Key highlights:

- Pantera invests $300M in crypto firms with tokens on their balance sheets.

- BitMine leads with 1.2M ETH, aiming to hold 5% of total Ethereum supply.

- Experts warn of risks from high leverage and bitcoin price volatility.

Pantera Capital has invested $300 million in cryptocurrency-backed companies, targeting returns superior to ETFs. The venture fund believes such firms can generate income that boosts net asset value per share.

Pantera general partner Cosmo Jiang and executive Erik Lowe said Tuesday that companies holding digital assets on their balance sheets “can generate yield to grow net asset value per share, resulting in more underlying token ownership over time than just holding spot.”

They suggest that holding shares in these firms offers higher return potential than owning tokens directly or investing via ETFs.

Pantera’s investments span American, British, and Israeli companies holding diverse tokens such as Bitcoin, Ethereum, Solana, and various altcoins.

BitMine as a model example

Ethereum-backed BitMine Immersion Technologies (BMNR), chaired by Tom Lee, was Pantera’s first investment from its DAT Fund.

Within two and a half months, BitMine became the largest public Ethereum holder and ranks third in cryptocurrency holdings among public companies globally. It owns nearly 1.2 million ETH, valued at around $5.3 billion, and intends to acquire 5% of the total Ethereum supply.

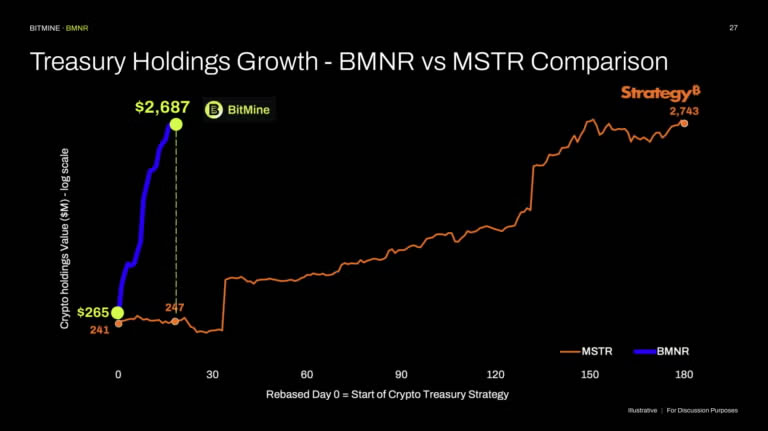

BitMine’s aggressive accumulation strategy has surpassed that of Strategy. Source: Pantera

The firm’s model enhances tokens per share by issuing shares at a premium to net asset value, leveraging convertible bonds to monetize volatility, and generating staking rewards and yields through decentralized finance protocols.

Results in numbers

Since implementing its Ethereum acquisition strategy in late June, BitMine’s stock (BMNR) surged over 1,300%, outpacing Ethereum’s 90% price increase in the same period.

Pantera highlighted BitMine’s attraction of institutional interest from financial heavyweights such as Stan Druckenmiller, Bill Miller, and ARK Invest.

The fund anticipates strong institutional demand for companies with substantial, high-quality cryptocurrency reserves.

Criticism and risks

Not all experts are optimistic about the success of firms with crypto reserves. Earlier this month, Ethereum co-founder Vitalik Buterin cautioned that excessive leverage could lead such companies to fail if management is not prudent.

Similarly, analysts at Standard Chartered warned in June that companies holding Bitcoin reserves might face significant losses if Bitcoin’s price drops sharply.

eToro: Best platform for beginners and social trading

- Trade cryptocurrencies, stocks, ETFs, and commodities on one easy-to-use platform

- Follow and copy top-performing traders with eToro’s unique social trading tools

- Earn passive income with staking on popular coins like ETH, ADA, and TRX

- Fully regulated in multiple jurisdictions with strong security protocols

- 0% commission on real stock trading and competitive spreads on crypto

- 30+ million registered users across 100+ countries

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

Source:: Pantera Capital Invests $300M in Crypto Firms, Aims for Returns Beyond ETFs