Polymarket built its reputation by letting you bet on real-world outcomes with crypto. No middlemen, just clear odds, fast settlements, and markets that turn news into numbers.

Still, no single site can serve every need. Maybe you want lower fees, more events, a slicker interface, a different chain, or a stronger privacy stance.

This list gives you a clear look at where Polymarket sits today, what drives people to try something different, and which Polymarket alternatives actually deliver in 2025. I’ll provide overviews and breakdowns of the top options, and compare them to see how they stack against Polymarket.

Let’s get started!

Quick list of 6 best Polymarket alternatives and crypto betting platforms:

- Kalshi – A US-regulated, real-money prediction exchange backed by the CFTC. Great for traders who want legal, high-liquidity markets on economics, policy, and world events.

- Azuro – A modular betting protocol powering dozens of front-end apps with shared liquidity and fast market resolution. Ideal for builders and DeFi-native bettors.

- PredX – An AI-powered platform focused on science, policy, and long-term forecasting. Built for analysts and researchers who want accuracy over entertainment.

- PredictIt – A U.S.-based political market with deep liquidity on elections and policy. Regulated under a CFTC no-action letter, it’s best for American political junkies.

- Augur – A decentralized Ethereum-based platform where anyone can create or join markets anonymously. Best for privacy-focused users who value full on-chain control.

- Polytrader – A crypto forecasting tool that combines analytics, sentiment data, and token metrics. Designed for traders who want to predict crypto moves with insight.

6 Best Polymarket alternatives for crypto betting in 2025

The world of crypto prediction markets is broader, weirder, and often faster than people expect. Some platforms push deeper into decentralization. Others make things easier for US users or build from the ground up on newer blockchains like Solana.

Whatever you’re looking for, there’s a place to try your luck and test your smarts. Polymarket has certainly made a big name for itself already. But let’s take a closer look at six strong contenders.

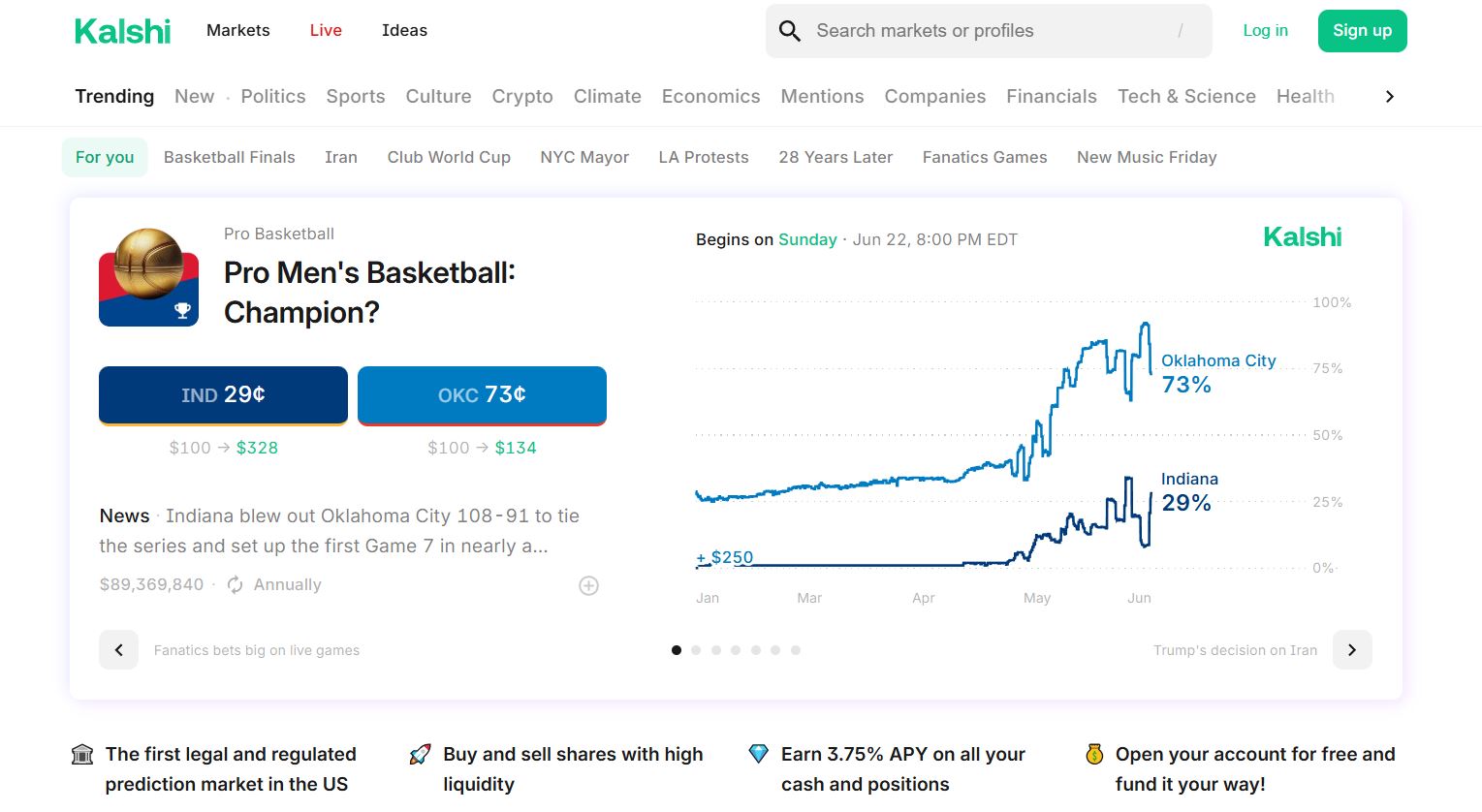

1. Kalshi – A CFTC-regulated real-money exchange in the US

Kalshi is a regulated heavyweight. While most prediction markets face legal gray zones, Kalshi went the hard route. They’re fully approved by the US Commodity Futures Trading Commission (CFTC).

That means US residents can legally bet real dollars on real-world events.

You’ll find markets on interest rate hikes, CPI data, government shutdowns, El Niño forecasts, and even whether Taylor Swift will announce a new album this year.

If you’re interested in the trading side, Kalshi is also one of the best crypto exchanges for day trading, thanks to its great platform and real-money options.

Why Kalshi stands out:

- Fully compliant: One of the only platforms legally cleared for US residents to place real-money bets.

- Broad financial markets: Covering everything from macroeconomics to political regulation.

- Familiar UX: Looks and feels like a modern fintech app.

Recent updates:

- As of 2025, Kalshi offers “mega contracts” with limits as high as $7 million for institutions, and $25,000 per event for individuals.

- Strategic partnership with Robinhood has made Kalshi’s interface even more accessible to casual traders.

- Trading volume surpassed $250 million in late 2024, with daily active users consistently rising.

Fee structure:

- 2% fee on debit card deposits.

- $2 withdrawal fee.

- Trading fees scale with position size, but cap out below typical options/futures platforms.

Pros:

- Legal and fully transparent for US users.

- High liquidity in major markets.

- Robust mobile and desktop platforms.

Cons:

- Limited market types (no crypto, no meme markets).

- Only accessible to US users.

- CFTC restrictions limit the creativity of event topics.

Best for: Traders in the US who want to legally speculate on news, economics, or politics—without needing to dive into DeFi or token wallets.

2. Azuro – The infrastructure layer powering Web3 betting

Azuro is the plumbing behind an entire new generation of prediction markets. Think of it like Uniswap for betting: a decentralized protocol that other apps can plug into.

Developers build custom frontends (like bookmaker.XYZ or DexWin), while Azuro handles the back-end magic: liquidity pooling, odds calculations, market resolution, and payout distribution.

Why Azuro stands out:

- Shared liquidity pools: Instead of each app or market managing its own funds, Azuro pools liquidity across all markets—leading to better odds and fewer failed trades.

- Permissionless deployment: Anyone can launch a betting app using Azuro’s SDK and tap into existing liquidity and infrastructure.

- DeFi-native design: Built for composability and integration with wallets, staking, governance tokens, and more.

Recent updates:

- As of mid-2025, Azuro supports 28 live apps, 28,000+ monthly users, and over $350 million in trading volume.

- Liquidity providers (LPs) earn yields averaging 10–20% APY in stablecoins, and apps built on Azuro generate real revenue—some crossing $2 million+ in 2024 alone.

- Data providers and affiliates now play formal roles in verifying outcomes and onboarding users, respectively.

Pros:

- Developers can launch apps quickly without building from scratch.

- Deep, shared liquidity for smoother betting.

- Decentralized governance and payout mechanisms.

Cons:

- Less direct market creation control for individual users.

- Higher complexity for non-technical bettors exploring the ecosystem.

Best for: Builders, DeFi-native users, and power bettors who want a modular, scalable system rather than a single platform. Azuro isn’t just a Polymarket competitor—it’s what Polymarket could build on.

If you want an inside look at Azuro, check out this interview with Rossen Yordanov, a core Azuro contributor.

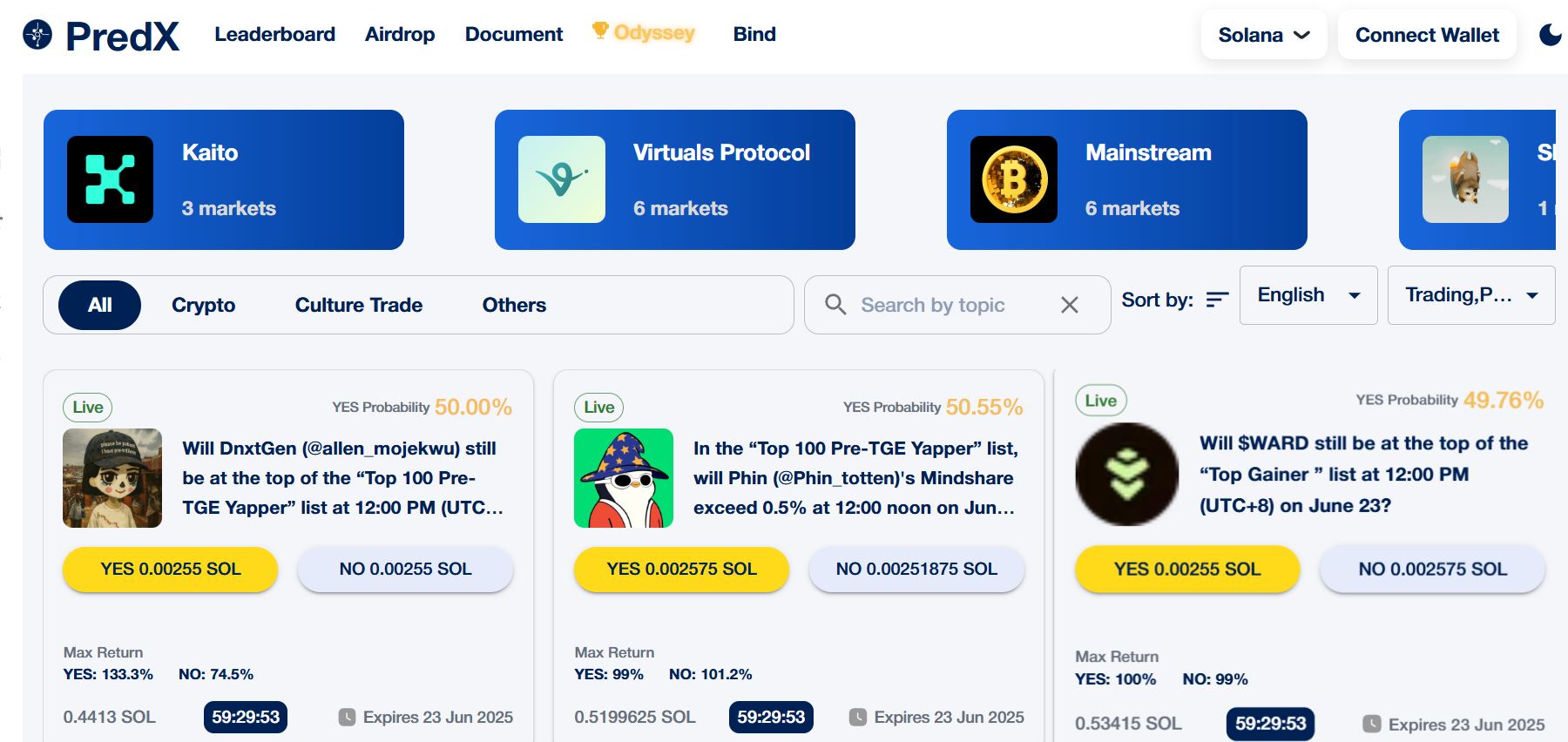

3. PredX – Where prediction markets meet science and AI

PredX doesn’t deal with celebrity gossip and meme coin bets. It focuses on hard data, global outcomes, and empirically grounded forecasting.

It’s made for researchers, analysts, and policy-minded users who want real predictive insight, not just gambling entertainment.

Why PredX stands out:

- Academic & scientific focus: Markets cover elections, climate change, AI risk, pandemic probabilities, and more.

- AI-enhanced forecasting: The platform integrates newsfeed aggregation and AI-generated market suggestions.

- Real-world incentives: PredX encourages accurate, honest forecasts over clickbait or hype.

Recent updates:

- In 2024, PredX raised $500k in a pre-seed round, reaching a $20 million valuation.

- AI tools now assist in event creation, probability scoring, and resolution modeling—an edge over traditional manual prediction.

- Markets are hosted on Sei Network and Polygon, keeping crypto fees low and transactions quick.

Pros:

- Intellectually rigorous and data-driven.

- Attracts professional forecasters, policy analysts, and research institutions.

- AI tooling makes market curation smarter and faster.

Cons:

- Small user base compared to more entertainment-focused platforms.

- Less appeal for meme traders or casual sports bettors.

Best for: Think-tank types, macro investors, or anyone who prefers long-term forecasting over short-term speculation. If you love Metaculus but want tokenized incentives, PredX is your next stop.

4. PredictIt – America’s political prediction playground

PredictIt has been a US political prediction market staple since 2014.

Run under a CFTC no-action letter and backed by Victoria University of Wellington, it was designed as a research platform. But, it quickly became a home for political junkies, campaign wonks, and hedge fund data scouts.

Why PredictIt stands out:

- Laser focus on US politics: Markets on presidential elections, Congressional races, policy decisions, and more.

- Research-grade infrastructure: Data collected is shared with over 160+ academic institutions, including Harvard and MIT.

- Accessible UI: Despite its age, the interface remains one of the simplest and cleanest for retail users.

Recent updates:

- The platform survived major legal battles in 2023–2024 and remains open as of 2025, albeit with tighter trading limits.

- Max trade per contract: $850, with a total 5,000-trader limit per market.

- PredictIt has integrated with new charting tools and community features to revive engagement and insights.

Fee structure:

- 10% fee on profits.

- 5% fee on withdrawals.

- No fees on losing trades, which benefits more frequent or hedged bettors.

Pros:

- Deep liquidity on major political markets.

- Institutional and media trust in data accuracy.

- Strong forecasting community and forums.

Cons:

- Only open to US users.

- Strict CFTC-imposed limits on bet sizes and participation.

- No crypto or global market coverage.

Best for: American users who want to speculate on elections and policy with real money, while staying compliant with US laws. PredictIt remains the gold standard for regulated political forecasting in the US.

5. Augur – Decentralized predictions

Augur went all-in on decentralization. No company to answer to, no off switch, no borders.

Built on Ethereum, Augur lets you create or join markets on almost anything: elections, sports, crypto prices, weather, and more. The platform uses its native REP token to facilitate governance and dispute resolution, ensuring outcomes are community-verified rather than dictated from the top.

Why Augur stands out:

- Open platform: Anyone can create a market, from meme-worthy bets to serious geopolitical events.

- Global access: No KYC, so users from most regions can participate freely.

- No house edge: Augur doesn’t take a cut—the money stays with the winners.

- Multichain support: Runs on Ethereum mainnet and Polygon for lower fees.

Recent updates:

- Augur launched an incentive program for liquidity providers on Polygon, helping address a longtime weakness: shallow order books.

- The team has hinted at cross-chain expansions and greater Oracle integrations for 2025.

- REP token governance has been simplified to lower the barrier for dispute resolution participation.

Pros:

- Strong anonymity and censorship resistance.

- Wide range of markets, from sports to scientific forecasts.

- Open-source and community-controlled.

Cons:

- Clunky UI, especially for beginners.

- Slow settlement due to on-chain mechanics.

- REP staking for disputes can be confusing and underused.

Best for: Crypto-native users who value decentralization above all else, and don’t mind UX hurdles in exchange for full control.

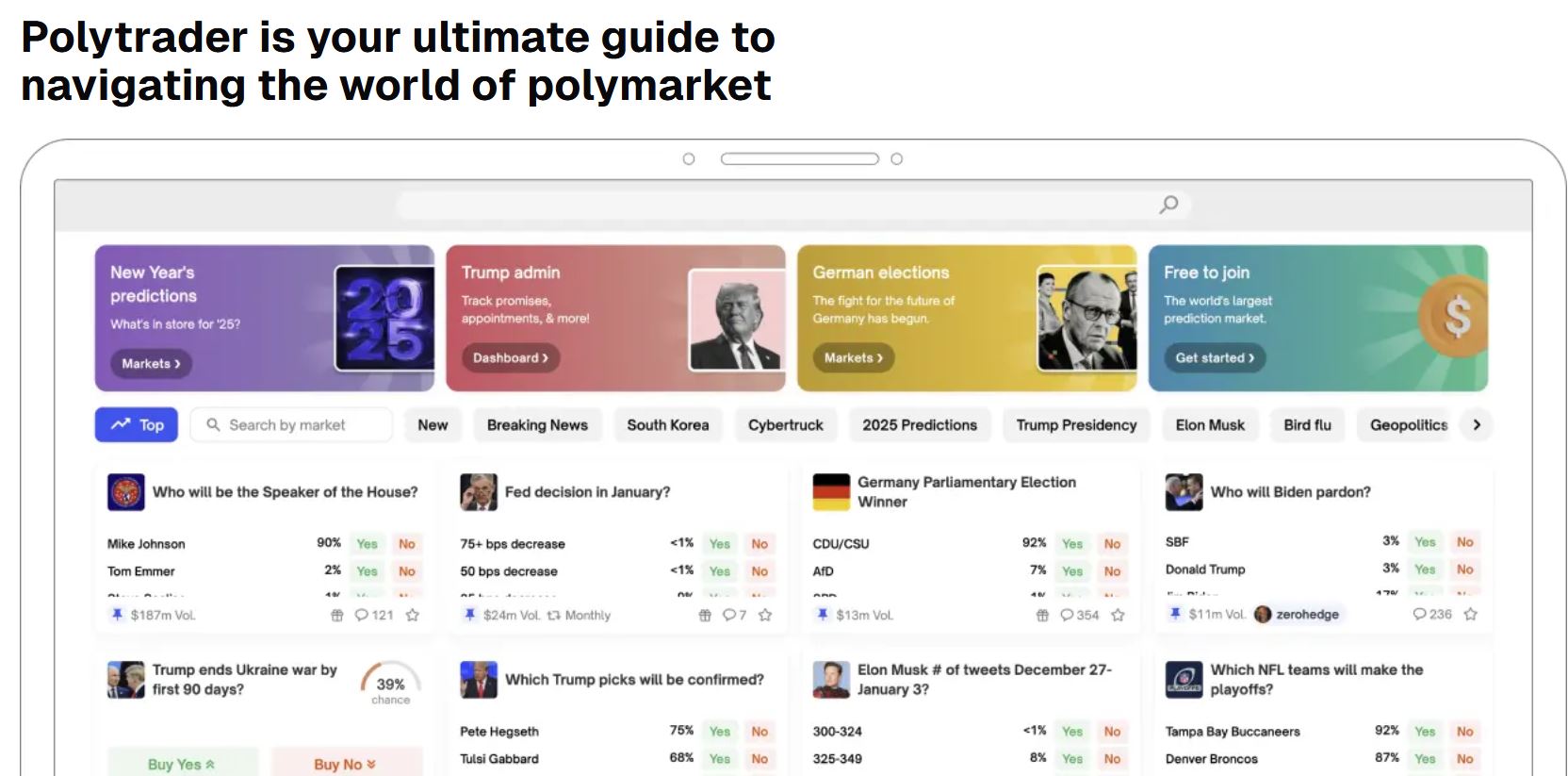

6. Polytrader – Crypto forecasting

Polytrader is what happens when prediction markets grow up with CoinGecko tabs always open. It’s not a betting platform by itself. Rather, it works together with Polymarket, and helps you make, in their own words, “make smarter, data-driven decisions by analyzing market sentiment and providing actionable insights.”

It’s a platform that mixes speculative forecasting with deep analytics. It’s designed for crypto users who want more than just “yes/no” outcomes.

Why Polytrader stands out:

- Crypto-native forecasts: Bet on project upgrades, protocol adoption, market caps, and ecosystem growth milestones.

- Integrated analytics: Real-time charts, token metrics, and sentiment data are baked right into the forecasting interface.

- Social insight: Traders can view, follow, and react to each other’s predictions—bringing a subtle “copy-trading” feel to the platform.

Recent updates:

- In late 2024, Polytrader introduced AI forecasting agents, which analyze headlines, token flows, and market structure to suggest high-probability trades.

- Forecasting options have expanded beyond price speculation to include adoption trends, staking participation, and community growth metrics.

Pros:

- Perfect for DeFi traders who want to add a speculative edge to their analytics.

- Clean UI with token-specific forecasts.

- Offers both short- and long-term event horizons.

Cons:

- Still a niche platform with relatively low liquidity.

- Forecast volume and user activity are lower than Polymarket or Kalshi.

- Market diversity is mostly limited to crypto-specific events.

Best for: Analytical crypto traders who want to turn token insights into predictions—and profit. If your favorite hobby is front-running CoinMarketCap headlines, Polytrader is your kind of playground.

Key trends in crypto betting and prediction markets for 2025

Crypto betting in 2025 is more popular than ever. Let’s take a look at some of the most notable trends, and they go way beyond placing a simple bet.

Gamification takes over

I guess we should’ve seen this coming. More and more casinos are using crypto, and more and more of those platforms are turning betting into an experience. Think badges for win streaks, missions that unlock bonuses, and live leaderboards.

Betting now feels more like gaming. It’s designed to keep users engaged and excited (and playing), not just placing one-off wagers.

Regulation matures

No longer the Wild West, crypto betting is leaning into regulation. This is especially noticeable in regions like Malta, Curaçao, and Southeast Asia.

It brings more stability and trust. Players often choose between no-KYC privacy or full verification in exchange for higher betting limits and bonuses.

AI + blockchain = Smarter bets

AI now powers dynamic odds, personalized risk alerts, and tailored promos. On-chain tech provides transparency with provably fair algorithms and secure, non-custodial wallets.

Global reach & mobile first

With mobile access booming in Africa, LATAM, and Central Asia, platforms are adapting: faster onboarding, wallet-based login, and local-language interfaces.

Expect more regional betting markets too, from local elections to esports tournaments.

Esports betting goes mainstream

More bets are now placed on games like CS:GO and Valorant than on some traditional sports.

Features like live in-play betting, Twitch-style integrations, and game-specific odds are driving this boom. There are many top crypto esports betting platforms to choose from, and the number keeps increasing.

The bottom line

Every platform on this list brings its own flavor: tighter privacy, broader markets, slicker interfaces, or stone-cold compliance for those wary of legal headaches.

Don’t just settle for the first platform you try. Rotate through two or three, compare speed, payouts, and community. There’s no single “best” here. There’s only what fits you right now.

If these platforms don’t fit your needs and you’d rather stick with Polymarket, you can look forward to a potential Polymarket airdrop.

Source:: 6 Best Polymarket Alternatives: Top Crypto Betting Platforms to Try