Key highlights:

Ethereum record

The crypto market’s focus over the past seven days has been on US Federal Reserve Chairman Jerome Powell. Anticipation surrounding his speech at the Jackson Hole conference has led to significant volatility in the market.

Bitcoin began the week with a sharp drop from $118,000 to $115,000, setting the tone for the first half of the week. By Thursday, after brief recoveries, Bitcoin (often referred to as digital gold) fell further to $112,000.

However, on the evening of August 22, Ethereum’s price nearly fully recovered from its losses, fueled by the positive effects of Powell’s speech. In less than two hours, Bitcoin soared above $117,000.

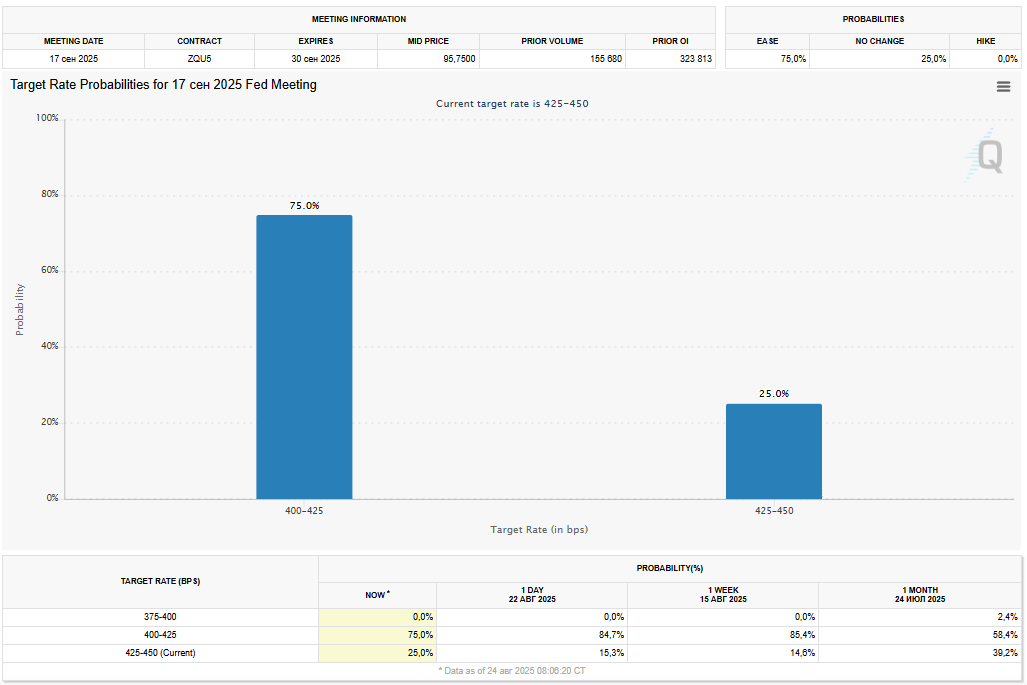

Powell hinted at the possibility of rate cuts in September, though he also pointed to weak labor market data and a slowing economy. After the speech, the share of investors expecting a rate cut at the next Fed meeting jumped to 75%, although it peaked at 89% immediately after Powell’s address.

Source: CME FedWatch

Ethereum outperformed Bitcoin in weekly dynamics, rising 5% while Bitcoin fell by 3%. Notably, Ethereum updated its historical maximum by just a few dollars, reaching $4,889 on Binance.

At the time of writing, Ethereum is trading around $4,591, maintaining strong momentum.

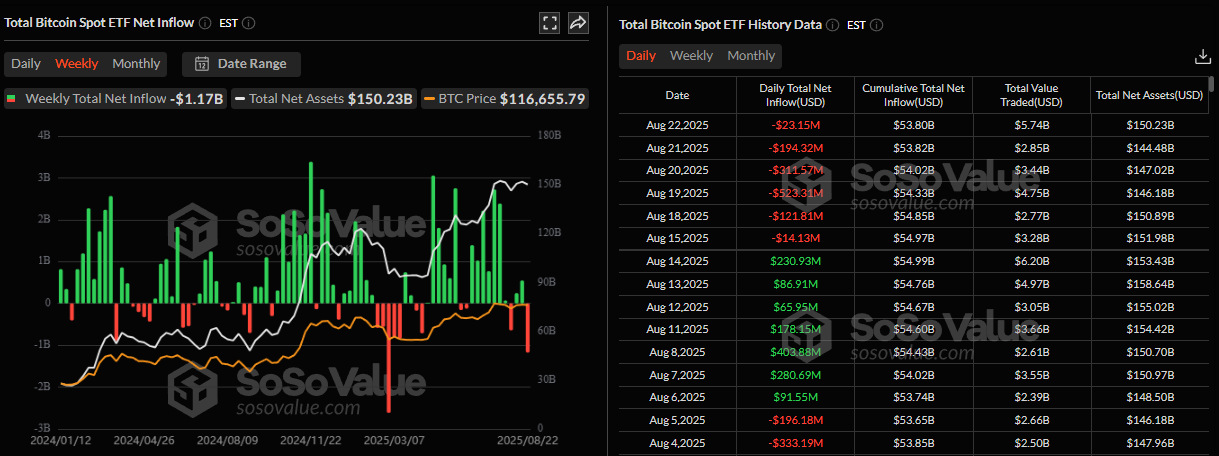

Meanwhile, the past week saw significant outflows from spot Bitcoin ETFs, totaling $1.17 billion, while Ethereum products saw $578 million withdrawn.

Source: SoSoValue

However, on August 21, Ethereum funds experienced an inflow of $288 million, recovering almost a third of the losses.

Altcoins have generally performed better than Bitcoin. On August 21, BNB reached a new all-time high of $881, and XRP remained above $3. SOL rose to $205, showcasing strength in the altcoin space.

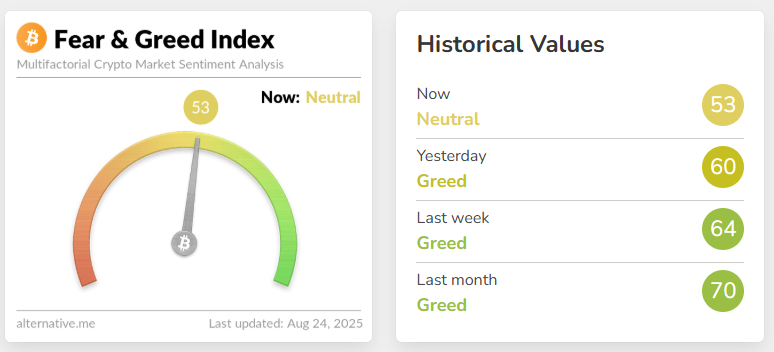

The total capitalization of the crypto market now exceeds $4 trillion, with Bitcoin dominance dropping to 56.4%. The crypto fear and greed index is at 53, signaling neutral sentiment.

Source: alternative.me

Bitcoin Mining and Hashrate Control

On August 22, Bitcoin’s mining difficulty increased by 0.2%, reaching a new record at 129.7 T, according to CloverPool.

The hashrate (7-day moving average) stands at 945 EH/s, while the highest value ever recorded was 966 EH/s on August 7.

Source: Glassnode

The daily volume of transaction fees in Bitcoin has also dropped to 3.13 BTC, a level not seen since 2011, according to Glassnode.

A 51% Attack on Bitcoin?

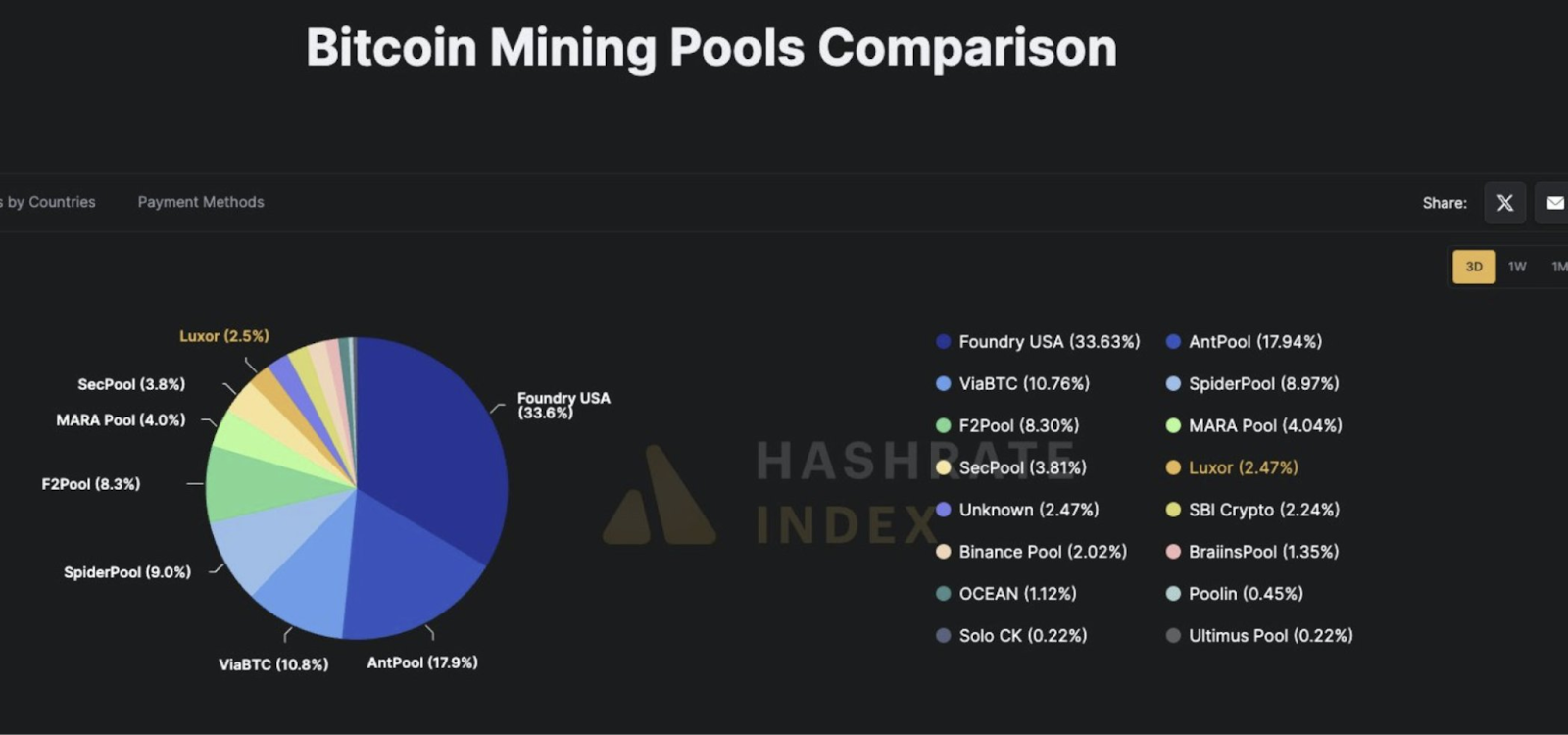

In a startling development, Foundry USA and AntPool now control over 51% of the Bitcoin network’s hashrate, raising concerns of a 51% attack. This level of concentration is reminiscent of 2015, when GHash.io controlled a similar portion and voluntarily reduced its hashrate following criticism.

Source: X

Jacob King, CEO of WhaleWire, expressed concern about the centralization risks. Despite this, some argue that coordination between the pools is unlikely due to their geographical locations in the US and China.

King warned that factors such as stablecoin manipulation, FOMO-driven retail investors, and false narratives spread by maximalists could undermine the market’s stability.

Stablecoin from Wyoming: Frontier Stable Token

On August 19, the state of Wyoming launched the Frontier Stable Token (FRNT), the first government-backed stablecoin in the US. It is issued on seven blockchains: Ethereum, Arbitrum, Avalanche, Base, Optimism, Polygon, and Solana.

Source: stabletoken.wyo.gov

The stablecoin is backed by US Treasury bills and domestic currency, with a 102% reserve requirement. FRNT is designed to support secure, transparent, and efficient digital transactions.

The token will be publicly available in the coming days through the state-registered Kraken Exchange and the Visa-integrated Rain platform on the Avalanche blockchain.

The Wyoming stablecoin will be usable anywhere Visa is accepted. It supports major mobile payment systems like Apple Pay and Google Pay, as well as physical cards.

To establish stablecoins as a significant development vector, the US House of Representatives has included a ban on Central Bank Digital Currencies (CBDCs) in the 2026 defense budget.

This measure would prevent the Federal Reserve from testing, developing, or implementing its own digital assets. However, an exception is made for “dollar-denominated currencies that are open, permissionless, and offer privacy protections similar to U.S. cash.”

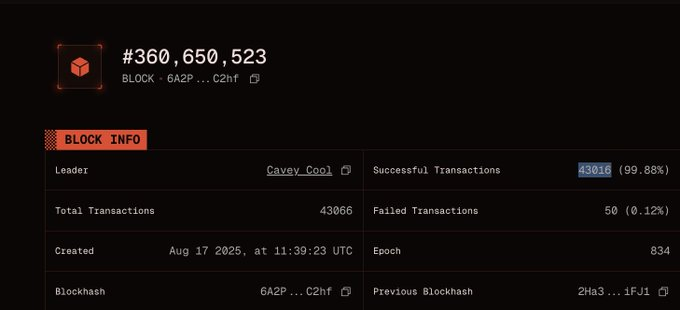

Solana Blockchain Sets Record Throughput Over 100,000 TPS

During a recent stress test, Solana’s network speed reached an impressive 107,540 transactions per second (TPS).

On August 17, one of Solana’s blocks successfully processed 43,016 transactions, with only 50 failures. However, it’s important to note that most of the transactions were “no-op”, meaning they did not perform real computations but were simply used to test the protocol’s metrics.

Source: X

Helios co-founder Mert Mumtaz commented that, even accounting for the specifics of the test, Solana is theoretically capable of handling 80,000-100,000 TPS for standard operations like transfers and oracle updates.

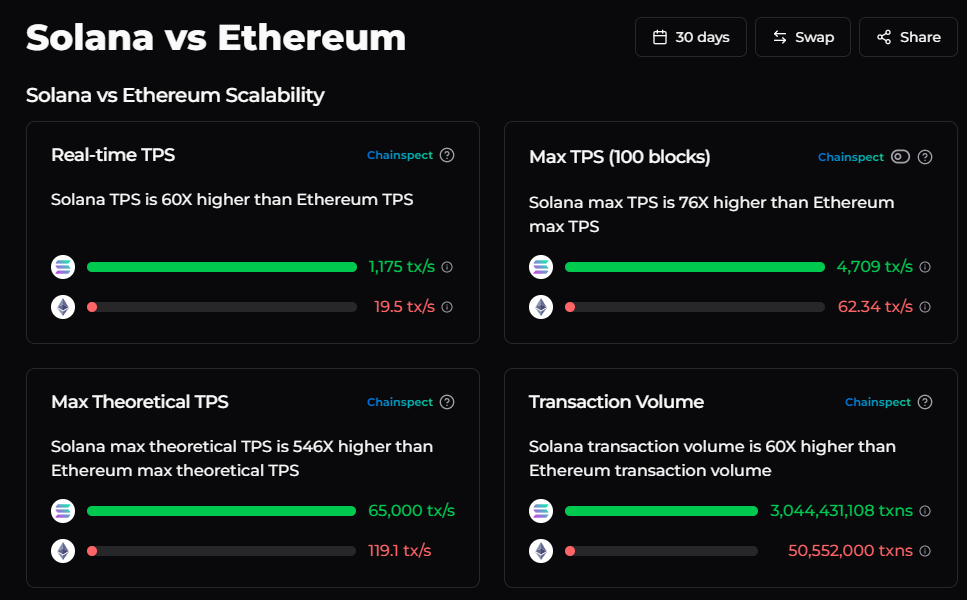

However, in actual usage, the network’s throughput is much lower. Over the last 100 blocks, the TPS averaged around 4,400, and the real figure—excluding validator processes—was closer to 1,100 TPS.

Solana vs. Ethereum TPS comparison. Source: Chainspect

Despite this, Solana remains several times faster than Ethereum, which can handle only around 20 TPS.

Over the past month, the number of active SOL addresses reached 80.9 million, and the network processed 2.4 billion transactions. The bulk of transactions on the Solana network continues to be driven by DeFi and meme tokens.

Focus on UX in Ethereum

This week, the Ethereum Foundation (EF) launched a new phase of its Trillion Dollar Security initiative, focused specifically on improving user experience (UX) in wallets and applications.

The EF team believes that the lack of user-friendly interfaces in wallets and smart contract applications remains a critical challenge for both private and institutional clients.

One of the key issues is the problem of blind signatures, where users approve transactions without understanding what they’re confirming. As part of its initiative, the foundation plans to create a new security standard for wallets. This would include transaction transparency, compromise protection, and confirmation management features.

The EF has also provided a grant to Walletbeat to help accelerate the development and implementation of these standards. Additionally, the foundation will work on creating an open database for developers to automatically verify vulnerabilities in smart contracts before deployment.

eToro: Best platform for beginners and social trading

- Trade cryptocurrencies, stocks, ETFs, and commodities on one easy-to-use platform

- Follow and copy top-performing traders with eToro’s unique social trading tools

- Earn passive income with staking on popular coins like ETH, ADA, and TRX

- Fully regulated in multiple jurisdictions with strong security protocols

- 0% commission on real stock trading and competitive spreads on crypto

- 30+ million registered users across 100+ countries

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

Source:: This Week in Crypto: Ethereum Breaks ATH and Bitcoin Pools Control 51% of Hashrate