Prediction markets have always walked a fine line between finance and gambling. Most people know them as offshore websites where you can bet on elections or sports. But in the U.S., that space has long been murky. Then Kalshi came along.

Founded in 2018 by two MIT grads, Kalshi is the first federally regulated exchange for trading “event contracts”, essentially yes-or-no bets on real-world outcomes. Backed by big-name investors and supervised by the U.S. Commodity Futures Trading Commission (CFTC), Kalshi is a legitimate alternative to unregulated prediction platforms.

The question now on many investors’ minds: is Kalshi legit, is it legal, and how does it actually work? Add in hot-button issues like election betting and whether the platform takes crypto, and you’ve got a lot to unpack.

In this guide, I’ll break it all down: from ownership and regulation to user trust and the latest legal battles. So, you’ll be able to decide if Kalshi is worth your attention.

Key highlights:

- Is Kalshi legit? Yes. It’s a fully CFTC-regulated exchange, not an offshore betting site.

- Who owns Kalshi? Founded by MIT grads Tarek Mansour and Luana Lopes Lara, backed by investors like Paradigm, Sequoia, and Citadel’s Peng Zhao.

- Is Kalshi legal? Yes at the federal level, though some state lawsuits (mainly around sports contracts) are still pending.

- Kalshi election betting is now officially allowed after a major 2024–2025 court victory, making it the first legal U.S. exchange for political contracts.

- Does Kalshi accept crypto? Yes. Deposits are supported in USDC, Bitcoin, Solana, and Worldcoin, with all funds converted into U.S. dollars for trading.

Kalshi’s background and ownership

Kalshi was founded in 2018 by Tarek Mansour and Luana Lopes Lara, two MIT graduates who set out to build the first fully regulated prediction market in the U.S. It was a simple but ambitious goal: create a financial exchange where people could trade on real-world events just as they trade stocks or commodities.

The company is officially registered as KalshiEX LLC, headquartered in New York. In late 2020, it achieved a breakthrough when the U.S. Commodity Futures Trading Commission (CFTC) granted it designated contract market (DCM) status. That recognition put Kalshi in the same regulatory league as futures exchanges like CME Group.

From an ownership perspective, Kalshi remains a private company. Its founders retain a leading role, but the firm is heavily backed by major investors.

In 2025, it closed a $185 million Series C round led by Paradigm, which pushed its valuation close to $2 billion. Other backers include Sequoia Capital, Charles Schwab, Susquehanna International Group, and Citadel CEO Peng Zhao, signaling deep financial industry support.

The platform also has advisors and board members with political and regulatory clout, including former CFTC commissioner Brian Quintenz.

This mix of experienced founders and heavyweight investors explains why Kalshi has quickly gained credibility. And attention.

How Kalshi works

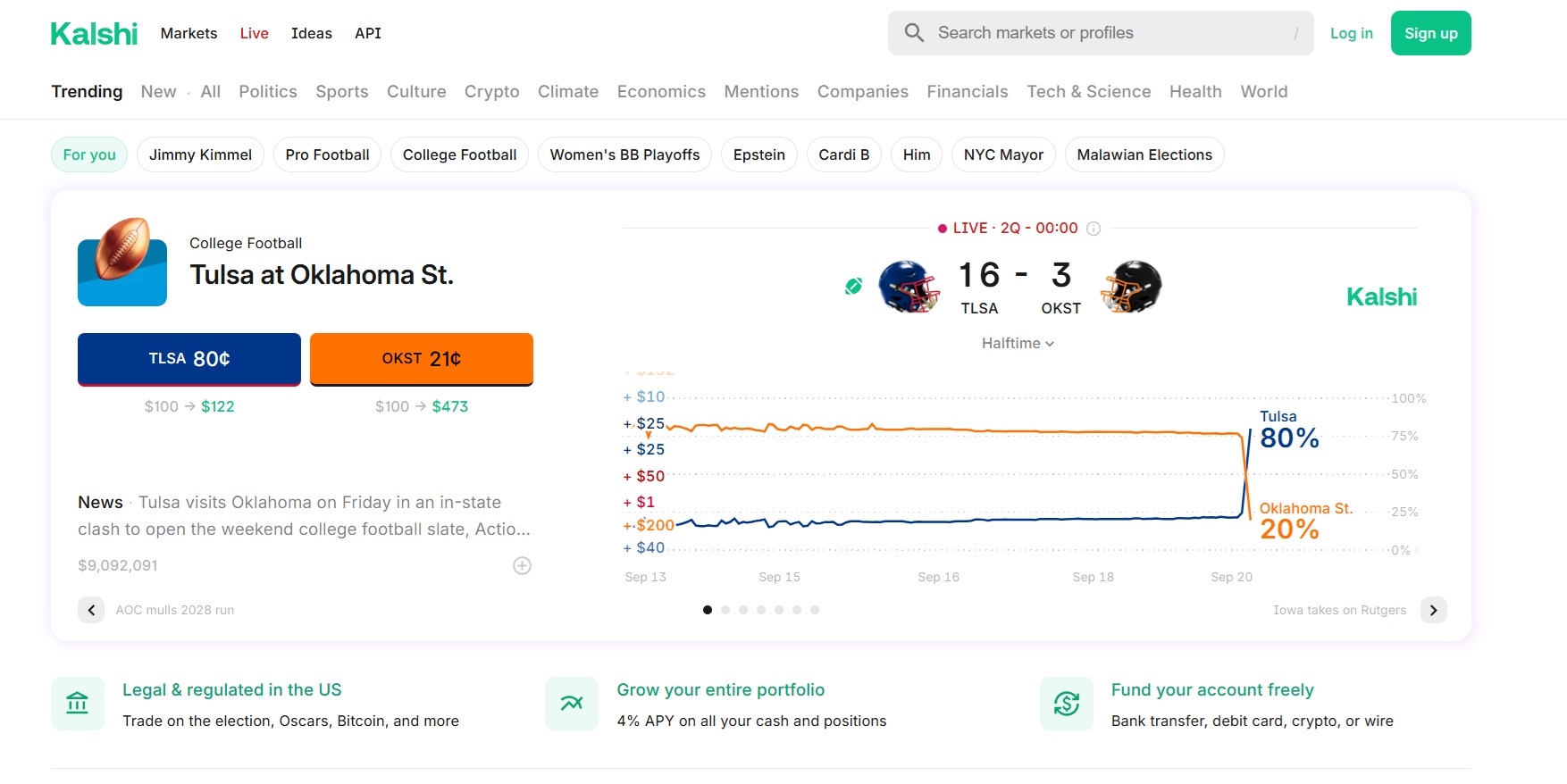

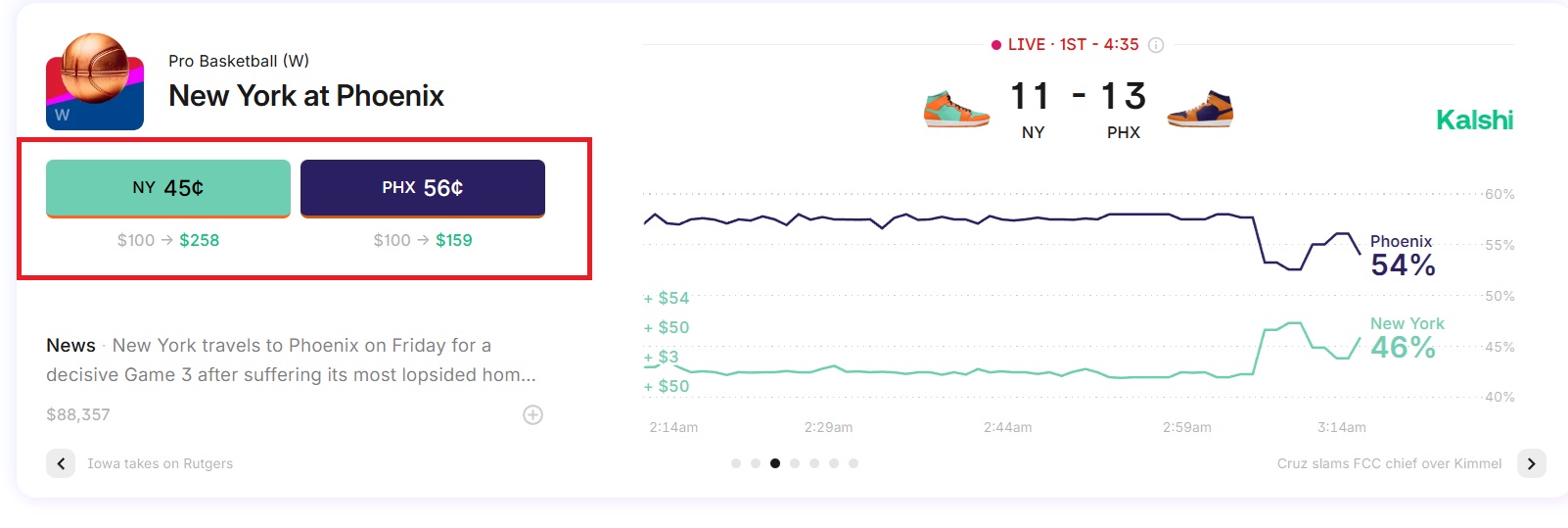

At its core, Kalshi runs like a traditional futures exchange. But instead of trading commodities or interest rates, you trade on real-world events.

The basic building block is the event contract, a simple yes-or-no wager that pays out $1 if the outcome is correct. Contracts trade anywhere from a few cents to 99 cents. The price reflects the market’s probability.

For example, if a contract asking “Will Bitcoin close above $70,000 this month?” trades at $0.60, the market is implying a 60% chance that outcome will happen. If you buy in and it settles “Yes,” you get $1. If not, you lose your stake.

The same logic applies if it’s about which team will win, or who will be elected governor, or any choice where there’s 2 options.

Key features of Kalshi’s model

- Event contracts: Yes/no questions with a $1 payoff.

- Transparent pricing: Market prices represent probabilities.

- CFTC-regulated: Operates under the same rules as U.S. futures markets.

- No leverage: You can only lose what you stake, reducing systemic risk.

- Broad categories: Markets range from economics and politics to sports, weather, and crypto.

This structure separates Kalshi from offshore prediction sites. It’s designed as a federally supervised exchange where traders can hedge or speculate on real-world risks (and not a gambling platform).

Regulatory status: CFTC approval

The single biggest factor that makes Kalshi different from offshore prediction sites is its regulatory approval. In late 2020, the U.S. Commodity Futures Trading Commission (CFTC) gave Kalshi Designated Contract Market (DCM) status. That means it’s held to the same rules as major futures exchanges like the Chicago Mercantile Exchange.

In practice, this approval means:

- Nationwide legality: Kalshi can operate in all 50 states under federal law.

- Strict oversight: The CFTC monitors Kalshi’s contracts, risk controls, and compliance.

- User protections: Funds are held through a clearinghouse, reducing counterparty risk.

- AML/KYC checks: Kalshi follows financial industry standards to prevent fraud and money laundering.

This level of oversight is unprecedented in the U.S. prediction market space. Most platforms that offer political or sports betting operate in a legal gray zone, often offshore.

In that sense, Kalshi’s CFTC license sets it apart as the only federally recognized exchange for event contracts in the country. It’s similar to how strict crypto regulation in the U.S. separates licensed exchanges from unregulated ones

Still, that hasn’t stopped legal battles, especially over high-profile topics like elections and sports. We’ll get into those in the next section.

Is Kalshi legal?

The short answer is yes, but with caveats.

Kalshi is federally regulated under the Commodity Exchange Act, which gives it the legal right to operate nationwide. Its Designated Contract Market (DCM) license from the CFTC makes it a financial exchange, not a gambling site.

It’s a big distinction, because it means Kalshi’s contracts are treated as futures, not bets.

Here’s why Kalshi is legal at the federal level:

- CFTC license: Full federal approval since 2020.

- Preemption: Federal law overrides state gambling restrictions in this case.

- Financial oversight: Kalshi follows the same compliance standards as other exchanges.

But legality hasn’t come without fights. In 2023, the CFTC tried to block Kalshi from listing contracts on congressional elections, arguing they were too close to gambling. Kalshi sued. And by late 2024, federal courts ruled in its favor. The CFTC dropped its appeal in 2025, which cleared the way for election contracts to go live.

That victory doesn’t cover everything, though. Some states, like Massachusetts, have sued Kalshi over sports-related contracts, claiming they fall under local betting laws. Kalshi argues federal law preempts state restrictions, but the final outcome of these disputes is still pending.

So while Kalshi is legal and regulated nationwide, its specific markets (like sports or elections) sometimes get tested in court.

Kalshi election betting

One of the most controversial (and groundbreaking) parts of Kalshi’s story is its push into political markets.

For decades, U.S. regulators have resisted election betting, calling it too close to gambling. Kalshi’s founders argued the opposite. They said that election contracts are a legitimate way to hedge political risk, just like companies hedge interest rates or oil prices.

The battle came to a head in 2023, when the CFTC rejected Kalshi’s proposal to list contracts on which party would control Congress. Kalshi took the regulator to court, and won.

In 2024, the D.C. Circuit Court ruled that these contracts fall under the Commodity Exchange Act. By mid-2025, the CFTC dropped its appeal, effectively clearing the way for election markets to launch.

What this means for users

- Legal clarity: Election contracts are now federally approved.

- First-of-its-kind market: Kalshi is the only U.S. platform where you can legally trade on congressional outcomes.

- High demand: These markets have already attracted significant volume from traders and institutions.

The ruling was a watershed moment. It legitimized the idea of election betting in the U.S. but as a federally regulated financial product, not gambling. Still, the debate isn’t over. Critics argue election contracts blur the line between markets and democracy, while supporters see them as tools for transparency and forecasting.

Does Kalshi accept crypto?

Yes, it does now.

For years, one of the biggest questions around Kalshi was whether it would open its doors to crypto users. At launch, the platform only supported U.S. dollar deposits through bank transfers. That meant the reach was limited, especially for traders who wanted faster or more flexible funding options. And let’s be honest, most do.

By 2024, that started to change. Kalshi integrated with ZeroHash, a regulated crypto infrastructure provider, to allow stablecoin deposits. The first option was USD Coin (USDC), which quickly became popular among crypto-savvy traders.

In 2025, Kalshi expanded further:

- Bitcoin (BTC) deposits went live in April 2025.

- Solana (SOL) and Worldcoin (WLD) deposits were added in September 2025.

- Many traders now move funds directly from their crypto wallets into Kalshi, where deposits are automatically converted into U.S. dollars for trading

This setup lets users fund their accounts with crypto, but it also ensures Kalshi stays within CFTC rules by keeping trading in fiat. For crypto traders, it’s a practical middle ground. It allows for faster deposits and withdrawals, with the security of a regulated exchange.

User safety and legitimacy: Is Kalshi legit?

With prediction markets, the biggest concern for most users is trust. Nobody wants to send money to a platform only to find out it’s unregulated or unsafe.

So, is Kalshi legit?

The evidence strongly points to yes. Kalshi isn’t an offshore site or a gray-market betting exchange. It’s a CFTC-regulated financial exchange, subject to the same scrutiny as futures markets. That alone sets it apart from unlicensed platforms.

Why users trust Kalshi

- Federal regulation: Licensed as a Designated Contract Market since 2020.

- Clearinghouse custody: All trades go through a regulated clearinghouse, reducing counterparty risk.

- Compliance standards: AML and KYC checks are mandatory for all users.

- Big-name backers: Investors include Sequoia Capital, Paradigm, and Citadel’s Peng Zhao.

- Partnerships: Integrated with Robinhood in 2025 to expand access to prediction markets.

Still, like any financial platform, Kalsh’s been criticized. Some users have reported account freezes or delays in withdrawals, usually tied to compliance checks. And while it’s legal at the federal level, ongoing state-level disputes (especially around sports markets) could still be an issue

Overall, though, Kalshi has more in common with regulated financial exchanges than with gambling sites. If you want to use prediction markets, Kalshi is one of the safest and most legitimate options.

Criticisms and caveats

Even though Kalshi has strong regulatory backing, it’s not without issues. Like any financial platform, there are trade-offs that new users should be aware of.

These are some common criticisms I’ve come across:

- Account holds and compliance checks: Some users have reported delays in withdrawals or frozen accounts when additional identity verification is needed.

- Limited market scope: While growing, Kalshi only offers event contracts. You won’t find stocks, options, or crypto spot trading here.

- Regulatory uncertainty: Ongoing lawsuits, especially around sports betting markets, mean some contracts could face restrictions or be pulled in certain states.

- Complexity for beginners: Event contracts look simple, but understanding pricing as implied probability can confuse first-time traders.

These aren’t deal-breakers for most. But they do highlight that Kalshi is still a young exchange in a not fully established space. Its legal victories on election markets are a huge step forward, but challenges around sports and state-level pushback show that it’s not over.

For traders, that means Kalshi is best viewed as a specialized platform. It’s secure and innovative, but not yet free of growing pains.

The verdict: Is Kalshi legit and worth your time?

So, is Kalshi legit? Yes. Unlike offshore betting sites, Kalshi is a CFTC-regulated exchange, backed by major investors, and designed to operate under U.S. financial law. It has cleared some of the toughest regulatory hurdles, including a federal court battle that legitimized election markets in 2025.

Is Kalshi legal? Also yes, at least at the federal level. Its designation as a Designated Contract Market means it’s recognized nationwide, though ongoing lawsuits around sports contracts show that state-level disputes could shape its future.

Kalshi election betting is now officially live and federally approved. It’s the first platform in U.S. history where you can legally trade contracts tied to political outcomes.

Kalshi is a pioneering exchange that has turned event trading into a regulated financial product. It’s still young and facing legal challenges, but if you’re interested in betting on real-world events in a secure, federally supervised environment, Kalshi is as legitimate as it gets.

Source:: Is Kalshi Legit? All You Need to Know About The Prediction Market Platform