Key highlights:

- DefiLlama detects Binance-like trading volumes on Aster

- Aster’s data transparency sparks major debate in DeFi circles

- Analysts question how real Aster’s trading activity truly is

Concerns over trading data accuracy

DefiLlama has removed Aster from its platform after discovering that the decentralized exchange’s trading volumes almost perfectly matched those of Binance, the world’s largest centralized crypto exchange.

The DeFi analytics platform said its decision came from doubts over the accuracy and transparency of Aster’s reported perpetual futures volumes.

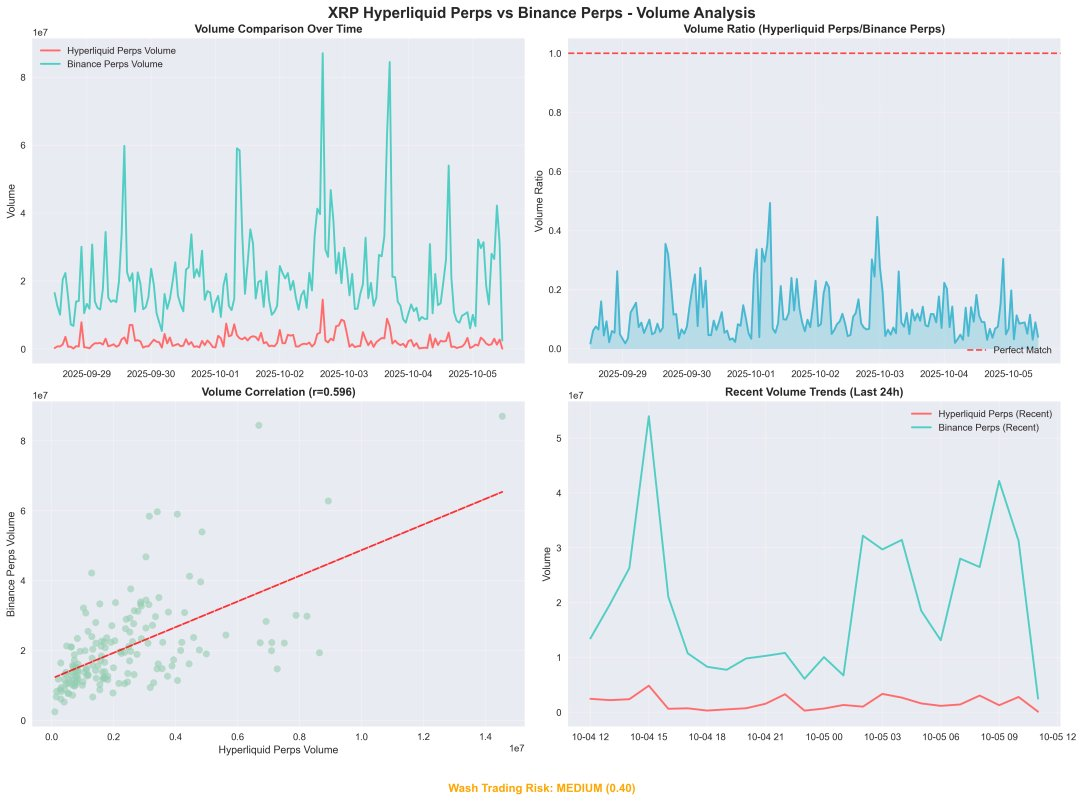

According to 0xngmi, DefiLlama’s pseudonymous co-founder, the correlation between Aster and Binance trading volumes reached nearly 1, suggesting an uncanny alignment between the two.

We’ve been investigating aster volumes and recently their volumes have started mirroring binance perp volumes almost exactly

Chart on the left is XRPUSDT on aster, you can see the volume ratio vs binance is ~1

Chart on the right is XRP perp volume on hyperliquid, where there’s… pic.twitter.com/MwVD7rRyEn

— 0xngmi is hiring (@0xngmi) October 5, 2025

“Aster doesn’t make it possible to get lower-level data such as who is making and filling orders, so until we can get that data to verify if there’s washtrading, Aster perp volumes will be delisted,” 0xngmi explained.

Source: X

From rising star to questioned transparency

Aster launched in September as a supposed competitor to Hyperliquid, another decentralized exchange for perpetual cryptocurrency futures.

It quickly gained traction, partly due to its reported ties to Binance founder Changpeng Zhao and the surging interest in on-chain derivatives trading.

Within just a week, open interest in Aster soared by more than 33,000%, signaling explosive growth and speculation. On September 25, its daily perpetual futures trading volume hit an all-time high of $60 billion, according to DefiLlama data.

However, as activity numbers climbed, so did skepticism. Analysts began to question whether Aster’s trading data truly reflected organic demand or was being artificially inflated to mimic real market activity.

Analyst predictions and market reaction

Crypto market analyst Marcell said in September that Aster’s token could rise by as much as 480%, projecting a target price of around $10. He noted that Aster had already surpassed rival HYPE in daily volume and revenue metrics.

Yet, DefiLlama’s delisting of Aster has cast a shadow over those bullish expectations. Without access to transparent order-level data, experts say it’s impossible to verify whether the exchange’s explosive growth was genuine or algorithmically engineered.

The case underscores a growing issue in decentralized finance: even “on-chain” platforms can lack transparency when they restrict key trading information.

Kraken: Best crypto exchange for security & reliability

- Buy, sell, and trade 400+ cryptocurrencies with industry-leading security

- Spot, Futures & Margin trading – leverage up to 5x for advanced traders

- Earn rewards with staking on top cryptocurrencies

- 24/7 customer support and high liquidity for fast trades

- Regulated in the US with strong compliance and security measures

- 13+ million users worldwide

Source:: DefiLlama Delists Aster After Suspicious Trading Patterns Emerge