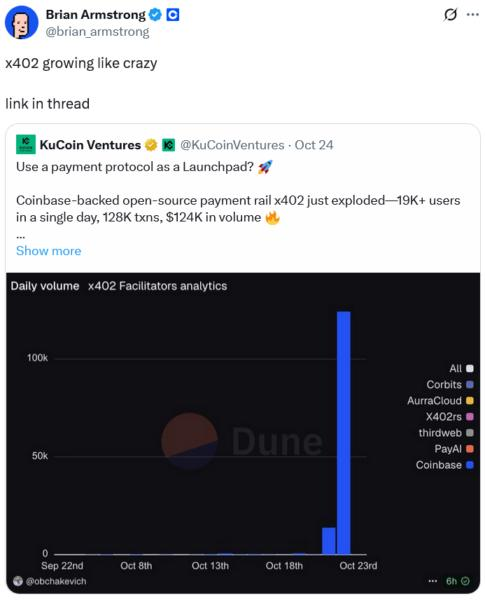

Meanwhile, Coinbase’s x402 protocol surged 10,000% in a month, processing nearly 500,000 autonomous agent transactions between October 14–20. a16z believes this new economy could power $30 trillion in automated transactions by 2030.

Source: X/brian_armstrong

Developers are already spinning up x402-native tokens, fueling a $180M memecoin micro-ecosystem almost overnight.

Conflicting forecasts: doom, boom, or something in between?

Analysts remain split. Tom Lee of BitMine warns Bitcoin could still drop 50% if macro risk escalates and Peter Brandt compared the current price structure to the 1970s soybean bubble, which ended in a giant crash. Yet Lee still maintains his long-term $200,000–$250,000 target.

Novogratz countered that such levels would require “crazy events” and believes BTC should at least hold $100,000 in a worst-case scenario. Arthur Hayes, on the other hand, went nuclear—predicting $1 million Bitcoin on the back of Japan’s new stimulus policies. Meanwhile, QCP Capital notes that the ongoing U.S. government shutdown has frozen key economic data, leaving markets to trade solely on CPI until Washington wakes back up.

Source:: Trump Pardons CZ, Stablecoins Go Global, and AI Learns to Pay