Key highlights:

- U.S. banks processed $312B in dirty money linked to cartels and Chinese gangs.

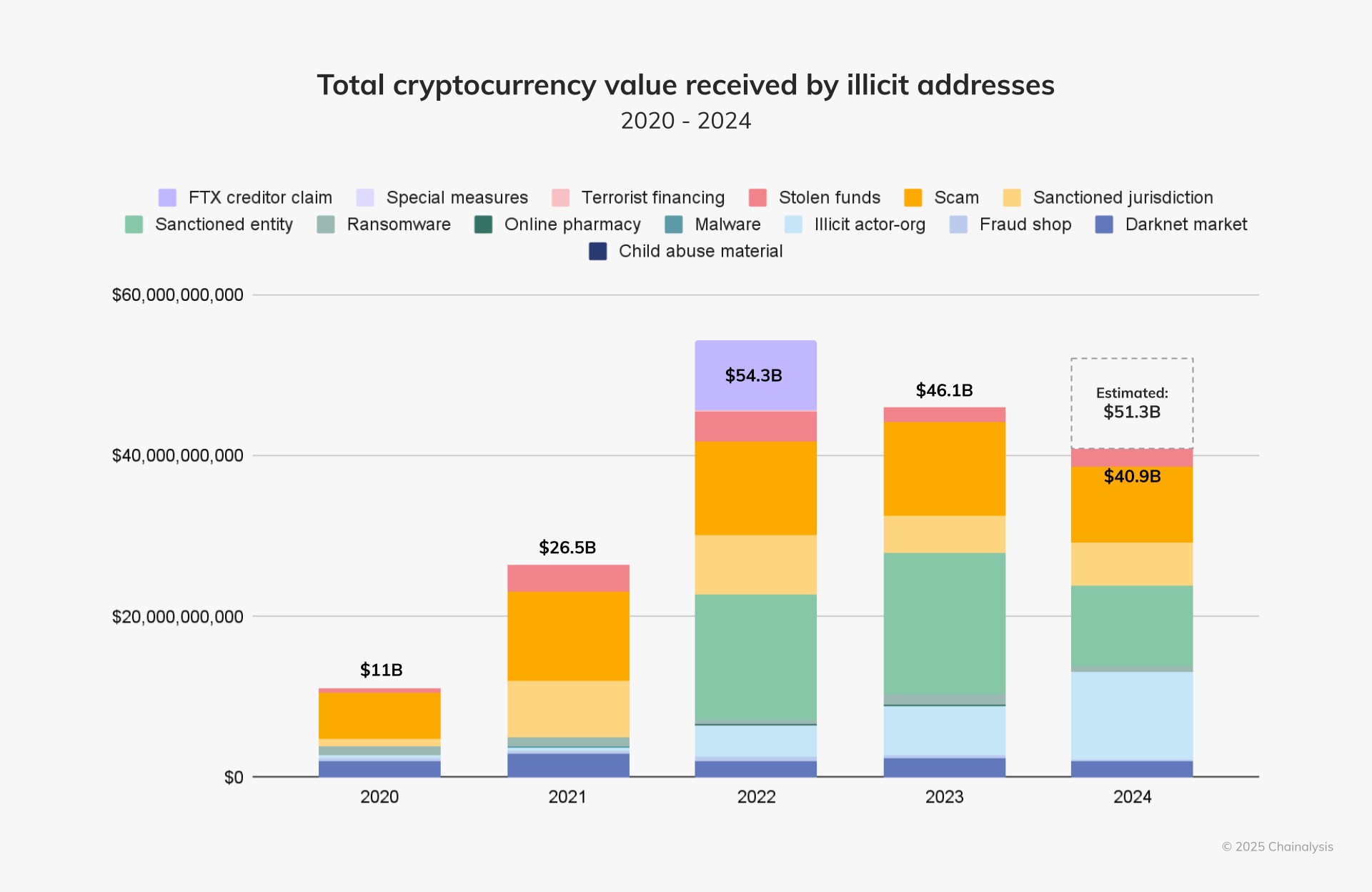

- Crypto crime totals just $189B over five years, under 1% of illicit finance.

- Politicians target crypto while ignoring banks’ much bigger laundering role.

U.S. banks quietly processed $312 billion in dirty money

The U.S. Financial Crimes Enforcement Network (FinCEN) has released a report that raises uncomfortable questions: Who are the true villains in the global money-laundering story?

FinCEN has issued an Advisory and Financial Trend Analysis raising the alarm on Chinese money laundering networks, which pose a significant threat to the U.S. financial system.https://t.co/QejJmzQaYw

— Financial Crimes Enforcement Network (FinCEN) (@FinCENnews) August 28, 2025

Between 2020 and 2024, American banks processed a staggering $312 billion tied to Chinese money-laundering networks, much of it linked to Mexican drug cartels.

Chinese networks and cartel connections

An analysis of over 137,000 Bank Secrecy Act reports showed that an average of $62 billion flowed through the U.S. banking system every year from Chinese money launderers. That money became fuel for Mexican drug cartels, which desperately needed ways to wash their dollar proceeds.

FinCEN Director Andrea Gacki speaks at Aurora University. Source: FinCen

“These networks launder proceeds for Mexico-based drug cartels and are involved in other significant, underground money movement schemes within the United States and around the world,” FinCEN Director Andrea Gacki said.

But cartels and drugs are only one part of the story. Chinese criminal groups have built an extensive “portfolio” of illicit finance — including human trafficking, smuggling, health care fraud, elder fraud, and real estate laundering worth more than $53.7 billion in suspicious transactions.

Politicians’ misplaced focus: crypto vs. banks

Despite these jaw-dropping figures, cryptocurrencies remain the primary political punching bag. Earlier this year, Senator Elizabeth Warren claimed that “bad actors are also increasingly turning to cryptocurrency to enable money laundering,” renewing her calls for stricter regulation.

Source: UNODC

But the data tells a different story. According to the United Nations Office on Drugs and Crime, more than $2 trillion is laundered worldwide each year.

In comparison, Chainalysis reports that the total volume of illegal crypto transactions over the past five years was only $189 billion.

Source: Chainalysis

The real picture: Banks, not Bitcoin

That means traditional banks are moving hundreds of billions in dirty money annually, while crypto represents less than 1% of global illicit finance.

Yet the public spotlight, driven by political rhetoric, remains fixed on digital currencies. This mismatch suggests not just a policy failure — but a dangerous distraction.

If lawmakers are serious about fighting financial crime, it’s time to rethink priorities and hold banks accountable for the massive laundering pipelines they continue to enable.

eToro: Best platform for beginners and social trading

- Trade cryptocurrencies, stocks, ETFs, and commodities on one easy-to-use platform

- Follow and copy top-performing traders with eToro’s unique social trading tools

- Earn passive income with staking on popular coins like ETH, ADA, and TRX

- Fully regulated in multiple jurisdictions with strong security protocols

- 0% commission on real stock trading and competitive spreads on crypto

- 30+ million registered users across 100+ countries

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

Source:: $312 Billion Scandal: Why U.S. Banks, Not Crypto, Are the Real Money-Laundering Machines